Get used to the idea that you will never retire: GAO report shows that half of Americans 55 and older have no retirement savings at all.

- 12 Comment

Some of you might remember the glossy highly produced advertisements back in the early 1980s when Wall Street decided it was time to turn American retirement plans into casinos. The slow and agonizing death of the pension plan was supposed to be replaced by the beautiful and wonderful world of the 401(k) plan. Save for 30 years and in the end, you will be a millionaire just like your friends on Wall Street that sincerely care about your financial future. Of course since then, we have found out about junk bond scandals, mutual fund fees that make loan sharks look conservative, and of course the financial shenanigans of giving people toxic mortgages that were essentially ticking time bombs of destruction. This was the industry that was put in charge of helping you plan for your future. We are now a generation out from those slick ads and the results have been disastrous for most Americans. A recent analysis found that half of US households 55 and older have no money stashed away for retirement.

The new retirement is no retirement

Planning for retirement takes time. Saving money is a slow process. There was a time when simply stashing money into CDs and savings bonds was enough to have a nice nest egg if you were diligent enough. Yet for the last decade, most banks are paying close to zero percent on their savings accounts thanks to the Fed’s low rate policy to juice the markets. Since the true inflation rate is much higher, you are essentially letting your money rot away. So the only other option is for people to invest in the stock market or try to leverage into real estate.

The stock market is largely an arena for the wealthy. Half of Americans own no stocks at all. Now after a generation, we are finding out that most people did not follow in the footsteps of those glossy over produced retirement ads:

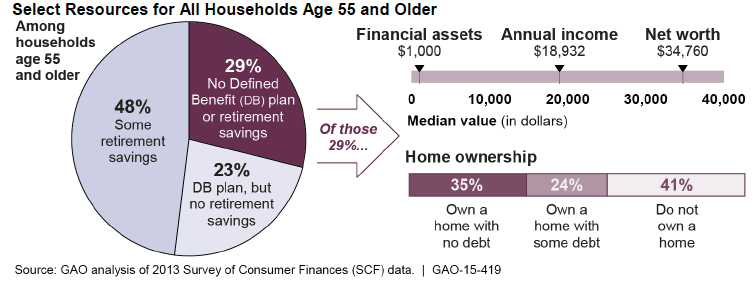

Source:Â GAO

“(Raw Story) Are we all in denial or is it simply impossible to save enough for retirement? Is it some kind of toxic combination of the two? Whatever the reason, yet another study – this one from no less an authority than the non-partisan US government accountability office (GAO) – is here to remind us that we’re woefully unprepared, financially speaking, for retirement. While we may all have dreams about how we’d like to spend our retirement years – fishing, golfing, writing that great American novel – the truth is that as many as half of all households with Americans 55 and older have no retirement savings at all . Nothing. Zip. Nada. Not a dime.

And the news gets worse, the GAO reports. Because households headed by older Americans that don’t have retirement savings like 401(k) plans or IRA accounts also are less likely to have other sources of income that they can rely on when they retire, such as pensions or even plain old savings accounts. About 29% have absolutely nothing : no pension plan, no savings, no 401(k), nothing.â€

The idea that all older Americans own their home free and clear is simply not true. Only 35 percent own their home free and clear from debt (and this does not mean they don’t have expenses like taxes, insurance, and maintenance). 24 percent are still saddled with mortgage debt. And 41 percent do not own a home meaning they have to pay rents that continue to outpace any wage gains.

The median net worth of those 55 and older is $34,760. This is basically one small illness from bankrupting this family. The median annual income of those 55 and older is $18,932 which makes them part of the new low wage America cohort.

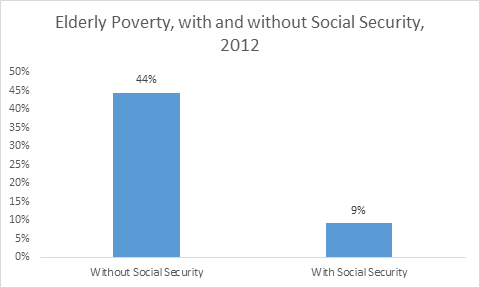

On the retirement side 48 percent have some retirement savings (not much). 29 percent have no pension or retirement savings. And 23 percent have a pension but no retirement savings. In the end, it is a tough situation for many older Americans. And that is why older Americans rely heavily on Social Security as their primary source of income into old age:

If it were not for Social Security, half of retirees would be out in the street bringing back another Great Depression like atmosphere. This is in stark contrast to that 401(k) dreams pushed by Wall Street investment banks of endless Margaritas and walks on nameless sunny beaches.

The sad reality is that retirement is no longer what people think. And keep in mind this is happening to the baby boomer generation that lived through some mega US prosperity and stock market bull runs. What about young Americans today that are starting in an even more precarious position thanks to the insane cost of going to college and the mountain of student debt? Many people are realizing that retirement is a luxury only a few can afford.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!12 Comments on this post

Trackbacks

-

Jon said:

Ruh-Roh.

But don’t worry, you can do it! You are the exception to the rule. Rugged individualism was coined to describe you, and since you’re just a lottery ticket away from telling your boss to go #@^ themselves, why worry about saving money for retirement. /sarcasm

The reality; Work until you are – insert median life expectancy – and then retire to a country with a low cost of living, that still takes USD, and doesn’t extradite since you needed to rob a bank to finance your trip there. That or cash your SS checks at Walmart, and buy Purina for you and your dog/cat to fight over

August 18th, 2015 at 3:04 pm -

WW said:

Build a small cabin on a piece of junk land and start a mini urban farm. That way you will have a roof overhead and food.

