The food stamp economic recovery – Food stamps increase by over 600,000 in last month of data. GDP at record levels yet US employment is 4 million below start of recession.

- 3 Comment

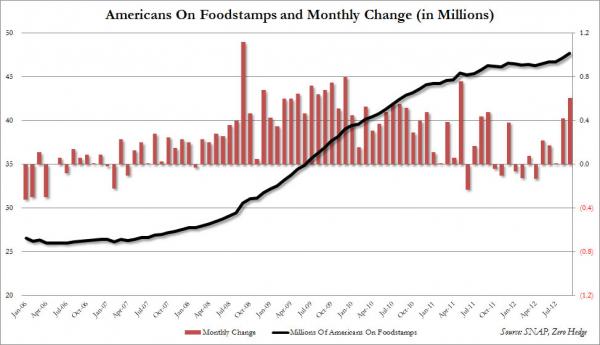

There was a startling figure that came across my desk from the United States Department of Agriculture regarding food stamp usage in the SNAP program. Food stamp usage has grown dramatically in the last decade even during the debt inspired boom times. Yet the devil is always in the details as we reported with the unemployment rate really dropping because of the over 500,000 Americans simply dropping out of the labor force. The food stamp figures are stunning because they show in the last two months food stamp usage has skyrocketed by over 1,000,000. In the last month of data observation, food stamp usage increased by more than 600,000. Keep in mind to qualify for food stamps you have to carefully demonstrate that you are earning very little and technically are classified as being in poverty. So what does it say that our nation now has 47.7 million Americans on food stamps?

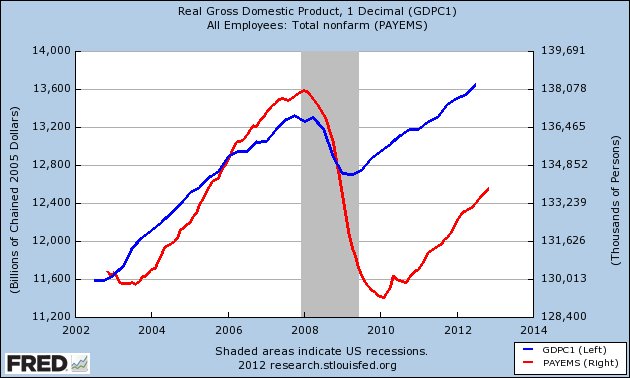

GDP to record levels yet employment down by 4 million

Our Gross Domestic Product is now at record levels yet we are doing this with over 4 million workers less than in 2007:

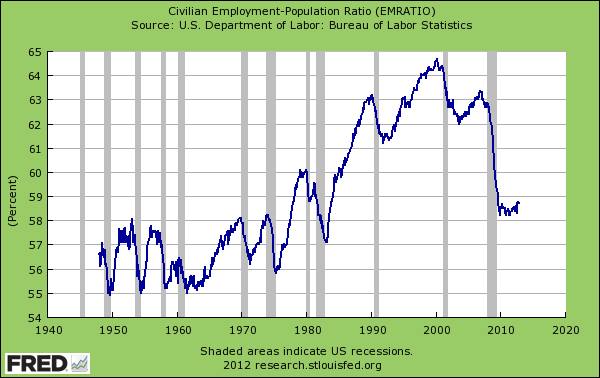

The reason this is possible is that income inequality is simply growing more dramatically. That is why on one side of the spectrum we see big financial institutions back to making big bets and earning big bonuses while in the last month of data, we added 600,000 more Americans to the food stamp system. If you want to visualize how things have played out since the recession began here is an excellent chart:

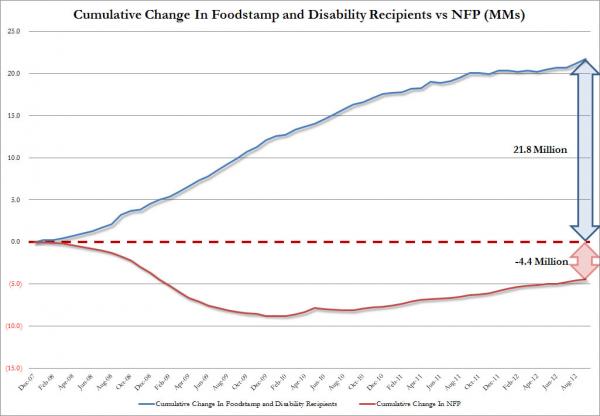

So if you were following the trends since the recession hit you would find the following information:

