The sound of rumbling from the student debt bubble – Jump in consumer credit last month came mostly from student debt growth. For two decades student debt expanded at a rate above 17 percent per year.

- 7 Comment

The flashing alert signs permeating from the higher education bubble should give people pause to the next flavor of the day bubble. This month information was released regarding consumer credit growth. Most of the headlines took this as positive economic news but digging deeper into the data we realize that the bulk of the growth came courtesy of exploding student debt. Even with the encyclopedia amount of data showing how horribly run many for-profit colleges are run, the government continues to back these risky endeavors while saddling young Americans with unrelenting levels of debt. It doesn’t take a rocket scientist to see the predatory nature of these operations just like it was easy to see subprime loans were going to end badly. So why continue to allow this to go on? Why is the system so adamant on continuing to pour layer upon layer of student debt syrup onto the younger segment of our nation that is already struggling in the employment market?

The continuing expansion of student debt

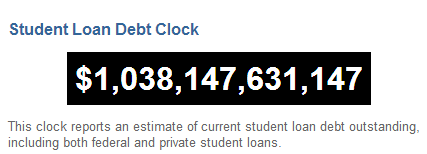

Every month the student debt bubble gets bigger and bigger:

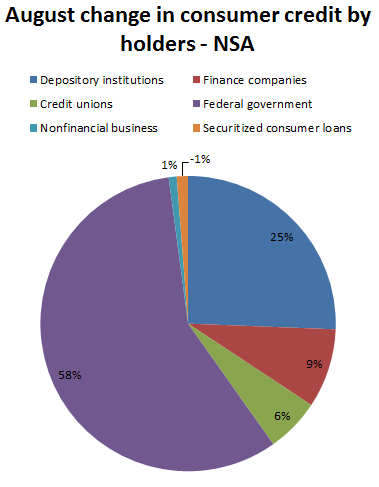

The figure above should shock you yet the student debt bubble simply continues to roll along. It was surprising to see the headlines this month regarding consumer credit growth. The headlines couched the growth as something positive but the underlying reality is that 58 percent of this growth came directly from expanding student debt:

Source:Â SoberLook

The 58 percent of growth from the Federal government is all student loans. Keep on fiddling while this unsustainable bubble keeps on growing and the longer this goes on the more painful the burst will be when it inevitably occurs.

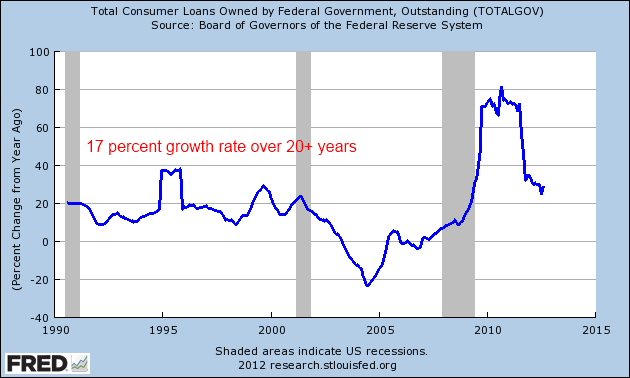

This isn’t a new thing and the rate of growth for student debt is simply out of control:

Over the last 20+ years student debt has grown by over 17 percent annually based on only the government portion of data. The early 2000s saw a slight decline as the private market was eating up some of this debt as well. But look at what happened during and after the recession. Student debt at some points was growing at an annualized 80+ percent! This was for the government backed loans as the private market retreated from student debt (a common story with mortgage debt as well).

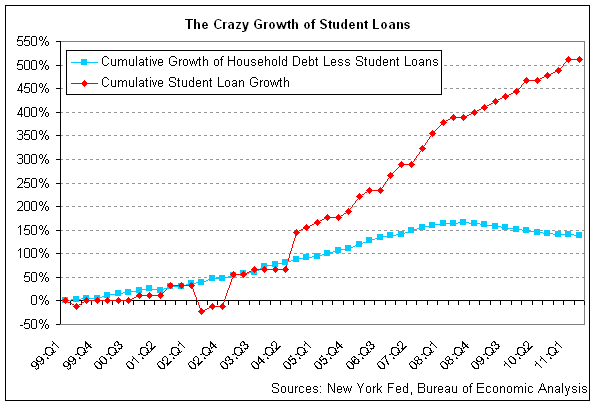

There is little justification for this astounding growth. Wages have not kept up to signify an underlying return on investment that makes up for this deep change in debt. We also realize that student debt is the fastest growing sector of debt in our economy:

