Where in the world do Americans spend their money? Taking a look at where incomes go each month.

- 5 Comment

I remember the first budget I put together. It left me feeling depressed and feeling as if I had been punched in the gut. The practice was done largely out of necessity but there was something that jumped out at me. Housing consumes a good portion of net income. For most Americans this is the reality. When we look at spending habits we realize that half of this country is living paycheck to paycheck. A budget is a basic necessity even if you do it just once to understand where your money is flowing. Yet most people spend money as quickly as it comes in like sand flowing through your fingers. I wanted to look at the latest spending breakdown of Americans to see where most of our money is going.

Where do Americans spend their money?

There are three major categories where Americans are spending their money: housing, food, and cars. These three items consume the bulk of net income. And keep in mind that with housing, more Americans are renting since housing values are once again high relative to incomes. This makes it tough to build equity and most Americans have their net worth tied up in housing. Food and cars also take up a healthy portion of your paycheck.

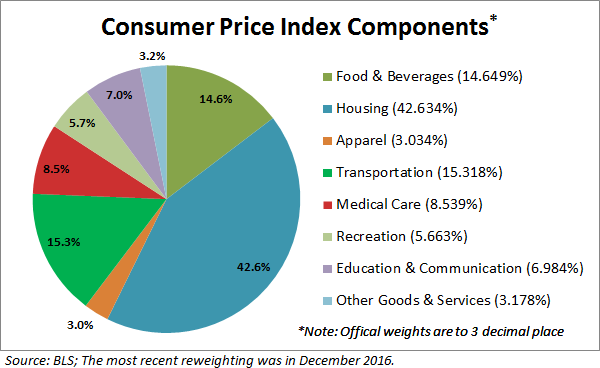

Take a look at this chart:

The BLS chart tries to break down categories based on how your typical American spends their money. 43% of their weighting is given to housing. What is interesting about housing is that it is measuring the owner’s equivalent of rent (OER). The issue with using this as a measure of home values is that it assumes all owners are renting out their homes and it doesn’t factor in the large Fed intervention on interest rates.

Interestingly enough, transportation actually edges out food in the BLS chart. Transportation makes up about 15% of the BLS basked of goods. Buying cars and financing them has become a big part of our economy. Over $1 trillion in auto loans are outstanding. You also have a large part of the auto market now being financed by subprime auto loans. So what you have is people spending beyond their means for transportation.

Finally you have spending on food at slightly below 15%. There was an interesting milestone crossed last year in that Americans now spend more on eating out than they do on grocery shopping. More Cheesecake Factory and less meatloaf at home. Part of this has to do with younger Americans and their spending habits but also the changing way people live their lives.

