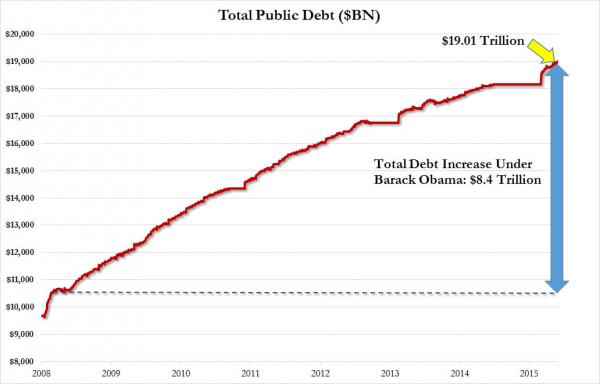

Total U.S. debt breaks $19 trillion mark: Total debt rises by $8.4 trillion in last 8 years and is on pace to hit $22 trillion by 2020.

- 2 Comment

When the party is getting ready to end, you might as well ramp up the spending and put it on the nationwide credit card. Total U.S. debt blew right through the $19 trillion mark and has expanded by $8.4 trillion only in the last 8 years. There are countless obligations in the form of Social Security, Medicare, military, education, and other expenses that almost guarantee that total U.S. debt is going to expand further. This brings up an interesting situation in the respect that we will never pay this debt off. I think people get this, right? In fact, the entire debt foundation is built merely on the servicing of debt, not the actual payoff. Yet the amount of interest we owe is now also ridiculous. In December alone we paid $86 billion in interest for one month. The pace of debt growth is unsustainable and has created a world where central banks are chasing negative interest rates just to keep servicing costs low assuming they can find a borrower.

In debt we trust

Total U.S. debt is growing at an alarming pace. We don’t even hear about debt ceiling talks since we have thrown caution into the wind. We are now stuck in a corner hoping and praying that low interest rates will save us. Japan just entered into a negative interest rate environment and their economy has experienced more than two lost decades. Are we gearing up for the same?

As of the end of January, total U.S. debt hit $19,012,827,698,417.93. And $8.4 trillion of that growth happened in the last 8 years:

At the current rate, we’ll be at $22 trillion in 2020. It is probably no surprise that the American public is frustrated and much of that stems from many becoming poorer as the middle class is now a minority. Lip service is given to the public about fiscal restraint but in reality, there are two worlds we live in. One that is built on austerity for the working and middle class. The other world is built on giant bailouts and big handouts to the politically connected. It is no surprise then that this election is being challenged by outsiders.

