The Economic Recovery Decoy: Bank Refuge and Auto and Home Sales Plummet. Two Largest Purchases for Americans still Treading Water. Number of Renters Increases by 748,000 in one Quarter.

- 3 Comment

When I hear about the banks and Wall Street returning TARP money to the government I can’t help to think of a successful Trojan Horse hitting our economy from within. The initial rush to back an unprecedented bailout for the sake of the economy actually turned out to be a strategic looting of the American taxpayer. The exercise of AIG being used as a conduit to funnel billions of dollars to firms such as Goldman Sachs was merely a diversion on the breaking backs of the American people. And to what end? Do we measure success by having 26,000,000 unemployed and underemployed Americans who are now destined to take jobs making half of what they once did?

When we hear the deep pain of our average citizens, they are told with a round about manner that there is no more money. We are broke. This is true. Yet over and over banks and Wall Street get hand out after hand out and policy that is conducive to their well being. Not from a current savings account since there is none to be found but from future generations and the sustainability of our country. The public was mislead to believe that Wall Street survival in its current form was the only way to assure the prosperity of America. This has turned out to be a ruse of historical proportions. If we even think about the two biggest purchases Americans make, that of the automobile and home they are no where near their historical peaks:

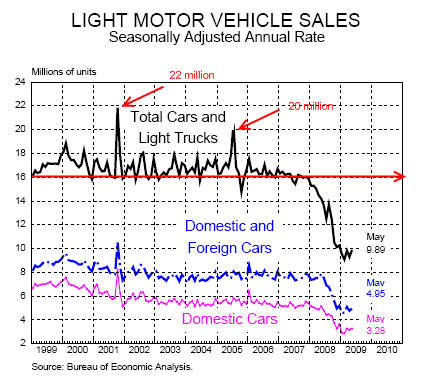

For an entire decade, auto sales averaged about 16 million per year. At times in the debt mania, the seasonally adjusted average went up to 22 million and 20 million. This is simply astounding. If we are to examine the troubles of the auto industry we need to only look at the current sale count. The current SAAR is hovering around 9.89 million. We are at half the volume from only a few years ago. The psychology that fueled the auto industry was partly based on the ever growing desire for more and more with deeper debt. Marketing and advertising attempted to convince would be buyers that the thing to do was to buy the next shiny model. This of course for many cars is utterly unnecessary. Instead of 3 years, many cars with basic maintenance can go for 5, 7, or even 10 years. Yet this idea propelled more and more people to buy out of want instead of need. With our current stock, we have enough cars for many years. This same pattern applied to the housing market.

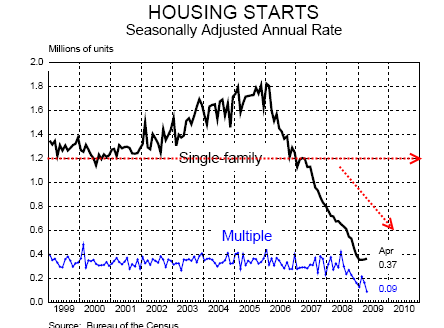

Home building went for a once in a lifetime building spree. It wasn’t like the United States experienced some kind of second Baby Boom but it experienced an obsession with real estate. The home became the vector to transmit the debt bubble. After all, what can be more secure than a home? Yet the home became more than that. The home transformed into a mini bank with phony valuations that allowed many Americans to drain their own wells and live a life that was fully beyond their means. The stock market collapsing with its wild fluctuations is merely deflating after a decade long bubble. There was no justification given population growth for the boom in homes. Price jumps were purely based on speculation and easy access to credit. The fact that in many of the regions in the country one can buy a home for half off is no random event. It is a mere reversion to the mean. We are trying to find the actual equilibrium but after a decade of high finance, how can one say that the bottom will be reached after a few months?

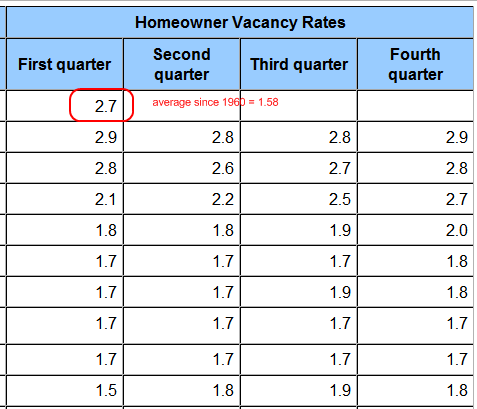

We have enough housing for many years and many people including Wall Street depended on the housing market perpetually going up. What industry will fill this gaping hole? The homeowner vacancy rate still stands near record levels:

Since 1960, the average rate hovers around 1.58. We are at 2.7 still near the all-time high of 2.9. What this tells us is we have plenty of housing to work through the system. So let us look at some data:

Total Housing Units:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 130,429,000

Occupied:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 111,368,000

Owner:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 74,942,000

Renter:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 36,426,000

Vacant:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 19,061,000

As you would suspect, the owner occupied number has fallen by 203,000 from last quarter and the renter amount has risen by 748,000 given the current foreclosure crisis. The bottom line is that there is still too much housing on the market.

So as we continue with the decoy bailout of Wall Street, we will still be looking at main street indicators to get a better sense of when we can expect recovery.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Ronald Bourgeois said:

Hi,

Where are you getting the housing stats?

thanks

ronJune 11th, 2009 at 1:12 pm -

Realist said:

I suspect that we were misled by Bush about the meaning of the “ownership society” he told us we were going to become years ago. Instead of more people becoming owners of businesses and property, fewer people are owning more of both. For instance, three empty homes surrounding my own have been sold in the last two months, but all were bought by investors, and only one has been rented. Can it be also thus at the level of Wall Street?

June 11th, 2009 at 4:22 pm -

direct shares said:

The recession hit almost all industries and only few people had mentioned to take a closer look at the two biggest markets – real estate and auto. If they are provided with the right solution, these markets can help the stock market regain strength.

August 26th, 2009 at 9:34 pm