Reinventing GDP: US GDP to be revised in July by adding “intangibles†to the tune of $500 billion. The make believe economy.

- 2 Comment

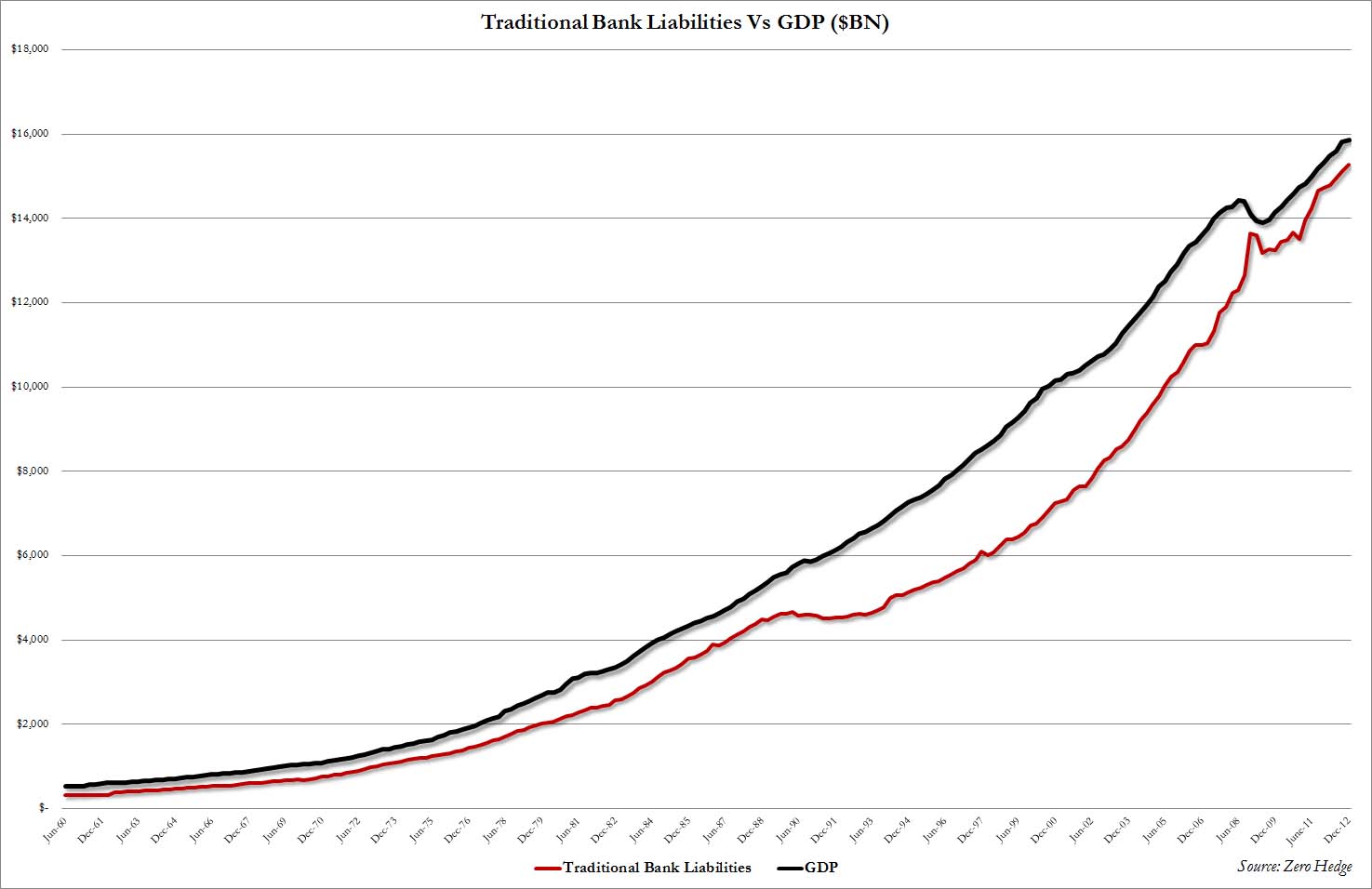

The US debt-to-GDP ratio is now quickly reaching insurmountable levels. It is interesting that a paper citing this issue is now being openly discredited as if this is reason enough to put on the rocket boosters of quantitative easing. Japan has gone so far off the deep end that they are now intervening in their stock markets. Why not just give everyone $1 million and push the DOW up to 30,000? The debt-to-GDP ratio in the US is now quickly approaching 107 percent. Of course, in the make believe economy, we now find out that the official GDP figure is going to be miraculously boosted up by $500 billion in July. Why? Because all of a sudden they want to add intangibles. How convenient that now that our ratios are out of whack that they want to add a whopping $500 billion out of thin air.

Making GDP go up with magic

After all, if you can make the unemployment rate go down by having hundreds of thousands of people leave the workforce, we can boost GDP by adding random items into the equation:

“(FT) The US economy will officially become 3 per cent bigger in July as part of a shake-up that will see government statistics take into account 21st century components such as film royalties and spending on research and development.

Billions of dollars of intangible assets will enter the gross domestic product of the world’s largest economy in a revision aimed at capturing the changing nature of US output.

Brent Moulton, who manages the national accounts at the Bureau of Economic Analysis, told the Financial Times that the update was the biggest since computer software was added to the accounts in 1999.

“We are carrying these major changes all the way back in time – which for us means to 1929 – so we are essentially rewriting economic history,†said Mr Moulton.â€

We truly have become a make believe economy! Of course when you add in the total amount of debt you can understand why:

At this point we are merely growing by loading up on debt. Of course this kind of action creates massive distortions in the economy. This is why you are seeing one out of every three homes being purchased by investors using cheap money from their best friend, the Fed. Total national debt is off the charts of course:

Total public debt outstanding is now above $16.77 trillion. Current GDP is at $15.84 trillion. Will the economy actually be that much better just because some economists are going to shift some numbers around and suddenly, $500 billion is going to appear out of nowhere? Sort of like calling it a recovery when 47 million Americans are on food stamps. Numbers are only as useful as what they tell us. This sudden one time boost is going to be misinterpreted and rehashed by the media because suddenly, GDP went up by 3 percent out of miraculous number crunching.

How many of us can reinvent our household balance sheet this way? Not happy with your current net worth? Just add a few zeros because of intangibles and suddenly everything is just great. Seems like a great gig if you can get a piece of the make believe economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

2 Comments on this post

Trackbacks

-

zorba the greek said:

They want to add $500 Billion out of thin air?

Why not? Everything is created out of thin air now, including

money. We are living in creative times where all data on the

economy is created out of thin air. What is really scary though,

is the fact that even the creative numbers on the economy are

coming in negative now.April 22nd, 2013 at 5:52 pm -

floridasandy said:

my country is breaking my heart.

April 22nd, 2013 at 6:04 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!