Stag-Inflation: Japanese Employment Trends in the United States: Part-time, Dispatched, and Contracted Workers. A Decline in the American Consumer Standard of Living. Why the U.S. is not Japan and This is Not Good News.

- 3 Comment

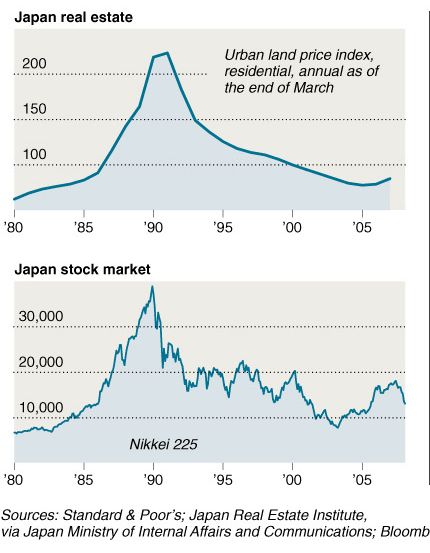

There have been many comparisons between the lost decade experienced in Japan after the Heisei bubble boom and the current real estate bubble in the United States. On the surface, superficially things may appear the same. Japan had a technology led bubble that sent the Nikkei to record heights only to have a bust. We had the NASDAQ. Japan had a major real estate bubble which at one point it was rumored that the Emperor’s Palace had a value larger than the entire state of California. Given the budget situation in California, this isn’t hard to believe. However, Japan saw real estate values implode and we have seen our own real estate bubble burst.

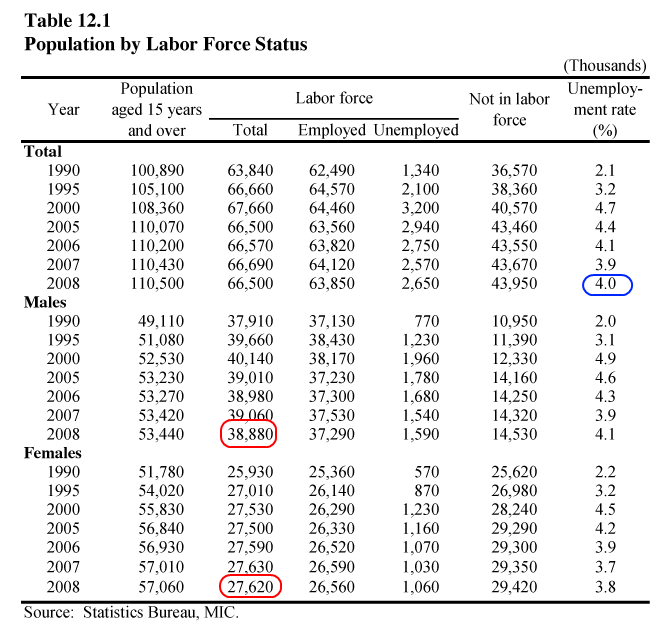

Then, we have similar policy moves to combat the contraction. Japan has held rates near zero since the bust, created zombie banks by bailing them out, and injected trillions into fiscal projects. All this must sound familiar because we are doing similar things. Yet those that compare Japan with the U.S. ignore a few key aspects. First let us look at the overall employment situation:

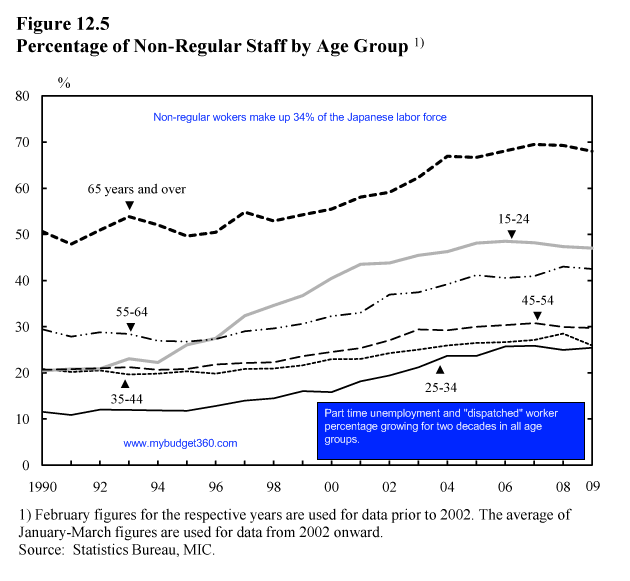

On the surface a 4 percent unemployment rate in 2008 is fantastic for an industrialized country. The actual current rate is 5.5 percent which is a lot better then the 9.8 percent official rate in the U.S. Yet those that study employment trends in Japan know that things are not as rosy as the data shows. Japan has a notoriously large number of “non-regular” employment. After the Heisei boom to combat excess in employment and fixed labor costs, companies started hiring workers on a part-time basis or in “dispatched” contract positions. What is a dispatched worker?

