Is college worth a lifetime of debt? Student debt reaches critical tipping point at $1.2 trillion as annual price increases enter the moment of truth.

- 5 Comment

The cost of going to college has come into deep questioning. In our inflation addicted market, the answer to every question regarding affordability involves more debt. Can’t afford a home? How about taking on a massive mortgage with a small down payment. Can’t afford a car? How about a 0 percent 0 down loan. Having trouble financing your college education? How about the albatross of student debt. It is no coincidence that student debt has fully gone off the rails courtesy of the federal government and banks dishing out student loans as if they were candy at Halloween. Is college worth the debt? In some cases it is and it also depends on what career you enter. This distinction is rarely made in the media where the general advice is “go to college and earn more†assuming all disciplines and schools are created equal (they are not). What about the predatory for-profit colleges that have horrific placement rates and high costs? What about going to a high cost private school and majoring in something that has little demand in the market? Yes college, is not a de facto employment training ground but at this price tag you better ask what you are getting for with that heavy debt burden. If we look at the low wage labor force, we have a market producing lower paying jobs and yet we continue to pump out more and more college graduates with heavier debt loads. Few will argue against education being a good thing. Of course education is important. However simply getting a degree does not equal financial success, or even getting a job in your field of study. The majority of this nation is financially in the dark when it comes to managing their finances or even understanding the deep capture the financial sector has on government. For most, these questions never come up until they see the price tag of their college degree. Is college worth the price of debt?

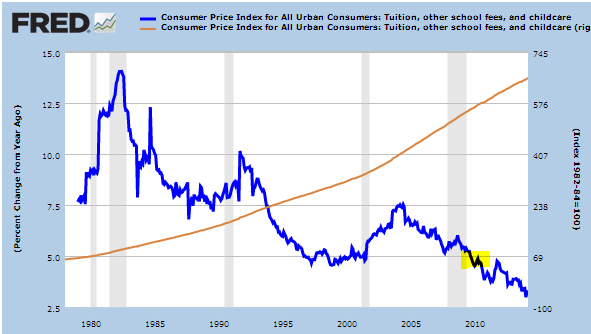

Tuition hitting maximum growth rate

The growth rate of tuition is simply a spectacle to behold. If this were a mutual fund, you could only hope that you had your funds in this account over the last generation. For the last decade, the cost of going to college has outpaced virtually every segment of our economy. The rate has been much higher than that of housing, healthcare, food, and energy. With incomes being stagnant after adjusting for inflation, many have to go into debt merely to afford their college education.

Take a look at tuition over the last generation:

The cost of going to college has gone up between 350 and 400 percent in the last generation. This depends on if we also look at for-profit costs, private schools, and public institutions. What you will notice in the chart above is that the annual increases are dropping much lower. We are reaching a tipping point on how much colleges can charge. Better put, we are reaching a saturation point as to how much debt students can take. Clearly most cannot afford the price without massive levels of debt.

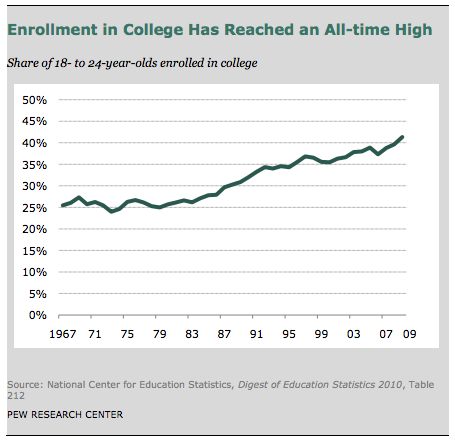

College to avoid workforce?

Never in the history of our country have we had so many people attending college:

From the 1960s to the early 1980s we had about 25 to 30 percent of our 18 to 24 year olds enrolled in college. All of this started expanding with the decimation of our blue collar workforce in place of our low wage economy. College in many cases is now the only road for most to enter into the shrinking middle class.

Yet this rise in enrollment doesn’t necessarily mean higher wages. Simply going to college is not going to get you a job that coincides with the level of debt you have taken on. In a previous generation, many went to affordable colleges and entered into a job market with good paying jobs. The cost of college was low and wages were high. Today, this paradigm is reversed. The market is flooded with low wage jobs yet the cost of going to college is high.

