S&P 500 Over Priced: With 97% of Companies Reporting Q2 Earnings the PE Ratio is Now at 129. The Most Over Hyped Market Rally Ever.

- 10 Comment

There is probably no better indicator of market volatility than the current price to earnings ratio of the S&P 500. The market volatility is spectacular and we are seeing more gyrations in this recession than we did during the Great Depression. Since March when the S&P 500 touched the 666 mark, the rally has boosted the index by 54 percent. Was this caused by stunning second quarter earnings? Absolutely not. With nearly 97 percent of all companies now reporting earnings for the second quarter, the S&P 500 PE ratio sits at 129. This is by far the most over hyped rally in the world.

First, let us look at this insanity on a chart:

Source:Â Chart of the Day

I think when people see charts like this they start doubting the source. This unfortunately is accurate. Even during the Great Depression, when the market plunged to the depths, the PE ratio never even touched 20 and some of the many mini-rallies after the crash of 1929 involved legitimate looks at low PE ratios. A PE ratio is important because it factors in the price of a stock to the actual earnings. This matters. Even right before the tech bubble burst in 2000 the S&P 500 had a PE ratio over 40 and this was extremely expensive. In this case, we have 26,000,000 Americans unemployed or underemployed and earnings are simply not there with consumers pulling back. So what is causing this massive rally if not earnings? This recent rally is being driven by the “getting less worse” mentality. Sure, we lost 247,000 official jobs last month but sure beats 700,000! Okay, earnings are way low but it beats actually losing money! This kind of thinking is leading many sheep to the slaughter again.

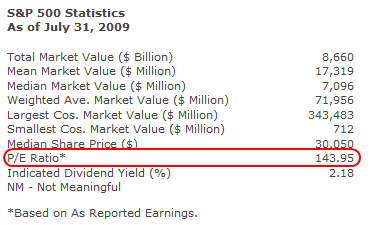

Take a look at some of the official data from S&P itself:

Source:Â S&P

At the end of last month, only three weeks ago the S&P 500 data had the PE ratio at 143. So to currently have it at 129 is a slight improvement. But with only 3 percent of companies reporting to close out the quarter, we are massively over priced. We have never seen the entire index suffer a negative earnings quarter that is until recently. So the crash wasn’t a panic but actually based on declining earnings. That quarter saw $202 billion in negative earnings (losses) from S&P 500 companies reporting. Q1 of 2009 saw reported earnings come in at $7.52 per share. So right now, everything looks good when looking from the ground up.

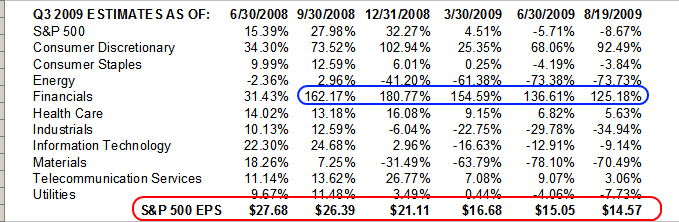

Yet to show you how off predictions have been and how wrong analyst can have earnings, let us look at the Q3 2009 estimates and how they have evolved over one year:

Now this chart is something. Back in June of last year, the Q3 2009 estimate was coming in at $27.68. Keep in mind we were already in recession at that point. In September of 2008, the EPS didn’t change much for analysts. After the market crashed and the U.S. Treasury and Federal Reserve had to step in to save the financial world supposedly, they finally revised earnings lower. The market went lower and lower and now, the latest estimate for Q3 of 2009 earnings is $14.57. This new revised estimate is a drop of 47 percent from the June 2008 estimate. Sounds about right with the market. Yet the market is up 50 percent while earnings estimates are down by 50 percent. Any value investor will tell you that looking at PE ratios is absolutely crucial. Some of the top experts avoided the tech stock mania because they were seeing stocks with PE ratios of 100 or even 200 on the prospect of making it big. Some did survive but the vast majority didn’t. Even a high flying stock like Google has a PE slightly above 30.

Now assuming the $14.57 EPS for Q3 of 2009. Is this necessarily good?

1026 (current S&P level) / ($14.57 estimated EPS) = 70 PE ratio

Even with this estimate, the PE ratio would still be at 70! At record levels. And keep in mind, a big jump of earnings in these last few quarters involved massive infusions of free money into the banking sector. Do they not realize that there are still some $3 trillion in toxic commercial real estate debt left? Of course on the estimates, you can see that the financial sector is having the best expectations. The industry that brought us the credit and housing bubble is now going to lead us out of this massive recession. We are in good hands.

