Almost Half of Americans Endure at Least One Aspect of Poverty: The Hidden Recession Continues to Hit Americans Hard.

- 3 Comment

Poverty is portrayed in a very simplistic fashion in the media. It is usually something that impacts other people far removed from your immediate family. However, poverty is incredibly widespread. This shouldn’t come as a surprise. We already know that half of the country lives paycheck to paycheck and is simply one small emergency from being out on the streets. We also know that in 2015 45,000,000+ people were assisted by food stamps. The number is still incredibly high but this year, nearly 1 million will lose access to food stamps because of how the unemployment rate is reported. Poverty is very real. The Brookings Institute just did a study and found that virtually half of Americans have endured some form of poverty. The report runs counter to the “great recovery†narrative.

The impact of poverty

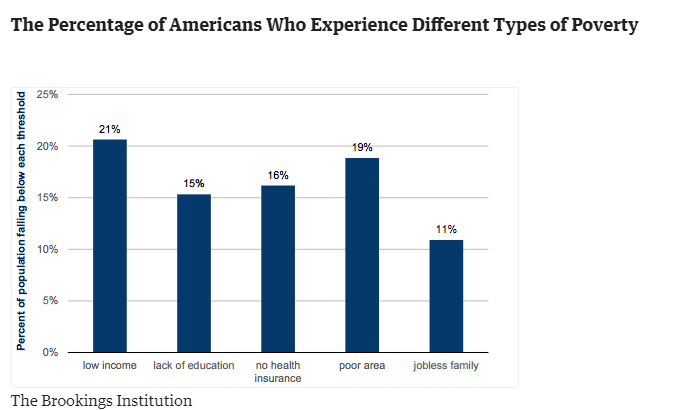

Poverty first needs to be defined. Usually, poverty is defined by the most simplistic measure which is low income. However, there are a few other measures that correlate with poverty as well:

-Lack of education

-No health insurance

-Poor area

-Jobless family

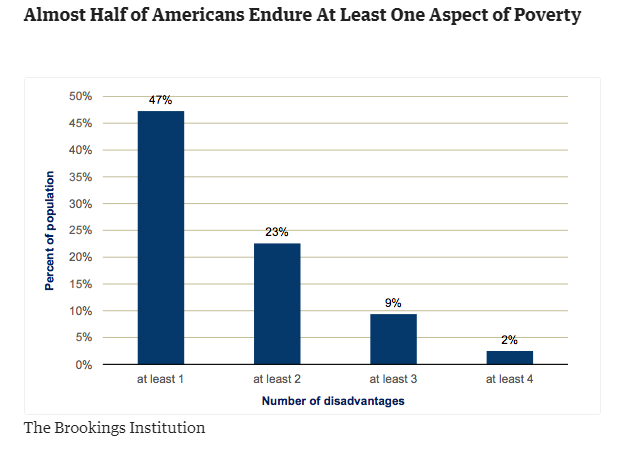

It is good to see a survey that looks beyond income. Let us see how many Americans have endured some form of poverty?

This is very telling but also highlights why people are so frustrated with the current economy even though all other figures would signify a healthy market: low unemployment rate, stock market near all-time highs, and record home prices. Yet many Americans are not participating in this recovery.

Here is the actual breakdown of what Americans have endured:

Poverty is a complicated thing. Poverty is more than simply having a low income. Many areas in the country also lack opportunity or access to good schools. People can become trapped in a cycle. The idea of trickledown economics is simply not registering for most. As we highlighted, many Millennials that are doing well are doing well because they came from families that were already in a good position. The idea of economic mobility is becoming tougher in an economy where the middle class is a minority.

Making poverty look better by ignoring the poor

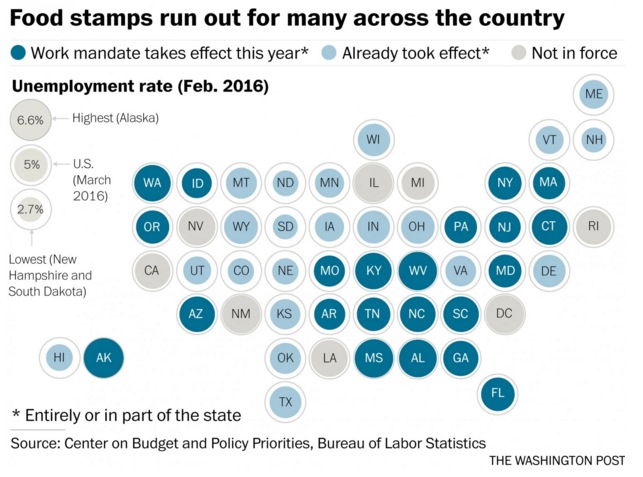

I’ve written many articles on the immense number of Americans on food stamps. Recently there has been discussion on the number of food stamp members dropping as a sign of everything being better. That might be one part of the reason but another is a repercussion on reporting and artificially low unemployment rate. Many people are losing food stamps because of this:

“(WaPo) As many as 1 million Americans will stop receiving food stamps this year, the consequence of a controversial work mandate that took effect this week in 21 states as the economy improves.

The revival of the mandate, which was hotly debated when adopted in the 1990s, is reigniting a discussion among policymakers and advocates for the poor about the fairness and wisdom of the social safety net in the new U.S. economy.â€

The mandate is modest yet many are simply not finding jobs even in the low wage economy.

