20,000 Americans Lose Their Job Each day but we Still Bailout Wall Street and Banks: 4 Charts Highlighting this Historical Financial Crisis. GDP, Inflation, Industrial Production, and Excess Reserves.

- 4 Comment

Four banks and one credit institution failed on Friday. This is now becoming a common Friday ritual. On February 13 four banks were also taken over by the FDIC. Multiple bank failures on one day are now growing in size. Yet the FDIC is quickly blazing through their insurance fund and soon, the taxpayer is going to be paying the bill. The American taxpayer is already bailing out many of the larger financial institutions. These are the 19 banks included in the smoke and mirrors government stress test. What a surprise that all banks looked fine especially since the U.S. Treasury allowed banks to self report on many items. 150 people were involved in examining trillions and trillions of dollars in assets. It was the ultimate bread and circus event for the masses.

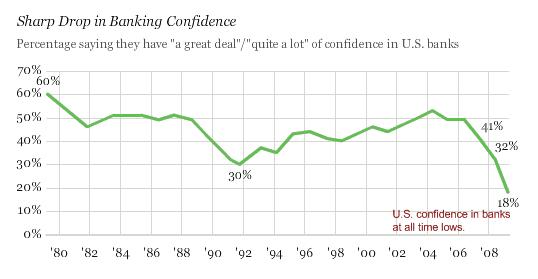

American households are quickly realizing that all the trillions committed to bailouts are essentially going to prop up the banking oligarchy that appears to be running the country. This is reflected in polling although the mainstream media hardly talks about this because they are hungry for advertising revenues which come from these sectors:

Source: Gallup

You would think that with only 18 percent of Americans having some confidence in their banking system that the media would be shedding a more critical eye on the banks. That is not case. And as I will show with the following four graphs, nearly 2 years into this financial crisis, the vast majority of Americans have not seen any noticeable help. A country with 24 million unemployed and underemployed citizens and we are asked to bailout the perpetrators of one of histories greatest debt bubbles.

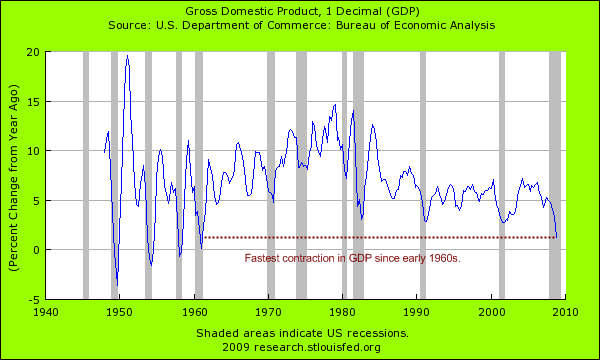

Gross Domestic Product

Gross domestic product is the aggregate figure of a nation’s economic vitality. Gross domestic product can be broken down as follows:

GDP = consumption + gross investment + government spending + (exports – imports)

A large part of our GDP comes from consumption (over two-thirds). If you stop and think about this, a country that spends more than it earns is bound to get into economic trouble eventually. And this balance completely shifted in the last 30 years. This credit bubble started 30 years ago and you will see that in a subsequent graph. The fairytale that was pushed onto the American public was that it was okay to consume more than it produced. In fact, not only was this okay but it was okay to consume and do this with debt. It is fascinating that we call this mess the credit bubble when in reality, it is a debt bubble. How often have you heard politicians, Wall Street, or the mainstream media call this the debt bubble? George Orwell would be proud.

Now the chart above is important. As you can see, on a year over year basis GDP is contracting at the fastest pace since the early 1960s. Most bailout recipients are betting (hoping) there will be a second half recovery because there is a growing populist anger against the banks and Wall Street and rightfully so.

And going back to our initial equation, consumption has been decreasing while government spending is attempting to make up for that fall in the equation. We are also exporting less and definitely importing less as measured by traffic at our busiest ports.

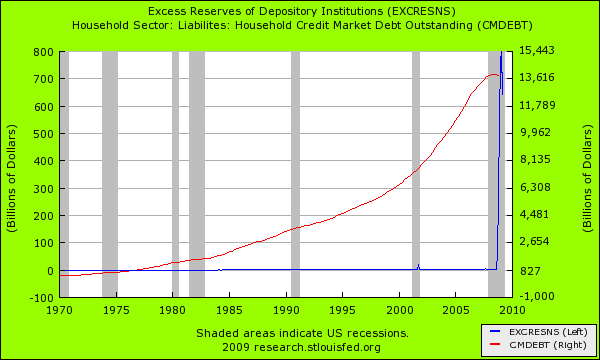

Household Debt and Excess Reserves

The above chart is rather telling. As you can see for yourself, household debt has been increasing by leaps and bounds for the past 30 years. It has gotten to the point where households have as much debt as our nation’s annual GDP. We have been spending our way to prosperity (or at least the illusion of it). I’ve also included in the chart part of the nice little gift we are handing out to banks. If you recall, the entire purpose of the bailout was to help American families have access to credit. That was the argument at least.

