Standard of living, meet falling US dollar – how a falling US dollar benefits banks at the expense of working Americans.

- 7 Comment

There is certainly a cost to a falling US dollar. Many Americans are living the consequences of this multi-decade long trend. The Federal Reserve has only added fuel to this trend but many families are now realizing that there does come a cost to unrelenting debt based solutions to fiscal problems. Shopping at the local grocery store I’ve noticed that some items have doubled in the last few years. Fueling up is also more expensive. The issue with living on a low dollar policy is that eventually, you end up in a low wage capitalist system. The easy money slowly inflates away especially on global items. We are seeing this in the US in various arenas especially with higher education. The end result is that the standard of living for the vast majority of Americans has fallen dramatically in the last few decades.

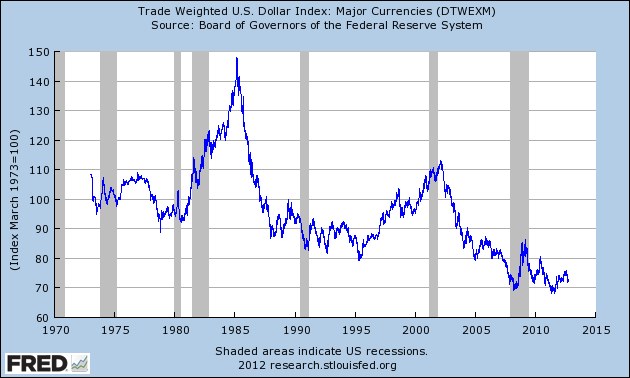

US dollar trend

The US dollar has been on a multi-decade long trend that has resulted in a 50 percent haircut:

Think about what this has done in a more practical sense:

-Energy is more expensive because it is traded on a global market (you are trying to compete with others with a declining currency)

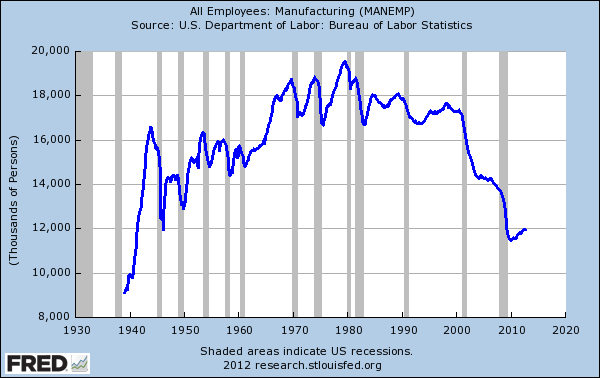

-Education. Massive debt has devalued the dollars even further. Very few families can actually afford to pay the sticker price of tuition and need to go into debt just to finance college. Most of the middle class jobs are now in fields that require degrees since the jobs are not growing in manufacturing (that is, making actual things):

-Food gets more expensive since you are also competing globally here. Take a look at your grocery bill and compare it to your bill from 10 years ago. This stands in stark contrast to household income that has been stagnant for over a decade.

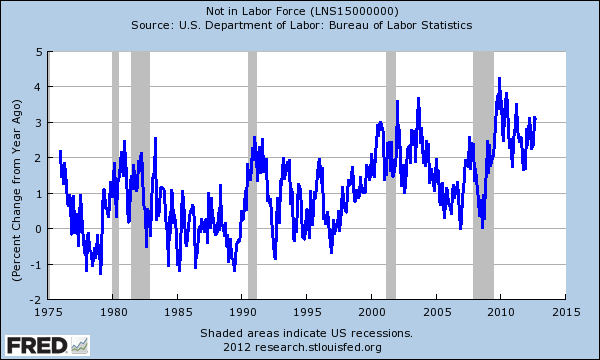

We rarely hear about the massive decline in the US dollar in the mainstream press. This is not likely to come up in any of the campaigns because the Fed and government realize they need to inflate our debt away. Who in their right mind thinks we are ever going to pay off that growing $16 trillion debt? The middle class in the US is a shrinking group. We now have over 46 million Americans on food stamps, a record percentage. We also have a growing number of Americans that do not participate in the labor force:

This is a very important chart to understand. The rate at which people are entering the “not in the labor force†category is growing at record speeds given our demographics. From 1975 to 2000 not once did we touch an annualized 3 percent rate. That was reached. Then when the debt bubble burst, we actually reached a stunning 4 percent annualized rate. Things are dramatically shifting and given that many older Americans rely on Social Security, that declining standard of living is felt even more deeply.

Another outcome of a falling dollar is rising commodity prices. Ultimately you are competing on a global market with a currency that is worth less relative to other currencies. If the Fed with their banking allies and the government are willing to go into massive debt, at what point do other people stop lending? We already see this with our internal mortgage market. The Fed is basically the mortgage market now because no one in their right mind would lend out money for 30 years at these current rates. With this kind of action however you crowd out other investors and hot money flows to largely unproductive sectors. Just look at China and their millions of empty apartments.

