The New Normal for the American Dream – 3 Cornerstones: Low wage jobs, high levels of college debt, and a retirement that consists of working until you pass away.

- 8 Comment

There seems to be a growing acceptance that the American Dream is hardly as accessible as it once was. Low wage jobs, higher education tuition pushing many into untenable levels of debt, and a new vision of retirement all seem to connect into one new theme. The new theme revolves on a much more challenging road in achieving the American Dream. The majority of working Americans have no sizable portion of stock wealth. In fact, close to 90 percent of stock wealth is in the hands of 10 percent of the population. That is why in spite of the rise of the stock market by 200 percent since 2009, many Americans remain gloomy when it comes to the economy. They are merely spectators to the high flying charts of Wall Street. Most Americans do know that their wages are stagnant, that food costs are jumping, healthcare is anything but affordable, and the road to a college education is paved with high levels of debt. Even the cornerstone of the American Dream which is a home, is very expensive thanks to hot money flowing into the sector and crowding out regular home buyers and pushing the home ownership rate to multi-decade lows. What is the New Normal when it comes to the American Dream?

New Normal #1 – Low Wage Jobs

The first obvious change is the prevalence of low wage jobs across the country. Coastal regions in California and New York have a hard time understanding what is going on in a large part of the country. Wages are being slashed and benefits are being reduced. This means more of the burden is shifted directly onto the employee to meet the needs of basic living.

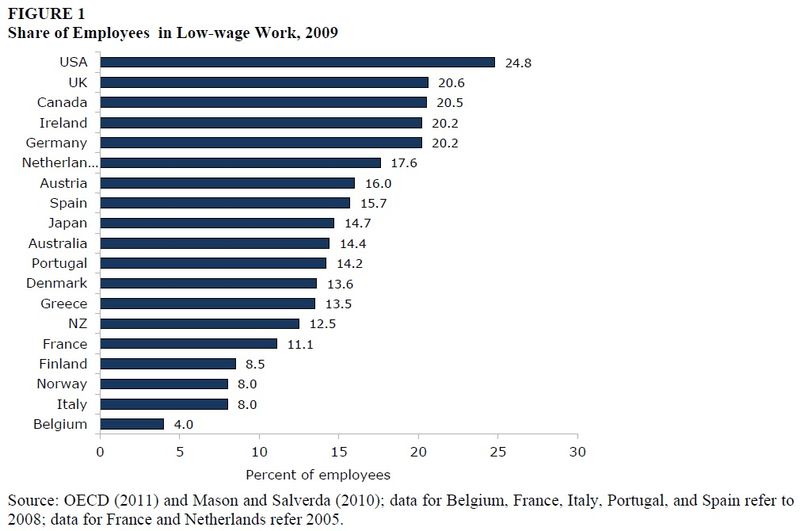

The US has a very high portion of its population working in what one would consider lower paid work (under $10 per hour):

1 out of 4 Americans with a job (many have no employment and are part of the massive non-labor force) work in jobs that pay $10 or less per hour. I think this comic sums it up for many younger workers:

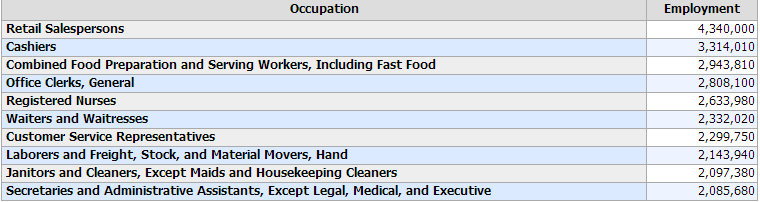

It isn’t all that surprising when you look at the top occupations in the country in terms of raw number of employees:

All of these jobs beside registered nurses pay paltry wages, barely enough to be considered part of the working poor. And nursing by the way requires a formal education and this is becoming more expensive. Where the costs are low, say a community college, you have waiting lists that are nearly comical. We will examine this trend in the next section.

