Can you live in California on a $60,000 a year household income? Living the middle class lifestyle in California on $60,000 a year.

- 19 Comment

Can you live comfortably in California making $60,000 a year? It really depends on what you define as comfortably. We should note that the median household income in the US is $50,000 and in California it isn’t much higher. California gets a notorious rap of being an expensive state but this is if the entire focus is on coastal regions. There are many areas where homes are actually affordable given current interest rates. Yet many people struggle to get by. You have many households pulling in $100,000 or more a year and they speak as if it were an act of poverty. Yet they choose to live in areas like San Francisco and spend up to their income levels. It is very feasible to live in California on $60,000 a year but not how many would expect. People are feeling the withdrawals of our debt based addiction and California is a prime example of this.

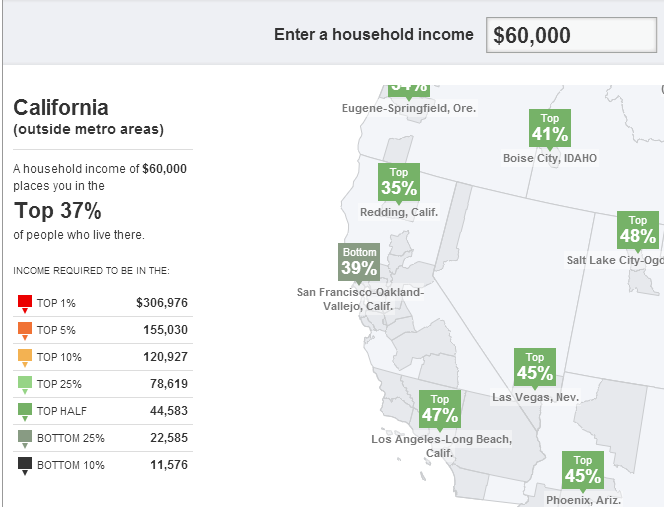

California income breakdown

Half of the households in California are barely pulling in $50,000 a year similar to what we see across the US. Yet if you live in the Bay Area, $60,000 a year will put you in the bottom 39 percent of all households. Rarely do we see financial articles actually try and breakdown a budget of how it would be to live on this kind of income.

Budgeting is such an important item for any households. But most households live on a motto of earn it and spend it. They suddenly get a raise or come into more money and they find other means of spending this funding.

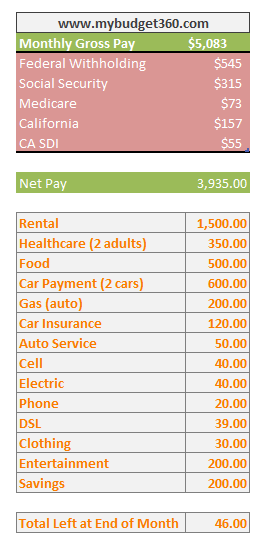

Below I’ve broken down a sample budget of a family making $60,000 a year and living in California:

Let us walk item by item here.

Net pay:Â After taxes and other mandatory expenses, your net pay will likely be $3,935 or close to $4,000.

Housing: You can certainly find a rental for $1,500 a month. Depending on where you live, this might have to be a one bedroom but you can certainly find something like this in any metro area if you spend some time scouring Craigslist.

Healthcare: We’re assuming two working adults here.  Relatively healthy people in our example and the cost should be about $350 a month. You can do a little research on places like eHealthInsurance and find similar health plans.

Food: You can get by on $500 a month with food for two people. California is home to many dollar stores and you can find a good amount of cheap vegetables there. You will also have room for meat at your local grocery store. Buy toothbrushes and soap at dollar stores for example. Seriously, a $7 toothbrush does the same as one for $1. You do not have golden teeth. I recommend non-big name stores for discounts. Go to Costco to buy bulk items and plan meals out. But if you go to Costco, go with a plan and don’t go lurking since you will blow your entire budget there. I know how tempting these places can be.

Car payments: Unfortunately living in California you will likely need to drive a lot. We’re assuming two cars with car payments of $300 a month. This will get you a Civic or Focus. Excellent cars. Cars that would have made our parents go bananas and feel as if they were in a real life version of Star Trek. We’re talking middle class here, not a Lexus on $60,000 a year.

Car Insurance: $120 a month should cover two of you. Places like Mercury Insurance offer very low rates. You will get discounts for anti-theft devices or having a good driving record.

Auto service:Â Oil changes and regular wear and tear.

Cell: Seriously, no need for the $100 a month contracts. What are you, JayZ? Get a Virgin Mobile plan for $35 a month and save hundreds of dollars a year. They even offer 4G services. Be smart and add on Skype or Google Voice and use the network to save on minutes if you need to. $100 a month for cell phones is nuts. You can also get prepaid plans for much cheaper like $20 a month.