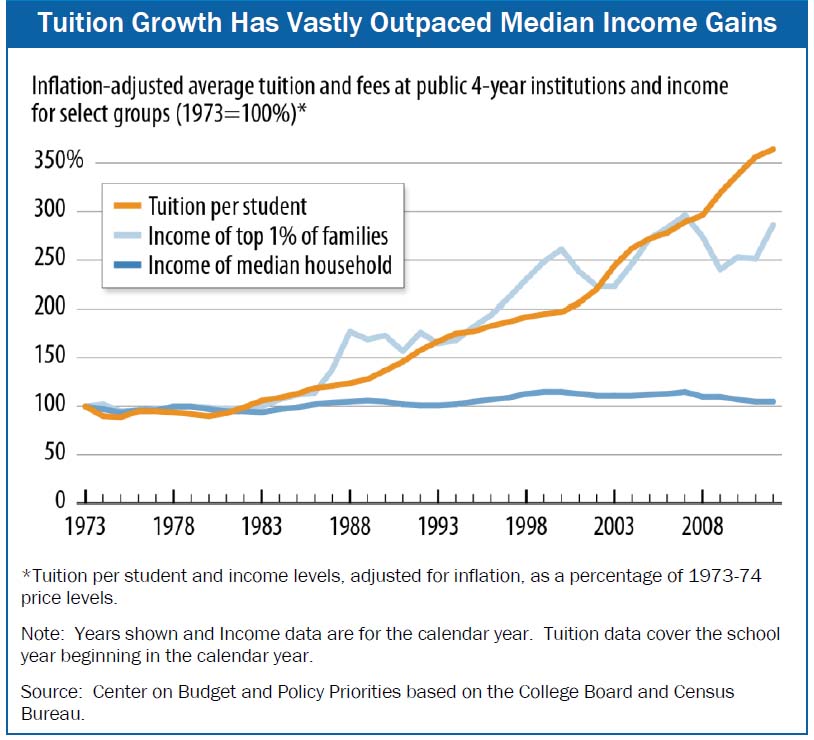

Income versus tuition

Household incomes have gone stagnant for nearly a generation. We all know that inequality is rising to a level last seen in the Gilded Age. To show how out of control college costs have become, take a look at incomes in comparison to tuition:

Even the top 1 percent of households that have captured most of the income gains in the last generation have a slower growth rate than that of college tuition. Of course, if you look at the above chart the regular working family is running the infamous Red Queen’s Race. Run faster and faster to stay in the same place.

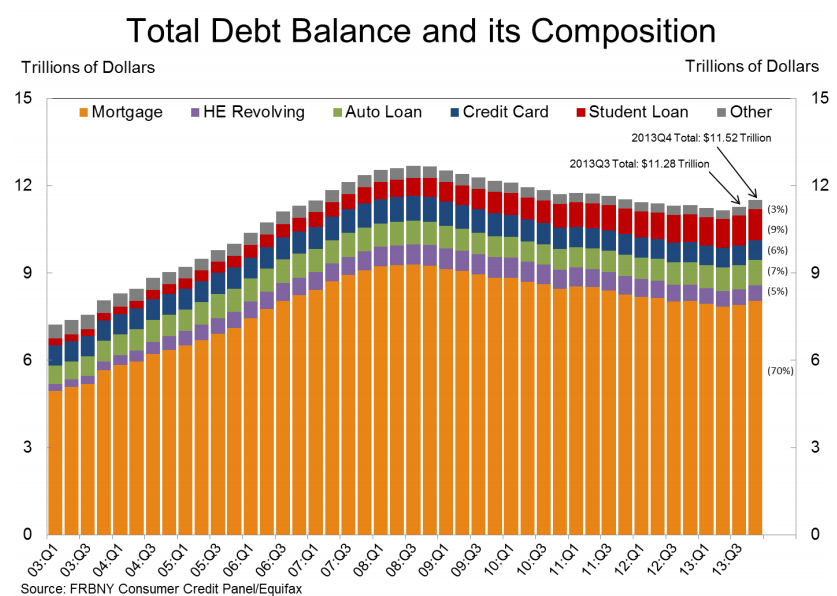

Largest non-housing debt sector

It is no surprise that student debt is now the largest consumer debt sector outside of mortgage debt:

Student debt as measured in the Fed’s report is at $1.08 trillion. More recent data suggests total student debt is well above $1.2 trillion. Keep in mind over the last decade this segment of debt has grown by nearly $1 trillion.

In other words, most of the student debt is on the backs of recent graduates. When we see all the reports showing that college graduates make more than non-graduates it is usually measuring data from a time when college costs were low and open jobs paid better. Will this paradigm make sense in a market where many jobs are paying $8 to $12 an hour and going to a private college costs $50,000 per year? The median household income in the US is $50,000 per year!