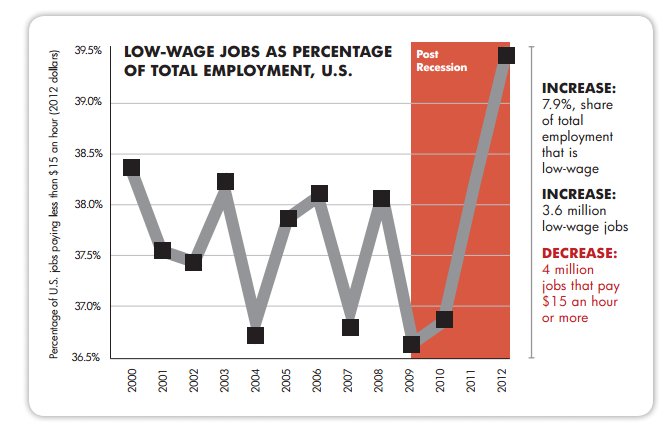

Many of the new jobs after the recession ended in 2009 have come in the form of low wage jobs:

Roughly 40 percent of jobs added came in the form of low wage work. The math is simple here: good paying jobs gone, lower wage jobs added.

New Normal #2 – A Very Expensive Education

Many of the jobs that do provide an entry into the middle class require a college degree: engineers, doctors, accountants, tech workers, and healthcare usually require formal education. This education path has become incredibly expensive over the last decade. Since many Americans cannot afford to pay this outright, they simply go into debt:

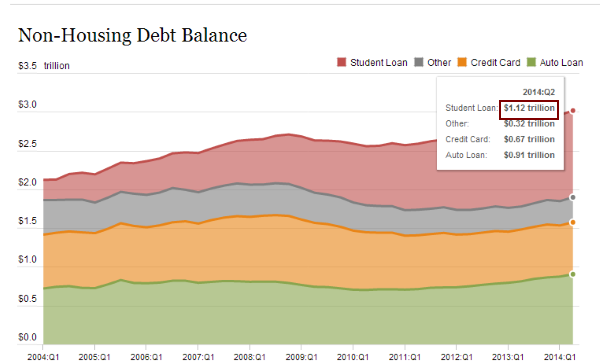

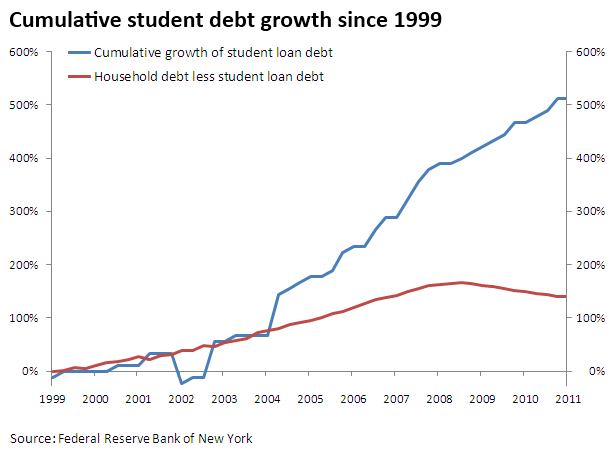

In the span of roughly one decade we went from $200 billion of student debt to over $1.2 trillion in student debt (the Fed chart lags the actual amount). The rate of growth is incredible:

There is no other debt sector that has grown as fast as student debt, including what happened in the housing bubble. What is troubling is that older Americans are not very well prepared for retirement while younger workers have a tougher hill to climb as well.

New Normal #3 – No Retirement

1 out of 3 Americans have no savings at all. Half of the country is living paycheck to paycheck. Most retirees are going to rely on Social Security as their primary source of income in retirement. This is why for most of the country, the new retirement is no retirement. Many will be working until their hearts stop beating.

This goes back to real wealth distribution in this country. Many Americans simply do not have enough saved up to sustain their lives in retirement. Obviously if you can, you should save starting early and be wise with your money. Debt is a necessary part of our daily lives but be cautious about taking on too much debt when it comes to student debt, housing debt, and auto debt. You have many taking on subprime auto loans – this is a horrible decision.