“There are two types of dispatched workers: (i) “registered-type” dispatched workers who register their names and other information at temporary staffing agencies in advance, sign an employment contract, and start work when they find their workplace of dispatch; and (ii) “full-time employed-type” dispatched workers who are recruited as full-time workers of temporary staffing agencies; these are typically skilled workers such as programmers. For both types, an employment contract is signed between the temporary staffing agency and the worker, since dispatching workers is a type of outsourcing human resources, whereas full-time and part-time workers sign their employment contracts directly with the employer of their actual workplace.”

Yet these positions do not have the implied long-term stability of a full-time job, at least how we would think of it in a Western sense. So if we factor in part-time workers how does Japan’s unemployment rate look like?

Japan has an enormous pool of non-regular type employment with those classified as part-time workers making up the largest number of the non-regular pool:

“Part-time worker: Like full-time workers, part-time workers sign a contract directly with the employer of their actual workplace. They differ from full-time workers, however, since either their scheduled working hours per day are shorter or the number of scheduled working days per week is fewer, even though the scheduled working hours per day are the same.”

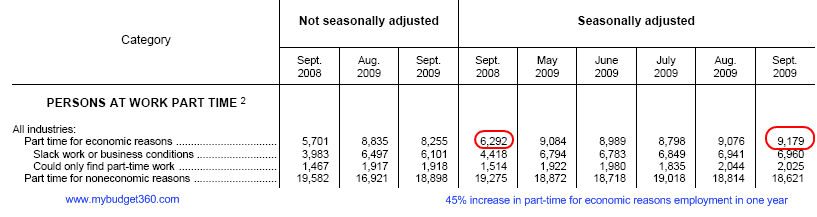

This is where we start getting a better sense of the real under utilization rate. In the United States this is measured through the U-6 number and our current rate is up to 17 percent.

In the U.S. the part-time unemployed has grown by a record breaking 45 percent in one year. 9.1 million Americans are working part-time but who want full-time employment. This trend is only growing. In Japan 34 percent of the work-force is under the non-regular category with over 20 percent being part-time employment similar to our 9.1 million workers. This helps reconcile the hard to understand fact that a country with 5.5 percent unemployment is in a recession. Yet culturally as well, there is pressure to keep the appearance of a well oiled machine. This is understandable. It sounds better to say 5.5 percent unemployed rather than trying to explain that 34 percent of your workforce is working under the non-regular category. It is similar to the quoting in our own recession that 9.8 percent unemployment figure when the under utilization rate is up to 17 percent. That is why the recession feels more painful.

It is an interesting name to call a category of workers “dispatched” workers. As in disposable. You call them in for a job. When it is done, contract is up and you move along. Many people in the U.S. are now feeling that. Many people working in firms have seen contract assignments instead of actually hiring a person for the job. In terms of productivity this helps the firm’s bottom line but does a number on the psyche of a nation which craves security in their job. On this front sadly, it looks like the U.S. is following in the path of Japan. This is a big cultural shift and Japan had to combat this as well after their two bubbles burst.

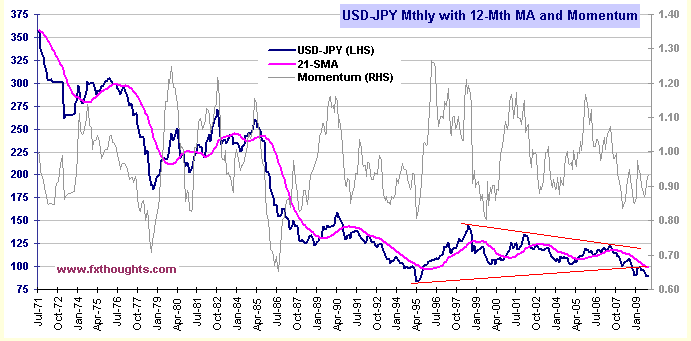

Yet there is a glaring difference. The Yen has appreciated and the U.S. dollar courtesy of the Fed has imploded over the years:

Now you might be wondering where our economic differences begin. The above chart is a chart that we will not be seeing with the U.S. dollar. Even with the Nikkei bursting, the real estate bust, and a lost decade the Japanese Yen has appreciated against the dollar at an incredible rate. In 1985 one USD bought you 250 Japanese Yen. Today one USD will get 89 Yen. In other words, the U.S. dollar is getting weaker against many currencies.

