The three legged fiscal cliff: US middle and working class already facing their own fiscal cliff – 2 million Americans will lose unemployment insurance by January 1 and the debt ceiling limit being hit on December 31.

- 0 Comments

To most of America the fiscal cliff is some sort of fiscal enigma. Most realize that we are spending more than we are bringing in and also that taxes are part of our system. What most have a harder time understanding is the machine of the Fed and how it selects winners and losers at will by digitally bailing out an entire banking industry. Yet here we are counting down the days to a new year and we are no closer to solving this fiscal problem. Congress is full of millionaires and come what may with the negotiations, they will remain this way. This fiscal cliff is largely a reflection of our three legged fiscal problems; a shrinking middle class with a growing population in poverty, a ritualistic process of hiking up debt ceilings, and the taxes versus spending equation.

Leg one:Â Middle class and poor

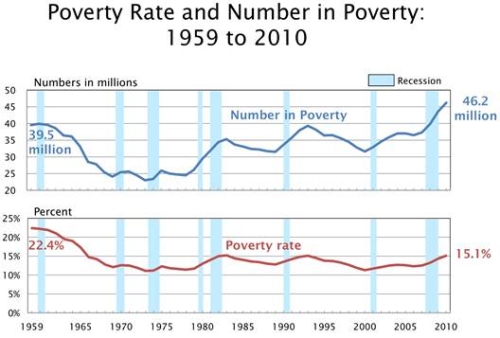

We have a large number of Americans living in poverty:

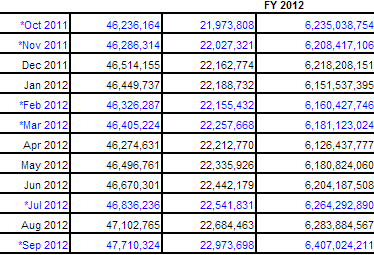

This is the highest percentage of our population living in poverty in over a generation. Today, we now have over 47 million Americans receiving food stamps:

In the last year alone, a year of recovery at least on paper, we added close to one million Americans to the food stamp program. Many Americans are no longer one paycheck away from poverty. They are now one food stamp payment away from being in hunger, in the most prosperous nation in the world. The growth in these numbers is largely coming from many people falling off the middle class track. The middle is getting smaller while both ends get more and more crowded.

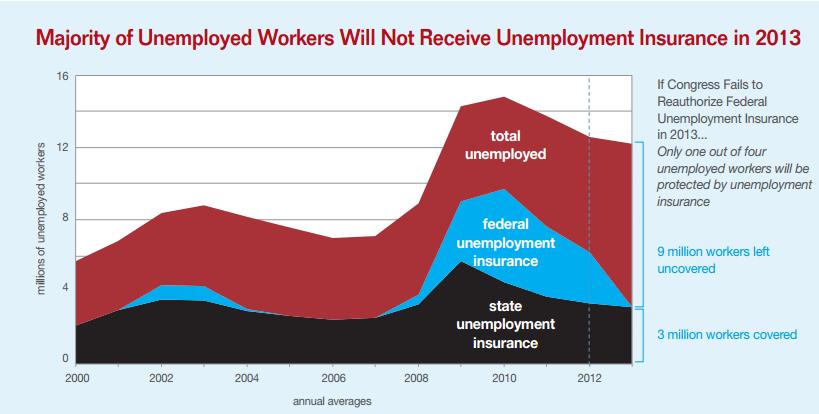

To the point of the fiscal cliff, if nothing is resolved between now and January 1 then 2 million Americans are set to see their unemployment insurance expire:

We still have 12 million Americans receiving unemployment insurance. Compare this to the 7 million or so in 2006 at a more baseline level. Many Americans are already living in a fiscal cliff version of reality and they are simply struggling to get by with government support. How would this nation look with those 47 million Americans on food stamps without that access or these 12 million unemployed not receiving any support? It would look like the US did during the Great Depression. In other words, we are one food stamp payment and one insurance payment away from reliving the darkest time in our nation’s financial history. You would think that would create some urgency in Congress but here we are, days away from the new year and no solid reform on the table.

