The epic retirement crisis for older Americans: The median family of retirement age has $12,000 in savings.

- 6 Comment

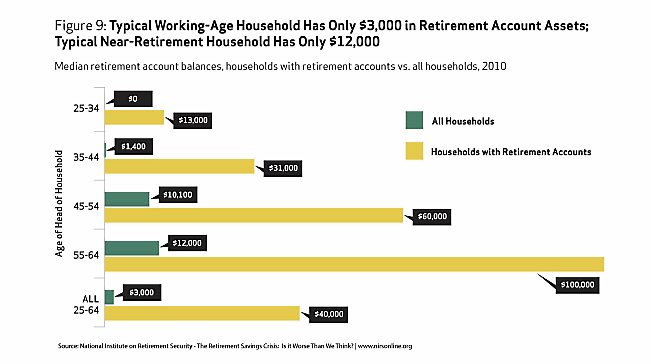

Given the discussion of 401ks and IRAs you would think that most Americans have a nice nest egg ready to support them into their margarita drinking days on the beach. Yet like most dreams, the reality is very different. Most Americans are broke. The Economist put out some data highlighting that the median family of retirement age has $12,000 in savings. In other words, one minor injury and you are bankrupt. It is a troubling contrast to the image that is portrayed on television and throughout the media of the fully financially prepared family. Life just doesn’t work out that way for most. Unsuspected illnesses, job losses, stagnant wages, inflation, family changes, and student debt all throw a wrench into the plans of most. What is also startling is that this drought in retirement savings is happening at a time when the stock market is near an all time high. So what gives?

The crisis in retirement

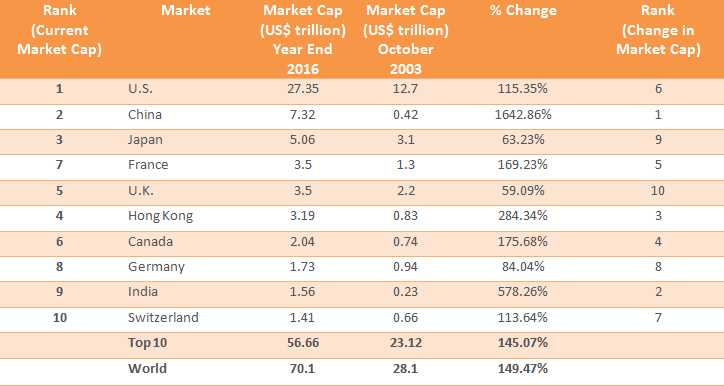

The total stock market cap of the U.S. market is $27.35 trillion. You would think with that amount, there would be plenty of prepared individuals. The challenge is that most of this money is aggregated at the top 5 to 10 percent of the population.

Take a look at market caps around the world:

You need to reconcile this with the reality that the median family of retirement age has $12,000. The typical 35 year old has a net worth of zero and is too broke to even afford a home. Even basic retirement planning will tell you that people need to start early to build up that nest egg. This is what was preached when pensions started to go extinct in the early 1980s and people were pushed into 401k style retirement plans. Here we are nearly 40 years later and the results are not that promising.

This is where the data gets massaged. The average amount saved by families of retirement age is $100,000 but this is skewed by those at the higher end (i.e., millionaires and billionaires). So this doesn’t necessarily show how the typical family is doing. The median is a much better measure of how the typical family is doing. And in that situation, they are not doing all that well. Those 55 to 64 have $12,000 to their name in most cases.

So what are the implications of this?

“(The Economist) They continue to ignore the savings crisis that should worry them: Many Americans do not have enough savings ever to be able to retire. Traditional macroeconomics cares only about aggregate levels of capital stock. There is plenty of that. But it is shared among too few people. The median family of retirement age has $12,000 in savings. That is a terrifying figure for a country where Social Security, the state pension, pays out a maximum of roughly $2,500 a month, and pensions for both public and private employees are underfunded.â€

Social Security. Social Security has already become the de facto retirement plan for most older Americans. Half of elderly Americans would be out on the streets begging for food if it weren’t for Social Security. And given how badly people have saved for retirement, there will be a heavier reliance on this system that is already having a tough time.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

Don Levit said:

Usually the median is about half the average

This is truly frightening if one is concerned about civility or civil war

Social Security from a cash flow perspective has zero dollars

Every FICA dollar designated for Social Security (as well as the dollars for Medicare) went to the Treasury’s general fund and spent for battleships, etc

It is only from an accounting perspective that the Trust Funds are filled with digits, not dollars

Every dollar withdrawn from the Trust Funds increase the $20 trillion debt

Even the Social Security Administration verifies this

Google trust fund perspective versus government budget wide perspectiveApril 23rd, 2017 at 4:01 pm -

most won't said:

Most won’t retire they will work until illness takes them out then hope for any kind of disability or have to work until they drop dead.

April 24th, 2017 at 6:36 pm -

nichole said:

There is no incentive to save other than for a basic emergency when gurus like John Bogle predict a “lost decade” of meager 4% returns on retirement accounts. 4% on money that is not guaranteed to be returned! Oh, did I mention the banks are paying 0.25% on money markets? Placing your savings in a bank at this rate is a loss after calculating 3% inflation. $10,000 at -2.75% is $9,725 first year compounding yearly at negative returns. Yikes, those numbers are scary. Better off spending the money on tires and canned goods. Inflation and taxes are the only guarantee…ask your grandparents.

April 25th, 2017 at 3:34 pm -

Rachel said:

Many Americans simply do not make enough to save even 5% of their income. Also, at some point in everyone’s life there will be setbacks such as accidents, injuries, deaths (loss of income, funerals to pay for, etc.), even criminal victimization that will destroy what little they have saved. People earning less than $30,000 or $40,000 a year who do not live in “flyover” states are usually not able to save even one year’s salary over the period of a decade due to common life setbacks. Getting divorced? You’re likely losing income and possibly half your wealth for each divorce you have adding to the financial disasters awaiting most who will not have the retirement that they were sold.

Throw atop this the fact that many people choose to create children they can’t afford and they are not able to save or invest and their children are doomed from seeing this check to check or poverty lifestyle from their role models. Atop this, add in the costs for college that many parents can’t afford and those who do have $12,000 for retirement will be likely to call themselves among the lucky from this group of Americans who have little saved for retirement. Welcome to the new normal.

April 27th, 2017 at 12:23 pm -

Nichole said:

Silly me…I forgot to mention the COST OF HEALTHCARE crushing the savings rate of the average family. How can anyone save anything when a root canal and crown average $3000 for one tooth! The lack of affordable healthcare is literally killing us. Is depopulation still a conspiracy theory now?

May 5th, 2017 at 5:43 am -

deimos said:

my wife and I made the decision over 30 years ago to not be bothered with what Madison Ave was selling. We don’t go out to eat preferring to prepare meals at home. I drive a 19 year old car, wear walmart clothes, don’t have cable or a new smart phone, and after all those years of frugality it has paid off. We invested a bit each payday and never touched it but kept watching what was happening in the world. In 18 months I am retiring and will have more coming in after retirement than I do now with working a lot of overtime. We will have just over $1 million, not a vast sum but with our lifestyle it will last forever and projected to hit $2.8 million when we turn 80. No one is going to take charge of your life except you.

May 20th, 2017 at 5:16 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â