August 19th, 2015 at 12:36 am -

wkevinw said:

I always have a mixed view of this.

Basically, I do think retirement is a luxury, and a recent luxury at that. So, working in retirement is not such a terrible idea. I wish everybody was rich, but that’s not a reality of economics. Please note that if you are a US citizen, most of the time, your worst day at work is better than about 75% of the rest of the world’s best day.

Enjoy what you have in the US; it’s not that good, unless you compare it to everywhere else.

August 19th, 2015 at 5:54 am -

Mr. Z said:

I’m the owner of a 2nd generation Mom & Pop shop. Our retirement policy is you retire at age 82. Suck it up buttercup.

August 19th, 2015 at 6:26 am -

Dennis Roubal said:

Everyone I know that invested year-in and year-out is a millionaire.

The biggest problem is that most people just don’t invest. Probably because they came from families that did not invest.Starting at 50 is too late, you have to have the saving-investing gene I guess.

Problems in particular markets, like high yield bonds, or gold or diamonds (I know someone who lost a lot in diamonds) should not have resulted in major loss of wealth. These people were speculating in investments they did not understand. If they just invested in the S&P 500 for 30 or 40 years they did well.

That may not be as effective in the future. Globalization has changed everything.

August 19th, 2015 at 2:42 pm -

Super Creepy Jon said:

Yet another assault on defined contribution retirement plans. Pray tell what is your solution?

Defined benefit pensions through the workplace? Well they have the exact same problems you describe for 401k’s don’t they? Except that even a responsible business owner who sets up the plan and makes regular and actuarially sound contributions can find themselves in the ZIRP NIRP environment sudddenly faced with an underfunded plan. Then they have to pay for these promises out of current cash flow cutting the amounts they can use for Capex.

Or perhaps you rather let the good old government do it. No brochures, no sunny beaches there. They will absolutely take care of you in your old age . . . look at the giant TrustFund they have. Full of IOU’s.

Maybe 401ks won’t work but they are order of magnitudes better than your precious defined benefit models.

August 20th, 2015 at 9:27 am -

dave stoessel said:

I am a multi-millionaire. Big whoop. I do not determine what money will buy or how much of it I will need. Saving COULD be a fool’s game. Having money is better than not but the value of money is not fixed. The dollar is an undefined asset. I have been very prudent but it is arguable that I have been very smart. My savings earn .6%. Could I do better? Sure. I have to “trust” someone. I even have to trust that my bank will give me my money back. It is all promises. If the people, company, government that promised you a retirement – delivers- then congratulations. You trusted the right person. But if the game changes–look out. Saving money is now part of the matrix of lies. When you are screwed-it is nothing personal-just business. Welcome to Reality 2015.

August 21st, 2015 at 11:35 am -

Drew said:

These comments are ridiculous. If you have more than several brain cells between your ears you learn to emulate the behaviors of the ultra wealthy. They got that way because they are good at business and investing. They delay present gratification in exchange for future rewards. How many of you are investing in dividend growth stocks at good valuations like Warren Buffett and Donald Trump?

August 21st, 2015 at 11:29 pm -

Jess said:

Donald got his cash from daddy. He started with a massive inheritance. Yes, let us follow in his footsteps.

August 22nd, 2015 at 6:14 pm -

Dave said:

First of all what you save is not money, it is debt. What?, you say?

A first year law student is taught that a debt is always called a note.

Look a little harder at your so-called money, it says “federal reserve note.” You are carrying around a piece of paper that is an interest bearing debt owed by you back to the federal reserve.

Money? Hardly.

I would bet that if the men “enshrined” with their likeness on your debt were alive they would want their pictures taken off of this debt immediately as it is what they so many times warned us not to accept as our money, it is debt. period.August 25th, 2015 at 5:41 am -

David said:

Much has to do with the lifestyle we assume we need. Newer vehicles, larger homes, cable or satellite, eating out, going out, costly weddings and vacations, phone data plans…and thinking a 40 hr week is enough. I really haven’t met anyone in my life that didn’t spend somewhat foolishly instead of putting away for a rainy day or retirement. We tend to let society dictate our wants as needs and never do learn the secrets.

August 25th, 2015 at 4:58 pm -

Tom said:

When I was young and single I lived frugally and invested half my income. I was proud of the finacial security I had achieved at a young age. In my huberous I got married and had two children. Now I do the stupid things I used to snear at others for doing. Why? Because living in a decent school district comes at a cost; keeping a wife mentally stable comes at a cost; flunking professional licensure exams comes at a cost, dental care for four people comes at a cost; and inflation comes at at cost. Once the blood was in the water, the power of compound interest that I so enjoyed in my youth, was used to cut my flesh each month. I have learned humility. My prudence and self-denial have not saved me. I now live paycheck-to-paycheck paying interest on credit cards because I cannot liquidate my retirement accounts without quitting my very necessary tedious deadend job. Wealth is a fragile thing. Hold it tightly or it will be ripped from you.

September 22nd, 2015 at 1:56 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â