The Disappearing Middle Class Dream – How the Average American is coping with the Recession: Savings, Banking, Housing, and Investing. Over 50 Million Households Living on $52,000 or less a year.

- 3 Comment

Last month the American Community Survey detailed the painful 2008 year for American households. This is a comprehensive survey looking at multiple financial, economic, and social characteristics of Americans. What we find is that the average American is having a tougher time maintaining a hold on the middle class dream. This isn’t a revelation but it does help us determine what to expect in the next few years. The American family in fact over the past decade has maintained the illusion of middle class living by going deeper into debt because of stagnant wages. The U.S. Treasury and Federal Reserve allowed this to occur by injecting liquidity and creating a credit market that had no brakes.Â

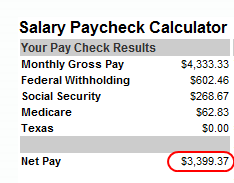

In the latest data, the median American household brings in $52,000 per year. Let us break down this data:

Using Texas or any state with no income tax is a good starting point because it puts us at the higher end of the take home pay bracket. Some states like California have state income taxes reaching up to 10 percent. However, this allows us to see how much actual take home pay the average American family is working with. By looking at the above it looks like people have roughly $3,400 a month for all additional expenses. Keep in mind that we are also not putting money away in any retirement accounts or paying for health insurance and that can add a large line item.

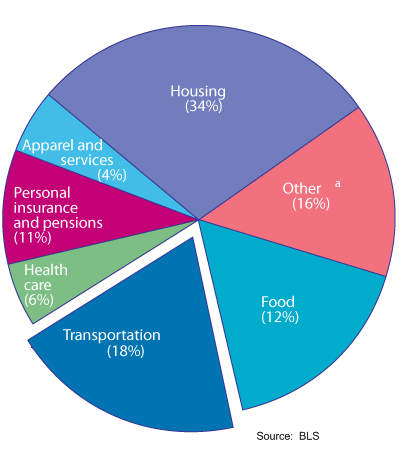

Let us see how the average family spends money:

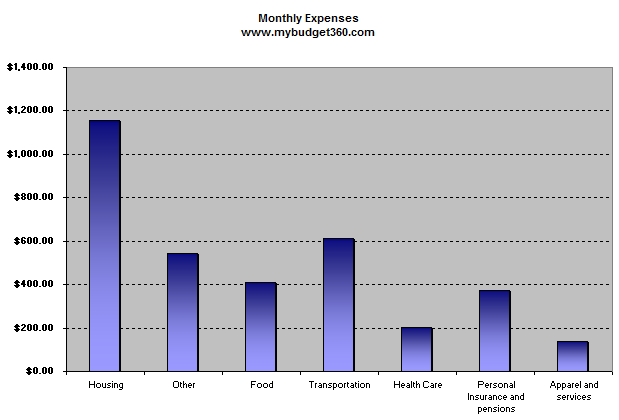

So let us use these estimates with the monthly take home to get an idea of what people are working with:

From here you can understand why the current recession is hurting so deeply. Take for example the housing expense. The current median home price in the U.S. is $174,000. So if the family above with the median income went to purchase this median priced home, how much are they looking to spend? Let us assume they buy the home via a FHA insured loan requiring only 3.5 percent down:

Down payment:Â Â Â Â Â Â Â Â Â Â Â $6,009

Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $167,910Â (at 5.5 percent 30 year fixed)

PI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $953

On the surface this may seem okay. But we are not including taxes and insurance above. If you include taxes and insurance, let us assume this family buys in Texas, the taxes with insurance can range from 2.5 to 3 percent of the purchase price of the home:

Insurance and Taxes:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $362 per month

Total monthly housing payment: $1,315

The median family in the U.S. spends $1,165 per month on housing. This may not seem like a big difference but we are looking at an 11 percent difference for the biggest line item here. That is why housing in many parts of the country is still having trouble. Americans have become more price conscious in a time with 17 percent unemployment and underemployment.

