Stock market flashing red at an overvaluation of 68 percent: Looking at Crestmont, Cyclical, Q Ratio, and S&P Regression all suggest market is in for an upcoming correction.

- 2 Comment

The stock market continues to make record highs even though profits do not warrant current valuations. Looking at four standard valuation models we find that the stock market is highly overvalued relative to earnings. For most Americans with little stock ownership, this is merely a sideshow as to what is unfolding in the real economy. Based on an average of four popular valuation models we find that the S&P 500 is overvalued by 68 percent. Typically you want to see earnings justify current valuations but something else is going on here. Either stocks are being priced at very optimistic future levels or hot money from the Fed is flowing into the stock market to avoid the slow erosion brought on by inflation. It is interesting to see some people falling for the myth that inflation is muted when housing values are up, college costs are soaring, energy costs are high, and healthcare costs continue to go up. Of course the CPI measure tends to understate inflation so it might be the case that market participants are diving into the game even with high valuations because they realize underlying inflation is much higher than what indicators are noting. One thing is certain and that is the current stock market is highly overvalued.

Big overvaluation in stocks

Earnings matter. When you purchase a stock you are buying much more than a piece of a company. You are buying for growth and future earnings. No use buying a share of a company at $100 only to have the company implode the following year along with its stock valuation. One of the best measures of a stock’s worth is looking at earnings.

In the current stock market values in general are too high relative to what companies are earning. This is usually reflected in your price-to-earnings ratios. Before moving forward, it might be useful to note that half of the country does not own one single stock. So for many seeing the stock market make new highs is only helpful to the degree that this translates to better wages. Of course many companies in the last half decade have boosted profits by slashing wages and benefits.

Let us take a look at current market valuations:

This is an average of four valuation indicators: Crestmont P/E, Cyclical P/E, Q Ratio, and S&P Composite from its Regression. In all measures, the S&P 500 is overvalued by a whopping 68 percent based on actual earnings.

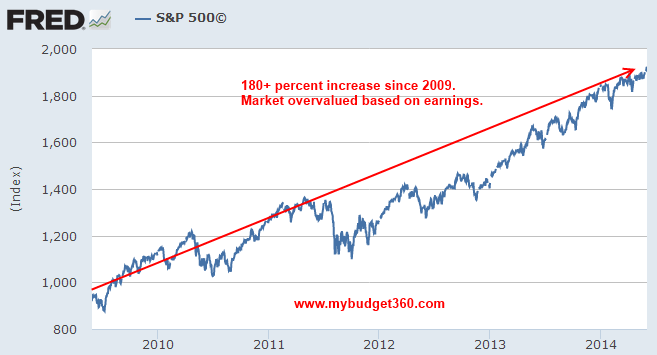

This is important to understand since the stock market has been on a one way rocket ship to the moon since 2009:

The stock market is up 180+ percent since the lows of 2009. You would expect some sort of correction after such a bullish run especially when underlying earnings are not justifying current prices. What is going on here? Are people simply delusional once again? One major factor here has to do with the massive rise in wealth inequality. Most of the wealth in the country is in the hands of very few people. In the real market, yields are being crushed courtesy of the Fed’s QE policies. So borrowing is cheap for those that can have access to debt. Once you have this debt, where do you put it? In a savings account? Bonds? It seems like most are willing to take the risk in the stock market given the incredibly low yield environment.

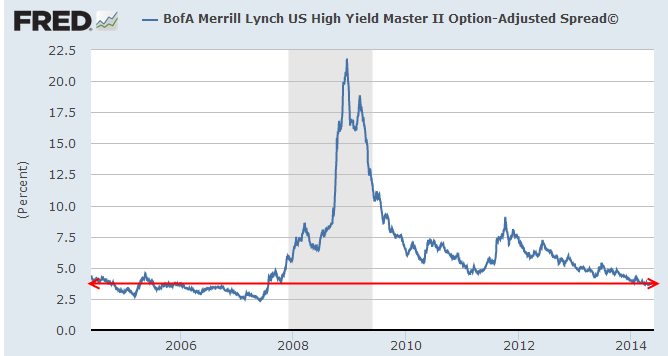

People are fully blinded by the current euphoria and are placing a nearly godlike power in central banks. Take a look at the rate of return on high yield (aka junk bonds):

High yield debt is being priced as if the economy were soaring with no underlying issues. No problem with massive student debt? What about the housing market being propped up by big investors and crowding out regular buyers? What about the negative interest rate environment that is punishing people on fixed incomes? Or what about the ever growing “not in the labor force†army in the nation?

It would be one thing if stocks were valued according to their earnings. They clearly are not. At some point something is going to give.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Roddy Pfeiffer said:

This is all true, except for TSLA. It’s going to the moon and beyond. Soon every American and Chinese citizen will be driving a Tesla and it will cost less than a Tata. And you will only have to recharge the battery on New Year’s Eve. Yeah.

20-to-1 P/E is the new normal

/sarc

June 3rd, 2014 at 3:25 am -

PRice said:

How about using the data series of MIT’s Billion Prices Project instead of the fake CPI? It only started in 2008 but it would illustrate your later points.

June 6th, 2014 at 7:17 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!      Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!      Â