It is interesting to note that the amount of student debt is also impacting home buying. Many recent graduates are carrying student debt that mimics a mortgage. College is worth a certain amount of debt. This is such an important point and this isn’t meant to make debt seem like the nucleus of evil. However at a certain point you need to rethink how much debt a society can truly carry. You want young Americans to understand net present value and future value when most can’t even calculate a ROI. Yet here we are allowing a large portion of our young to go into massive debt, a burden that will be carried for a lifetime.

There is no easy solution here. A good college education is a very valuable thing. Yet when costs get this out of hand, you do have to run the numbers. You also have to be realistic with what jobs are paying well in this market. If you are getting a degree with lower wage prospects then you should opt for a state school and be cautious on the debt. We have over 4,000 universities in the US. How many actually produce a good value to students? We can certainly agree that most for-profit schools operate as cash cows for federal loans and basically exist to make the owners rich. Career placement is a joke at these schools. You would be better off watching videos off the Khan Academy online for free.

Yet we continue to have a system that is addicted to debt and blindly is going forward by saddling a generation of young Americans with debt. You have to wonder if there is a reason why no basic finance or investing class is required for high school graduates on the cusp of entering college? Then again, maybe this is how you get people to pay to $25,000 to $50,000 a year for a college education by going into massive debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Todd L said:

If we eliminated all federal funding of the for-profit universities (and other types of federal aid), we could send everyone to college for free at the state universities.

http://www.theatlantic.com/business/archive/2014/01/heres-exactly-how-much-the-government-would-have-to-spend-to-make-public-college-tuition-free/282803/The Obama Administration tried to rein in federal aid for the for-profits in 2011. Within a small amount of time, the for-profits cranked up their lobbying efforts and killed any legislation.

May 14th, 2014 at 8:15 pm -

SnowieGeorgie said:

( I meant to say “. . . WITHOUT arguing the debt load first . . . ” )

May 16th, 2014 at 7:42 pm -

SnowieGeorgie said:

This article is excellent — the critique of college, costs, benefits is spot on — and the idea of the debt being unmanageable as well . . . still, the whole question is not framed correctly to begin with.

–

I’ll keep this brief : Get a STEM degree, something that takes real effort and intellect, and YOU WILL GET A JOB !!! Whether you can manage the debt, well, that still remains an important question. But it is a question that can be solved. STEM MAJORS GET GOOD-PAYING JOBS !

–

http://en.wikipedia.org/wiki/STEM_fields

–

Or you can get a degree in 17th century French Literature. And then see if you can support your college debt, with income from the jobs you’ll get tutoring other French students, who want to follow you into massive debt.

–

http://theeconomiccollapseblog.com/archives/20-completely-ridiculous-college-courses-being-offered-at-u-s-universities

–

http://www.toptenz.net/to-10-useless-college-classes-degrees.php

–

Come on, the debt story is huge. REALLY HUGE. But if you do not cover the back story that most people who survive the AMERICAN K-12 fundamentally-flawed educational system, CANNOT GET A STEM DEGREE ( just look at the numbers ) then the question of debt load is really beside the point.

–

Well, I have rambled on too long. If students are pursuing degrees, for which no rational hope of good paying employment exists – – – then the debt-load is really beside the point.

–

SnowieGeorgie

–May 17th, 2014 at 6:40 am -

Kendall said:

Every high school should offer a seminar for parents and college-bound students that addresses questions of college selection and issues of debt. Decisions made at age 17 or 18 will impact the student for years to come, often with negative results. My niece and her husband have combined debt of $200,0000 for a PhD and MBA. They have a combined income of about $150,000, but will probably be paying that debt for the rest of their working lives. It has prevented them from buying appreciating assets, like a home, or stocks. For them, it has become the new mortgage–of their future.

Students and parents are in a rat race of chasing prestigious schools with which they can impress their friends and relatives, or in the often false hope of lucrative and high-profile careers. Financial and emotional resources are strained to gain admission to such schools. Some parents send their children to costly private high schools in hopes of increasing their chances of gaining admission to a prestigious college, or spend thousands for a year beyond high school to increase the odds. Many of these private schools in New England, for example, cost $40-$50,000 annually, i.e. more than many private colleges. For many, these hopes turn out to be illusory. Some fields, like law, for example, are glutted, many law schools having made false promises of employment prospects for which they are now being sued. Thousands of law graduates cannot find work, yet are saddled with debt burdens they will carry for the rest of their lives. Many find jobs which inadequately allow them to pay the inordinate amount of debt they have amassed. While average baccalaureate debt is now $33,000, average law school debt is now over $125,000.