Many now agree that this is the worst recession since the Great Depression. Yet many think things will turn around in a few months. These kind of market dislocations last years and impact generational thinking. There is a new austerity out in the market. In fact, this new spending habit is taking hold so deeply that the government had to entice people to trash their working vehicle for a new car. People are surprised that the cash for clunkers program worked. How are they shocked? Free money for your bucket and a new car? Who could have ever seen that coming!

Yet even the analyst estimates put the S&P 500 at a PE ratio of 70 for Q3 of 2009. A more normal average PE ratio even at the high end would be 20. From the mid-1930s to the 1980s the PE range would peak out in the low 20s. But then, the technology bubble and housing bubble gave us two decades of wild valuations. But let us assume a high 20 PE ratio. What should the stock market be valued at?

(X/ $14.57 Q3 2009 estimate) = 20 PE ratio

291.40

This is the insanity of the current market. For the PE ratio to come in at 20 for Q3 of 2009 and with estimated earnings of $14.57 per share, the S&P should have a value of 291.40. This is even less than that the 666 low reached in March. So why the rally? Because people believe we’ll be back to peak earnings again. And insiders seem to have a different opinion. Last week, insiders had 18 buys for $30 million while on the sell side some 131 sold for over $889 million. Maybe the insiders know something that the public doesn’t regarding the S&P casino?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

eachtradingday said:

looks a little bit scary!

especially the insider transaction ratios at 1:7.3. 7 times more seller then buyers and in dollars the ratio is 1:30 million . it smells like a big storm is coming.

August 22nd, 2009 at 2:37 pm -

S in PA said:

Are you saying that now would be a good time to speak to my broker about shorting some stock? If so, could you please suggest some stocks to short and give me a timeline? Or, on the other hand, does this mean that everything is about to implode, that is, I should get out of the market while I still have money to get out and load up and move to another country? If so, could you suggest a sane country with consumer protections that actually protect consumers rather than big business? Thank you.

August 22nd, 2009 at 3:48 pm -

Glenn Atias said:

I think the recent market run-up is a Generational Ponzi Scheme. Bernanke pushed 2 trillion in TARP funds, borrowed from future generations, over to the banks, and the banks are laundering it through the back door of the market.

As you said, there are no fundamentals that would indicate the market should be this high – revenues are way down across the board, companies have only been achieving “better than expected” earnings through layoffs! Making themselves look better on paper – by shrinking.

Bernanke engineered a ponzi scheme. A shell-game with borrowed funds over to the banks, then they shell-game it into the market. Then a rising market would cause people to do the very thing you did in your post – pronounce the market a result of “green shoots.” This would then get the consumer to start opening the wallet.

But the consumer is tapped out, and earnings are in the toilet, and Bernanke is no more than a two-bit ponzi schemer. Time is up on his little charade.

August 22nd, 2009 at 6:50 pm -

MrMarket said:

Not for nothing. But a P/E is calculated using annual earnings not quarterly. So using these numbers the P/E would be more like this.

1026/(14.57*4)=17.6 or S&P / (4 times Q3 estimate).However, I wouldn’t pay a penny over 10 times earnings estimates for a company with 0 growth. Even less for one with negitive growth as many have right now. So in my humble opinion I have to agree. The S&P is seriously overpriced!!

August 22nd, 2009 at 9:25 pm -

Kelly Trimble MAI said:

This is very interesting, and I agree that equities may be overpriced and could fall, but there is one big factor that is not directly discussed here.

At the recent Jackson Hole conference, the head of the ECB noted that their data indicated that the net economic effects of the various stimulus/bailout programs around the world has not been directly stimulative, but has instead merely shifted economic risk away from some private sector balance sheets to public balance sheets, overall at 28% of the economy in the Eurosphere and over 30% in the US.

Real returns to capital are as close to zero as they have ever been, but the perceived risks are high. There is still a world of cash out there looking for investments, but nothing has a positive return if you account for perceived risks. There is a hypothesis out there that the markets are responding to changes in perceived risks, not to changes in expectations of future earnings. If you think of equity markets as being markets for averting risk instead of markets for expected future earnings, the gyrations in the markets over the past year start to make a lot more sense. Under this conjecture, the run up in equity prices over the past two or three months can be explained as a response to the shifting of risks to the public sector.

