Does inflation matter? The real cost of living for middle class Americans. Fed on path to growing balance sheet to $4 trillion.

- 1 Comment

Does inflation matter? If you ask this question to the Fed, it appears like it doesn’t. The Fed is doing everything it can to stoke the fires of inflation. Instead, what it is doing is causing further asset bubbles and misallocation of capital in markets. For most people the cost of living is becoming more expensive. Tuition costs are soaring, healthcare is extremely expensive, energy costs have reached a new level, and incomes are stalled. It is hard to see how inflation is a good thing when incomes get stuck but it is also part of the plan. The psychology of inflation is excellent for a consumer driven economy. If you think prices are going to go up tomorrow, you are more likely to spend today. Falling prices cause consumers to hoard. So the Fed is trying to manufacture more spending but this only works if underlying household incomes move up as well. Inflation for most, does matter.

Inflation back in business

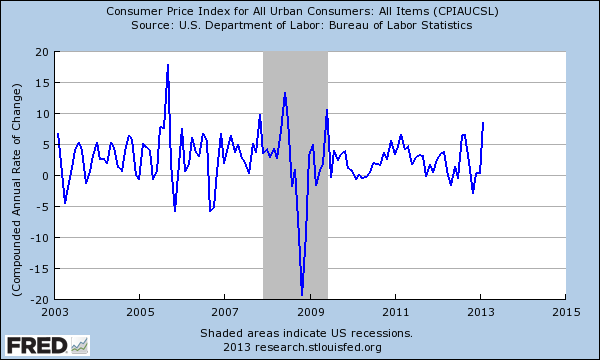

The overall rate of inflation is picking up:

Of course when incomes are stalled, even a modest bit of inflation is going to cause pain. Think of all the items that you pay for in your life. Things have certainly gone up in price yet some people may not notice it because the financing has simply made it longer. How so? For example, you can pay $100,000 in student debt over many decades. Yet the price tag is still $100,000 and many times higher once you factor in the cost of interest.

The Fed continues to offer near zero percent rates to member banks and speculation is now prevalent throughout the financial system again.

Fed balance sheet will hit $4 trillion

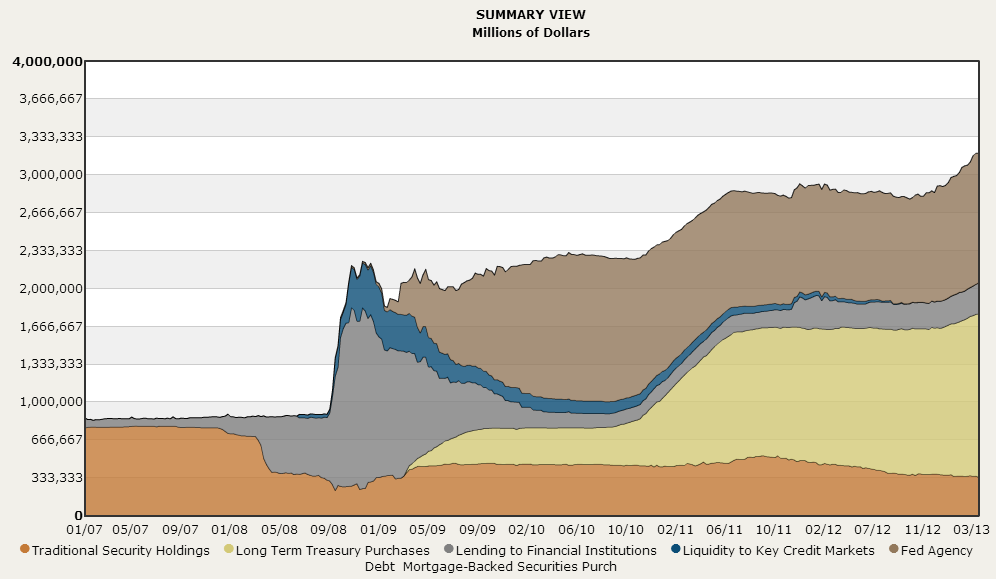

The Fed’s balance sheet continues to expand:

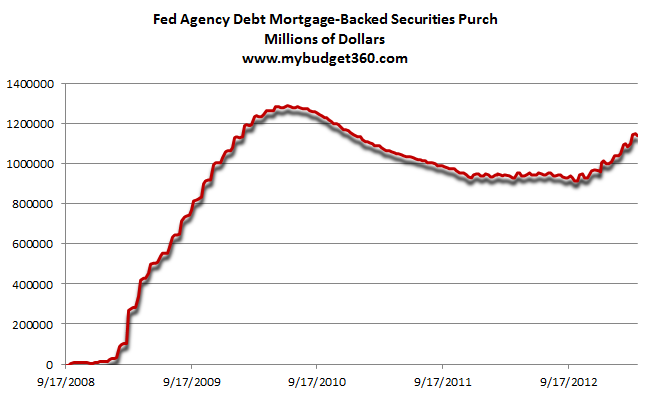

The Fed balance sheet is now over $3.3 trillion. At the current rate, it will get very close to $4 trillion within a year. A big driving force is the $85 billion a month of mortgage backed securities it is purchasing to keep the housing market afloat:

Back in 2008, the Fed did not have any Agency MBS on its books. Today it has well over $1 trillion. The Fed also recently discussed the challenges of winding down this massive trade in the market. The Fed is driving the housing market by keeping rates low but also, assuming MBS onto its balance sheet. This is creating severe distortions in the housing market once again.

Japan is a demonstration of what happens when quantitative easing is taken to the next level. Recently, Japan has jumped into the financial markets to boosts its ailing economy. It is hard to see how this adds any benefit to the real economy aside from short-term bursts.

Rising healthcare

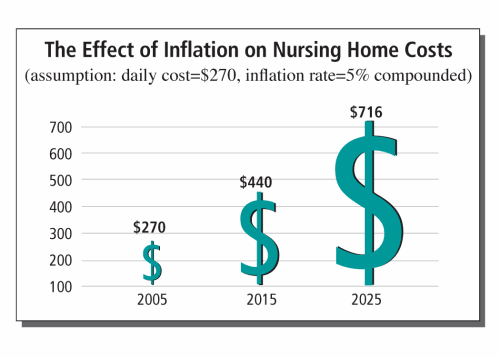

Many baby boomers are now facing growing healthcare bills while having very little saved:

You can see how quickly inflation is hitting some areas like nursing home care. Ultimately, many items that many Americans need to access have far outpaced any real wage growth. The end result is the standard of living for most Americans continues to diminish. Does inflation matter? Only if you live in the real economy and only if you care about the shrinking middle class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Don Levit said:

I see that 30-year Treasuries are paying under 3.%

Who is willing to buy these investments?

What percentage of these Treasuries is bought by the Fed?

What percent are bought for the federal employees’ retirement plans?

Does anyone have a link and excerpt for this?

Don LevitApril 12th, 2013 at 12:32 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!