S&L Crisis Part Two: Are We Repeating Mistakes from the S&L Crisis? Accounting Sleight of Hand and Mortgage Fraud.

- 0 Comments

During the savings and loan crisis (S&L crisis) of the 1980s and 1990s a total of 745 thrifts failed. If we look at the history of the crisis, total losses were largely saddled to the American taxpayer. It is estimated that some $160.1 billion was the total bill for the crisis with roughly $124.6 billion being paid by the American taxpayer. This crisis accounted for a large part of the early 1990s budget deficits. With our current economic crisis and having 26,000,000 Americans unemployed or underemployed, we are repeating many of the mistakes from that time.

The S&L crisis has many similarities to our current crisis. A banking system welcoming deregulation decided to capitalize on the massive real estate boom. S&Ls made far too many risky loans that were backed by unqualified assets. Estimates had US mortgage loans at $700 billion in 1976 which more than doubled by 1980 to $1.5 trillion. Another major issue that occurred was banks and thrifts were loading up on specific junk bonds from places like Drexel, Burnham and Lambert which again were labeled much too high. This is similar to our rating agencies missing the boat on this crisis labeling CDOs and other toxic assets with AAA ratings.

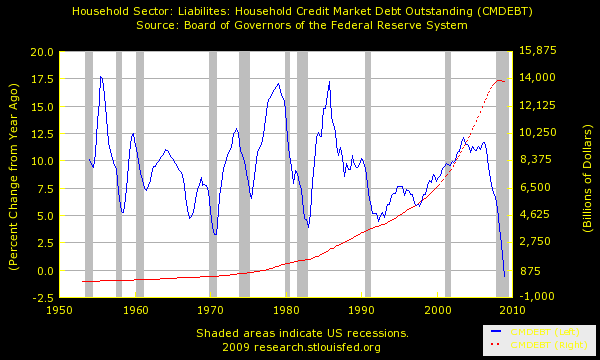

If you look at household debt which is largely made up by mortgage debt, it exploded near the time of the massive S&L bubble:

There is a fascinating passage in The Creature from Jekyll Island by G. Edward Griffin that examines the S&L debacle:

“Long before this point, the real estate market had begun to contract, and many mortgages exceeded the actual price fro which the property could be sold. Furthermore, market interest rates had risen far above the rates that were locked into most of the S&L loans and that decreased the value of those mortgages. The true value of a $50,000 mortgage that is paying 7% interest is only half of a $50,000 mortgage that is earning 14%. So the protectors of the public devised a scheme whereby the S&Ls were allowed to value their assets according to the original loan value rather than their true market value. That helped, but much more was still needed.”

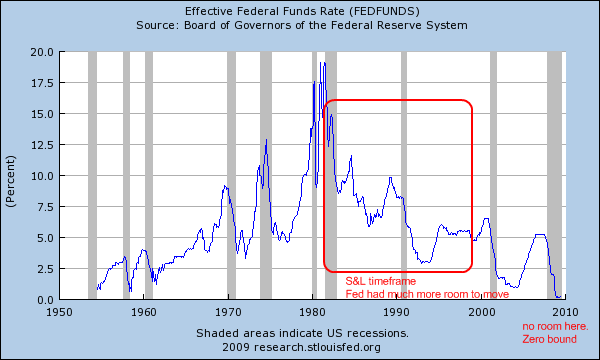

Indeed the Federal Reserve and U.S. Treasury were manipulating the mortgage markets back in the S&L crisis as well. The same trickery is being used today with the freezing of mark-to-market and allowing banks to label mortgages at face value even though if they were to place a real market price, they would be much lower. One difference with the S&L crisis however is we do not have any buffer to the downside. That is, mortgage rates are already at an all time low. If you look at when the crisis hit for the S&Ls, you would see that that Fed funds rate was nowhere near where we are now:

During the 1980s, the Fed funds rate never dropped below 5%. In fact, it didn’t drop below 7.5% until the middle of the decade. That is now not the case. For the large part of this decade, the Fed funds rate hovered around or below the 2.5% mark and is now virtually zero (.21 percent mark).

The massive manipulation of the housing market has gone on now for 30 years and this may be the final stop. Mr. Griffin continues:

“The next step was to create bookkeeping assets out of thin air. This was accomplished by authorizing the S&Ls to place a monetary value on community “good will”! With the mere stroke of a pen, the referees created $2.5 billion in such assets, and the players continued the game.”

And this is the stage with our mark-to-market suspension. And now with the advent of the public-private investment program the plan is to gather up the toxic mortgages and push them onto the taxpayer so the losses will never be fully recognized. In fact, just like our massive budget deficits and these toxic products, they will try to never realize the losses and we will never pay those deficits back:

“The FSLIC permits the S&L, which sold the mortgage to take the loss over a 40-year period. Most companies selling an asset at a loss must take the loss immediately: only S&Ls can engage in this patent fraud. Two failing S&Ls could conceivably sell their loweset-yielding mortgage to one another, and both would raise their net worth! This dishonest accounting in the banking system is approved by the highest authorities.”

And so it is again. The book was written in 1994 but even at the time, some thought the RTC were talking about turning a profit but little do they mention how devastating the dollar tanked and how inflation eroded those so-called gains. In the end as we now know over 15 years later, the taxpayer still paid much of the bill. Unless we start putting an end to this, we will be talking in 2024 what gigantic rip off the current bailouts are. It is the S&L redux on a scale 100 times bigger.

“Once the pattern of government intervention had been established, there began a long, unbroken series of federal rules and regulations that were the source of windfall profits for managers, appraisers, brokers, developers, and builders. They also weakened the industry by encouraging unsound business practices and high-risk investments.

When these ventures failed, and when the value of real estate began to drop, many S&Ls became insolvent. The federal insurance fund was soon depleted, and the government was confronted with its own promise to bail out these companies but not having any money to do so.

The response of the regulators was to create accounting gimmicks whereby insolvent thrifts could be made to appear solvent and, thus, continue in business. This postponed the inevitable and made matters considerably worse. The failed S&Ls continued to lose billions of dollars each month and added greatly to the ultimate cost of the bailout, all of which would eventually have to be the common man out of taxes and inflation. The ultimate cost is estimated at over one trillion dollars.

Congress appears to be unable to act and is strangely silent. This is understandable. Many representatives and senators are the beneficiaries of generous donations from the S&Ls. But perhaps the main reason is that Congress, itself, is the main culprit in this crime. In either case, the politicians would like to talk about something else.

In the larger view, the S&L industry is a cartel within a cartel. The fiasco could never have happened without the cartel called the Federal Reserve System standing by to create the vast amounts of bailout money pledged by Congress.”

And so the story is repeated. The Federal Reserve and U.S Treasury are once again protecting their banking industries and letting the taxpayer bail them out under the guise of protecting the common person. In the early part of the 1900s, some 20,000 banks existed and smaller banks were cutting into the profits of the Wall Street east coast elite banks. They were also eating into market share. The Federal Reserve was largely devised to suck business away from small local bankers to concentrate power into a few banks that would never be allowed to fail since they had the taxpayer’s wallet at hand. How long will this go on?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!