The chart above shows since the 1970s (and even before that) banks never carried any size of excess reserves. Why? They have been lending money out like maniacs for 40 years. All this money was handed out to consumers to spend and spend on things increasingly made abroad. We were told that manufacturing and making “things” was a waste of time and should be relegated to “third-world” countries. But recently, even banks don’t believe this.

The jump in excess reserves, money that was supposed to trickle down to American consumers is being hoarded to deal with problems on bank balance sheets. Ask yourself this, if banks were so healthy like the stress test told us, then why are they holding onto $700 billion in excess reserves? The answer of course is that they are not healthy and are looking out for themselves. The entire premise of bailing out the banks was false. The reason we bailed out the banks was to protect Wall Street and the banks. Period. It had nothing to do with protecting the American consumer who is already maxed out in debt as you can see from the chart above.

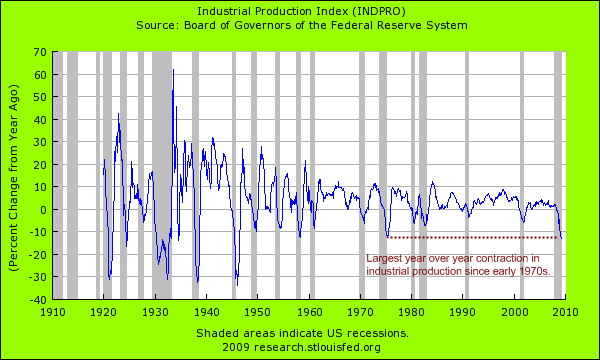

Industrial Production

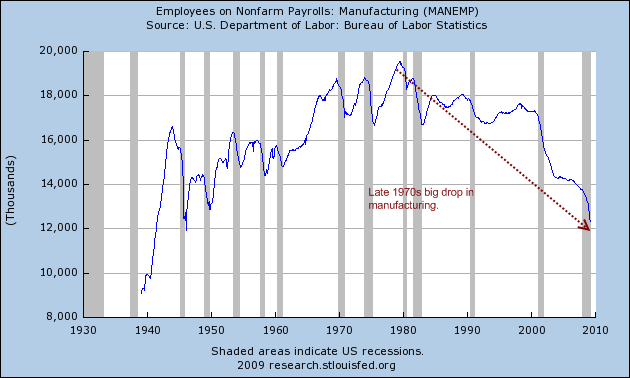

As the largest economy in the world, we still do produce a lot although as you can see from the above charts we have been consuming more and more. Industrial production is contracting at the fastest pace since the 1970s. The trouble with this is that in the 1970s, there was a legitimate reason for the decline in industrial production. That reason was we were shipping manufacturing jobs overseas:

So much of that fall in the 1970s had to do with this. But now, the contraction is largely due to the economic consequences of spending too much all fueled by debt. While Americans are now having to do more with less, banks (the select 19 at least) are having an unlimited line of credit to the U.S. government. Over the past few months, 20,000 Americans are losing their jobs per day. Many are realizing they have no safety net yet watch their tax dollars go to pay executive compensation and bailout banking giants who profited by creating the biggest debt bubble ever known.

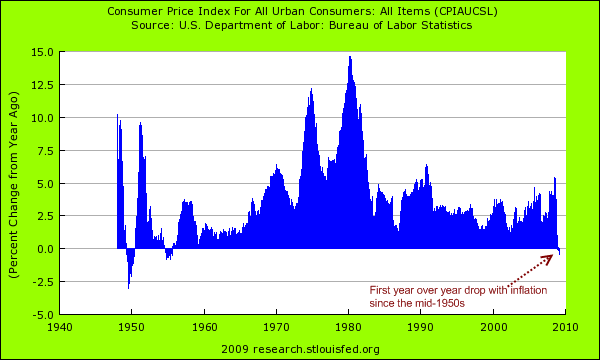

Inflation and Deflation

The menace of deflation is making the rounds. Cheaper homes. Automobiles that now cost thousands of dollars less because of falling demand. Cheaper fuel. Stagnant wages. All these are signs of deflation. As the chart above will show, this is the first time we have seen a year over year drop in the CPI since the mid-1950s. We keep hearing that eventually, we will see inflation because of all the bailouts. That would only be true if banks weren’t hoarding the money to prop each other up. The money would have to make it into the hands of consumers to cause any inflation. Yet that is not happening. Also, since the crisis started nearly $50 trillion in global wealth has evaporated. So even though we are committing approximately $13 trillion to bailout our economy (largely Wall Street and banks) there has been more money destruction than money creation. So that is why we have yet to see any signs of inflation.

