Will subprime auto loans ignite another credit crisis? Fed reports $101 billion in new auto loans between April and June with a sizable portion being in the form of subprime debt.

- 0 Comments

Buying a car is a big deal given that the sticker price of an automobile is close to the annual per capita income of an American worker. The average car in the US now costs $31,000. That is a healthy amount of money for a regular working person. Since incomes have gone stagnant for well over a decade, Americans have peppered over their loss of purchasing power by going deep into debt. Many are priced out of the housing market which at least provides some sort of equity building over your lifetime. Big banks have crowded into the housing market making it difficult for regular households to compete. However, the desire for easy lending profits has gotten Wall Street all excited once again. The current hot debt sectors are auto loans and student debt. Let us focus on auto debt today since the quarterly household report from the Fed was released this week. The report is stunning because it shows a massive jump in auto debt. In the last quarter, auto debt jumped by $101 billion. Total outstanding auto debt now stands at $905 billion. In other words total auto debt jumped 12 percent in one quarter alone. More troubling of course is that a sizable portion of this debt is in the form of subprime debt. Without a doubt, many of these loans will default. So what are the financial ramifications here now that a giant portion of auto debt is in the subprime variety?

No income? No problem!

A long running factoid during the housing crisis was that you only needed the ability to fog a mirror for a mortgage. In some cases, loans were made to deceased individuals so fogging the mirror might have been too much due diligence. Americans blow an enormous amount of money on cars. Beyond the monthly payment you have insurance, gas, and maintenance. Practically every other ad on television has to do with automobiles. An expensive car is not a long-term asset or a pivotal step in becoming financially stable. Most cars are money pits and many people go into crazy financing to afford a car. Subprime debt in auto loans is now becoming a tasteful delight to investment funds.

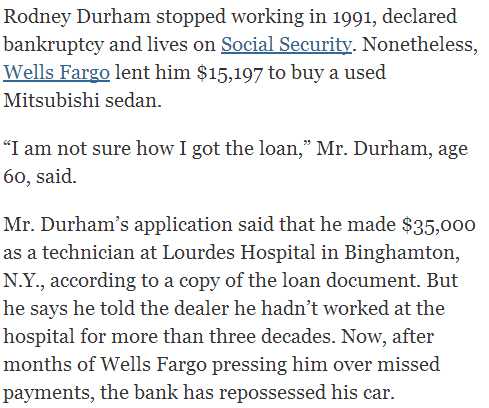

The New York Times had an in depth look at this issue before the Fed report came out this week:

Do the math here. This person was lent $15,197 for a car based on false income data. He had his car repossessed recently. The number of loans made to subprime borrowers has grown a whopping 130 percent over the last five years. Money is funneling into this debt structure as Wall Street enters into another greedy phase. It should also come as no surprise that this junk is being bundled up into complicated bonds and sold off to mutual funds and pension funds. Great. As if we needed more problems with our looming retirement crisis.

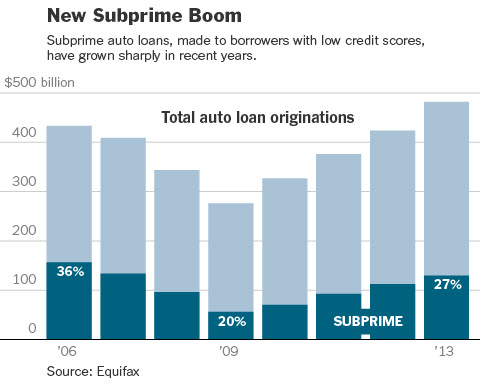

Total subprime auto debt is growing at a healthy clip:

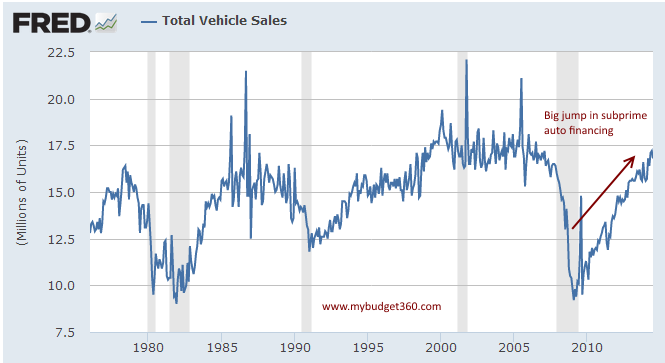

It should come as no surprise that this growth is going hand in hand with auto sales:

The problem with many of these loans is that they are being made to those that least can afford it. We now have a massive number of Americans working in low wage labor. Little benefits. Little security. And little paychecks. With auto loans, we are now seeing insane terms like 60, 72, and even 84 months for a payoff cycle. When the inevitable contraction hits, what will happen to these loans?

It is crazy to think that loans on such an expensive purchase are being made without careful analysis of income or even credit scores. It is very likely that this will get worse before it gets better now that we know FICO is going to ease up on some credit standards. The party always gets wildest before the crash comes.

Driving by local car dealerships you can’t help but to notice signs like:

“No credit? Bad credit? No problem!â€

“We finance EVERYONE!â€

“0 percent financing for everyone!â€

The echo of the previous bubble is still very much alive and is manifesting itself in auto debt. This bubble will pop. Will it have larger implications for the financial sector? Yes and for many reasons. This is a confidence game and the pool of qualified buyers is dwindling. Wall Street is hungry for more ways of extracting money from the working economy without providing a real world benefit. This is why the intense focus of purchasing up single family homes with easy Fed financing and turning them into a field of rental checks. The cascade on these auto loans is working right now but how many will work in the low wage side of our economy? Those in the low wage sector are also usually the first to lose their jobs.

Where else can Wall Street extract money? Housing is being pumped up again and auto loans seems like a nice place to dive into subprime again. Sure, the yield might look good for the first few months but the same occurred with subprime debt in housing. The crash starts with one domino falling.

No income? No job? Not a problem when it comes to buying cars apparently. Now servicing that debt, that is another issue entirely. By then, this will be out of the hands of big money and will suddenly be a bailout worthy candidate.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â