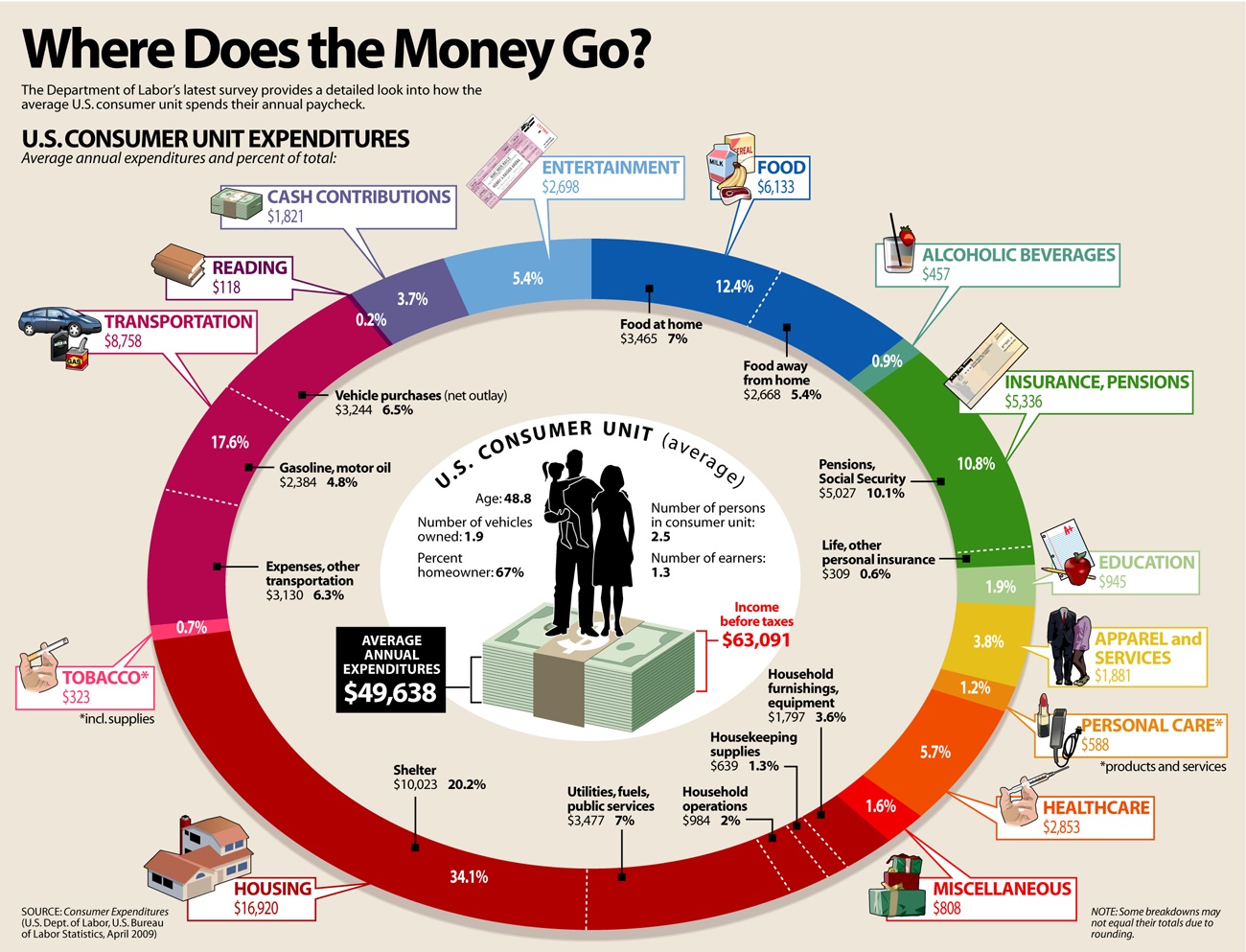

Here is another breakdown of how Americans spend their money:

It is still surprising how much money goes in to tobacco and alcohol. Then look at how much goes into reading. Nearly 8 times more is spent on tobacco and alcohol. Reading is a great way of opening your mind and exposing you to new ideas. Being critical and skeptical are skills that are developed but also knowing how to manage your money. That is the point of all of this and yet some people continue down a path of spending more than they have.

This doesn’t even look at the $1.4 trillion of student debt and how young Americans are deeply mired in school loans before they even start working. Some people live paycheck to paycheck because they have little money and some live paycheck to paycheck because they spend beyond their means. We do live in a consumption based economy and the above highlights were Americans are spending their money.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

5 Comments on this post

Trackbacks

-

Tom Cammack said:

Good discussion. CPI doesn’t seem to include taxes. Wonder how much of our income goes to pay taxes (personal property, income, school, sales taxes, etc.)?

August 17th, 2017 at 8:52 am -

roddy6667 said:

Americans pay massive amounts of hidden taxes. If a person buys a consumer item, the price has to be high enough to cover the costs of the company that made it. This includes property taxes, income taxes for the company, the cost of huge amounts of regulations (another hidden tax), and wages. The worker has taxes to pay–sales tax, property tax, excise tax, income tax, etc. His wages need to be high enough to cover his living expenses. All these taxes are buried in the price of the consumer item.

Every village, town, city, state, and the federal government borrows huge amounts of money to run their operations because they don’t have enough cash to pay for it. This means quarterly bond interest payments, which are paid for by the citizen. This is all buried in the price of goods and services.

In China, an auto worker makes $5.75 US an hour. This pay is for a good job with good working conditions, job security, health insurance, and a pension. This hourly pay in China buys a middle class lifestyle measured by Western standards. It includes home ownership, lots of consumer goods and clothes, dining out and movies, vacations and travel, and the ability to save 36% of their gross pay for the future.

Because of all the hidden taxes and expenses buried in goods and services, Americans would have to make about $50 an hour to match the Chinese worker. That’s why jobs won’t be coming back to America. It’s too expensive and it can’t be changed.

Everything an American buys is repackaged taxes from earlier in the business cycle.August 19th, 2017 at 7:15 pm -

Someone said:

Even if you make a good salary, up to 1/3 will be confiscated before and after your check to support local, state, federal government.

But I think most Americans simply don’t make enough income. In the end how low can you realistically go? You need at a minimum about $35k a year in most lower cost places of the country to have a rented place to live, transportation, and groceries.

August 20th, 2017 at 4:21 pm -

SBayBlue said:

roddy6667, the workers at Foxconn would disagree with your take on their salaries and working conditions:

https://www.theguardian.com/technology/2017/jun/18/foxconn-life-death-forbidden-city-longhua-suicide-apple-iphone-brian-merchant-one-device-extractThe federal government collects enough taxes, but it pisses away $700-$800B+ per year on defense and intelligence, and then there is all the corporate welfare. We get generous tax breaks on mortgage deductions, and as a business owner, I get tons of deductions too.

Why can’t people see they are getting fleeced when people in Europe pay about what we pay in taxes (Scandinavia excluded), yet they get free college, free healthcare, nicer cities, their roads are better, and they have a better safety net? And we still can’t balance a budget?

August 27th, 2017 at 6:37 pm -

Manny said:

Taxes — yes BLS never includes them & as commented on previously, they are onerous due to being aggregated for the entire product life cycle.

As far as wasting $ on defense, yes we are the policemen of the world. We should have charged (& keep charging) the world for that all along.

As Mark Twain said “We have the best government that money can buy”. That is a major part of the part of the problem, corruption & the fact that politicians serve themselves 1st vs. doing what is good for the country. Many of the problems we face could have been solved less painfully if they were addressed earlier & not kicked down the road.

September 19th, 2017 at 11:12 am