Arrested development courtesy of student debt: How student debt is putting the lives of many young Americans on hold.

- 3 Comment

Many young Americans view student debt as a necessary evil in pursuing higher education. The level of student debt now reaches Himalayan levels as many are falling behind on keeping up with payments. A double-edged sword has befallen young Americans. First, the path to middle class jobs no longer runs through a blue collar industry (as I’m sure Detroit would testify to this fact). Second, the required skills for middle class jobs (i.e., healthcare, engineering, sciences, etc) run through formal education for better or worse. The ability to pull oneself out of one class and have mobility to another is at the core of the American Dream. Yet this dream is now becoming a debt filled labyrinth. Recent college graduates are finding it difficult to buy a home or other typical life journeys when many already come out with mortgage like debt thanks to the student loans they carry. Are we seeing a sort of economic arrested development for younger Americans courtesy of the maze of student debt?

Student debt problems

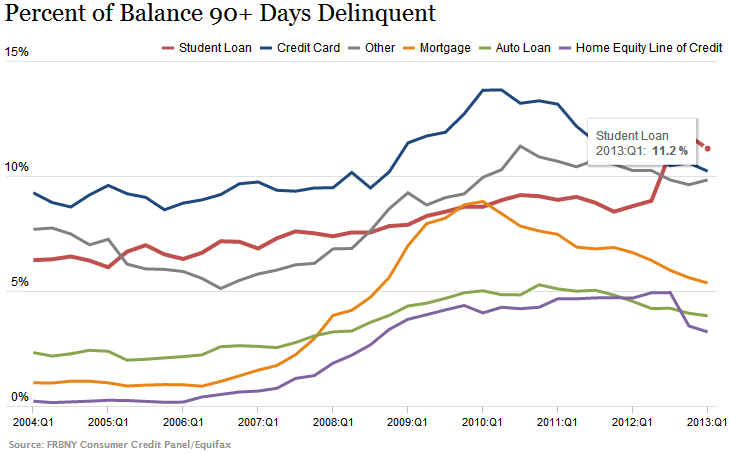

The latest data from the Federal Reserve has student debt showing up as the most delinquent of all household debt:

11.2 percent of all student debt is 90+ days late which is startling given that many students are given six months after they graduate to begin paying back their debt. This is also the first time that student debt shows up as the most delinquent of all household debt.

An impact the size of a meteor crater is felt when too much debt is taken on.

“(CBS) I’m $90,000 in debt from student loans,†says his mom, Kaitlin Smith.

That enormous bill impacts nearly every decision the young couple makes.

“It definitely holds you back. It’s hard to move forward in your life and career knowing you have this debt,†says Kaitlin.

At 26-years-old, the preschool teacher is saddled with a $457 loan payment every month. Over the next two years that monthly bill will double. Kaitlin and her husband, Eric, would love to use that money to save for a house.â€

$90,000 in student debt is nothing to sneeze at. In many areas of Florida this could be the amount of a mortgage. So it is no surprise that people feel constrained and hampered by the student debt they carry. The above case is playing out in many households. How many young Americans are delaying buying a home or even saving for retirement because of the financial challenges they are facing, in many cases brought on by burdensome student debt?

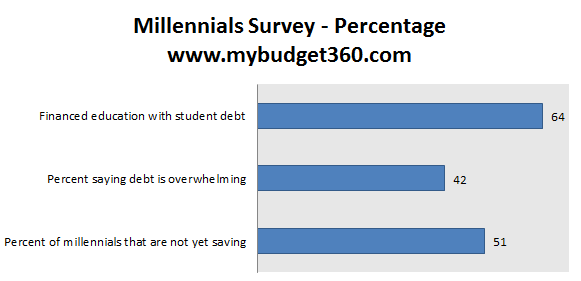

A recent survey gives us an idea:

Source:Â Wells Fargo

51 percent of Millennials have yet to save for retirement. What you’ll see from the survey as well is that 64 percent financed their education with student debt.

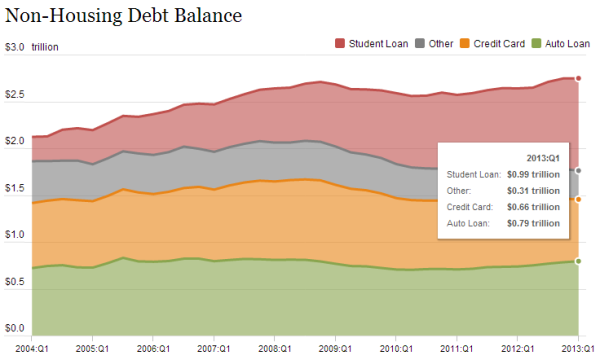

So it should come as no surprise that of non-housing related debt, the largest debt sector in the US is now student debt:

Over $1 trillion in student debt is outstanding. And as we have shown in an earlier chart, many Americans are having a tougher time paying their student debt. How can this be when the stock market is reaching new peaks? Could it be that much of the recent gains are not filtering down to younger Americans? The figures seem to show a stunted financial development for many young Americans.

The amount of student debt filtering through the financial pipes of our system is definitely causing some clogs along the way. What we are seeing is income being diverted to service old student debt versus buying new items. And surveys are showing some real challenges:

“According to a recent survey conducted for the American Institute of CPAs by Harris Interactive, 41% are not contributing to their retirement, 40% have put off buying a car, 29% can’t buy a house, and 15% have decided to delay marriage.â€

The problems of student debt are boiling up to the top yet the media fails to address them. Similar to other recent financial challenges, by the time you hear about it on the regular press the walls of the student debt dam would have already busted wide open.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

ScottinTexas said:

This could be a sign that values of these students is poor, but also that Hi Ed has become overly expensive and a scam on students for the benefit of the Administration, Faculty, and Staff who are lining their pockets and getting wealthy off a profession that is supposed to be for the love of the student. Ha, right!

July 22nd, 2013 at 8:48 am -

Rick said:

They took out the loans and now they are crying about it. I have no sympathy for someone who spent 30-50 on a liberal arts degree in something that they will never find work in. These kiddies voted for obama in droves, now they can live with the economy they voted for.

July 22nd, 2013 at 6:42 pm -

Chris said:

The pay for the elites should be reduced to lower the cost for consumers including students. The CEOs of publicly listed companies should be drastically reduced as they are only employees. They should be paid enough to have a comfortable life but not to the extend of making them rich. The more elites are paid, the more they will work against the interest of the general public and to some extent, they work against the interest of their own company. Being paid too much may encourage corruption as he/she is afraid of losing such a highly paid job.

July 27th, 2013 at 8:18 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!