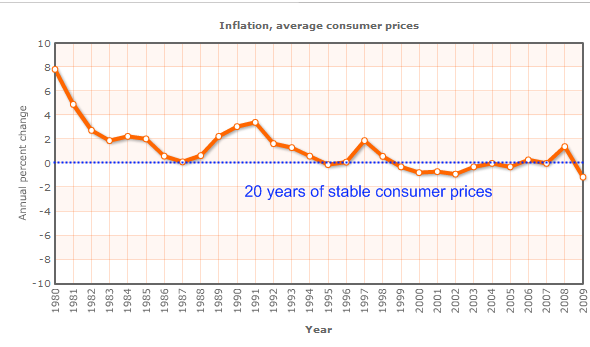

That is why for those that live in Japan, the employment situation is tough but in terms of goods and services, prices have remained stable for nearly 20 years:

Now this would make sense. Japan does a lot of exporting and has one of the largest U.S. dollar reserves in the world. Culturally people are bigger savers than Americans. The IMF estimates that the Japan savings rate is near 25 percent. At one point in this consumption bubble expansion in the U.S. Americans had a negative savings rate. So what does this mean for the average American? Where Japan was able to meander through 20 years with prices moving sideways after there bubbles burst, the U.S. is going to have a slowly declining standard of living through slow inflation once this dis-inflation runs its course. How so? Just look at the U.S. Dollar Index:

Since 1985 the U.S. Dollar Index has fallen a stunning 54 percent. With deficits as far as the eye can see, why are we to expect the Federal Reserve and U.S. Treasury to reverse course? That is why a Japan like lost decade of stagnant prices in virtually every category including their stock market, we can expect a declining standard of living over the next decade and that is very different. And how does this translate for the American consumer? More expensive goods and a more insecure employment environment. As the chart above shows, the Japanese Yen has gotten much stronger against the dollar so we are now buying Toyota or Sony products with a weaker currency. In other words, we get less Toyotas with the same amount of dollars. And people seem to like their flat screens and foreign cars. Yet this is how we will pay for it because in the end there is no free lunch.

The same thing will happen with China. Slowly we will see prices creeping up. Yet localized items like real estate will remain weak because wages will move sideways since a larger part-time labor force will bring home less money. So people will need to make due with less money. Short of another real estate bubble, prices will move sideways or slightly lower. Think it can’t happen? Look at Japan and as we are pointing out, they had a higher buffer to resist the double bubble pop:

20 years of stagnant real estate values. They are no where close to those peak levels and may never see them again. The Nikkei after collapsing hit the 20,000 mark in five trend waves that were spread out over 10 years! Up and down with an overall trend lower. Where is the Nikkei today? Slightly over 10,000. This is our optimistic scenario. If we get a lost decade we will be fortunate. There is simply no other way to pay the trillions in debt we have.

Politically no one can say they are for a weak dollar policy but that has been the case for over 3 decades. Every politician has fed into the spend every penny you got consumerism culture of the U.S. The bill is now due. How do we pay is the big question. To go from a society that saves zero to one that saves 25 percent won’t happen over night (or ever for that matter). We need to save more for longer term prosperity but look at current policies. Tax rebates? Cash for clunkers? It is merely masking the symptoms of the deeper problem.

It is no coincidence that since the stock market bottom in March that the U.S. dollar has tanked while the market has rallied. A 15 percent decline in a currency over 7 months is no small thing. Yet the U.S. Treasury and Federal Reserve seem destined to go down this path. I think we can learn a lot from the Japan situation. Similar bubbles. Similar policy measures. Yet different people and spending habits. Unlike Japan, our currency will not appreciate. Why would it? Our central bank is offering near nothing in return via the interest rate just to keep Americans spending money they don’t have. China and Japan will only allow this because it keeps their manufacturing bases humming. A strong currency isn’t always good. Just ask some countries in Europe including Spain with 20 percent headline unemployment. But how long can this go? It can’t go on forever. Imbalance in trades, especially this big usually get balanced in dramatic fashion.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

DDearborn said:

Hmmm

I guess this begs the question: Why are the officers of the member banks of the Federal reserve, as well as the members of the Federal reserve board in jail for fraud, treason and a whole host of other crimes?

October 15th, 2009 at 8:53 am -

stag parties said:

In terms of productivity this helps the firm’s bottom line but does a number on the psyche of a nation which craves security in their job. On this front sadly, it looks like the U.S. is following in the path of Japan. This is a big cultural shift and Japan had to combat this as well after their two bubbles burst.

July 21st, 2010 at 10:04 pm -

stag parties said:

That is one reason why the Japanese government’s efforts to stop computer companies from including software with their computers has been ineffective and many Japanese see nothing wrong with copying it freely.

July 28th, 2010 at 4:10 am