Top 10 States make up 55 Percent of United States GDP. 6 of the top 10 States have Unemployment Rates over 10 Percent.

- 2 Comment

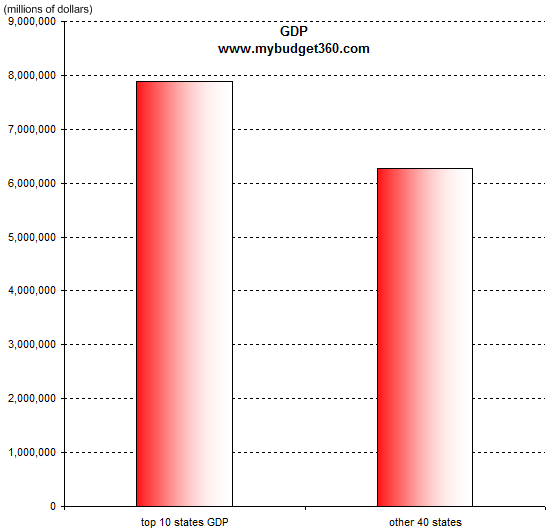

It should come as no surprise that the economic production of each state is not evenly divided. There are many variables including population, industrial base, and regional specialties. With this deep recession it is important to get an understanding of how things are divided in the United States. It is easy to get into the mode of thinking everything is evenly divided or the recession is being felt equally across state lines. It is not. Some states like California had historical housing bubbles that saw real estate prices in some areas triple in 10 years only to come crashing down. Other areas like Texas had minor real estate appreciation. In the United States 10 states make up 55 percent of all GDP. The U.S. in 2008 had a GDP of $14.16 trillion and these states produced $7.89 trillion of that amount.

Let us take a look at how this breaks down:

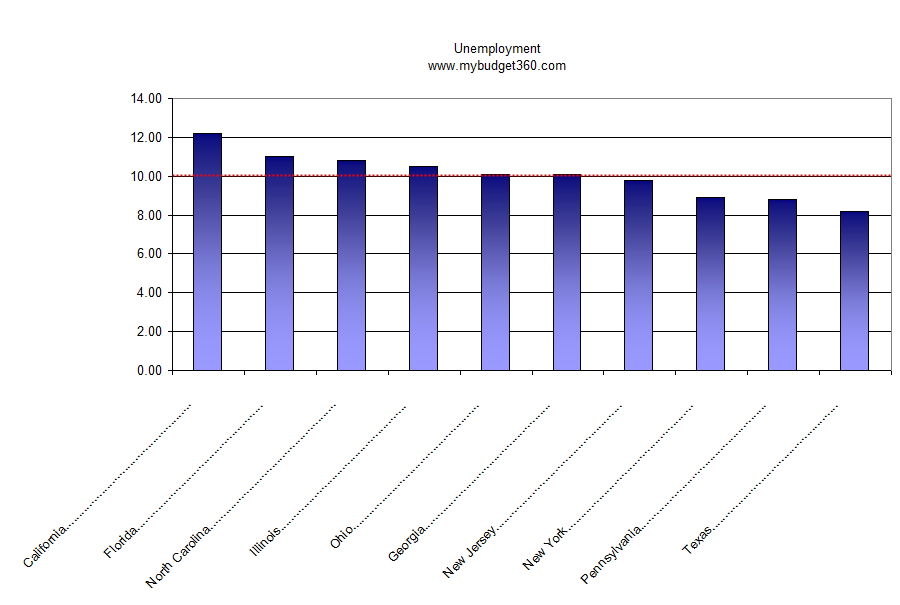

When we start narrowing down the big economic states, we can also look at their local dynamics to get a better understanding of why this recession has made it so difficult for jobs to be created. In fact, we have yet to see a month of positive job growth since the recession started back in December of 2007. The national official unemployment rate is 9.8 percent. Out of the top 10 states, 6 have unemployment rates over 10 percent:

Think of the local dynamics of a few of these states. California and Florida had enormous housing bubbles and the repercussion of a bursting bubble are still being dealt with. These states are still losing jobs since a large part of their industries revolved around the housing market. New York and New Jersey have big industries around the financial industry. Now that the stock market has recovered, certain institutions are taking in gigantic profits since some of their competitors collapsed while the government selectively decided to bailout a few chosen. But still, employment in these sectors do not come close to rivaling the peak of what we saw earlier in the decade.

The above data is important to focus on because these are the states that make up the bulk of GDP. With rampant state budget deficits many of these states are cutting spending but also raising taxes. Unlike the federal government that has access to the U.S. Treasury and Federal Reserve, states need to contend with balanced budgets. These states are grappling with these problems so their GDP surely in 2009 will be lower than what was shown in 2008. If tax collections are any sign, the contraction will be rather severe.

If you boil the data down further, the top 5 states make up 40 percent of GDP. In a way, this is similar to the too big to fail banks. Sure, the U.S. has some 8,000+ banks that are insured by the FDIC but approximately 100 hold over 70 percent of all assets. If there are problems in these big states, will smaller states carry the slack in GDP?

Many of the smaller states are also contending with higher unemployment. The economy is interconnected and many of these states export goods to higher populated regions. If people stop spending and buying these goods, it will also hurt them. Ask GM or Chrysler what happens when people stop buying your goods.

Looking at the list of the top 10 and four of the states had economies that benefited enormously by the housing bubble; California, New York, Florida, and New Jersey. Other states also saw benefits from the housing bubble but nothing to the level of these states. You would have to look at Nevada and Arizona but these two states do not make it to the list.

So why look at these states? These are indicators of economic growth. If these states can show that they can grow without the housing bubble, then we might begin seeing a recovery. But instead, the government and Wall Street have decided to revive (or try) the housing bubble. Giving away an $8,000 tax credit to potential home buyers, the Federal Reserve buying over a trillion in mortgage backed securities to keep interest rates low, and allowing banks to keep toxic assets hidden for as long as they like. That is effectively the strategy. The hope is that somehow, people go back to spending all their money on housing and cars again. I’m not sure if that is going to happen because job growth is now nowhere to be found. What did happen for their trust in a banking sector that largely led us into this crisis is that more and more money is now concentrated in fewer and fewer hands. If anything the government is looking more and more like a kleptocracy. 27 million unemployed and underemployed are wondering where that $13 trillion in bailouts and backstops has gone? Clearly it hasn’t gone to create jobs.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

George Wanker Bush said:

This is a very good example of why it is time to break up the union.

The bottom 10 states actually cost more than they are worth to us.

Yes Arnie, your state is included. It’s time to cut ties.

October 25th, 2009 at 2:08 pm -

robertsgt40 said:

” Now that the stock market has recovered”…I’m assuming this was said with tongue in cheek. This is not a recession. It is a DEPRESSION that has barely started. Wait till the alt-A and ARMs begin to reset next year. Commercial real estate is just about to nose over. Approx. 40% of federal expenditures are BORROWED. The federales have transfered trillions in wealth to the banking handlers. The dollars is about to loose it’s place as world reserve currency. The DOW at 10,000 fails to mention the dollar loss of value of 25% since 2000. It’s really about 7500 and will tank shortly. We are still exporting mfg. jobs as fast as we can. With reduced GDP and increased govt spending we have a recipe for insolvency in short order. The sad thing is this is all by design.

October 26th, 2009 at 8:15 am