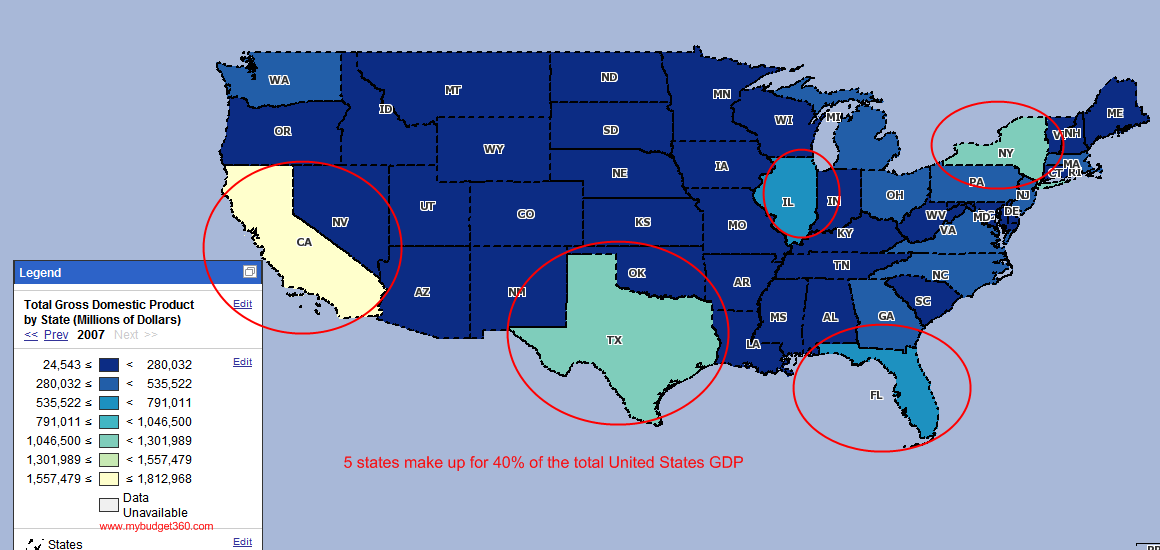

Gross Domestic Product: 40 Percent of the United States GDP comes from 5 States; California, Texas, New York, Florida, and Illinois.

- 5 Comment

Our gross domestic product contracted in the third quarter of 2008 and is contracting in the forth quarter. There is very little doubt surrounding that. The National Bureau of Economic Research put the start date of our current recession at December of 2007. Simply looking at the employment patterns and trends it appears that this recession will be the worst on record since World War II. Another reason why this recession will be so painful is that 40 percent of our national GDP comes from 5 states, many that are in painful contractions.

The United States received 40 percent of its GDP from California, Texas, New York, Florida, and Illinois. California accounts for over 12 percent of national GDP and currently has a state unemployment rate of 8.2%, the third highest in the nation. If we dig deep and look at the California housing market, it is abysmal and shows no signs of bouncing back. This weekend 60 Minutes talked about the Alt-A and option ARM crisis that will hit us in the upcoming years. The 2 states with the largest concentration of these loans are California and Florida.