Outrageous tuition, increasingly expensive food, energy costs, and stagnant wages are all part of the standard of living compression brought on by these actions. That is great that you are saving $200 bucks a month on your mortgage (behind the scenes the bank can offload these inflated assets and the American public slowly forgets about the biggest financial crisis perpetrated on the nation since the Great Depression). It is going to cost you $50,000 per year to send your kid to a good private college so hopefully that $200 saved per month is going to help. In the end the falling dollar is merely a way to inflate our way out of our massive debt and bailout the banking sector. Most Americans as based by their net worth are not doing financially better.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

moira said:

strong point about the cost of college and entry point to the middle class requiring one and so what then, if you don’t pay to go to college you live on food stamps?

October 13th, 2012 at 9:12 am -

Varian Wrynn said:

Using US Gov’t documents, I projected out the next 8 years of life in the US. I started by taking the White House Budget that shows taxes will more than double and factored in escalating food cost (9%/yr), inflation (3%/yr), labor participation rate (-0.3%/yr), wage increases (2.6%/yr), etc.

End result? The average American’s taxes will increase over 120% and they will not be able to pay their bills by 2020. See: http://www.scribd.com/doc/107058480/Life-in-2020

October 14th, 2012 at 9:49 pm -

clarence swinney said:

FISCAL YEAR END 9-30-12 and 2013 Budget

Expenditure—3540B—3800(2013)

Revenue——-2450B—2900

Deficit———1100B—-900Borrowed again? When will we stop letting the rich get richer instead of taxing wealth?

Our leadership is too weak to face the facts that Wealth Income and Estates

are not being taxed Fairly. Pay 15% on income in Gambling and 28% as a school teacher or policeman.

Top 400 Incomes paid less than 1% of Income in Payroll Tax.

Rip off must stop.

Obama inherited a 3510B Budget and three budgets later it is 3540B

Big Spender? Ha Ha

If he spends 3800B in his last budget(2013) he will have increased Spending by 8.6%

Bush 92% and Reagan 80% Obama 8.6% Wow! Why is this not promoted?October 15th, 2012 at 7:26 am -

clarence swinney said:

Second Fact Check On Spending

The last budget of Bush spent 3510B

Actual spent in fiscal 2012 was 3540.

The 2013 budget projects spending at 3800B.

That indicates that Obama will increase spending

from 3510 to 3800 or 8.3% for four years.

Compare to Reagan 80% and Bush 90% (1830 to 3510)

One big problem is failure to tax to get revenue to pay our way

thereby creating the horrid debt burden.

In fiscal 2012 we borrowed 1100B. A shame. While corporations made record profits and richest got much richer. We have the income to pay our way.

The revenue in fiscal 2012 was 2450B is why we rank below only Chile and Mexico as Least Taxed in OECD nations. The 2450 is 17% of our National Income.

Runaway unfunded spending is in Medicare and Pentagon.

We must cut the runaway spending and tax wealth more to start paying down the debt.October 16th, 2012 at 7:31 am -

Steve said:

No, you will not be able to live on food stamps. The government is about to cut all of that out. You will just be left to starve in the streets, or this same facist government will round you up and send you into the labor camps if you cannot find work, and you will labor on the infrastructure in the name of the new nation state. Hos is that for solving national/international economic problems? Think and research before you laugh. It is all unfolding right now. See how gun control is suddenly at the top of the agenda?

October 17th, 2012 at 5:14 am -

clarence swinney said:

WAH

worst administration in history

Bush took 1830B Budget to 5800B or 90% increase

5800B debt to 11,900 or doubled

237,000 jobs per month to 31,000 or lowest since Hoover

Surplus to 1400B deficit—first time over 1000B

Invaded two destitute—unarmed nations –alienated 1500 Million Muslims

Allowed destruction of Housing Industry

Allowed Casino Derivative of America to becomes world’s larges gaming facility

Violated international laws on torture

He and 11 staffers told 935 lies to sell the people on invading Iraq..

Why invade a country that had done nothing to us.

It smells. Black Gold. OIL. Mitt a deja vu?October 17th, 2012 at 9:19 am -

clarence swinney said:

Ye! I am worried that we rank #4 on Inequality in oecd.

I am worried that 10% own 73% net wealth—83% financial wealth–get 50% individual income.

I am worried We borrowed 15,000B since 1980 that went to help them get much richer.

I am worried when one family has more wealth than 90% of families

Â

I am worried when 70,000,000 get 14% of individual income.

Â

I am worried when we borrowed 1100B in fiscal 2012 and taxed only only

only 17% of out Total Income. Why borrow when we have so much money??? Tells you why we rank behind Chile And Mexico As Least taxed in oecd nations

Â

Obama will end 4 years increasing spending by 8.6% to Bush 90% in 8.

(Bush 1830 to 3510) (Obama 3510 to 3800)

Â

Must tax wealth much higher must must must  they have most of the $$$$October 18th, 2012 at 7:34 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!