Detroit files for bankruptcy while S&P 500 hits record high: The bifurcation of the American economy and the long decline of the American manufacturing base.

- 3 Comment

The US is full of economic dichotomies. The DOW hit a peak when food stamp usage peaked. Incomes for the wealthiest are reaching record levels while the median household income has fallen back to levels last seen in the mid-1990s. And today, the once manufacturing powerhouse of Detroit is filing for bankruptcy at the exact same time that the S&P 500 reaches a record. The symbolism cannot go unnoticed especially as a reflection of our so-called recovery. We have offshored our blue collar workforce and this has helped a small group at the top at the expense of the working and middle class. The low wage capitalism race is full speed ahead and Detroit is merely another bystander in the way. How is it that we can offer lifeline after lifeline to banking giants while Detroit is left to contract and suffer a painful demise? This isn’t to say that something should be done but it offers a bifurcated method of how we are operating today. The financial giants are bailed out with corporate food stamps while the working class is left to fight the global forces of low wages on their own. What else does the bankruptcy of Detroit tell us?

An American manufacturing icon files for bankruptcy

Sadly, I saw this posted on Twitter:

While this headline scrolled across my screen this other headline hit as well:

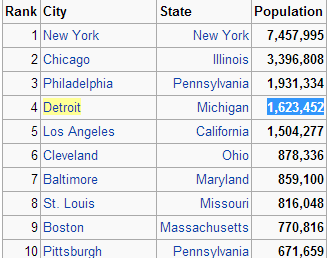

Detroit during the 1940s was the fourth largest city in the United States and a manufacturing behemoth:

As of the 2010 Census Detroit now ranks number 18 of the most populated cities in the United States. Detroit was a powerhouse when it came to manufacturing and the US auto industry. These have taken painful hits in the last generation. Even with the stock markets rebounding Detroit has not been able to recover.

A city in decline

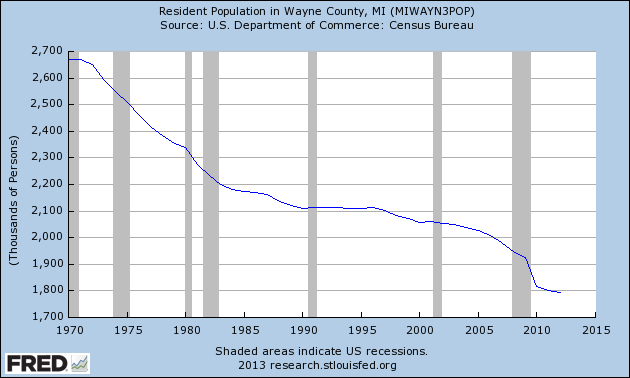

The trend is rather obvious:

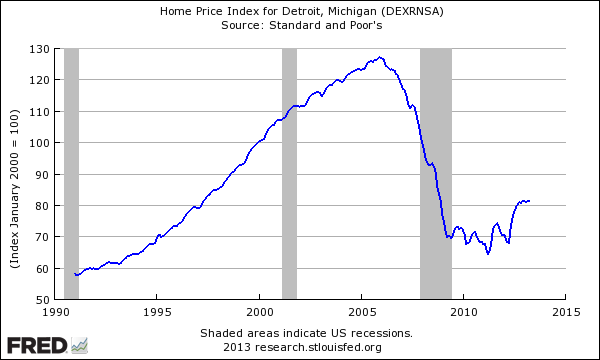

Not only is Detroit’s population on a continual downward slope but the entire surrounding area is falling dramatically as well. This brings up many challenges for the area. Business and politics have run the city into the ground. Yet bad business and politics occurs in many other cities and they do not face the wicked challenges being experienced by Detroit. Some are pointing to home prices rising as some sort of big turnaround but this is more a reflection of funny math thanks to the Fed’s QE easy money bazooka:

