Unsocial Insecurity: Social Security Fund loses money for the first time since 1983. The new retirement model will have you working until you fall over from a heart attack.

- 10 Comment

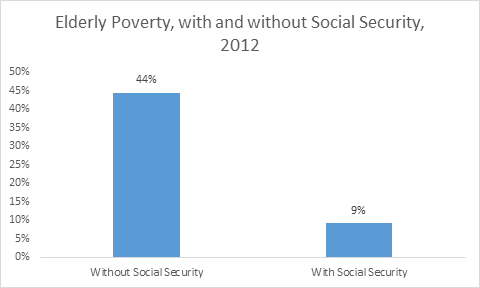

Social Security was never designed as a long-term pension. It was implemented in 1935 during the Great Depression to assist families from falling into absolute poverty. The large work force dominated by men usually meant that many would die and leave a large family behind with no financial resources. Social Security was there to protect this group. But over the generations, Social Security is now seen as a retirement fund and many depend on it for their livelihood. Recent figures highlight that 44 percent of retirees on Social Security would be in abject poverty without this support. More to the point, the number one source of income for retirees in America is Social Security funds. So it might come as a troubling surprise that the Social Security fund ran a deficit last year for the first time since 1983.

Social Security fund takes a hit

“(Bankster Bubble) The Social Security Trust Fund lost money last year…

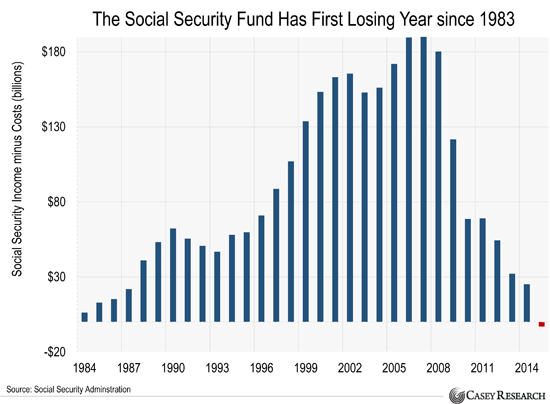

Today’s chart shows the Social Security Trust Fund’s annual cash flows. As you can see, the fund took in more money than it paid out every year from 1984–2014.

However, in 2015, the fund handed out $3 billion more than it received. It was the fund’s first deficit since 1983.

Unless the government reforms Social Security, the Congressional Budget Office says the fund will run out of money by 2029.â€

Here is the chart:

This is not a good thing. The average retiree gets a check of $1,355 from Social Security each month. To bring cost in line for long term feasibility, a report was done saying a 29% cut was required bringing the monthly payment down to $962. I for one can tell you this is not going to happen because older Americans are a massive voting bloc and with the cost of living soaring, this is political kryptonite.

Not only is this a third rail in politics, half of retirees would be in absolute poverty without Social Security:

“In fact, if it were not for Social Security roughly 44 percent of elderly Americans would be in poverty. This is calculated by how many Americans receive Social Security and the standard poverty income cutoff created by Census figures.â€

Many Americans are worried and this is being reflected in the extreme political sentiment this year. If things are so fantastic, how is it that the Social Security fund lost money? This is the first time this has happened in over a generation. I’m sure retirees are going to be thrilled to hear about this.

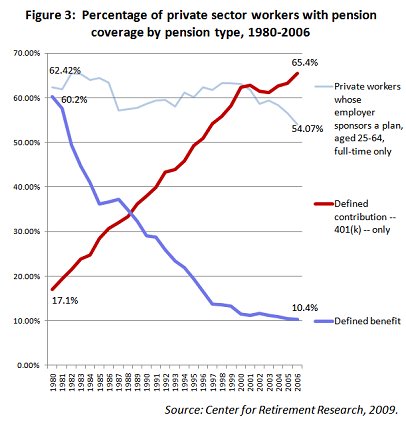

The fund handed out $3 billion more than it took in last year. You need to remember that many young people are earning low wages and this is where taxes are being taken. So you are taking from one struggling group and shifting to another struggling group. And in the end the middle class disappears. Nothing to see here people. Just the first time the Social Security fund ran a deficit since 1983. Ironically around this time there was a rush to destroy the American pension in lieu of juicy casino like mutual funds and stocks pushed by Wall Street:

And this leads us into 2016, a year full of insecurity and uncertainty.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

Rachel said:

Many Americans are in poverty depending on Social Security, I have heard absolute horror stories of people subsisting on $600 a month and think of their standard of living, lack of care, lack of privacy, independence, etc. Yet every politician is kicking this can down the road if not completely avoiding it.