This is really the elephant in the room right now for the economy. The fastest segment of debt growth right now is coming from student debt. We are well over $1 trillion now and this is now into a territory that is likely to cause a shock to the economy once it pops. What is the banking system and government doing about this? Not much really as we see from the latest data on consumer credit growth. Apparently saddling countless young Americans with suffocating student debt now passes for solid economic news.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

Dennis said:

I taught for two years at a for profit and it felt like I was working for the Mafia. The cost, for what they offer, is way way too high and the debt is put on students who can least afford it. Tuition exactly matches for Military students what the Government allows per year from what I can tell. It has nothing to do with the course worth. Teachers are very sincere in my view but the administration and recruiters are put in a very bad place to keep the cha ching going. I have no idea why anyone would choose a for profit school over local colleges etc.

October 10th, 2012 at 8:42 am -

Justin Case said:

This is going to be sooooo freakin funny when this bubble pops. I hope Obama gets blamed for it because he’s black.

October 10th, 2012 at 10:08 am -

Anne said:

These kids would be better paying off the student debt using credit cards, then defaulting would be an option if they need to. The way the govt set up these loans they cannot ever get out of them and the fees and penalties grow exponentially, if what I have read is correct.

October 10th, 2012 at 10:49 am -

bill hopen said:

“hey! hey! we won’t pay….free education in the U-S-A” marching in the streets, a generation of college trained debt slaves, working(if at all) for $10 per hour, paying Soc Sec taxes to support the Boomers retirement, unable to bankrupt and default on their loan-for-life, borrowed in their youth, ….They discover in their thirties and forties that they’ll never get a loan for a car, never get a loan for a house, caught in a negative credit report, they are refused better employment level, they will descend into a debt slave’s cynicism, take all benifits availible from gov’t programs, eat on food stamps, hide any real wealth they attain in cash/off-books/black market. They will be legion, the poor rent payers with no hope of economic growth, no incentive to work harder or longer or to save because the 100k+ loan hovers over them, defaulted on, laden with penalties, sold to collection vulture corps who are watching, ready to pounce on and clean them of any showable assets they acquire on-the-books…..meanwhile the computer driven cashless economy tries to track every cent they make and spend closing in more and more.

I am advising my children to not go to college, but to learn a 21st century trade, like bill collecting, drone surveillance, etc

October 11th, 2012 at 7:31 am -

major said:

What causes the excess growth in student loans, I dont think the terms are that much easier than when I was a student 45 years ago. Are they approving too many loans for students who dont intend to pay them back or dont finish college programs. I know the graduation rate for those who start a bachelors program is lowest its ever been. In some cases only 50% of those who start ever graduate.

October 11th, 2012 at 8:47 pm -

Bud Wood said:

Seems like the above comments are correct. Current college costs seem to be unbelievable when viewed in the context of what the “education” provides.

We have seen bubble after bubble inflated and most have popped with devastating results. This college debt is another bubble based upon a want of getting a degree that will provide a key to an (easy) semi-productive white collar job. Sorry; it doesn’t work that way, at least not any more.

Certainly, there are a few very good schools that provide highly productive skills which are in demand. However, in most cases, that’s not what students are getting. Better to take Mr. Hopen’s suggestion: invest the four years in a (blue collar) skill without drowning in debt. On the other hand, having college debt is highly educational, at least for those who can climb out of debtors’ prison.

October 12th, 2012 at 10:00 pm -

Jerry Parker said:

I went to junior college, undergraduate university, and grad school at a good time, back in the 1960s to the very beginning of the following decade. It grieves me what students must endure now. Back then, I really was able to focus on studies with only a few hours per week part time work to get by, and that without any debt to pay off after graduation. How much more liberated my life was due to that situation. Now, what`s the use of even trying? University should be a worthwhile experience, not a one-way ticket to life endette

dness!October 23rd, 2012 at 11:47 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!