Subprime lending at highest level since financial crisis hit: The three leading subprime categories are auto loans, credit cards, and student debt. $189 billion in subprime loans made in 2014.

- 0 Comments

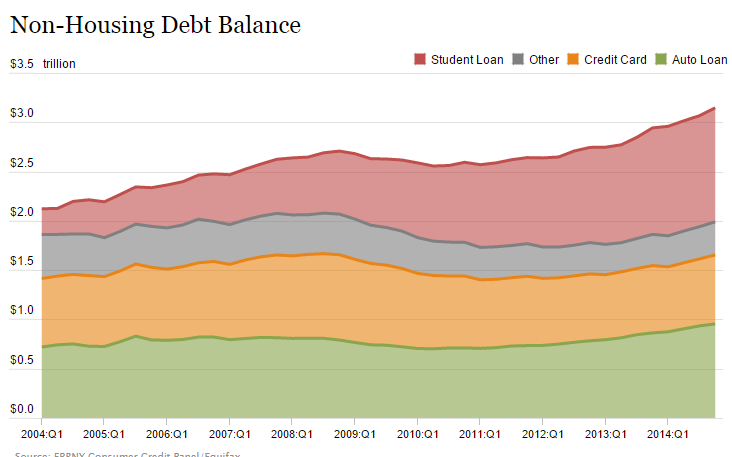

The euphoria is bleeding into every corner of our debt driven economy. Access to credit is being given to consumers but unfortunately, the loans are tied to items that are counter to becoming financially healthy. More to the point, subprime loans have reached levels that were last seen only during the financial crisis. As fewer good borrowers are available, lenders are digging into every nook and cranny of the economy to find additional borrowers. Money is brought into existence through debt. People have a hard time wrapping their mind around this. For example, say you are a student looking at going to college but have zero dollars to pay for it. A lender will pay for your school and create this “money†out of thin air. How so? All of a sudden you graduate and now owe $50,000 for example. You will need to pay this back with real earned income for many years. This is money that was brought into the system from financial institutions and we are now seeing it permeate into auto loans and credit cards with subprime borrowers. In 2014 $189 billion in subprime loans were made. Welcome back to the easy debt party.

Subprime rising in a big way

Subprime lending is rising in a big way. We started noticing this many years ago with college loans being given to students to attend for-profit institutions. Many of the for-profits target low income neighborhoods and realize that many will qualify for government loans and grants. Quality of education doesn’t really matter so long as they can get these students in. The money is created out of the financial system’s “magic†and the big winners are the institutions, not the students. Another category that we have seen more recently funnel money at subprime borrowers is with auto loans.

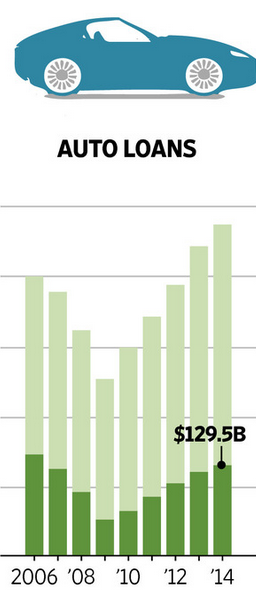

The Wall Street Journal compiled some fascinating figures on subprime lending. Take a look at subprime auto loans first:

There is nearly as much subprime auto debt as there was in 2006 when the market was going crazy on lending junk loans. $129 billion in subprime auto debt was made in 2014.

Take a look at credit cards:

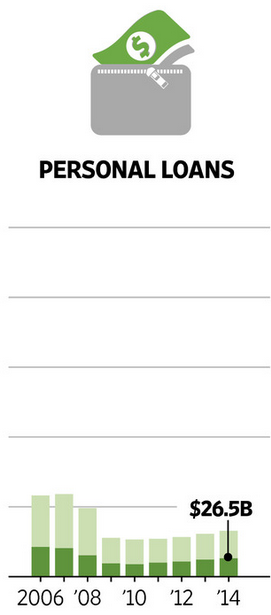

$21 billion in subprime credit card debt was extended in 2014. Finally, look at personal loans:

Another $26 billion in subprime personal loans were made in 2014. Subprime is rising in a big way. And of course, we now have over $1.2 trillion in student debt and a good portion of this is subprime since it is being made to many students going to low quality schools and many unfortunately have no way of paying it off or even getting rid of it via bankruptcy (unlike car debt or credit card debt).

What is telling is that a good portion of the consumer spending that is happening is coming from marginal borrowers. What happens when the economy hits its next recession? People are living on the marginal edge and we already know half of Americans are living paycheck to paycheck. Do you think giving people access to subprime debt is going to make their financial future more secure? All it is doing is allowing them to consume future income (which in many cases is in the form of low wages) and making any ability for financial security disappear. Keep in mind what subprime debt means:

“(WSJ) Almost four of every 10 loans for autos, credit cards and personal borrowing in the U.S. went to subprime customers during the first 11 months of 2014, according to data compiled for The Wall Street Journal by credit-reporting firm Equifax.

That amounted to more than 50 million consumer loans and cards totaling more than $189 billion, the highest levels since 2007, when subprime loans represented 41% of consumer lending outside of home mortgages. Equifax defines subprime borrowers as those with a credit score below 640 on a scale that tops out at 850.â€

Lower credit scores reflect late payments or too much debt relative to income. So giving those with low scores more debt, it is logical to expect more defaults once slight hiccups hit. Subprime is back again and of course the current narrative is that it is different this time.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â