A demographic time bomb: Over the next decade 20 percent of the US population will be 65 years of age or older.

- 1 Comment

It is no secret that the United States like many developed nations is facing a demographic shift of epic proportions. Within the next decade 20 percent of the US population will be 65 years of age or older. This will place severe constraints on young workers, Social Security, and Medicare. Roughly 300,000 Americans per month hit the age of 65. As we have noted before many are unable to retire because they simply do not have enough money stashed away to enter into retirement. Many continue to work. The vast majority will mostly rely on Social Security benefits. Never in the history of the US have we had such a large number of Americans entering old age at one time. The baby boomer generation like a pig moving through a python is now entering the typical age of retirement. Yet many are in no financial position to retire comfortably. Many delay retirement and continue working. Some argue that this delay in retirement is plugging up some channels for younger workers to enter into the employment market. While this might be true, the unfortunate reality is that many Americans, young and old are simply in poor financial shape thanks to the financialization of our government and banking sector. This is brought on by our new low wage economy and lack of protection or concern for the middle class. We are confronting a demographic time bomb and things are already set into motion.

The baby boomer wave enters into retirement age

A lower birthrate combined with baby boomers entering retirement age is shifting the demographics of our nation. If you ever watch the nightly news or 60 Minutes for example, every commercial is targeted at older Americans. That is, those 65 years of age and older. It is a fascinating trend to unfold. Yet older Americans actually spend less than younger Americans overall. That is why networks that can capture the 18- to 45- years of age market carry incredible premiums. Yet it is unmistakably clear that the United States is turning gray at a time when it is having a harder time of affording it.

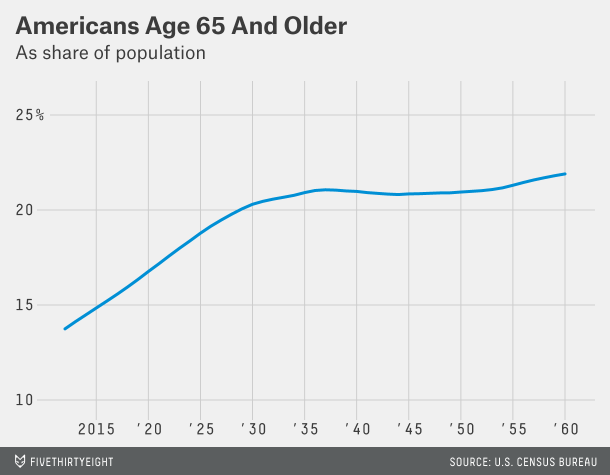

As a percent of our nation, Americans age 65 and older currently makeup about 14 percent of our population. That is quickly going to be 20 percent:

This is a dramatic shift in how the nation will look. The chart above is a big reason why healthcare is front and center as a debate. The issue of course is that inflation is eating away at the purchasing power Americans currently have. For older Americans, one health issue can wipe away any assets that were saved. Most don’t have to worry about this because half the country is flat out broke. Yet who will pay for this? We already see that younger Americans are having a tougher go at the current economy. Many younger Americans are carrying incredible levels of student debt.

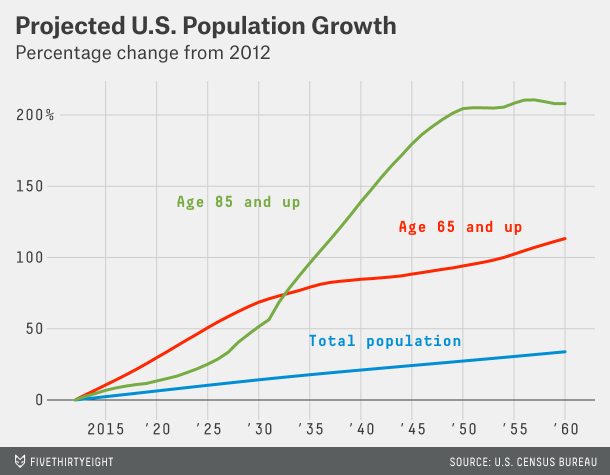

As a percentage, the growth rate of older Americans is much higher than that of the population overall:

Starting a few years ago, this demographic tsunami was set into motion. It is only going to accelerate from here on out. If you want to look a little bit into the future, you can look at Japan and realize that having a massively expanding older population with a younger less affluent workforce is not a recipe for financial success.

Some will point out that we will largely make up the difference by our larger growth with immigration but will these future Americans have access to the same avenues of success as previous generations? Many will have to go into massive debt simply to keep up the veneer of a middle class life. It is unclear this future generation will have the ability to support such high levels of entitlements.

Social Security will be the default retirement plan for many

The vast majority of Americans entering into retirement will depend heavily on Social Security for their retirement income. This income is chained to the CPI that largely understates overall inflation. And we know that healthcare costs are zooming upwards so how will many Americans afford healthcare at a time when expenses skyrocket?

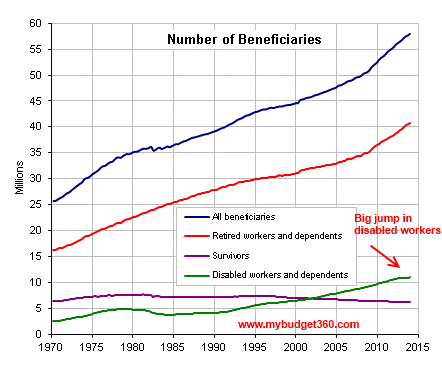

It is clear that this trend is now in full motion:

Source: Social Security

“For most people, they are going to have to wait until they hit 67 before they can draw full benefits. This is why it is becoming more common to see older workers at places like Target, Wal-Mart, or many other retail establishments. People need to supplement their benefits with other income. Not exactly the ideal notion of walking on the beach with Margaritas riding into the sunset.â€

We already have 58 million Americans receiving Social Security retirement benefits and survivor benefits. This number is only going to increase. This is important to note because this means the government is going to spend into oblivion. There are simply no other options. The Fed talking tough is merely a confidence game. They have no intention of scaling back. The only question is, can their confidence keep this house of cards standing up and for how long.

The point of all of this is that you need to start saving for your own future now if you have not done so. Protect your assets and don’t plan on having Social Security as your main source of income. Inflation is going to erode your purchasing power more than you can imagine. While it is hard to make predictions on stock markets there is no need to be a genius on this prediction. We as a nation will be getting older at an alarmingly high rate. That is fact. Learn to manage your budget and save as much as possible. The future may be uncertain in many areas but what we do know is that the expenses for older Americans are going to keep rising at a crazy fast pace.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Gringo Bush Pilot said:

Simple answer … Reduce out insane defense (war) spending by 80% – problem solved.

May 18th, 2014 at 5:57 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â