How much do Americans earn? Average income data for individuals and households. Stagnant income growth for American families.

- 1 Comment

How much do Americans earn? This seems to be a relatively easy question to answer yet rarely do we get concrete facts in the media about American income figures. On some financial shows, you get people saying that being middle class is making $250,000 a year which is outrageous because this is twisting words and ignoring basic math. If we look at the true middle, the actual median, the typical U.S. household makes $51,000 per year. That is a far cry from $250,000 or even $100,000. Yet this kind of misinformation is what passes as financial news today. Americans for the most part are largely in the dark as to what other people earn. There is no conspiracy out in the market but there is a concerted effort to keep people in the financial dark because it keeps them from realizing how bad financially they actually have it. It also keeps people spending money they don’t have and rarely asking questions about their financial health. Instead of confronting this reality families dive into massive debt to try to keep up the pretense that they are making progress forward. Budgeting and methods for taking care of your hard earned income are largely left off any educational curriculum yet will likely have a massive impact on your lifestyle. How much do Americans earn?

American earnings in a time of inflation

Inflation has a slow eroding power to your purchasing prowess. You may get the same nominal amount for the same work but when you go out to purchase items, you realize that your dollar simply isn’t going as far as it once did. For example, think of the price changes in the following items over the last decade:

-College Education

-Housing

-Food

-Energy

-Automobiles

-Healthcare

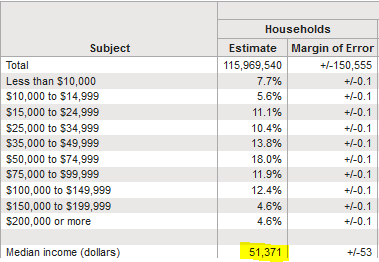

These areas consume the largest portion of your earnings. Before we go any further it would be useful to get the latest Census data on household incomes:

Source: Census

As of the latest Census survey, we have 115+ million households in America. The typical U.S. households pulls in $51,371 per year. This is the true middle in our middle class. If you make more than $200,000 per year, that would put you in the top 4 percent of all U.S. households. That is definitely not the middle class. That is the upper class at least based on the income tables above that look at hard data and facts from U.S. families.

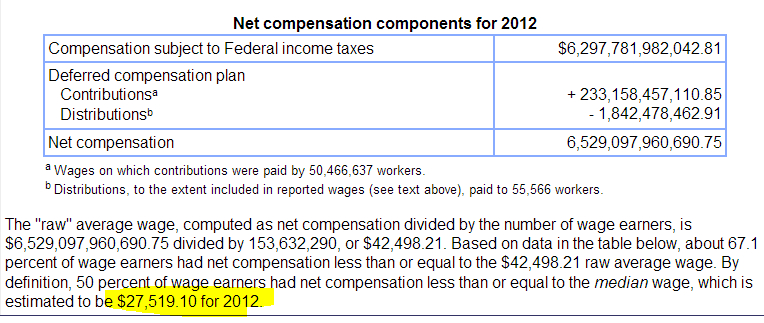

It is interesting to also look at individual wages overall:

Source: Social Security

The above is from the Social Security data set. The typical individual American earns $27,519 per year. Looking at the Census data, this would make logical sense. It also adds more evidence as to why so many Americans are facing an imminent retirement crisis. Many Americans simply do not earn enough to save after paying all the basic bills. A few research studies show that 1 out of 3 Americans have absolutely no savings to their name.

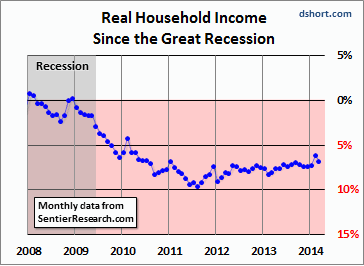

Why are things tougher? Because adjusting for inflation people are making less:

Keep in mind the recession officially ended in the summer of 2009. Americans are finding that most of their earnings are getting eaten away by basic items like college education, healthcare, housing, and food. More to the point, many Americans can’t even afford a house or a college education without going into an abyss of debt.

Even a moderate amount of inflation is problematic if wages are not going up. How much do Americans earn? Less and less as erosion eats away what income they earn.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Bud Wood said:

We have raised a large family and during that time, we were frugal. That provided a reasonable backlog of savings. So now, we have a paid for home and some investment income which provides the necessities like food, etc.

I understand that many people lived better than we did on essentially the same income. The key is to sock-away about 10% of one’s income. Then, there will be the backlog when needed.

Also, be aware that today will probably different from yesterday. Most people tend to look after their perceived best interests. The people who do business with other people do so because there is a perceived gain on both sides. When that breaks down like in taxation, just figure that there is a loss; better paying for such that being drafted for fighting on some front line where there’s more to lose than taxes.

May 20th, 2014 at 8:13 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!