The thriving cronyism of the stock market: 81 percent of stock market wealth held in the hands by 10 percent of the population. Housing also being snatched from middle class families.

- 2 Comment

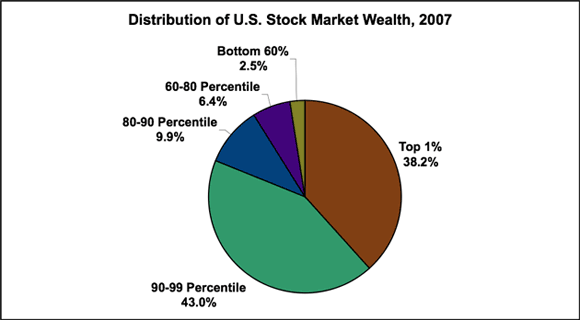

Most Americans are confronting a system where the deck is stacked against their interests. Most Americans saw the true colors of the system during the Great Recession panic when government joined forces with Wall Street to essentially fire the middle class with explicit and hidden bailouts. There is unfortunately a large amount of cronyism embedded in the current system. Most Americans have very little in stock market wealth. Over 81 percent of stock wealth is held by the top 10 percent of the population.  This is why for most, retirement is largely one pipe dream. Yet the problem of the bailouts was the split of corporate welfare for connected institutions and austerity measures for the rest of the country. Wall Street is driven by profits and companies were able to slash their way into profitability while boosting earnings and using large safety nets and golden parachutes for those at the top. Banks that should have failed survived thanks to the too big to fail mantra. This is why, after a record stock market run since 2009 many Americans still view the economy as performing poorly. For them it is. You also have Wall Street invading the one asset where Americans used as a forced savings account, housing. Even in this one asset class Americans are being pushed out.

Not buying the stock market rally

The data is clear in that very few Americans own any substantial amount in stock wealth. 81 percent of stock wealth is held with 10 percent of the population. The recent rally was driven by slashing wages, cutting benefits, leveraging bailout funds, and ultimately using the recession as proof that labor was fully disposable. The days of corporatism are gone and now the reality of company loyalty is long gone. The government and lobbyists will assist those at the top but for most middle class Americans, the game is over.

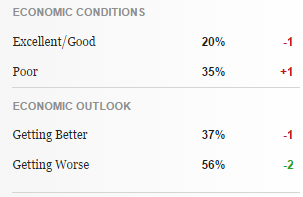

This is how you can have a stock market peak with such poor sentiment:

Source:Â Gallup

56 percent of Americans think the economic outlook is getting worse. 35 percent think economic conditions are poor. Does that sound like a population benefitting from the stock market revival? Most are merely looking at a party from outside and wondering what is going on as their paychecks are devoured dollar by dollar by inflation.

It is rather clear why a stock rally has done very little to impress Americans:

Keep in mind that stock wealth has soared for many of the financial institutions that were on the verge of collapsing and for good reason. These were the financial masters that led us into this market full of cronyism and quick opportunism. It wasn’t about being the best and most profitable. It was making sure you were able to twist the law enough where even an absolute failure of market economics did not interfere with your gains. Many Americans would remember that during the buffet line of bailouts, the government was “unable†to slash pay packages for those at the top because of arbitrary rules. Yet they were able to create new rules to give these people bailout funds. Funny how that worked.

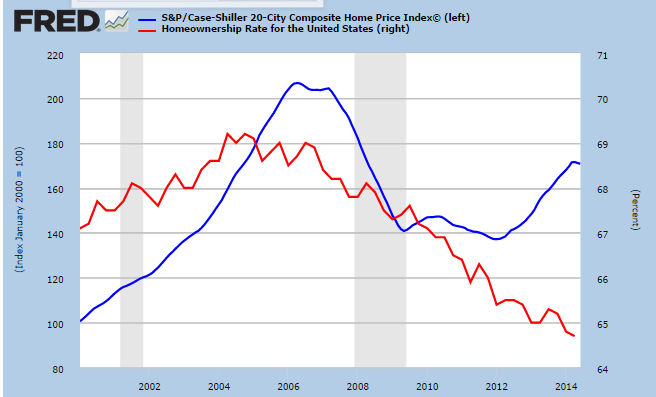

While the stock market and in particular financial institutions have become one giant casino, Americans were able to depend on housing as their one true source for their net worth. But even here, as the chase for profits heats up, large money investors have jumped into the housing market. Because of this you have seen home prices go up while the actual ownership rate has fallen:

This is the end result of a market dominated by cronyism and given the template of the bailouts, many of these firms feel comfortable that the government will be there to support their adventures yet again when the inevitable correction hits. Cronyism has little to do with free market economics. It has to do with leveraging connections, many times bought with money, to setup a safety net no matter what transpires. In many cases what is arranged is largely not beneficial to the public. This is clear as the middle class is steadily shrinking and more Americans are left to the fierce world of free market austerity while those at the top are essentially riding a complex system of corporate welfare. The survey data shows a clear divide between the stock market and what people are seeing and feeling in the real economy. Fire 1,000 to increase earnings by one penny for the sake of a few that even hold stocks. If everything goes bust, you can rely on the government for the golden parachute. For the public, you can rely on luck, family, and charity.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

laura m. said:

Many are invested in the S&P 500, etc. in their 401k’s like we were until we retired. That covers way more than 10% people investing. Many retirees invest in individual stks for div. income as banks aren’t paying anything.

September 12th, 2014 at 10:13 am -

Ame said:

Those who owe nothing on a home mortgage, a.k.a. actually owing a home, still have to worry about taxes. In the Great Depression, many lost homes and farms purely for a lack of funds to pay tax. I know. My great-grandfather purchased such a home for the taxes owed; a fraction of what it was worth before the GD came and whisked away so many dreams.

So, if you’re one of those who don’t owe the bank for your home, stock up now on cash/gold/assets in which to pay those taxes for when the economy takes the REAL DIVE so you don’t lose your “retirement” nest egg.

September 12th, 2014 at 4:32 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!