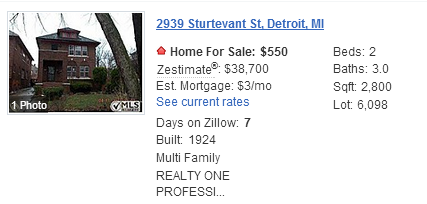

The rebound is largely being driven by cheap money. Even with this easy money market, you can find some incredibly cheap real estate in Detroit (no shock):

Looking for a home for $500 bucks? There you go. You’ll need to figure out where you will work and also the massive maintenance, management, and upkeep for something like this.  When prices reach these kinds of low levels, an areas is simply falling apart. Livability is important. Work is important. Community is important. It is a very telling sign that as the S&P 500 hits a peak a stalwart of American manufacturing is filing for bankruptcy.

Detroit has been on a long-term contraction. At what point does it reach bottom? The city is redesigning itself at a snail’s pace for a smaller population but we are talking about the 4th largest city in the US in the 1940s. This isn’t some little boomtown that sprouted up around a California goldmine. Peak food stamps and peak S&P 500 aligned with a giant US city filing for bankruptcy. A good summary of the current recovery.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

freebird said:

It was the best of times, it was the worst of times. Here’s something roughly the same size (not as old, but not detached) in a “little boomtown that sprouted up around a California goldmine” [aka silicon valley].

http://www.financialsamurai.com/2013/07/14/how-strong-is-the-real-estate-marketJuly 18th, 2013 at 3:35 pm -

Russ Smith, Caliornia said:

Hi!, Patrons Of My Bydget 360 Et Al:

This story reminds me of the story: “The Knome Of Zuric Returns”, featuring the Knome of Zurich; Hans, Otto, Alexander, Exabiar, Bear. When Hans landed in America decades ago he exclaimed in no uncertain terms: “Wee!, paper money!” Hans already knew of Americans’ addiction to paper “I Owe U Nothings” and disregard for gold. Thus Americans have pumped up the price of shares etc.; while neglecting Article 1; Section 10 of their Constitution calling for gold and silver coins only as tteir money in lieu of all debts. Now, Americans of all stripes are trying to use all maner of schemes to get and reamin high on paper money over which Daniel Webster once exclaimed: “Of all the contrivances ever designed for cheating the laboring classes of mankind, none has been more successful than that which deludes them with issues of fiat, irredeemable, I Owe U Nothing, paper money!” Through such delusions the whole US is in economic decline with DETROIT being one of its’ cannaries in my opinion. Hans must be smiling now in his grave, along with Karl Marx, watching how that America has abrogated itself to capitulations to the mere mirage of prosperty represented by its’ TROJAN HORSE; The Federal Reserve Banking System with its’ fractional reserve creating trillions of US fiat $’s of debt owed by all US citizens for which the interest on such debt has NEVER been created to repay the FED entirely. This means the trillions of $’s in US debt can NEVER be repaid to the FED which in my thinking then means that the FED is stuck in QE Infinity forever; unless steps are taken to return to OUR Constitutional governance including Article 1; Section 10 but probably hell will freeze over before that action needed is even recognized. Therefore we should all welcome the fact that DETROIT is coming to be a town near and dear to each one of US someday? Insead of abandoning the FED mandated by Article 1; Section 10 of OUR US Constitution, the FED is looked up to for its’ false promise leadership which sooner or ater must fail in my opinion.

RUSS SMITH, CA. (One Of Our Broke Fiat Money States)

resmith@wcisp.comJuly 18th, 2013 at 7:09 pm -

jkru said:

As a non union retiree of the City those were my thoughts exactly. Bernanke buys $45Billion toxic trash per “month” keeping Wall St alive and the only real beneficiaries are the Elites which hold so much stocks they can live a luxurious life off dividends alone. The purpose of QE (supposedly) is to help the economy. The Feds could bail out Detroit of it’s $2Billion debt which would actually save SE Michigan’s economy. but that makes too much sense. The corruption is on its way out and it would be a great start.

July 18th, 2013 at 7:16 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!