Are stock investors coming back in at another debt induced peak? How regular stock investors are horrible at market timing.

- 3 Comment

The media is falling over itself with articles on how fantastic the stock market is. The fact that the S&P 500 is now up from the March 2009 lows by over 100 percent seems to put the financial crisis in the annals of history. Yet for most investors, the stock market is largely a casino. For example, if we take a look at the fundamentals we realize that much of the meteoric rise has come courtesy of big institutional funds trading on low volume. The retail investor has been largely absent because first, nearly one third of this nation has no actual savings. It is hard to save with no money. Next, you have the median household income at $50,000. With the rise in tuition, healthcare, and now housing values once again the cost of living is getting more expensive. But of course, just like at the peak of the tech boom, the average investor is now inching slowly back into the waters only to realize that much of what has occurred has been on the backs of giant piles of digital dollars printed by the Fed. Are investors making another investing mistake?

The VIX views no problems

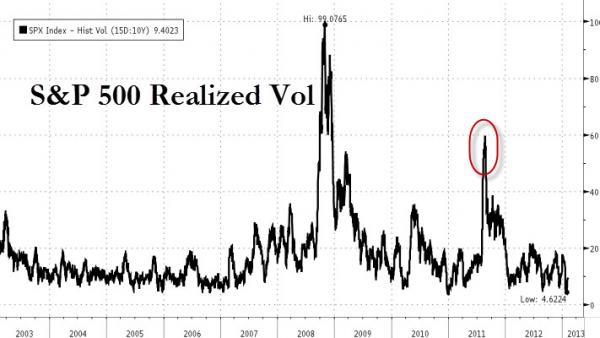

The VIX index measures market volatility and according to the latest data, all seems to be well:

No worries are imminent that our debt-to-GDP ratio is now in excess of 100 percent. There is little worry about the coming pension crisis. Student loan bubble? No need to worry when the digital printing press is all you really need. The VIX is acting as if all is well but in reality we have 47.5 million Americans on food stamps and real inflation is back in the market. Since the manufacturing sector is stripped down, most pathways for middle class jobs require some sort of college or vocational training. The cost for this education or training has far outpaced any gains in income.

Yet people are moved by emotions, not actual numbers. They see or hear about their friend that has made money hand over fist in the stock market. Similar to the stories that emerged during the housing bubble these stories are pulling in retail investors back into the market but not many have the big piles of money to make a dent in overall volume. Tulip mania, the Roaring 20s, the tech bubble, the real estate bubble, and now the easy Fed money bubble.

This is another fascinating point regarding trading volume. You would think with all the good news that trading volume would be steadily up. That is not the case:

Trading volume is at decade lows. You see the big crisis in 2008 and the issues that emerged in 2011. Yet most of those issues have not been resolved. Banks are fully leveraged again thanks to Federal Reserve digital printing. The Fed is buying up virtually every mortgage being made. Hedge funds are crowding out regular home buyers and pushing prices up on the rental and home price front. Colleges thanks to Fed lending are pushing prices up since most students will incur student debt.

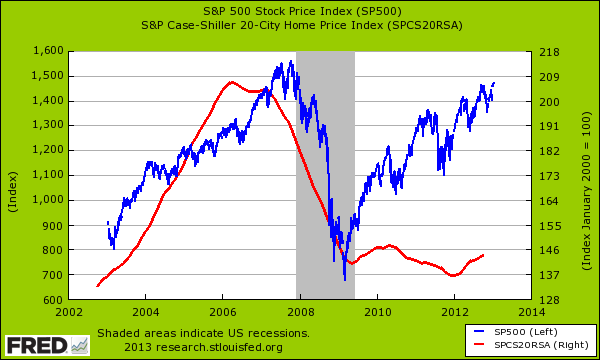

Most Americans derive their wealth from housing and housing is still very far from a full recovery:

While the S&P 500 has nearly recovered all losses incurred since the financial crisis, home values are still down nearly 30 percent from their peak. For an asset class that has never experienced an annual decline for a generation, this is a big deal. The fact that investors are now diving back into the stock market with little regard to fundamentals is similar to what happened during the tech bubble. The big money has already been made.

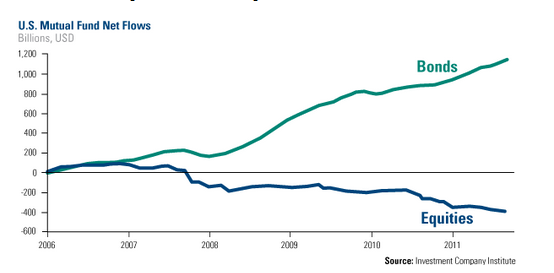

You also see this with the flood into bonds over equities:

Part of this from the retail side is occurring because many baby boomers are recalibrating their portfolios as they near retirement. It is common wisdom that your bond allocation should be heavier as you near retirement. Yet the yields on junk bonds for example are incredibly low for the risk being taken on. This is what happens when the Fed artificially prices risk in the markets and people try to protect their money. And of course, the ultimate indicator of a bubble is when the mainstream press talks about the good times:

Timing does matter when you are investing. Some seem to think that getting on a wave that is about to crash is a smart move.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

JD said:

Yes. Timing is everything which reinforces the need to have a long term view of markets( equities) The Fed is currently the market maker, but corporate performance has improved. Unfortunately the improvement has not yielded the traditional job recovery, and the skill matrix required or 21st century employment is changing. Addressing that area will be and is a most pressing need in the US if we are to remain the beacon of opportunity.

February 13th, 2013 at 6:35 am -

juserbogus said:

don’t we want home prices to be lower than the peak… otherwise we’d be back in the bubble, right?

February 13th, 2013 at 6:50 am -

stock fan said:

Stocks are good

February 13th, 2013 at 12:04 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!