Electric: Self explanatory. If you are living in a $1,500 rental you will not spend much here.

Phone: $20 is on the high mark but we’ll just add this here for another cell plan.

DSL: You can get dry loop internet for about $40 a month. Get rid of the nonsense cable. Go for Netflix and use your internet to stream content. You can even purchase a Roku player and add various channels like TED that actually teach you something instead of the mind numbing mainstream programming.

Clothing: $30 a month is really all you need. You can get by with this even if you work in an office environment. Why are you shopping at Nordstrom’s every weekend anyways?

Entertainment: $200 a month is enough. You can have a couple of meals out, a movie, or grab some food and go for a hike in many of the nice areas outside of the city. A bike ride is free and it is one of the best things you can do. $200 a month is plenty here. But many people want to go out to fancy restaurants and drop this much in one go around. That is living as if you were making $200,000 (see chart above) and many are not.

Savings: Need to build that buffer. Sock away $200 in an emergency fund.

So what are we missing here? What about retirement savings? That will be hard to come by on this budget. What about sending your kid to college? Well in California you can send them to an affordable community college followed by a state college. Healthcare? We already factored that in above. Housing? If you live in areas in the Central Valley or San Bernardino you can have a nice home for $1,500 a month. In big expensive metro areas expect to rent or go for a condo.

So it really does depend what you would think of as middle class. In California, we have two nice cars, cell phones, DSL, Netflix, the ability to eat out, and also the ability to send a kid to a state school. In the first half of the 1900s this would have been very luxurious. Today it might seem constrained because instead of the Civic, you want the Mercedes. Instead of sending your kid to the local city college you want to send them to a private $50,000 a year school. It is very doable to make it on $60,000 a year in California but people need to adapt expectations. The Fed is already juicing the economy to make debt very accessible again. Yet this only feeds into the constant need for more and more and look where that got us?

Is $60,000 a year a middle class income in California? By definition it is but quality of life means different things to different people.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

19 Comments on this post

Trackbacks

-

tom said:

$200 month for gasoline? I will also assume there are no children in this household. I live on Long Island,NY…our cost of living is quite high. I am not so sure about renting a place for $1500 a month and if you find a place, there’s a good chance it’s in a good neighborhood

January 27th, 2013 at 4:11 am -

John said:

This is completely inaccurate. With $60,000 salary you don’t walk away with $3,935. Different companies have different payments but you will more or less end up with about $3,450 according to the paycheck calculator (link below). Your salary need be about $71,000 to collect nearly $4,000 in California. So based on that you can kiss your entertainment and savings good bye.

January 27th, 2013 at 5:09 pm -

Jenny said:

$60,000 / 12 is $5,083??? This is a complete farce. You don’t bring $3,935 home after all the taxes and deductions for $60,000 salary in California. It’s more like $3,450. So based on that you can kiss your entertainments and savings good bye!

January 27th, 2013 at 7:48 pm -

abramsgunner said:

I’m sorry, I think you are single and have no kids ($30 wont keep your kids in diapers a week). Can you live a decent life on $60k, yes. I’ve been doing it with a family of 5 for the last 10-15 years, but I don’t live in Cali, and it is getting more and more difficult. I can tell you though, that the budget as posted will make you a regular visitor to the payday loan franchise of your choice. All your budget items here are fixed expenses that you know are coming…. You need to carve out at least 25% (if not more) of your monthly take home for things that aren’t on your budget, as life has a way of handing you a $1000 setback at least once a year if not twice (sure you could use your savings and entertainment budget, but then why call them that at all). Inflation is raising those expenses every year and your paycheck will not budge… that extra $46 a month won’t be there next year. On this budget, you can’t afford $1500 rent, or $600 on cars. $30 is light for clothing, $500 food is heavy for two adults, light for family with two kids, $50 for car maint will cover maint. items only, no repairs of any kind, Healthcare is light unless you never get sick (that rules out kids), as the budget stands, entertainment and savings will always suffer the ravages of reality.

January 28th, 2013 at 8:01 am -

M said:

Sure cali is fine on 60 k a year , long as 30 k of your money is non taxable. You get substantial savings on groceries . Keep your 20 dollar a year midwest plates . Other than that , no turned down 75 k a year and that was 14 years ago , did the cola math. Discovered that 45 k in the midwest was a better deal for me.

