The accelerating race to a student debt implosion: Federal student loans rose by $266 billion since 2011. 85 percent of consumer debt growth since 2011 because of student debt.

- 1 Comment

The Federal Reserve released an interesting report on consumer credit this week. While the mainstream spin is that it is good that consumer loans are growing, the vast majority of the growth is coming from the student debt portion. The student debt problems are starting to become dramatic given rising default rates combined with sub-par institutions essentially operating as paper-mills financed by easy government money. Of course, like the housing bubble of the 2000s, many connected individuals see this but what motivation is there to pop this bubble? Who has the fortitude to step in and pop this bubble before it simply implodes on itself? What we have learned from history is that people will simply raid the market and ride this truck until the wheels go flying off in spectacular fashion. Yet the damage will be deeper and more profound the longer the bubble is allowed to grow. The student debt market is now well over $1.2 trillion. Not only is this growing, but since 2011 student debt has grown by $266 billion. The student debt bubble is becoming ripe for the popping unfortunately.

Student debt biggest part of consumer debt growth

Here is a troubling part of consumer debt growth outside of housing:

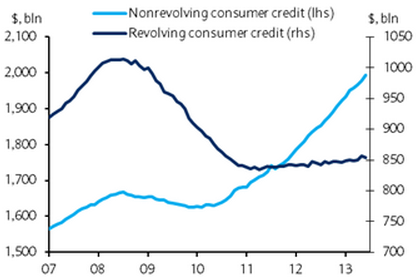

“(Barclays Research) …since the start of 2011, total revolving consumer credit outstanding has risen by just $15.9bn while nonrevolving credit has increased by $312.6bn. Nonrevolving consumer credit held by the government, which is comprised of federal student loans, has risen by $266bn over that period, according to our seasonal adjustment process. … we think that the costs of federal student loan programs are being understated and that they could pose a significant fiscal challenge to the US government in the future.â€

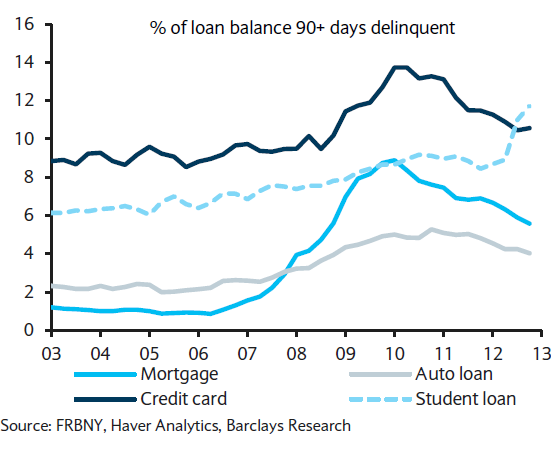

In other words, since 2011 consumer credit outstanding has risen by $312 billion and of this growth, 85 percent has come from student debt. This is completely unsupportable and student loans now have the highest delinquency rates of any debt class in the US:

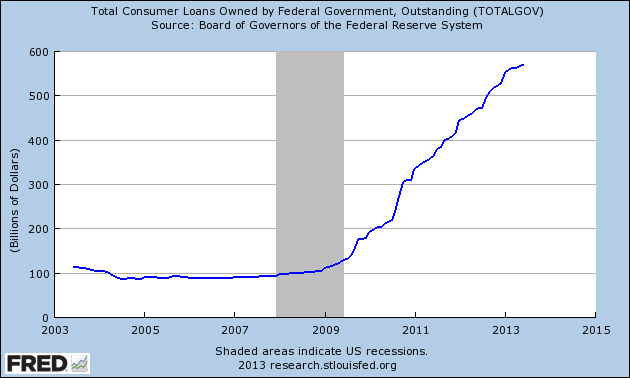

Is this surprising? Of course not. Student debt outstanding is $1.2 trillion and growing at a blistering pace. The government itself is fully responsible for something like $600 billion of this and another large portion is fully guaranteed:

The private student loan market is a small part of the $1.2 trillion so in essence, when this bubble pops it will be fully on our balance sheets. To put this in perspective, when the subprime component of housing went down there was something like $1 trillion of subprime loans outstanding (and at least in this case, the underlying value of homes would still render some sort of payback). How much will we get back for the student going to a shady for-profit institution and racking up $100,000 in debt? Out of more than 4,000 universities in the United States, how many are truly worth the current price?

The fact that student debt made up 85 percent of consumer credit growth since 2011 is startling. It is also problematic that we have crossed a new Rubicon here. Student debt is now the most delinquent loan of all consumer debt. Is anything being done about this? No. Many people are making out like bandits here so you can expect another “shocking†bailout in short order. And then you wonder why some schools are charging $62,000 a year for an undergraduate degree.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Reynaldo said:

This has been done on purpose by the banks in collusion with the colleges and politicians. What bank would not want to loan out billions in student loans after lobbying Congress to make them no-default loans? It’s absolutely absurd! And the colleges, knowing that students can now get basically unlimited student loans, are free to keep raising tuition through the roof. And every year, the banks go back to the politicians pandering to have the loan limits raised so they can lend more money. The politicians are all too eager to comply once it’s been promised to them by these banks that they’ll get lots of “benefits” for helping the cause. The colleges in turn, knowing the limits have been raised, once again raise tuition. On and on it goes, just like what happened with the mortgage bubble.

August 14th, 2013 at 10:19 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!