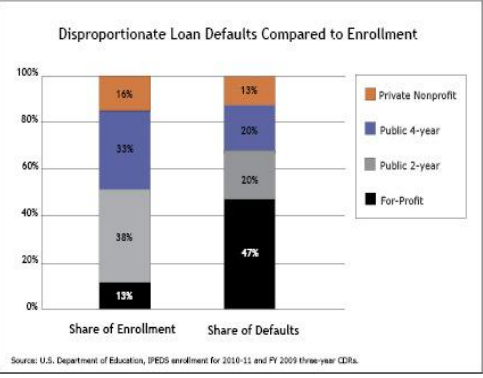

The higher education racket gets long in the tooth: For-profits account for 47 percent of defaults but make up only 13 percent of total enrollments.

- 3 Comment

Bubbles do not burst in a nice orderly fashion. In fact, incredible graft enters the system where it becomes obvious to any bystander that the bubble is going to burst. This is the case for higher education. The US has over 4,000 colleges and universities, with many of them operating like glorified paper mills. Similar to the apex of the housing bubble where we heard about no income buyers qualifying for hundreds of thousands of dollars in mortgage loans, we now have many Americans diving into for-profit institutions that operate at the level of paper mills for tens of thousands of dollars of non-dischargeable student debt. Not only is the for-profit sector a sign of the worm turning for higher education, but many other institutions have jacked up prices to levels that are simply unjustified. This bubble is getting ripe for the picking.

For-profits show dramatic share of defaults

One of the more obvious points to spot out is the incredible default rates at for-profits:

Source:Â US Dept of Ed

While for-profit institutions only make up 13 percent of total student enrollment they make up a stunning 47 percent of student loan defaults. This of course is incredibly high and many in the for-profit industry talk about giving access to poor Americans hence the high default rates. This is similar to the nonsense argument made with subprime loans. Well of course defaults are higher because we want to give access to the average American making $25,000 a year a $500,000 loan to buy that McMansion. Of course these people are comfortable lending out other people’s money while they would never in their wildest dreams make that loan with their own capital. If that is the case, then give students more access to low cost state run schools but that is not the case. Even state schools are increasing their tuition rates dramatically:

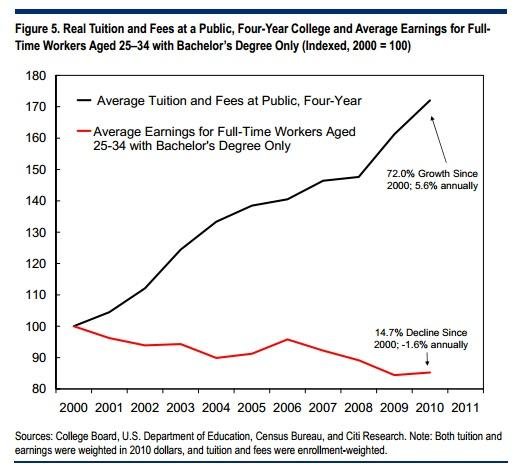

Average tuition at public four-year schools is up a whopping 72 percent since 2000 however the typical earning for young college graduates has fallen by 14.7 percent. How is that justified? Many are now vocal about the higher education bubble. Mark Cuban, billionaire owner of the Dallas Mavericks has this to say: Â

“(Blog Maverick) For the smart student who cares about getting their money’s worth from college, the days of one school for four years are over. The days of taking on big debt (to the tune of 1 TRILLION DOLLARS as I write this ) are gone. Going to a 4 year school is supposed to be the foundation from which you create a future, not the transaction that crushes everything you had hoped to do because you have more debt than you could possibly pay off in 10 years. It makes no sense.

Which in turn means that 4 year schools that refuse to LOWER their tuition are going to see their enrollment numbers decline. It just doesn’t make sense to pay top dollar for Introduction to Accounting , psychology 101, etc.â€

This is very true. Why would someone saddle themselves with unbelievable levels of debt for basic knowledge that can be learned for very little money? Take a look at college tuition measured in context of inflation:

The above also accounts for the once in a lifetime housing bubble and college far outstrips any gains seen in that sector. Student debt now stands at well over $1 trillion. In 2011 there were was someone in the media even trying to discount that there was even $1 trillion outstanding. This was posted in late 2011:

“(Reuters) This chart shows the total stock of credit-card and student-loan debt, up to the second quarter of 2011. The most recent figures show total credit-card debt at $690 billion, and total student-loan debt at $550 billion. It is not true that Americans now owe more on student loans than on credit cards, and total student-loan debt isn’t even close to $1 trillion.â€

As it turns out, this “expert†was incredibly wrong. Official data both from the Fed and the government now shows that combined public and private student debt is well over $1 trillion. Similar to the housing bubble where near the apex people were trying to downplay the large levels of debt, we see similar arguments made today for the student debt bubble. Yet it is getting more and more obvious that this thing is going to pop given the high levels of default rates with the riskiest loans. The problem is, there is a giant portion of risky loans in that $1 trillion pool.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Don Levit said:

If college tuition is rising due to the availability of loans, what will happen to health insurance premiums when the PPACA exchanges are created in 2014? There, we have subsidies, not loans, to purchase the pricey insurance.

Subsidies which one does not pay back – only if his income increases so that he was “oversubsidized.”

Don LevitFebruary 15th, 2013 at 1:17 pm -

Peter de Luca said:

There is one flaw in this article. The article shows that the default rate is lower for two year public colleges than for for-profit colleges. That is misleading. In California, a college student pays only about $36 a credit. When a student drops out of a community college or fails a course, it is the taxpayer that pays most of the bill. That is a lot of wasted money that the taxpayer pays for students at the community college level. At the community college I teach at, there are 20,000 students. You would think that about 10,000 students would graduate each year. But last year, only 850 graduated.

February 16th, 2013 at 2:06 pm -

Paul Verchinski said:

This is already starting to happen at private universities. Catholic University Law school has just laid off a number of folks due to declining enrollment. It reflects the high cost of Law School and the inablility for graduates to find jobs in the law profession.

February 17th, 2013 at 2:45 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!