Food stamp usage:Â Â Â Â Â Â Â Â up by over 21.8 million

Employment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 4.4 million below the point where the recession officially started

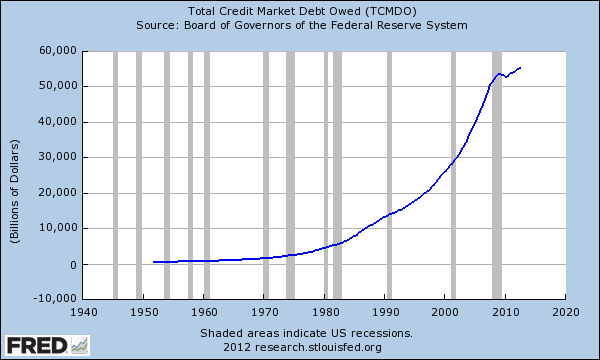

These figures are important. You might be asking how this occurring in a supposed recovery. A large part of this growth is being juiced up by massive debt programs and pseudo-debt and money creation programs like QE3:

The total US credit market debt is at a record $55.3 trillion. We are inching closer to blowing right through another debt ceiling and the fiscal cliff is not a shocking surprise, it is merely the culmination of massive debt addiction stemming back to the 1970s. Yet as many countries are now facing including many in Europe, there is a point of debt saturation. Inequality reaches a major tipping point especially when you eat away at your middle class. Are all those people on food stamps buying iPads and purchasing new cars? Unlikely. If they are, some are doing it via debt that they clearly cannot afford.

Food stamp nation

Food stamps have essentially kept 1 out of 6 Americans from being out on the streets and starving:

Yet a recovery this is not and the 7.8 percent headline unemployment rate is largely driven by the dwindling workforce participation:

The above is a better indicator of the percent of Americans actually working. As you can see, it is hard to see an actual recovery. You have to ask deeper questions like what are those 500,000 people that dropped out of the labor force now doing. What propelled 600,000 people to suddenly enter the food stamp program and push the overall figure to 47.7 million? The data is readily available yet no one in the mainstream press covers this because in all honesty, the mainstream press is a vehicle to sell advertising. So of course they have a vested interest in keeping the story going that all is well and people should go out and spend (another reason why 1 out of 3 Americans has zero saved to their name). Just look at the ads they have. You think telling the public that 1 out of 6 Americans are scraping by in poverty with food stamps is going to sell more cars?

Debt is not wealth. Food stamps are not a sign of positive economic growth. You would think this would be common sense but as we approach another debt ceiling, the Fed is trying to inflate a housing bubble again, and as we confront the fiscal cliff you realize that we are back to old habits.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Ulysses said:

Re: Debt is not wealth.

On the contrary, in a fiat currency system which guarantees a steady loss of its purchasing power (over 90% during the last four decades, actually), being in debt is the safest strategy and saving is not only meaningless but outright dangerous.

People are not stupid and if you want them to save, then give them something worth saving which the fiat dollar certainly is not.

December 13th, 2012 at 12:32 am -

HXR said:

I read you regularly and have seen the posts on food stamps. It would be interesting to know the total dollar outlay. In my experience food stamps are currency, especially if you’re out of unemployment benefits. It is not uncommon to be shopping in the grocery section of Wal-Mart and have a person approach you for a deal. They will pay for your groceries on their card, and you reimburse them 50 cents on the dollar in cash. I know this also happens between people looking for a place to live and someone working and renting. Food stamps for renting a room. A good deal for both parties and done all the time, and also illegal. This way they can buy their drugs, booze, and cigarettes and keep a roof over their head. How do I know this? I see them in bars and I ask them! So here we have an underground economy that is probably somewhere between 1% and 50% of the total food stamp outlay that is fueling “bad behavior.†Do you know of any valid studies on this? Ironic but not uncommon for the gov’t to end up with unintended consequences to their social engineering.

December 14th, 2012 at 10:28 am -

TrapperGus said:

The issue of turning the United States back to the 19th Century started with the rabid anti-labor movements in the 1960’s and beyond. It is not a surprise that with the distruction of the Unions most of the people in the United States are being forced to beg for their daily bread….if you want to fix this pass a law that everyone must be ina Union and that only Unions represent workers…

December 23rd, 2012 at 6:54 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!