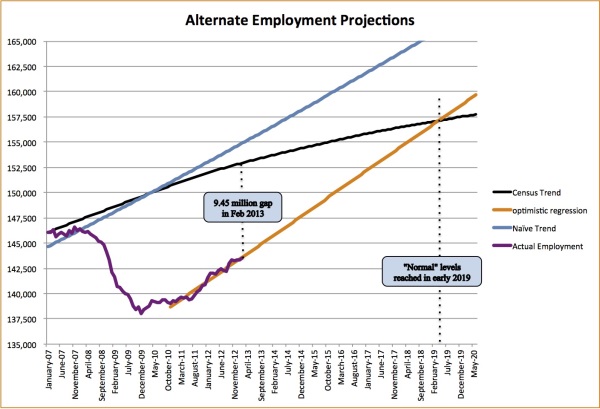

The long slog ahead for jobs: We are 9.45 million jobs short of where we should be and are unlikely to reach normal levels of employment before 2019.

- 1 Comment

Employment is the most important indicator of a healthy economy. The recession has left a deep scar and has set us back into a lost decade. Primarily for this reason many Americans are having a hard time jumping on this recovery that officially will reach a four year anniversary this summer. The long term projections for employment have picked up but the recession hit at such a profound level that it jolted the trajectory of job growth for an entire decade. Estimates put a return to “normal†employment deep into 2019 assuming no other major events happen. That is unlikely given our massive debt and the major demographic shifts that we are now experiencing. Over 47 million Americans now rely on monthly food stamps simply to get by. Our economy still faces major challenges but the most important one is putting Americans to work and having an economy that creates enough jobs for population growth.

The long-term trend for jobs

An interesting chart was sent my way highlighting the employment gap:

Source:Â WLU.edu

The above chart shows how deep this recession was. The growth since 2009 has moved us out of the trough but you can see that we are also chasing normal population growth. At the current rate of job growth it will take us until 2019 to get back on track. Keep in mind that much of this job stability has come at tremendous costs. The Federal Reserve now carries a balance sheet with over $3 trillion. The Fed has also pushed interest rates into the zero percent range and our national debt is now well over $16 trillion. Also, the Fed bailed out the entire financial sector and much of the support is still there. It is unclear if all these measures will sustain the above trajectory.

Keep in mind that the orange line above is the optimistic trend. This is assuming everything moves nicely for the next six years. Six years ago in 2007 we were still in a big euphoric period. We were starting to see cracks in the financial system but the stock markets had yet to make their first peak run. Of course late in the year, the global economy went unglued and we had our first national housing bubble burst in spectacular fashion. For many years all we heard was “unprecedented†or “unforeseen†so it is very likely that we will have some unlikely events in the next few years especially with many countries reaching peak debt situations.

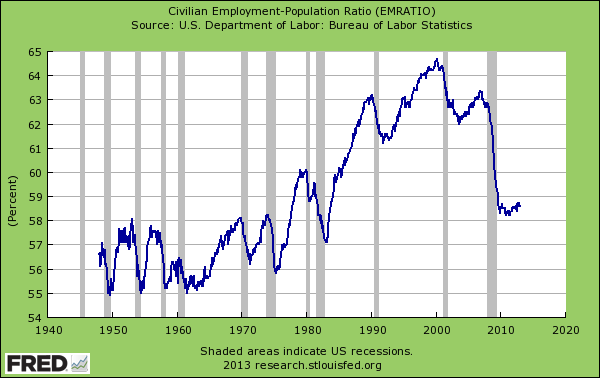

Unemployment is a major problem in many countries. Look at Spain, Greece, Italy, Ireland, or even here in the US. In the US, our unemployment rate looks much better than it really is because we are seeing a large portion of our population opt out of the workforce:

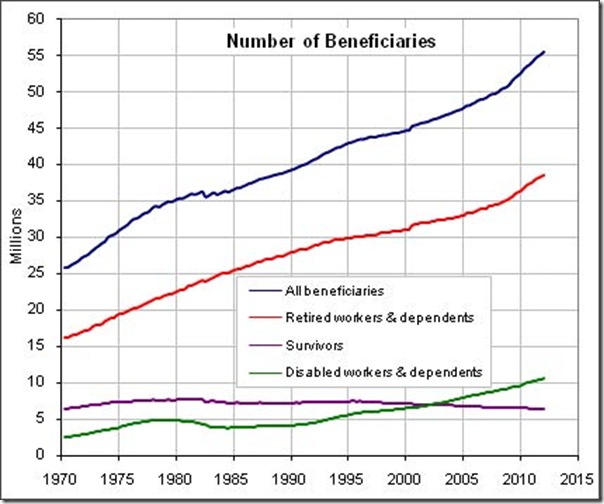

This ratio highlights the major changes in our workforce and we are heading back to levels last seen in the early 1980s. The number of those retiring on Social Security as you would expect is rising:

This would be an ideal time to have a large tax paying base to support all the baby boomers entering retirement. Yet the opposite is happening. We have sluggish growth and many younger workers are facing tough times as they enter the job market.

And Social Security is only one part since Medicare spending is going to be an even bigger issue given the massive costs in healthcare. All of this ties into the economy and employment because it is very likely that taxes will be going up as we move forward to pay for all of these commitments we have made. Debt has to be repaid. Although it is laughable to think we will ever repay that $16 trillion in debt. The ultimate goal for the Fed is to inflate our way out of this mess and the temptation is too high to print when times get tough. So each little hiccup is going to require much more spending and much more dramatic action. That is why the action in Cyprus regarding banks essentially taxing savings to use for bailouts is so startling. In the end, you money is being inflated away.

Given all these short-term challenges, it is very optimistic to think that we will hit the trend line by 2019. Give us a few months with 400,000 or 500,000 jobs added and then we can readjust the above trend line.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Paul Verchinski said:

Cyprus has already occurred here by stealth. About $500 billion in foregone interest is being extracted from savers if interest rates were where they should be and not at zero. The Federal Reserve just protects the banks. It is not part of the Federal Government and sets its own rules unilaterally. We retirees made this country great over the past four decades. Now that Social Security has to be paid to retirees, it is too much. The Greenspan Commission “fixed” Social Security in the 1980’s. It was unfixed by W spending all of it and then borrowing in the 2000’s (recall the infamous lockbox?). Sad to say, another “fix” will be undone by future Congress spending.

March 18th, 2013 at 6:22 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!