There are several ways to avoid these traps:

1. Educate yourself while still in high school regarding the projected costs and the probable debt burden you are likely to incur and weigh this against potential income in the field in which you can realistically hope to gain employment.

2. Consider alternatives to the traditional four-year degree. Many associate degrees offer the training you need for a well-paying career, including many in medical and technical fields. By doing this, will not only cut your debt by half, but have a two-year start on paying it off.

3. Don’t be an intellectual or social snob by falling for the “prestigious” college trap. Impressing your friends and family will mean far less to you when you are burdened with high levels of debt after graduation. For most students, a solid education can be gained at a community or state college, provided you make the effort. Besides, the PhD glut has increased the likelihood that your professor at the local community college will have earned a degree from a one of those “prestigious†universities (if that is important to you). A “prestigious” degree may help you gain your first job, but, after that, it becomes largely irrelevant to future advancement which is largely dependent on job performance.

4. Consider low-cost alternatives to liberal arts courses. For example, one four-credit course at Brown University costs approximately $5,500.00 (with annual tuition of $44,000). Substitute one of the Great Courses on DVD for $189.00 (on sale) with some of the top professors in the field. Savings: $5,300.00. What you lose in direct classroom interaction, you gain in the form of the ability to re-play the lectures at will and avoid the kind of indoctrination and political correctness you may experience at some schools and with some professors. These kinds of things are screened out of the Great Courses presentations, which are aimed more at adults than college-age students. If it is your intention to earn a four-year degree, and you must earn college credits for liberal arts courses, consider testing out of them where appropriate with what you can learn through the Great Courses, or other forms of auto-didacticism (self-learning).

5. Take every opportunity to earn college credits while still in high school. Some states and communities are moving more decidedly in this direction, in order to shrink the time in college, and to reduce attendant costs.

6. Frankly, most students are not of an intellectual bent and need the discipline of direct instruction, professorial demands, examinations, etc. But the self-motivated learner can master the same material, particularly in the liberal arts and social science fields, without these demands/pressures. Course syllabi are freely available on most college websites which you can download. Or ask a professor for a reading list. One area where you would be advised to seek direct instruction is in writing. Hire a local writing tutor to help you polish your writing style. You will have to conduct some soul-searching before you pursue this course, however. For example, are you an intellectually curious person? Do you read independently apart from course demands? We know from the Jenkins survey, for example, that one-third of high school graduates never read another book for the rest of their lives, that 42 percent of college graduates never read another book after college, and that 80 percent of U.S. families did not buy or read a book last year (2003). If you fall into one of these categories, a four-year college or university may not be for you. Go to a trade school and enter the workforce as soon as possible.

7. Finally, consider Albert Einstein’s dictum about the most powerful force in the universe: compound interest. Starting a savings/investment program as early as possible will reap tremendous benefits down the road. If your can pick investments that, for example, earn 10% annually, your portfolio will double every 7.2 years. Thus, by starting your investment program at age 22 instead of age 30, you will gain an additional doubling when you reach retirement age. At that end, the doubling may be worth several hundred thousand dollars. Example, a portfolio of $25,000 at age 25 earning 10% per annum will yield $1.6 million at age 65. The last $800,000 will be earned between ages 58 and 65. By age 72, it will total $3.2 million. Start at age 30, you investment will be worth only $800,000.

Those who go for advance degrees usually forego these financial opportunities because they have spent those years accumulating debt rather than assets. With the right kind of financial discipline, a savvy plumber who saves can become far wealthier than many lawyers, or PhDs, burdened with debt, and a shorter time frame in which investments can grow. And there’s nothing to stop that intellectually plumber from buying a lecture series in Ancient History from Great Courses and learning with the best of them. My father had an eighth grade education and worked 42 years in a steel mill. His chief pleasure was reading books on history, philosophy and religion, and his Letters to the Editor were superior to what most college graduates are capable of writing today.

June 4th, 2014 at 11:16 pm -

JB said:

My first year of college (1966-67) totaled (tuition, room & board, the whole works) less than $1,000. At the time, my father was earning about $20,000, making that college year represent a bit less than 5% of the family’s gross income. Currently, a year at UW-Madison at that same 5% proportion would require that he earn over $500,000, an amount absolutely not relevant to the actual income of a K-12 public education administrator…

July 12th, 2015 at 11:37 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!