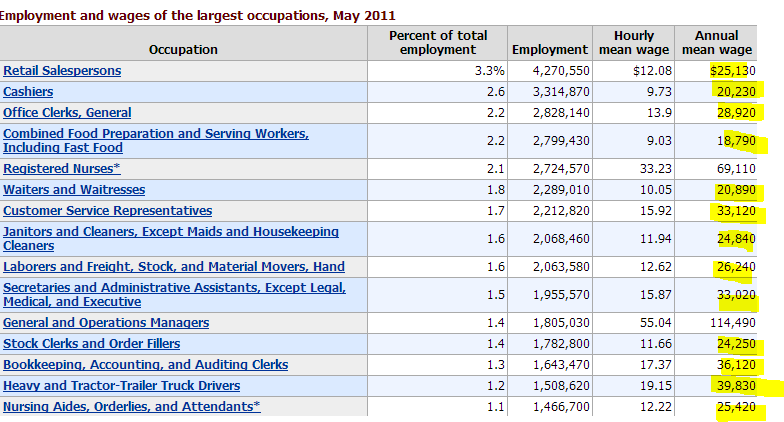

Little by little we have become a low wage service oriented society. All we need to do is look at the top job sectors in this country by the number of people employed:

In the past, you would expect to see higher paying manufacturing jobs near the top but that is no longer the case. Our two top occupations are retail salespersons and cashiers. You can see that it is becoming increasingly hard to get by with blue collar work at least given the cost of goods in the country. Many view the only option out as a college education but be suspicious about the levels of debt you take on and the quality of the school you attend (a selection of your career is also important).

This leads us to the next leg of the fiscal cliff, the debt ceiling.

Leg two:Â Debt Ceiling

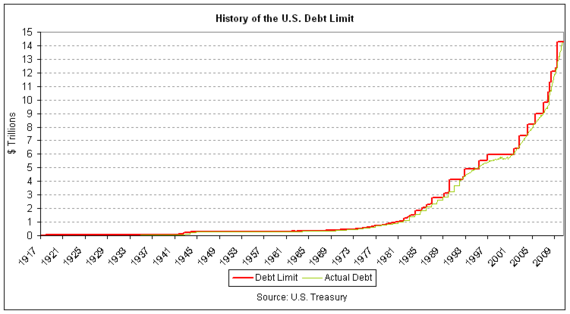

Raising the debt limit is nothing new:

What is new, however is that our debt ceiling is now larger than our annual GDP. Like crossing the Rubicon this is a critical new stage. We will hit the $16.4 trillion limit on December 31. All of this is happening at the end of the year and there is now a sense of urgency although all of this was expected. Politically not much is happening because there is very little to gain from taking away the punchbowl. This is why the Fed never stepped in to stop the housing bubble from going way overboard. Yet this is the reason for their existence to monitor the deep financial health of our banking system and not allow for this kind of graft to occur. In many ways they have failed to live up to this mission. If Congress does pass anything expect it to be watered down to the point of uselessness. We’ll be back dealing with these issues one year from now.

Leg three:Â Taxes and spending

If we reach no fiscal cliff solution, taxes will go up on virtually everyone:

Source:Â CNN Money

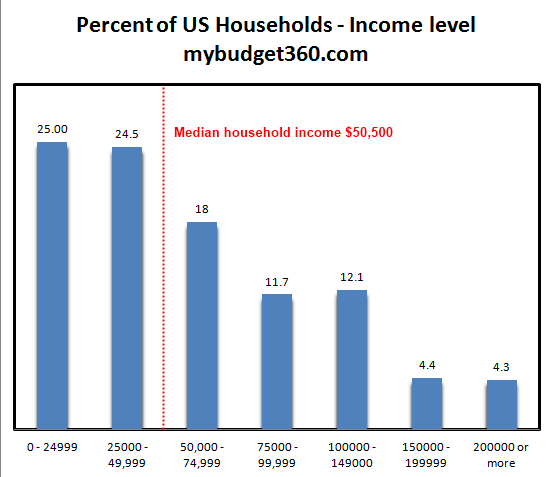

These are sizeable gains given how tepid the economic recovery has been. For many poor Americans they are already cash strapped as is. The problem of course is we have been spending way beyond our means for well over a decade and the bill is coming due (since the 1970s we have been deficit spending). Who will pay? No one really wants to pay. So we are left with a Congress that represents the wealthy and has lost touch with the public making this:

Only 4 percent of US families make more than $200,000 a year (2 percent make more than $250,000). Yet this is all we hear about in the media as if this was the standard to go by. Again, the real picture is rarely reported. The three legged stool is now very wobbly and is tilting over. Unfortunately there are only hard choices ahead. In our current global economy low wages are being pushed on countries like Greece and Spain for example. The more they resist, the longer their unemployment rate will stay high. This is the unfortunate reality. How can you compete with people making $1 a day? Is this the future for our low skilled workforce? The ideal scenario would have been for the overall economy to grow and revenues would have increased because of this. That is not the case. The fiscal cliff is very real but something that has been coming down the pipeline for many decades.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!