January 28th, 2013 at 2:51 pm -

Sarah said:

Thank you for playing with the numbers to come up with this budget as well as the few others I’ve found on your website. What each budget shows me is how careful one must be with the major expenses like housing and transportation. Keeping housing costs under control is critical. Personally, I watch every penny we spend, and we couldn’t live any other way. Too quickly expenses can get out of whack with income…without any big luxuries, just a few medical expenses can push people over the edge. At least these ‘models’ help portray the situation.

January 28th, 2013 at 3:31 pm -

John said:

I’d say the answer is “no” you cannot have a stereotypical middle class lifestyle with vacation trips and remodeling the house, but it’s a perfectly nice working class or lower middle class lifestyle with few hassles. If it’s done on one income – well, that’s even nicer.

January 28th, 2013 at 10:27 pm -

ame said:

If you have children, you need life insurance. I didn’t see that factored in.

Also, you didn’t add in the cost of child care. Big bucks.

$30 a month for clothing for two adults? Perhaps if you shopped Goodwill? Add in a child or two that grow constantly, and it’s an impossibility.

Gasoline is too low at $200 for two adults commuting in the Bay Area. You burn that just idling in traffic.

Personally, I think the entertainment value is too high. Play at home!

January 29th, 2013 at 9:11 am -

Mrs. T said:

My question is how can I live on less than 10,000 a year?

January 31st, 2013 at 3:58 pm -

Mrs B said:

I think the numbers were manipulated to fit the authors ideal. A standard telephone line in my area is a minimum of $35 a month before ask the fees and taxes are tacked on that can easily bump the price by $10. That’s out for us. As for internet service, that’s even further off. For decent service, not the fastest but not dialup up either – just enough to watch Netflix without it buffering 100 times in a show, costs me $70 after tax and all the ridiculous fees they tack on, too. Rental – $1900 for a simple, no thrills, minimal convenience 3 bedroom house, and that is CHEAP for my area. As for location, you have to go where the jobs are and hope you can find something reasonable without spending everything you earn on gasoline and not having to worry for your safety or the safety of your kids at home or at school. If middle class means making barely enough to make it paycheck to paycheck without saving any for a rainy day (or car repairs on that 20 year old car you keep nursing and hoping it doesn’t finally crap out on you altogether) and skipping any family vacations, then I’m living the middle class American dream! Thanks for the laugh, though.

June 5th, 2015 at 2:33 pm -

Phillip Self said:

Yeah, you are smoking weed too. Electric bill alone will be $200 easy and if you enjoy a cool home bump it to 300. Southern Edison keeps raising the Kilowatt price and they bill in tiers. Same with water. You will have a $50 water bill at a minimum and trash service is at least $40. $300 car payments???? Are you paying them out over 7/8 yrs? You didn’t mention car tags either and most people have kids. 60,000 before taxes is tough. A lot of people are doing it I suppose but they are usually one accident away from disaster.

September 20th, 2016 at 2:52 pm -

chris said:

The problem isn’t the pay in California, it’s everyone’s incessant need to live beyond their means. Doesn’t matter if they are making 20k or 100k, you still hear everyone at work bitching about not making enough. Makes me sick to my stomach. all that being said these points being made in the article and comments are moot, people live on much less on a day to day basis. and yes, they are one step away from disaster and it’s the ugliest thing you’ll ever see if kids have to be involved.

“…ask not for more riches, but more wisdom with which to make wiser use of the riches given to you at birth, consisting in the power to control and direct your own mind to whatever ends you might desire.”

January 15th, 2017 at 2:34 am -

Megan said:

Uh… this article must have been written someone that lives in Kansas and is over the age of 70 years old. Obviously you have no idea what you are talking about and have done no actual research. One person cannot even live a normal life on $60k in San Diego…. so…. ya. $30 for clothing?! Where are you buying your clothes from Tijuana Hookers R Us? And no you obsolureky cannot find an apartment that is suitable for two humans for $1500…. are you insane?! I live in a 300sqft studio that looks like an “the projects” and I pay $1600 plus utilities!. Gas is 3.00 a gallon no question about it…. now think about how much traffic our state has. So, no, try at least $300 for gas. Even with Obamacare if you want decent healthcare here be prepped for $500 a month. Do I even need to point out that you didn’t add state tax into your equation?!!!! If you are making between $37k-$92k you WILL pay 9.4% in California state tax. Then add the federal 25%. Now deduct SSI and all the other bullshit things they take out. Food… don’t even get me started. If you want to barely make it as a single individual adult, and actually live like an adult without a roommate, you HAVE to make $80k per year. And you better damn hope if you have a spouse or significant other that they are pulling in the same amount.

