The Balance Sheet Recession: $4.2 Trillion Lost in Residential Real Estate Value. Yet Mortgage Debt Down by $140 Billion.

- 0 Comments

What we are experiencing is a balance sheet recession. The reality of our current economic funk is highlighted by the growing unemployment rate and the diminishing purchasing power of many Americans. What is going to make this economic crisis drag out like a painful Hollywood divorce is the inability to reconcile the past with our current reality. Take for example the nucleus of this recession, the housing bubble.

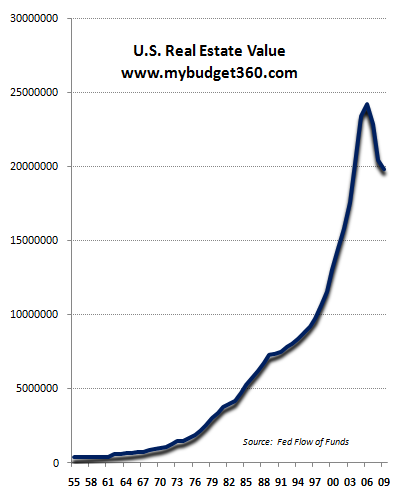

At the height of the bubble in 2006, residential real estate in the United States had a value of $24.25 trillion according to the Federal Reserve Flow of Funds report. Mortgage debt stood at approximately $10.54 trillion.

Fast forward to the second quarter in 2009 and look at the new values:

Real estate value (household and nonprofit):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $20 trillion

Home mortgage debt:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $10.4 trillion

We can chart this out:

American households have seen real estate values plummet by at least $4.2 trillion but mortgage debt has only fallen by $140 billion. This is the large predicament we now find ourselves in. Much of this is being corrected through the foreclosure process. Residential property values have fallen and either consumers live in an asset that is no longer worth a peak price, or lose the home so it is liquidated at a new market value.

$4.2 trillion has disappeared and needs to be reconciled. Many of the bailouts and the haphazard measures to prop up housing prices fail to acknowledge that there can be a significant probability that trillions of dollars were merely a mirage. That value is now being reflected without the special bubble lenses. However, the debt is still out there and reflecting optimistic valuations on the books of many banks. The FDIC is realizing this through the weekly failure of banks.

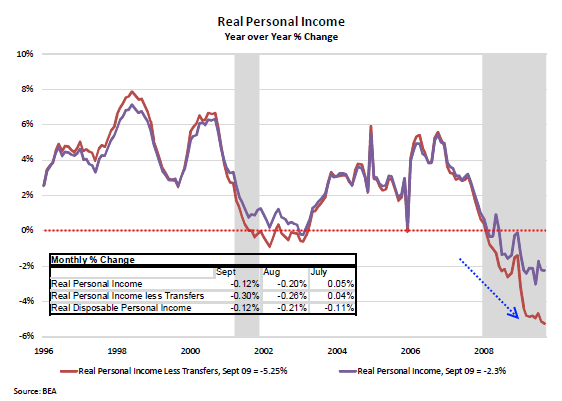

Household balance sheets are adjusting to the harsh new reality. The unemployment rate is officially at 10.2 percent, a spot that hasn’t been seen since the early 1980s when Disco was merely going out of fashion. Household income has also been declining:

Americans are now faced with a new form of austerity. Credit card offers are looking like a thing of the past. Forget about those home equity line home renovations or vacations. Many are dealing with this new reality not by choice, but by force. It is interesting to look at the Dow now over the 10,000 mark, a spot we hit over a decade ago. Think of a simple investment made in November 10, 1999:

$10,000 invested

Dow:Â Â Â Â Â Â Â Â Â Â Â Â Â 10,700

Gold:Â Â Â Â Â Â Â Â Â Â Â Â Â Â $300

Dividends excluded, your $10,000 invested in the Dow after 10 years has basically moved no where. At the spot price in 1999, $10,000 bought you 33.33 ounces of gold. Today that amounts to $36,663 for basically holding on to an old store of value. This out played an index of 30 of the biggest industrial powers, many now replaced like AIG. Am I saying go out and put all your money in gold? Of course not. But the truth of the matter is gold has gone up more in response to the massive spending and debt the U.S. has accumulated.

The unfortunate reality is the U.S. Treasury and Federal Reserve have figured out how to tax Americans without calling it a tax. Even though on a nominal level, Americans earn the same they did a decade ago, with the erosion of purchasing power the standard of living has fallen drastically. Gold is merely reflecting this new reality. The stock market is up because the sea is draining and our boat merely looks bigger given the current context. In reality, we are in the midst of an enormous tempest.

The $4.2 trillion in lost real estate value is a new reality. This for the most part is a large reason for the massive amount of foreclosures. Negative equity brought on by years of dubious lending. At the moment, there is painful reconciliation of the balance sheet. Americans are doing their part yet Wall Street isn’t. In fact, they are on path to having another record breaking year with more rounds of epic bonus paydays as they exploit the imbalances in the system. This is courtesy of the U.S. taxpayer since many of the firms would be obsolete if it weren’t for the historical bailouts. No one has bailed out the average American although the pretext to the Wall Street bailouts was to help the average person.

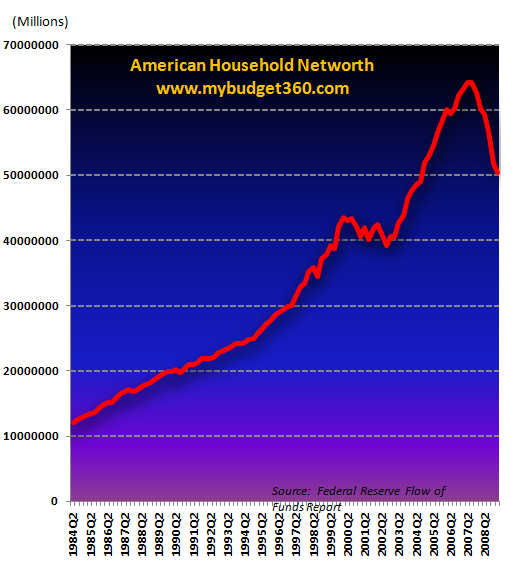

If we combine equities, businesses, and other forms of wealth Americans have seen some $12.2 trillion in net worth disappear since the peak in 2007:

The Fed is trying to inflate the nation out of the trillions in debt that is weighing on it like an albatross tightly affixed to the neck. Will it work? It is doubtful that the average American will feel it like a stunning success. Wall Street can leverage the weak dollar to sell abroad and also, use carry trades to their advantage. Yet the vast majority of Americans don’t play the foreign exchange markets and thus will benefit little by this move in the long-term. In the end, we will need to reckon with the balance sheet in some shape or form. The only way this will happen is if we get our financial system restored to some form of integrity. Otherwise, you can expect to see other “firsts” like gold hitting $1,100 an ounce.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!