Average Salary in US: What does the average salary in the USA have to do with economic issues for a consumption based economy?

- 1 Comment

What is the average salary in the US? It is a challenge to get your hands on this data since a big portion of income figures are reported via median household income. In the US, the latest Census figures from 2008 to 2012 show that a typical household earned $53,000. Per capita income in the last 12 months came in at $28,000. This tends to surprise people especially with the high cost of living that has been brought on by the slow process of inflation. One of the better ways for looking at average income is by going into Social Security figures since this looks at all income earned in the country. According to the latest Social Security figures the average salary in the US is $44,321. Yet Social Security income data comes with a cap at $117,000 for 2014, the maximum taxable earnings limit. The average income in the US according to the Census is $81,400 and this goes beyond the Social Security cap rates. That however is a big difference from the per capita income of $28,000 being reported by the Census. Why? Well the Social Security and Census data for averages also looks at high income earners that will certainly skew income figures to the higher end, much more so in Census figures. For the purposes of economic discussion, the most important income figures are per capita income and household median income. For a consumption based economy, what does it say when the average American is not seeing their income grow?

Where do you stand?

It is still fascinating to see the media spin income figures. Only a few weeks ago I was seeing reporters discuss that $250,000 was middle class. If we are using math and following the rules of language, “middle class†would mean the actual middle. In the US the median household income is $53,000 between 2008 and 2012. That is a far cry from $250,000. More to the point, most of the income growth over the last generation has gone to the top 5 percent in the country while other working families have seen their income shrink in inflation adjusted terms.

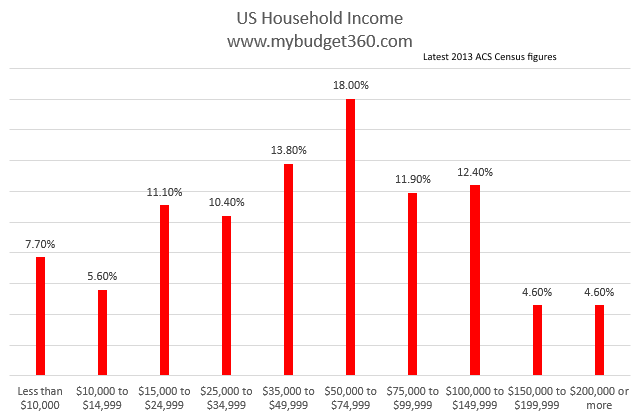

It is always helpful to visualize this change in income with data. Take a look at household income figures broken down in great detail:

In fact, only 4.6 percent of US households make more than $200,000 per year. Less than 2.5 percent make more than $250,000 per year. So in fact, this is not even close to being middle class. The latest Census data shows that in the last 12 months, US households earned a median of $51,000. In my book $51,000 and $250,000 are miles apart.

Yet when people hear US salary figures they tend to underestimate how big the gap in this country has become. This is why FICO is now going to make it easier for people to have higher scores so they can borrow more. Why? Because incomes are not keeping up and we are still a consumption based economy. The fact that subprime auto loans are rising is incredibly troubling since a car is not an asset. Americans need to save and saving can only occur if you put some of your income away for a rainy day.

Most Americans are not seeing average or median salaries rise. It is a painful dilemma in a system fully dependent on getting people out into the market and spending. Income has been supplanted with debt as the means of spending which is problematic. People go into debt for the following items:

-College

-Cars

-Housing

-Medical Care

-Groceries

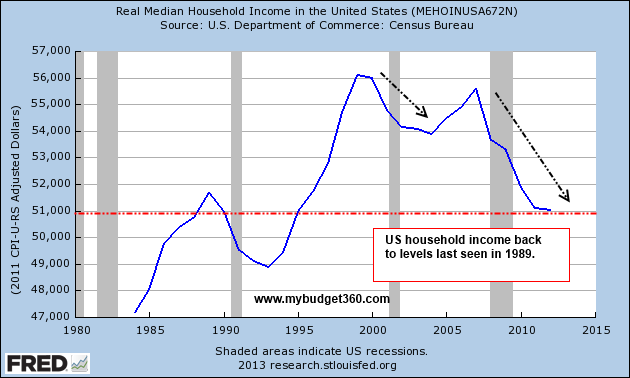

While that is occurring, the typical household income in the last ten years has gone down:

The average salary in America is just not keeping up. The average American is falling further and further behind. Income comes from work and we are expanding our employment base of lower paying jobs.

“(NPR) He makes about $50,000 a year — but that’s the same amount of money, in real dollars, that he was making when he was laid off 14 years ago. At 50 years old, he has no benefits and no retirement.

His wife went back to school for a degree and now teaches elementary school and recently started a retirement plan. Two of their kids are going to college next year, but Eldredge and his wife can’t help with tuition.â€

This is a typical story. Someone has a good paying job then proceeds to lose it. Bounces around in other jobs that pay a lot less in inflation adjusted terms. Next thing you know, retirement is looming yet you have nothing saved for retirement. This story is happening millions of times over in the US.

The implications here are big and that is why we are seeing big disconnects in our economy especially when it comes to incomes. Home values are up but because big money is flooding the market. Regular buyers are being priced out or forced into bigger debt. Incomes are not keeping up overall but the top income earners in our country are earning more than they ever have. We have more college educated Americans but more in debt. Debt seems to be the way people are trying to mask the losses in average salaries in the US. Not a winning outcome for an economy dependent on consumption.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

sharonsj said:

Nowadays middle class means earning about $50,000 a year. That means half the population earns less. Most new jobs pay about $25,000 and somebody earning that can barely get by. For a family, husband and wife both have to work just to be “middle class.”

America has been turned into a third-world country and I don’t expect things to improve.

August 30th, 2014 at 12:04 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!