January 30th, 2016 at 3:42 pm -

Don Levit said:

If the trust fund was a store of wealth why does every dollar withdrawn add to the debt?

January 30th, 2016 at 5:07 pm -

Stephen verchinski said:

Please Congress, raise the cap by a reasoned amount to allow for the system of social insurance for old age to continue. We need action and not cuts.

January 31st, 2016 at 7:17 pm -

Helix said:

So either premiums will rise, benefits will be cut, or the shortfall will be printed. Maybe all three. The issue will be most critical when the baby boomers have moved fully into the social security recipient category. After that, the demographics will begin to soften. This is a 25-year problem.

February 2nd, 2016 at 7:04 am -

wkevinw said:

Most likely is that the benefits will be cut as is already in the law; when the fund goes broke. There is no free lunch.

Economics is not just a science of numbers, but also of emotions and incentives. Social safety nets (which might be needed, and seem a very ethical thing to provide) also incentivize spending (not saving) for a rainy day and/or old age (a type of rainy day, really).

The system needs some type of reform and neither party will touch it.

They might raise the tax again, but that will just postpone the inevitable.

It will go broke.

February 3rd, 2016 at 7:29 am -

Don Levit said:

Stephen

Raising the cap has little or nothing to do with the solvency of Social Security

FICA taxes like income taxes go to the Treasury’s general fund

There they are spent on general appropriations

Assuming Social Security is ten percent of the budget the trust fund receives 10 cents on the dollar

With those small revenues the trust fund is not filled with dollars from taxes but with unfunded IOUs

In short the trust fund is not a store of wealth and has zero liquidity

Raising taxes does not correct this fundamental flawFebruary 3rd, 2016 at 4:08 pm -

paul said:

Government Owes $2.7 Trillion to Social Security. The government has embezzled all surplus Social Security revenue, generated by the 1983 payroll tax hike, and spent the money on wars and other government programs. None of the money was saved or invested in anything.

February 4th, 2016 at 7:55 am -

ARMAND W. TONUCCI said:

What has been forgotten is that the funds raised, when they raised the s.s. taxes in 1983 in preparations for the baby boomers retirement STARTING IN 2005 is 1) the funds collected and placed in the S.S fund were then transferred to the general fund . (2) Approximately 2.5 trillion dollars ( that Is TRILLION ) WERE TRANSFERRED TO THE GENERAL FUND TO make it appear the YEARLY DEFICITS run by the U.S.government were MUCH LESS THAN THEY REALLY WERE. THIS OCCURRED MAINLY IN THE 90’S EARLY 2000’S. THE U.S TREASURY DEPOSITED NON NEGOTIABLE BONDS OR NOTES INTO THE S.S FUND. NON NEGOTIABLE MEANS YOU CANNOT CASH THEM IN- EVER. IF THE GOVERNMENT RETURNED THE MONEY, WITH INTEREST, THE S.S FUND WOULD BE SOLVENT FOR MANY YEARS TO COME. HOW COME THE GOVERNMENT NEVER MENTIONS THIS WHEN THEY DISCUSS THE SOLVENCY OF THE SS FUND?

February 4th, 2016 at 8:31 am -

Reality said:

The SS trust fund has NOT been spent for other purposes; that’s one of the biggest myths going.

Payments into the trust fund are NOT counted as credits against the deficit. For example, if the federal govt runs a $100 deficit, and I pay $10 into the SS trust fund, the govt’s deficit is not $90 – it’s still $100. That’s how the Dept of Treasury’s total federal govt deficit is calculated (Google it for proof), and this is the number that Congress uses in it’s debt ceiling calculations. So, payments in are not credits, and payments out are not deficits. The trust fund is fine.

February 4th, 2016 at 5:59 pm -

Don Levit said:

If the trust fund was fine then why does every dollar withdrawn increase the debt?

February 6th, 2016 at 8:18 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â