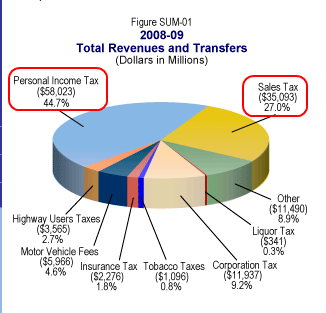

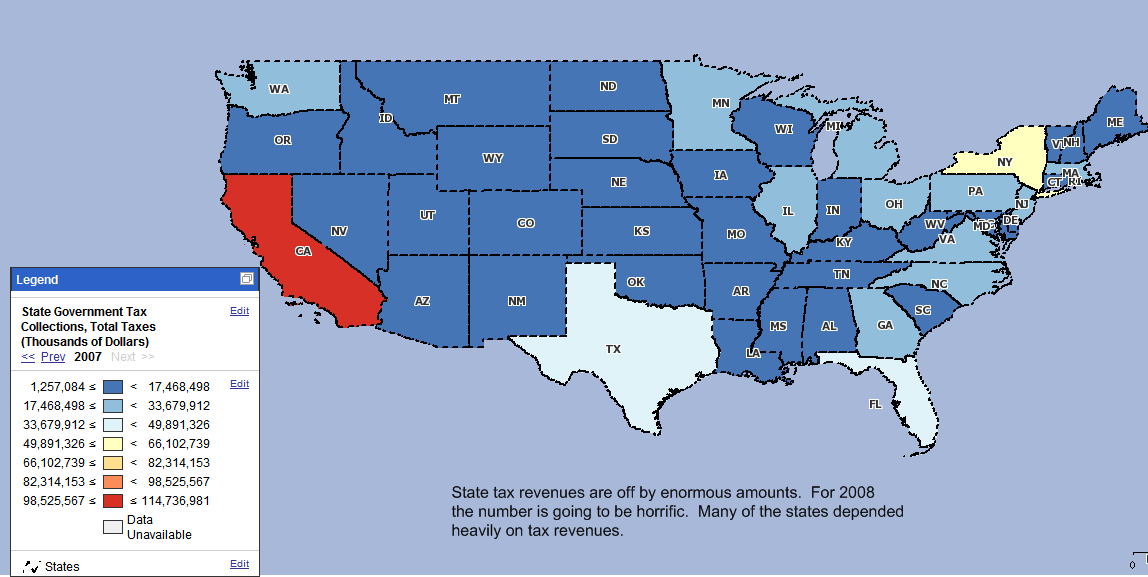

First, let us take a look at each individual state GDP on a map:

*Click for sharper image

Looking at the map this way, it is easy to see why a few states can cause such widespread pain. Even states that avoided the housing bubble to a large extent are feeling the repercussions of what is going on. If we are to include the top 10 states in terms of GDP, we will then account for 55% of total U.S. GDP. That is why arguments that look at states as silos only hold true if the recession is minor or isolated. This is no isolated recession. The tentacles of the problems run deep and are very widespread. Let us now shift and look at unemployment on this map:

