Federal Reserve bubble escape clause: The master of bubble creation talks about preventing future bubbles and other circular banking logic. Fed aggressively buying securities outright.

- 3 Comment

It is no secret that the Federal Reserve is aggressively buying up a variety of securities and storing them in their opaque balance sheet. The Fed in essence has become the bad bank and has served as the conduit to support bad banking policy. There seems to be a policy of slowly shrinking the middle class and over time, maybe people will not notice it. How can you not see that the central bank of the United States has been at the nucleus of many of the previous bubbles? So with that said, I found it rich that the Fed has talked about its ability to moderate bubbles. That is right. The Fed, the numero uno culprit in the housing bubble is talking about preventing future bubbles. Ironically by going deep into QE3 they are essentially inflating asset prices yet again by destroying fixed income investments and causing inflation to pick back up.

Bubble maker to prevent bubbles

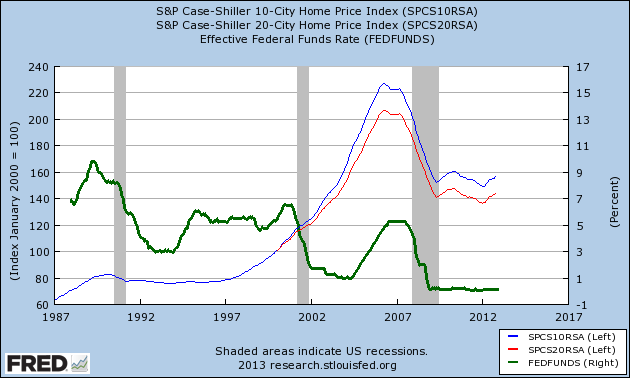

One of big reasons for the housing bubble was because of the Fed’s inaction in the banking industry. The Fed has the power to patrol and monitor banks. Instead, in the early 2000s when it was clear housing values were taking off for no reason aside from a mania, the Fed drove interest rates into the ground:

The Fed essentially added fuel to the flame. By the time the Fed stepped back we were already at a peak. The damage had already been done. This is the problem with this bubble clause measure. The Fed is controlled by people and very few will have the political will and power to pop a bubble in the early making. What is there to gain? If Alan Greenspan popped the housing bubble in the early 2000s what would he have gained? Instead he kept inflating the bubble and allowed the mess to be cleaned up by his predecessor when the bubble inevitably burst causing the deepest recession since the Great Depression.

Yet we are now seeing the issues with keeping rates low for such a long-time. Inflation is now picking up in many sectors and is stripping the middle class of purchasing power. The Fed is actively targeting mortgage backed securities and is pretty much the only player in the mortgage market right now. Banks are operating in a private-public partnership where gains are privatized and losses are socialized. This bubble machine is perfectly setup. Even with housing and the middle class that rely on housing as the backbone of their financial wealth, families have lost over 5 million homes in foreclosure. Interestingly enough, many of these banks and hedge funds are buying up these properties from these bailed out banks. Those that were prudent are largely subsidizing all this activity.

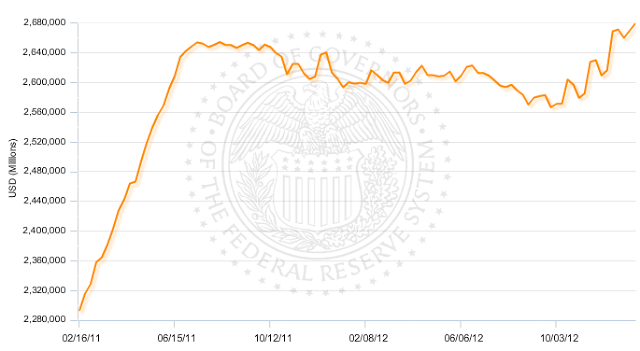

Fed securities holdings hit a record:

Outright securities holdings by the Fed (source: FRB)

The market is weak here and the Fed is crowding out all players. The desire for such low rates is driven more by keeping the banking system in place and allowing the tragic bets of the 2000s to slowly inflate away. It is also driven by our massive debt. A low interest rate allows us to borrow more and pay less.

Yet low rates are typically driven by safe bets in the open market. The opposite is occurring here. The safe bet belief is happening because the Fed is buying trillions of dollars of securities. The only reason people believe rates will stay low is because they might perceive that the Fed can keep rates low. The perception is not working all that well thus the Fed needs to be the largest player in these markets.

The notion that the Fed can somehow stop future bubbles is comical. What have they done since the recent crisis to shore up the banking system? The same gambling and speculation continue today. So we expect the Fed to self police itself? No wonder why we now exist in a perpetual system of booms and busts.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

jimbo in limbo said:

If the Fed can create money out of thin air, can it cause money to disappear into thin air? Is that what they’re doing?

January 15th, 2013 at 8:13 am -

surfaddict said:

The bank of Japan has kept rates low for decades, why can’t the US Fed do the same? The current 30 mortgage rate in Japan is well under 1%.

January 15th, 2013 at 10:24 am -

TrapperGus said:

You talk about the Fed as if it were a monolyth…there are many positions withing the Fed…

The Fed is just a symptom of a larger problem where the Conservative Economic Policies have been in command since Reagan…Greenspan, that displine of Ayn Rand, was appointed by Reagan because Volkner beoeved in using the regultory powers of the Fed to do what you suggest should have been done while Greenspan believes that markets are 100% self regulating. The current chairman is more like Greenspan than Volkner. We haven’t had a government that was concerned about the 99% since Nixon…

January 20th, 2013 at 7:42 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!