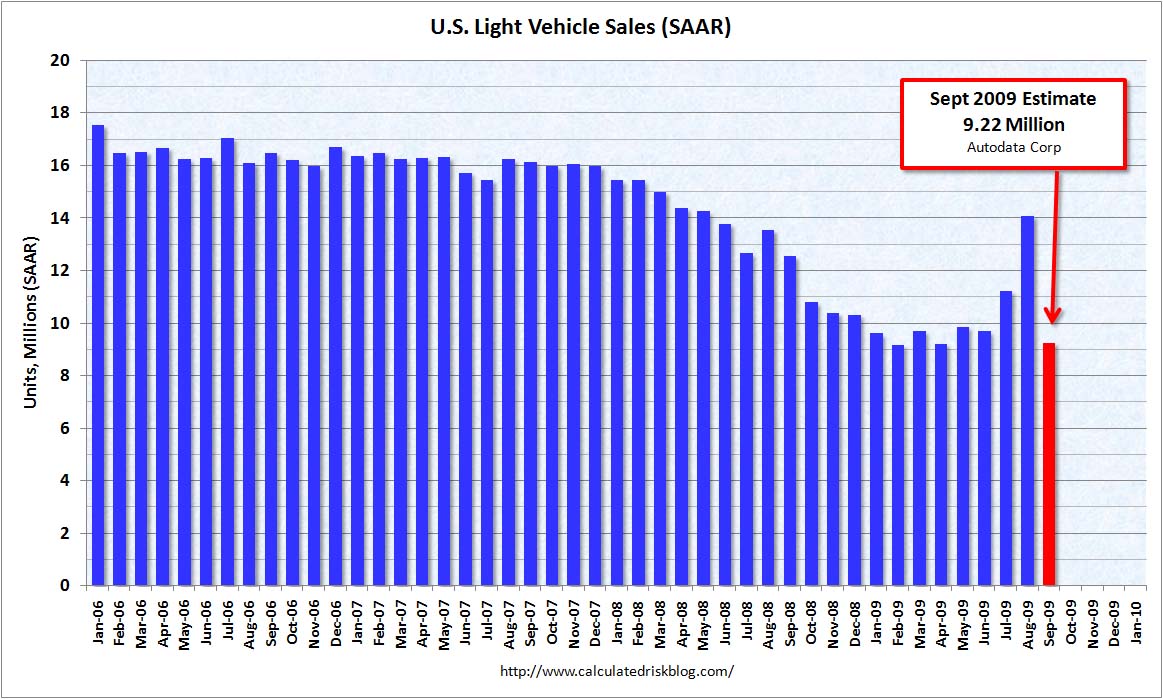

The transportation item in the budget above is also high. Spending nearly $600 a month Americans have become more reluctant to buy expensive autos. This number looks to include one car payment and fuel cost for the average family with two cars. Assuming a $300 car payment and $300 in insurance and fuel cost per month, many families are now unable to purchase a new car that averages close to $30,000. That is why the government found it necessary to offer a program like cash for clunkers to get people buying. But that program has run out of steam:

Source:Â Calculated Risk

It is obvious what occurred above. Sales for autos were front loaded into August and fell off when the cash for clunkers program wore off. We can expect a similar thing to happen for home sales that have benefited from the $8,000 tax credit. What is largely missed in all of this is the actual money Americans have in their wallet. That money comes from working and with unemployment rising, more and more people are having less and less money to spend.

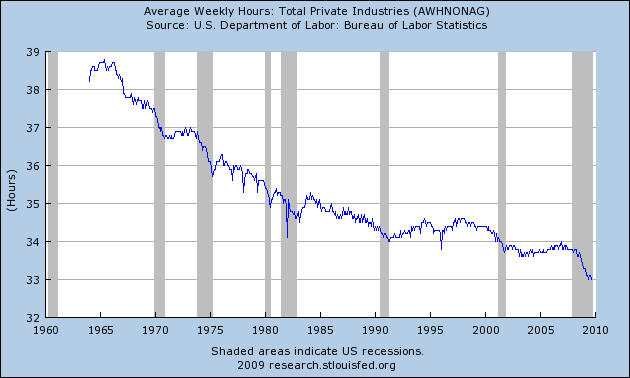

With no job or hours being cut, Americans are all feeling this recession including those who are working:

The above gives a better perspective on the new consumption era. Even those that are working are having shorter work weeks. This is happening from less overtime and also employees who are furloughed. These people are still considered fully employed yet their wages do not reflect a fully employed work schedule.

So when we break down the above budget and see what is happening it is clear that Americans are going to permanently shift their spending habits short of us going back to the bubble peak days. Not by choice this change is occurring, but by economic force. The U.S. Treasury and Federal Reserve are targeting the dollar so we can expect imported good prices to increase in the next few years (short of the dollar becoming strong again). It is a new era for the middle class dream.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

Rich W said:

Here’s the real truth of it… the middle class would be doing a heck of a lot better if credit weren’t so freely available. Giving buying power to people, that don’t have the earned cash to begin with, only increases price levels beyond the afford-ability of median income households. It’s basic supply and demand… credit only artificially raises the demand level leading to higher prices and reduced purchasing power per dollar. This effect I’m describing makes your earned and saved dollars worth less because “artificial dollars” (credit) can compete for the same assets one could buy outright with earned/saved dollars. Look at houses and cars as the prime example. Why are we here? Credit and Debtors my friends. The middle class will come back when interest rates rise and the age of credit ends… if you’re not already a debtor of artificially price-inflated goods, that is. Unfortunately for the debtors… they’ll end up where debtors always do… in-hoc and looking to be forgiven their debt. BTW… Credit isn’t the “life blood” of the economy… common sense and hard work are. Those who fail to learn from history are doomed to repeat it… how sad.

October 11th, 2009 at 9:45 am -

williamwallace said:

http://www.bbc5.tv/eyeplayer/articles/money-debt

That will give some light to why our government has keept this secrate for so long and why every president who was assanated or was attepted to be was silenced to expose its dark secrate. that we are debt slaves like in the movie the matrix. To take the red pill is to know the truth that the more we struggle to fix the problem the deeper we sink and become more enslaved(indebted). the only soultion is to make a gold system that dosent use interest is totaly controled my congress who issues tickets to gold and silver deposits and if gold or silver is to be held on a person and returned to the bank light or diluted he is jailed and fined. No interest on loans is good for everyone and prevents the fractional reserve banking that created derivitives now in jeopardy of poping that bubble is 1 quadrillion in stacked debt that system has created. that is 1 thousand trillion.1,000,000,000,000,000 dollars. denyial to being a debt slave means you are the most loyal one they have. Of course ingnorance will be forgiven we all have been hoodwinked at one time or another.October 11th, 2009 at 10:10 am -

Moneymonk said:

We are no better off than the family of 1973. I blog about this on my blog

Nice breakdown

October 19th, 2009 at 4:55 pm