The disturbing path we are following is largely what Japan did in bailing out their banking system. They now have some of the largest government debt burdens in relation to their GDP because of these bailouts. And what was the result nearly 20 years later? A stagnant economy with their stock markets still at lows and their real estate market still near the bottom. Yet some people made out like bandits. These were those tied to the largest banks. Is this sounding familiar?

The bottom line is once Americans realize in mass that they are largely bailing out banks to save banks, not the country, they will start asking more important questions. And the above polls reflect this change. Yet watching the mainstream media you would not know this. Hearing politicians talk you would think that we are all for committing trillions to save Wall Street. The vast majority of Americans do not support these actions.

Just read what was released by New York Attorney General Andrew Cuomo regarding Bank of America’s shotgun marriage to Merrill Lynch (the entire letter is worth a read):

“Despite the fact that Bank of America had determined that Merrill Lynch’s financial condition was so grave that it justified termination of the deal pursuant to the MAC clause, Bank of America did not publicly disclose Merrill Lynch’s devastating losses or the impact it would have on the merger. Nor did Bank of America disclose that it had been prepared to invoke the MAC clause and would have done so but for the intervention of the Treasury Department and the Federal Reserve.

Lewis testified that the question of disclosure was not up to him and that his decision not to disclose was based on direction from Paulson and Bernanke: “I was instructed that ‘We do not want a public disclosure.”

Basically Ken Lewis, CEO of Bank of America did not have the guts to do what was right and the U.S. Treasury and Federal Reserve basically sacrificed the American taxpayer to save another crony bank. Ken Lewis wanted to back out because Merrill Lynch had horrific losses which made the deal a bad one. Yet the U.S. Treasury through Paulson realized that the only way they were going to get political power to save Merrill Lynch was if they linked it up to a large institution most Americans are familiar with. Bank of America. Lewis greedy and hungry naively jumped into the deal to own a Wall Street broker powerhouse and got screwed. Once he found out the fact that the firm had lied (shocker) about losses it was too late.

Once BofA had Merrill, Paulson basically told Lewis if he backed out he would be replaced. You keep hearing systemic risk non-sense but Lehman Brothers failed and we managed. Yet how could they allow one of their own to fail? This folks is how Americans are bailing out banks and Wall Street while each day 20,000 additional Americans become unemployed.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

KingofthePaupers said:

“20,000 Americans Lose Their Job Each day but we Still Bailout Wall Street and Banks”

Jct: Too bad 20,000 Americans gain a Local Employment-Trading System time-based interest-free community account each day so no one would care about what they do with the government’s bank-created currency.

Best of all, when the local currency is pegged to the Time Standard of Money (how many dollars/hour child labor) Hours earned locally can be intertraded with other timebanks globally!

In 1999, I paid for 39/40 nights in Europe with an IOU for a night back in Canada worth 5 Hours.

U.N. Millennium Declaration UNILETS Resolution C6 to governments is for a time-based currency to restructure the global financial architecture.

See my banking systems engineering analysis at http://youtube.com/kingofthepaupers with an index of articles at http://johnturmel.com/kotp.htmApril 27th, 2009 at 5:33 am -

John Sanders said:

We have been spending our way to prosperity (or at least the illusion of it).

This line said it all for me. We keep ourselves blind to the banking oligarchy…

April 27th, 2009 at 6:21 am -

Laurence Robson said:

“American households are quickly realizing that all the trillions committed to bailouts are essentially going to prop up the banking oligarchy that appears to be running the country.” Go to “The Gig Is Up: Money, the Federal Reserve and You.†a video by Gary Fielder on U-tube for an explaination of how the world has fallen under the control of the few that own the Federal Reserve.

April 27th, 2009 at 11:41 am -

Dan H said:

We are not blind to it, we just need to raise a sink!

These malfeasant representatives and their Big Bank friends need to hear the wrath of the people. These Big Banks and Investment firms need to be dismantled in an orderly way. The CEO’s of these firms are still set up to make obscene personal fortunes while we get screwed! If they had any humility they would resign in disgrace.

But our government is in their pocket! Remember, only those voting against TARP should not have a prayer for reelection….if there will be an election…..maybe martial law or death by pandemic. The second amendment follows the first. Speak up now and defend yourself later!

The swine emergency is in Washington. There are too many pigs and we are SICK of them. America has Pork Flu, and it starts with to most toxic asset, Obama. We need to flush all these illiquid politicians now.

April 27th, 2009 at 5:35 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!