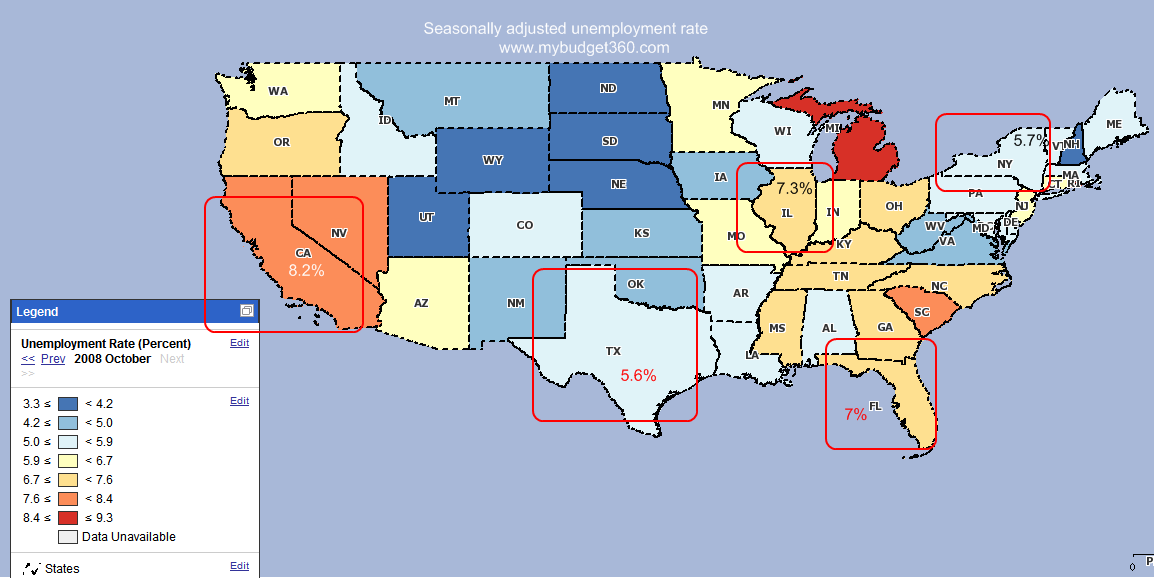

3 out of the top 5 GDP states have unemployment rates above the 6.7% national rate. California, the biggest GDP contributor has an unemployment rate of 8.2%. The only state of the five that seems stable is Texas. New York is quickly jumping higher because of the job losses now hitting New York City this year. The number should change rapidly. Ironically, the only stable state Texas is the single state of the five that had very little influence this decade with the housing bubble. States like California and Florida which depended more on the housing market are feeling even deeper pain.

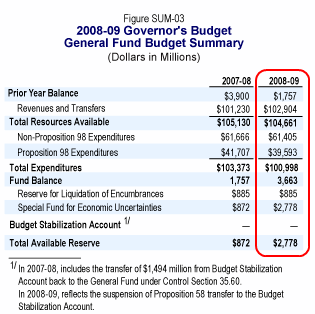

The next map should give you an idea why many of these states are on the verge of bankruptcy:

This above graph tells the story. A state like California is so enormously dependent on taxes. All you need to do is take a look at California and you’ll understand the magnitude of the problem:

A state like California with over $100 billion in expenses does not have the flexibility to adjust a budget on the fly.  In fact, these budgets are planned nearly a year in advance.  This budget was planned before the California housing market fell over 40% statewide. That is another reason why severe market volatility is not good for the health of the economy because it throws a wrench into future planning. But the more troubling sign is look at the 2 largest revenue sources for California. The personal income tax makes up 44.7% of revenue and sales tax makes up 27%. Together, these 2 volatile areas make up 71.7% of revenue to the state. Well, if you refer to the above employment chart you can begin to see how this all starts to tie in. With less employment, the personal income tax revenues will fall. With that, you will also see the sales tax decrease because in recessionary times, people spend less and certainly those with no employment will not be buying.

In conclusion, the fact that many of these states still have profound problems in their housing markets almost assures us that this will be no minor recession. 5 states account for 40 percent of the U.S. GDP and some of the states have the worst housing bubbles which are still deflating signals to us that U.S. GDP is set to decline for the near future.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Bill M said:

Solution to this is for government to shrink, downsize like all the other companies are doing.

December 16th, 2008 at 9:08 am -

shane said:

I live in Illinois. I am unemployed. I am looking for a job, and it aint easy at all. EVERY job that posts a position in the paper, has an extraordinary ammount of applicants. This is just basic jobs. 30-40 applicants for 1 open position. I live in the Champaign county area, population of around 200,000. I was guaging the workpool based on what is happening around here. This article stated the unemployment at 7% for illinois, I would think it is double digits easy.

Add to that, governmental corruption….I always believed that the numbers for the “good times” was over inflated. I am an earner in the $25K-$30K annually. I had KNOWN that employment in Illinois was a good barometer for the employment situation in America. Having 5 states making up 40% of the GDP is disconcerting, knowing Illinois is one of those 5 is not good at all based on our employment situation.

December 23rd, 2008 at 1:13 pm -

mark said:

Time for Texas to secede while they are ahead of the game…

January 14th, 2009 at 1:52 pm -

dman said:

it’s interesting to see that the states bearing the burden for the rest of the Republic are having unemployment issues. glad i live in Texas, where the unemployment rate is at least stable.

July 14th, 2009 at 11:49 am -

J said:

Texas cannont secede from the US, it violates too many treaties.

September 11th, 2011 at 7:55 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!