January 26th, 2017 at 11:01 pm -

bob mcbob said:

40 bucks a month for electricity? haahaaaahaaaaaa

no gas bill? haaaaah!February 21st, 2017 at 8:23 pm -

Jenny Tuffnell said:

How about $1100 a month for health insurance for 2 adults? Sound familiar to anyone out there? I don’t know where this dude gets his health insurance but he must have a $10,000 deductible.

May 15th, 2017 at 10:41 am -

Daniel said:

love Megan’s comment. I couldn’t agree more! lol

June 9th, 2017 at 4:31 pm -

Jaeson said:

I’ll be honest I’ve lived in CA for 30+ years. Grew up here, still here. I made around $20,000 after I got out of college (with a graduate level degree), then $44,000, then $56,000, then $64,000, and then $55,000…. How did I get by? I never moved away from my parents house and they haven’t been charging me rent since things are so bloody expensive in this state! Gas prices to fill up a non-gas guzzler are $40 per fill up (yes you read that right). A phone bill is more like $45. Cable/DSL? $100. After taxes and msc deductions from work I make around $3000. The rental units near me are $1800 for a one bedroom, and not even in a “nice” part of town. To give you a good idea of how expensive it is here, my friend, who is an engineer with a graduate degree and several years of experience, still lives at home with their parents due to rent cost. Near their workplace rents are $3500 (yes you read that right). They said forget that! And they now live at home. A friend of theirs who is also an engineer decided to get a 800 square foot condo to the tune of…. $700,000. Yep. That is pathetic! Not sure when the housing will burst again, but it is long due for it. One of my classmates in college got a condo because their rich dad gave them $270,000. They barely qualified for a loan for the remaining $100,000k. So $375,000 for a 2 bedroom, 1000 square foot place in a building built in 1960. So they can continue to make payments until they are 60 something… its really pathetic. I don’t know anyone who has successfully moved away from home, even half a decade after graduating. Wages are increasingly stagnant in this state. To live comfortably here as a single person, you’d need to be making well over $87,000. As a couple, I’d say the cost goes up, it doesn’t go down! You’d want to earn at least $170,000 if you even remotely think about buying any property, and even then its prob going to be in the ghetto and you better have 8 months of savings in the event of a lay off, which seem to happen pretty often here, and the automation of 50% of the workforce by 2035. Kids? Well they happen….but you prob shouldn’t have them unless you are rich. They will set you back $20,000 per year (so a newish car every year as if you were paying it outright) if you want to send that kid to college by the time they hit 18 and it costs $250,000 to go to a State University.

So solution? Do you have a relative that will allow you to live rent free?

May 30th, 2018 at 5:15 am -

Ward said:

Well,

I am in the California with the Golden Gate Bridge? Just checking. Need a reality check. Don’t do pot so I don’t think the sugar cookie I just finished off is making me trip, and I don’t have those kind of mushrooms. 62 years California born and raised… Moving forward, rent for $1500? Huh, it has a roof? Don’t think so. In Fairfield, try more like $1800 for a 1 bedroom. PGE? Try more like $200 average, keeping it at about 62degrees in the winter, In the summer 76degrees. Entertainment? What’s that? Hulu, Netflix, Prime & UVerse, wife already says were not getting rid of that so, around $180 a month, that includes purchasing avg 2 movies on prime a month. Food? $600 is do-able, lots of soups and stir-fry’s. Health Ins. Try $540 a month for 2 via Kaiser Cal/North, thanks to corp retirement benefit. Cell phones avg $300 unlimited, for 5, I pay for ours and my parents. Savings: LOLOLOLOL. What is that? It’s called save for the next 4 months for what you really need extra. Just being real… sorry for the venting… by the way we have my 97 year old gram living with us… she handles just her expenses. We provide EVERYTHING ELSE. That’s just what you do. Hope someone does the same for us when that time comes. Our 36 year old son lives with us too. As mentioned my one of the commenters, he doesn’t pay any rent or contribute to the general expenses. In 27 years the house will be his… :P. And life goes on..December 25th, 2018 at 4:16 pm -

Ivan said:

I think you did a great job here. All the people bitching having a very narrow mind or are not living within their means. I live in a 2 bedroom apartment with my wife and 2 kids and I pay $1,350 a month and it’s in Imperial beach a mile away from the beach. And yes electricity is never more than $40-45 a month. And by the way for those complaining that this guy is single and his expenses are therefore less than a family are not calculating the fact that your monthly take home pay should be more than $3,900 since your tax refund will be much higher than a single person with no kids making the same amount. So that should make up for extra expenses. I make $50k a year and it’s in San Diego and I have 740 credit score with no debt.

March 31st, 2019 at 12:47 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!