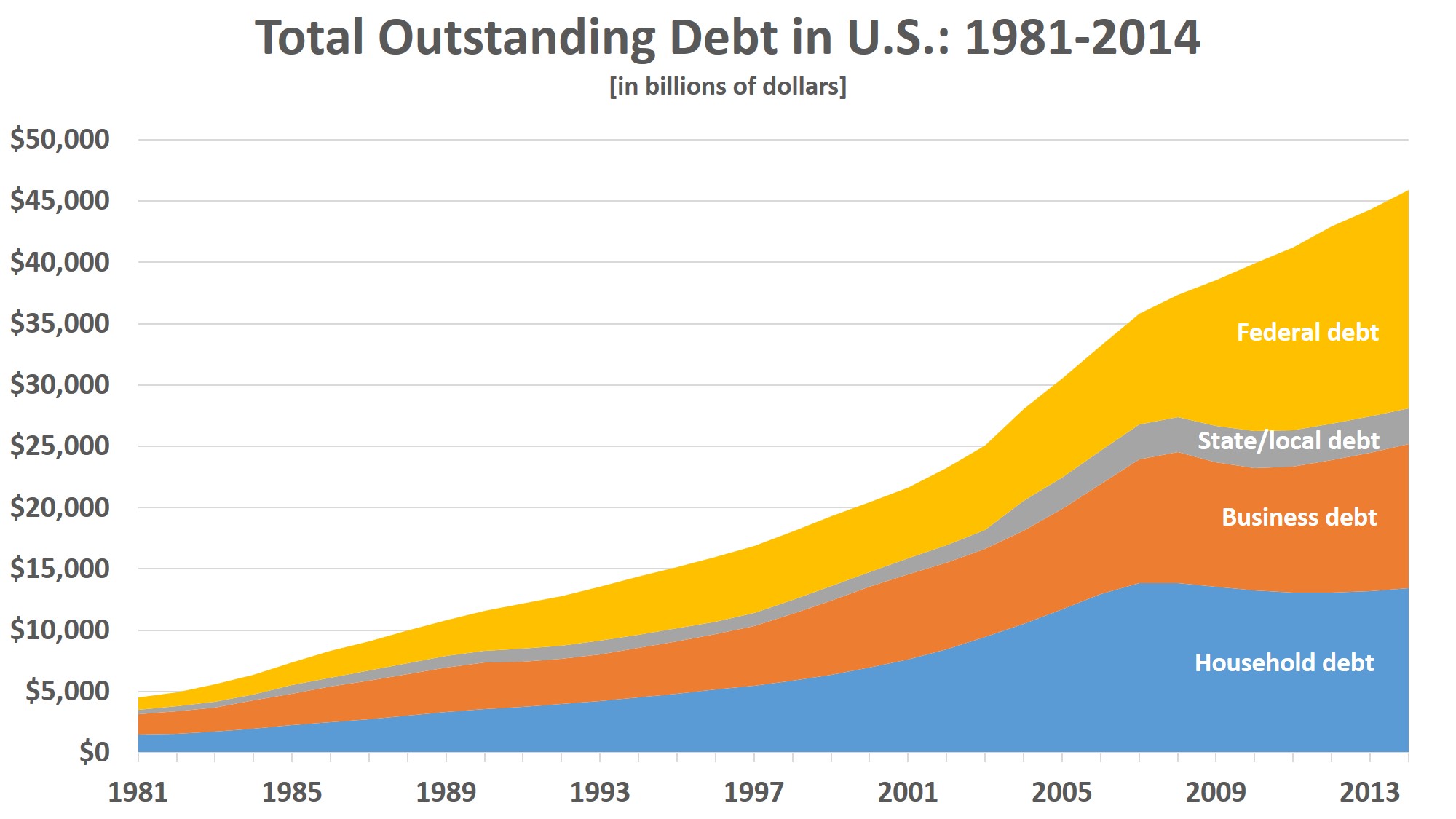

The story of U.S. public debt is only one piece of the puzzle. Total debt outstanding in this country is monumental:

Total debt outstanding is well over $50 trillion. Households are leveraging up dramatically with student loans, credit cards, auto debt, and once again mortgages that stretch the family budget. Is any of this sustainable? No. In fact, this is what happened in 2007. We reached a point of too much debt and a great liquidation unfolded. This is the tsunami that unfolded with foreclosures, auto repossessions, and bankruptcies. For a nation, the unfolding isn’t so clean cut.

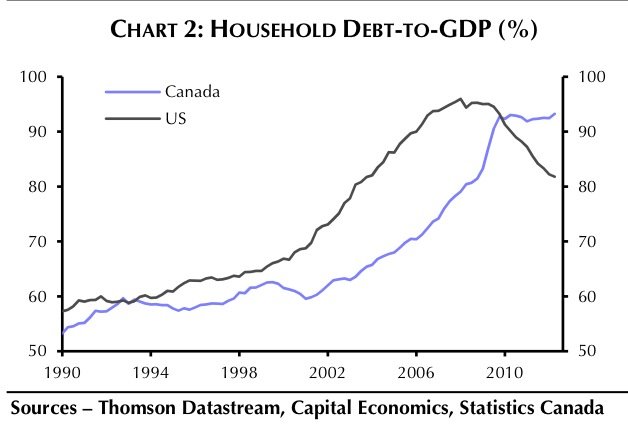

People might look at the $19 trillion and scoff at that figure. Yet this is monumental because total public debt is much larger than our annual GDP output. For U.S. households, once total household debt hit the mark of total annual GDP output, a great contraction began:

A similar situation is likely to unfold if we continue to grow national debt too quickly without any acceleration in GDP growth. Then again, the credit cards are running amok all around the country and no one is minding the store anymore.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

RKae said:

Our unfunded liabilities are now over 101 trillion. So putting that with the national debt, it’s 120 trillion.

Meanwhile, the national assets are 116 trillion and falling.

February 4th, 2016 at 9:30 am -

Nimbok said:

Senate Majority: Republican Party

House Majority: Republican PartyFebruary 4th, 2016 at 7:38 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â