The government is already in a soft default and is addicted to low interest rates: Government expenses at $3.87 trillion while receipts enter at $3.29 trillion.

- 1 Comment

The term default has varying definitions depending on whether you are an individual, a big bank, or the government. For you as an individual, default will occur when you are unable to pay your debts with the income you are generating. You are constrained by your income. As we saw with the housing crisis, when you are unable to pay your mortgage a bank will foreclose on your home. Unable to pay your auto debt? Repossession is the likely next step. Not making those college loan payments? Garnishment of wages is a typical course of action. Yet for the government, they have the ability to print their way out of problems courtesy of our fiat money system. The end result is inflation in the real economy which ultimately impacts families. Banks of course have the ability to restructure debt and circumvent accounting rules to their own convenience. If we applied the same rules of default that individuals follow to the government, we would already be in a soft default. This does not happen but what ultimately occurs is inflation in items that are financed via debt (i.e., housing, student loans, cars, etc).

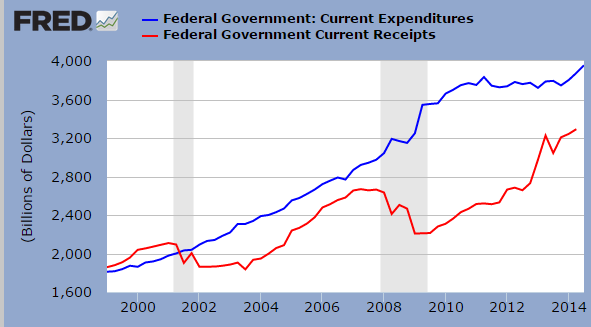

Government spending versus tax revenues

Government is merely a collection of people reflecting the goals and wants of the overall population. We elect representatives to serve our interests once in office. If they choose to deviate from the path, we ideally would punish them at their re-election campaign. The issue we have currently is that power is bought in politics. Power comes from money and most Americans are flat broke. The government is running major deficits each and every year. This is how big money in finance is able to have generous corporate welfare while the public endures the bitter pill of forced austerity.

Take a look at income versus expenses here:

The government had $3.87 trillion in expenses in the last reportable quarter with $3.29 trillion in tax receipts. In other words, the U.S. government spent $580 billion more than it brought in. Of course this gets pushed into the corporate government credit card and our expense on the debt keeps rising. Even with record low interest rates courtesy of central banks racing to the bottom, we still spend a large amount on interest payments. Payments on principal that will never be paid back. Let me repeat, we will never ever pay back the principal we owe. Â Â

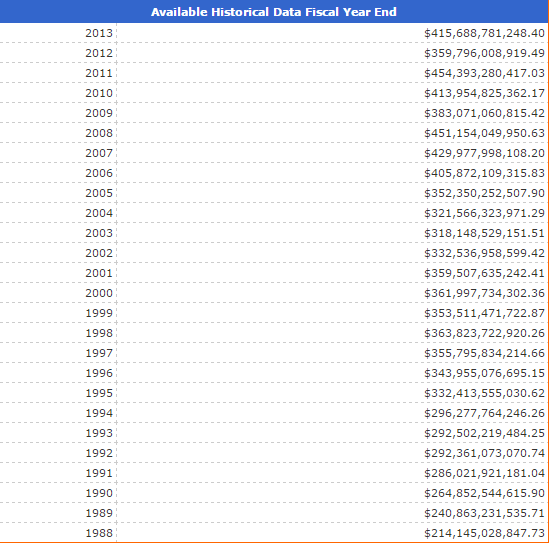

Debt to the penny and interest expenses (why interest rates have to stay low while inflation will occur)

As of today, we currently owe $17.93 trillion:

Source: U.S. Treasury

This debt comes at a cost just like borrowing on a credit card. The only difference is the government gets fantastic rates. Take a look at what it costs to service our debt:

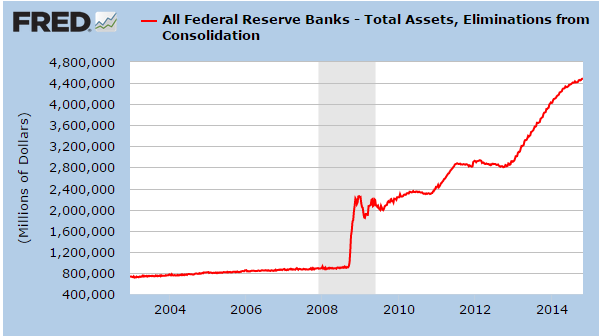

We currently spend $415 billion per year just to pay the interest on this debt. You’ll notice that in previous years we paid more but that is because the blended interest rate was higher. Today, we are at record low rates but this has come at the expense of the Fed ballooning their balance sheet to uncharted territory:

The Fed’s balance sheet is now up to over $4.4 trillion. There is talks of tapering and unwinding but the chart above says otherwise. We are forced into a corner with low interest rates now. Even if rates slightly went up to historical standards we would be spending nearly $1 trillion a year simply on paying interest on the debt. We are essentially in a soft default and that is why inflation is raging in items financed by debt, the elixir of choice of central banks.

It would be nice to spend more than you earn into infinity but of course as we all know, there is no free lunch, including for governments.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Archy Don said:

The slow boiling frog.

Lays in his martini shaped pool on an inflated float lounge, a large adult beverage with an umbrella in one hand, and the mote to a big screen TV on an adjacent raft with the Monday Night NFL game on in the other.

No worries. Life is good.

And the scene replicates for years on end – with no end in sight.

Until one day the TV tips over into the pool and the frog…well, the frog is fried.

November 4th, 2014 at 4:14 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â