The American Dream usually meant a good paying job, a home you could afford, and being able to send your kids to college for a reasonable price. All of these cornerstones are being challenged under the New Normal when it comes to the American Dream.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

8 Comments on this post

Trackbacks

-

VVV said:

This is the fundamental change to America promised in 2008. Hope and change indeed.

September 24th, 2014 at 4:13 pm -

laura m. said:

All the above proves this country is down the crapper never to rise again short of a miracle. We are ten years into retirement drawing a 401k which we put the max into. Army pension also and SS, some stk with dividends. Banks pay nothing on CD’s and fortunately we are out of debt unlike many our age. We were never that materialistic and rarely change out furniture or appliances like many do. I know folks our age still working because they can’t quit spending or helping slacker grown children. Younger folks: I run into young 20 something gals who say will not have kids ever. This is smart thinking as the country is trashed with a zero future. Kids are for the well to do, not us working folks.

September 24th, 2014 at 4:27 pm -

Lucio said:

Last week I started living in the back of my truck. I will have to live here for at least a month until I can save enough money to get an apartment. Then again maybe not. The prices are too high. I have to eat or get shelter. One or the other, the job I have requires that I drive my own pick up truck. I will have to live in it. I am a single man, it appears that I will most likely work until I die. I have been at it for more than 30 years, I have nothing to show for it! The government has taken everything from me.

September 24th, 2014 at 5:52 pm -

It is I only said:

USA ! USA ! USA ! USA ! USA ! USA ! USA ! USA ! USA !

Dohh………..September 24th, 2014 at 10:03 pm -

Mick McNulty said:

Like the late, great comedian George Carlin said, they call it the American Dream because you’ve got to be asleep to believe it.

September 25th, 2014 at 4:59 am -

Lorungee said:

The story mentions home ownership. Yes, the average cost of a home is 200,000 dollars. The attitude is that IF you can pay the typical mortgage off in full, you are then free and easy. Sorry, not so. You will ALWAYS have the typical costs of upkeep and repair. But that’s not all. Even more onerous are all those property TAXES that comes with home ownership. And this is one payment you HAVE to make, or you will lose that home due to tax foreclosure. So in the end…you really own nothing. You are just a glorified renter. So, instead of paying that 1000 to 2000 dollar a month rent payment…every month… you only do that once a year to the tax man of your city and county, if your house is payed off. IF you are a retiree with the average pension, you might be able to slide through without too much difficulty. If you are a retiree with the average pension with some debt to service…then this is a burden because anything you may be able to set aside in the bank, you will have to disgorge it to the friendly tax authorities of your city and county. Or else.

September 25th, 2014 at 5:01 am -

James Hammers said:

It would be interesting to know, or at least speculate, how the poor economy could become a robust one if, instead of low wages being the norm because wages are an expense which must be kept low, a living wage were the norm because wages are an investment in a strong consumer base. People work more to spend what they make in meeting first of all the needs for at least a basic life and then, as wages warrent it, in meeting the needs and wants beyond a basic style of living. With at least the means of providing a basic style of living,1) customers would not only no longer be as dependent upon Fedreal and State progrms as now and releasing those funds for other federal and state budget considerations, more of them would be paying taxes rather then drawing funds from them; 2) the corporate world would find their investments in research and adversising paying off at a higher rate because of a much stronger customer base being able to buy the goods and services produced by the corporate world; 3) becauseof increase demand in goods and services, new jobs were created. Just imagine what it would mean for the economy if the customer base who could afford to buy at least the basic needs in food, clothing, housing, medical care, etc.wiothout having to resort to federal or state programs would see a 49% increase in buying power. That would go a long, long way toward not only restoring the economy but seeing and increase.

September 25th, 2014 at 7:36 am -

Ame said:

Anyone wanna bet derivatives chock full of student loan debt? Check out The Economic Collapse Blog’s article on how five U.S. Banks have more than 40 TRILLION dollars in exposure to derivatives. Too big to fail?

This student loan bubble is shimmering with sheerness.

September 25th, 2014 at 6:17 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â