If the idea that markets are responding to shifts in perceived risks is correct, then we would expect the equities with the highest PE ratios to be those stocks with 1. the best overall fundamentals, b. the least exposure to input price risks, and III. the firms that are best able to shift their customer risks to the public sector, such as the S&P500, most particularly the financials.

This line of thinking would lead one to conclude that in the long term the S&P is dramatically overpriced, but it may accurately reflect the market’s perceptions of relative risk in the short term, so we might not be looking at a crash in the next few days.

But, this line of thinking is only academic. There is no rational expectation for earnings to improve to the point that these prices make sense, and as the market comes to the realization that PE ratios are this high, even in anticipation of a recovery, this market will almost certainly correct itself, probably in a violent fashion. The only question is will it happen Monday morning or sometime next winter.

Another aspect to consider is that those firms that have managed to shift their risks to the public sector are now particularly exposed to political risks much more than they ever were economic risks, potentially resulting in periods of even more volatile pricing as demonstrated in the overall markets last fall when congress was trying to pass the bank bailout.

August 23rd, 2009 at 9:42 am -

GT said:

I’m a bear too, but I think it’s important to understand those numbers: are they the estimates for FULL YEAR earnigns for the S&P, or just quarterly?

If an S&P component company reports $3 a share for the quarter and is trading at $100, then it’s PE is NOT 33; it’s close to 8 (4 quarters at $3 – assuming no growth – makes $12 annual earnings; or you can assume some growth and foward estimates for full year earnings will RISE).

I am pretty sure that the numbers you have posted are right (that is, they reflect analysts’ estimates for earnings for the TWELVE MONTHS TO Q3/2009), but you didn’t give us a source.

My longer-term target for the S&P is under 200, but it’s not going to get there without some jerky upward action from time to time… and with Bernanke giving out cash to Goldman Sachs, you’ve gotta expect them to goose the market.

Cheerio

GT

August 23rd, 2009 at 4:13 pm -

john baughman said:

I think you are trying to re-define PE calculations. Anyway, forward projections are for the S&P to earn roughly $62 this year, and $75 next year. I think next year’s number is a real stretch. But arbitrarily assigning a TTM PE of 15 on those two estimates results in an S&P at 935 this year and 1130 in 2010. And this results in a valuation that isn’t cheap, especially considering where we are now in the economic cycle. But it certainly doesn’t stretch the S&P to obscene levels either. I think the current risk is that 2010 S&P earnings fall far short of $75 due to continuing high unemployment and stagnating earnings.

August 29th, 2009 at 6:39 am -

vv said:

The P/E ratio calculation is incorrect. The EPS estimates you cite are per quarter not the whole year’s worth of earnings.

http://www2.standardandpoors.com/spf/xls/index/SP500EPSEST.XLS

But I do agree that P/E ratios are very high (100+) if you consider trailing one year of earnings (due to bad Q4 in 2008). However, the market seems to be discounting that due to better outlook going forward. If you are a long term investor then look for P/E over 5 – 10 years.

http://www.econ.yale.edu/~shiller/data/ie_data.xls

If you still want to use one year worth of data, then try this also.

1. Get EPS for the last 2 quarters

2. Get EPS estimates for next 2 quarters

3. Take current price and divide by sum of 1 and 2.If you do that you get a P/E about 19. Definitely over priced but not as drastic as you state.

Also, these numbers are based on operating earnings not as reported earnings or GAAP earnings (which are more accurate and include write offs etc.). Using the correct earnings will result in the P/E shooting up even higher.

Absent a double dip or a threat of a double dip recession, there should be only a moderate pull back at some point. The threat however, is very real. The inflated earnings of the last few years will be hard to match.

August 29th, 2009 at 10:00 am -

dizzy7 said:

As many others have pointed out, P/E ratios are based on annual earnings, not quarterly. While the current S&P P/E ratio is indeed very high (about 20 times the current estimate of 2009 operating earnings) it is not the ridiculous 100+ you claim it is.

Also, the reason your figures from S&P show a P/E of 143 is that they are using “as reported” earnings, which include 1 time charges. The P/E ratio normally used for stock evaluation is based on “operating” earnings, which are typically much higher than “as reported” earnings and therefore result in a lower P/E.

September 15th, 2009 at 1:19 pm -

Barb Friedberg said:

Fell into this blog while research earnings yield for an MBA class (Investing & Portfolio Management) I’m teaching. I’m working on the section of economic and market analysis. This post was very timely… I’m coming back for more!!

April 17th, 2010 at 9:19 am