“But not all are able to find work. Among those affected is Danny Lamb, a 41-year-old former factory worker in Pittsburg, Kan., who said he has been spending his days filling out employment applications for several weeks. He has no degree and two lame knees, from injuries he suffered playing linebacker on his high school football team, that restrict the kind of work he can do.

Recently, though, Lamb was deemed , and since his 8-year-old son lives with the boy’s mother, Lamb legally has no dependents.

No employers have shown any interest in him.â€

It is good to see some press on this issue. The reality is the economy is still in tough shape for many Americans. And as recent research has found, nearly half the country has had a taste of poverty at some point. Yet what do we expect now that the middle class is now a minority?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Opiner said:

Many are kept in poverty because of low wages and limited working hours. There are many recipients of welfare that are employed. It wasn’t very long ago when there were many in the military that were even eligible for welfare assistance. There are still some now.

When corporations hire workers at a level that does not provide them a living wage, they become eligible for welfare benefits. Taxpayers in effect supplement those corporation’s ability to continue paying poverty wages. Trickle down doesn’t work. When the taxes of the rich came down, the rich kept those windfalls. Wages have not improved as productivity went up.

As computerization, mechanization, automation, and robotization becomes more widespread, the rich will continue to reap the benefits. I’ve read articles that state as the “end of work†becomes more widespread due to robotization, society will force the rich to give up more. I don’t think this will occur as it is not happening in the present. The corporations and the rich have taken more and kept more.

Raising the minimum wage will raise everyone’s wages as all wages will ratchet up. This will force the corporations to give up some of their profits. That’s why they oppose it.

There was a time when the personal income tax stepped up to 91% for the highest earners and corporate taxes were 53%. It’s time we start raising rates back to that level. The current corporate tax rate is 35%, but, due to “loopholes†in the tax code, the effective rate is 17%, among the lowest in the world. It’s time we adjust the tax code.

I have been successful through life and retired at 57. I used to be a registered Republican. I wanted to feel like I was “part of the well to do partyâ€. I am no longer a Republican. And many others should take a look at their partisanship. I like the moral values that Republicans espouse, but, I think their economic policy is terrible for workers. I am not a Democrat either. Folks, you don’t have to vote along party lines. Vote for your best benefit. And, as I have stated in the past, if you want change, it’s the senators and representatives that make the laws to change things, not the president.

April 18th, 2016 at 5:57 am -

Rascal said:

@Opiner:

I wonder if raising the minimum wage is the answer when the “market” will adjust it’s prices to reflect the new ability of people to pay. Sort of like when women entered the workforce heavily in the 70’s and 80’s.

Nowadays, women are not working for the “extras” their moms did, they must work in order to make ends meet.Corporations who must pay a higher minimum wage WILL raise their prices to compensate. The gain in the paychecks of workers will get eaten up by the higher prices to purchase goods.

The real problem, as I see it, is the unfavorable tax rate in the United States. Corporations are hiding their money off-shore and not paying their fair share. Many have left altogether. What America needs is an INCENTIVE to create middle class jobs that pay well. By giving corporations a huge tax break and holding them to contracts that require the hiring of only American workers to receive those breaks, you’ll see companies returning to our shores and re-hiring people like Danny Lamb. I feel that NAFTA and GATT literally raped our country and the TransPacific Partnership will murder her if allowed to come to fruition. You remember Ross Perot saying we would hear a giant sucking sound as jobs left. He was right! Yet the media called him an “isolationist” for not sharing.

I live in Oregon, a state that is going to lose benefits for those who need them. I live in an area where over fifty percent of kids get free lunch. Making their parents go to “work” isn’t the answer since any work they can get will be offset by childcare, transportation, wardrobe, etc. costs. They will be WORSE off because of that horrible mandate. I know you sympathize; you sound like a caring individual.

AS for the two “parties”, they are so far removed from the reality of our lives it’s really of no consequence how one votes; as Donald Trump is discovering. The elephant and the donkey are essentially one party, the Progressive Party, leading us all down the path of destruction of our once great country.

April 19th, 2016 at 5:31 pm -

Opiner said:

Well said Rascal.

Corporations will raise their prices to compensate but only as much as US consumers and commensurate worldwide consumers will bear. It appears that Wal-Mart is already showing signs of the average consumer slowing down in purchasing power.

Middle class jobs as we knew them in the 50s-70s are gone and will not return. Not as long as there are workers in the world that will work for $3.50 an hour or less and with less worker’s rights, under less environmental restrictions, and in a less litigious (less lawsuits) environment. In addition, we have more stringent governmental regulations and higher health care costs. How can we compete against that? Government regulations have usually been put into place for safety reasons. It’s going to be hard to reverse those. Our universal healthcare system would have been better off if the government would have taken over as the insurer. But, president Obama kept the present insurance system largely intact. They take out such a large portion of the healthcare dollar as to make Obamacare a potential disaster. Our competitor’s universal health care system operates at a much lower cost per person.

Our corporations have even given up their factory tooling secrets, put patents at risk and made available management skills honed over generations available at little to no cost. They gave future competitors the keys to manufacturing and production for what I consider “flash in the pan†profits. Lowering corporate tax rates may help…, probably not, as the effective tax rate is already only 17%.

I feel one of the biggest things hurting the American worker is the American culture. But, that is another discussion.

April 24th, 2016 at 9:28 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â