Inflation unchained: US dollar down 23 percent from 2000, Tuition up 72 percent, and home values up 44 percent. Incomes adjusting for inflation are back to 1990s levels.

- 0 Comments

It is hard to believe that people in the US are still denying the obvious impact of inflation. The slow erosion of purchasing power has occurred for many decades now. What people tend to forget in a completely fiat based system is that the Fed can print as much money as it likes. And they have in digital format but also monetizing debt via mortgage backed security purchases. When the crisis hit in 2007 debt was being destroyed via foreclosures and bankruptcies. Debt in a fiat system is money. That is why the Federal Reserve injected trillions back into the system to revive it. Yet this money did not trickle down to most people. However, today, we are seeing where debt is present prices will soar. Just look at student debt and housing prices again. How is it that college costs and housing prices are moving back up a nice pace when actual household wages are stagnant? Because inflation is hitting the system and more debt is accessible to these sectors.

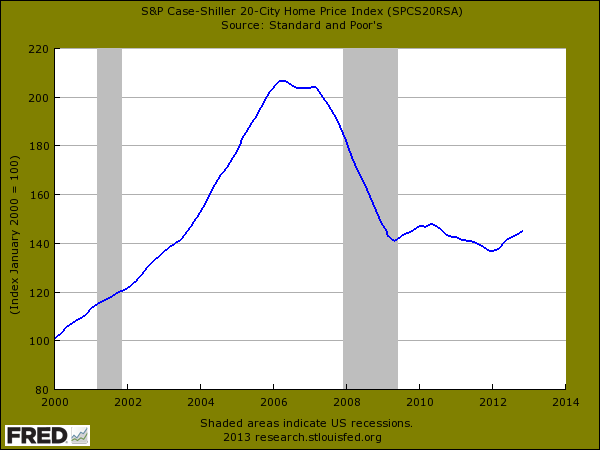

Housing

Home values are now up over 5.5 percent year-over-year:

At the same time, housing prices are up 44 percent from 2000. Household incomes are up close to 30 percent without adjusting for inflation so a good portion of this increase has been stripped away by inflation. The housing market is being juiced with easy money and in a fiat system, access to debt is viewed for all intents and purposes as money in the system. After all, you can go out and buy a house today for $200,000 in cash or with a $200,000 mortgage created out of thin air from your local big bank. Either way, you end up with the same tangible asset.

The reason housing prices are going back up has to do with the leverage of lower interest rates and the very low supply in the current market. This is also why after the crisis, there was no concerted effort to bring back larger down payments even though a big culprit of negative equity was allowing people to buy with nothing or very little down. People still have similar demands to purchase homes so of course adding more leverage will simply push prices up. After all, the US dollar hasn’t done all too well since 2000.

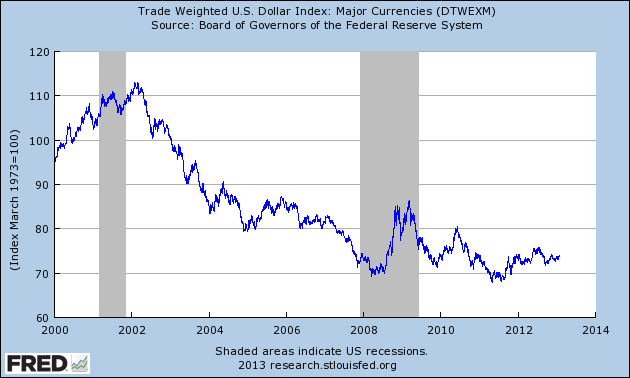

US dollar

The US dollar is down by over 23 percent from 2000:

In other words, every dollar you have in your wallet today has lost a good amount of purchasing power since 2000. In many ways, this is what we are seeing with our middle class being hollowed out. Everything is “feeling†more expensive because in reality it is. A dollar no longer purchases as much as you would think. So the incentive is for people to simply go back into deep debt and continue purchasing big ticket items like homes, cars, and going to college. Like our massive $16 trillion plus in national debt, the hope is that inflation will wash it away over the years.

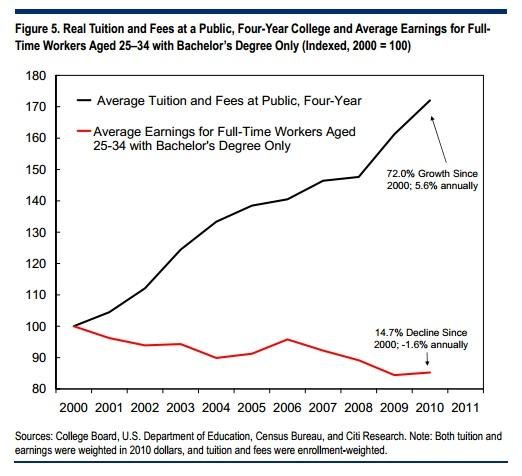

College

The one area where prices have gone seemingly gone out of control is with college tuition:

From 2000 average tuition has gone up by 72 percent yet real earnings are down by 14 percent. As we become a predominately service oriented economy, the good paying jobs do require some sort of actual training typically in the STEM fields. Yet this in itself is no guarantee of a job. So you have many competing for low wage jobs or we have another 47 million on food stamps. The only reason this continues is that easy government funding allows anyone to take on enormous amounts of debt to pursue a college degree.

In the end, it is hard to see how some will argue that inflation isn’t chipping away at our standard of living. It is. Debt is money or is treated as such and housing and higher education are perfect examples of two segments of our economy where unlimited debt is available as long as you are willing to sign on the dotted line. For housing, you only need a tiny down payment. For college, you just need a pen and piece of paper.

Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!