Going Broke on $50,000: The Story of the Struggling American Middle Class. The $50,000 Median Household Budget.

- 17 Comment

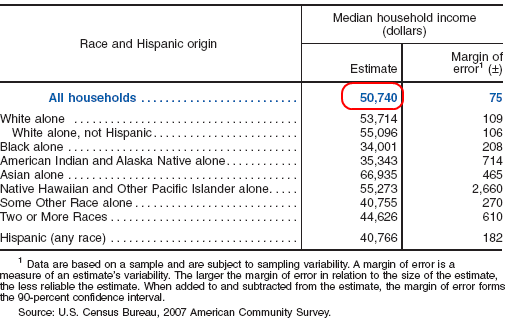

The recent recession is exposing how many American families have been treading on the edge. Problems were already in the system before the recession began but the downturn in the economy was the ultimate catalyst. Many families were using credit cards as a means of supplementing a decade of stagnant wages. The median household income for the entire country is $50,740. In addition we have 34,000,000 Americans now receiving some form of food stamps. They are not part of the middle class group. Yet when we dig deeper into the data, it is clear why so many Americans are going broke on $50,000 a year.

The current recession by many accounts is one of the worst since the Great Depression. Some 26 million Americans are without work or underemployed and many other millions have seen no pay raises or have seen their hours cut back. With an aging population and rising healthcare costs, many are facing a balance sheet that seems impossible to balance:

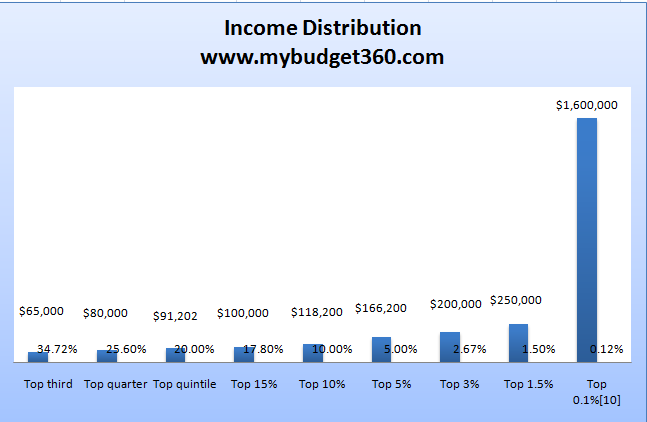

To understand this data even better, let us break out the income by top earning households:

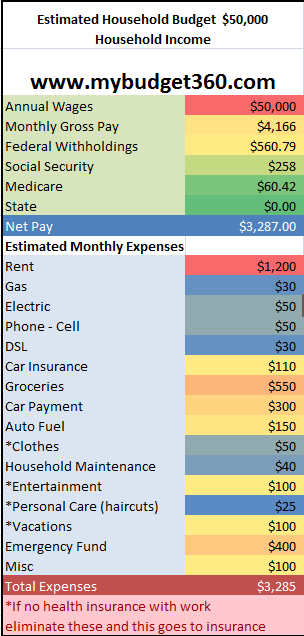

In order to be in the top 20 percent of households, a family would need to earn $90,000 a year. To be in the top 10 percent a family would need an income of $118,200. Yet these numbers are clearly out of the reach of the 50 percent of U.S. families making $50,000 or less a year. Let us put out a hypothetical budget of a household making $50,000:

With this budget we are assuming a few things. First, we are being generous in assuming no state income tax. In a state like California, this can add up to a 10 percent burden depending on the circumstances. But for our purposes, we are assuming no tax here (for example, Texas). The gross monthly pay comes out to be $4,166 but after taxes, the net pay is $3,287. This is where you can see why the middle class is having a tough time maintaining in the U.S.

We are assuming the person is renting a home. Rent of $1,200 should be sufficient for a nice home (a 3 bedroom and 2 bath home in Texas). In terms of utilities including gas, electric, and phone I went on the conservative side. These costs have been creeping up now that oil is back up. Groceries are always a big expense in a household. For the middle class family, food can take up to 15 to 20 percent of their net pay. And food has gone up in price. Now, people are getting more for less because of smart packaging:

You also see less quantity in items like cereal for example. For most middle class Americans housing is the biggest line item. This applies to both renters and homeowners. Roughly one-third of net pay will go to housing. In the above budget, we are assuming the household has one car payment at roughly $300 per month. They may have two car payments so you would have to adjust for this.

Next, we need some form of emergency fund. We are setting aside $400 per month here. Ultimately, you want to have 3 to 6 months of expenses set aside. At roughly $2,800 in monthly expenses, we need to set aside $8,400 at a minimum. At $400 a month, this will take us 21 months.

We are spending $100 in entertainment. This probably amounts to 2 movies and 1 night eating out. Many Americans do more of this. I’m not advocating one thing or another but just pinpointing why someone at the middle income level is going broke and it doesn’t take extravagant spending.

Haircut and clothes are optional, I know but if you work in a professional environment you might need to have a decent set of clothes. This line item can adjust depending on your work environment.

So what are we missing? How about retirement funds and healthcare? These are expensive items. You can see that $300 to $500 a month for healthcare will have to come from another line item in the budget. Retirement? Ideally they will invest pre-tax dollars into the market but people are shaken up since the S&P 500 has become basically a Wall Street casino.

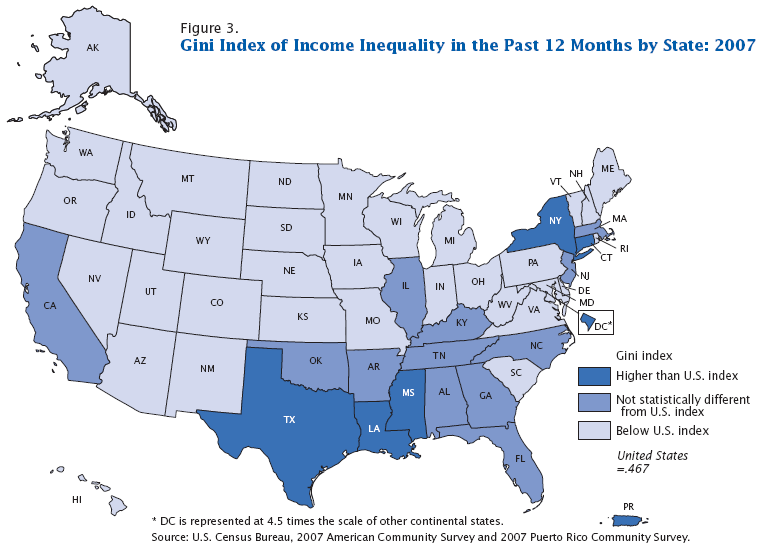

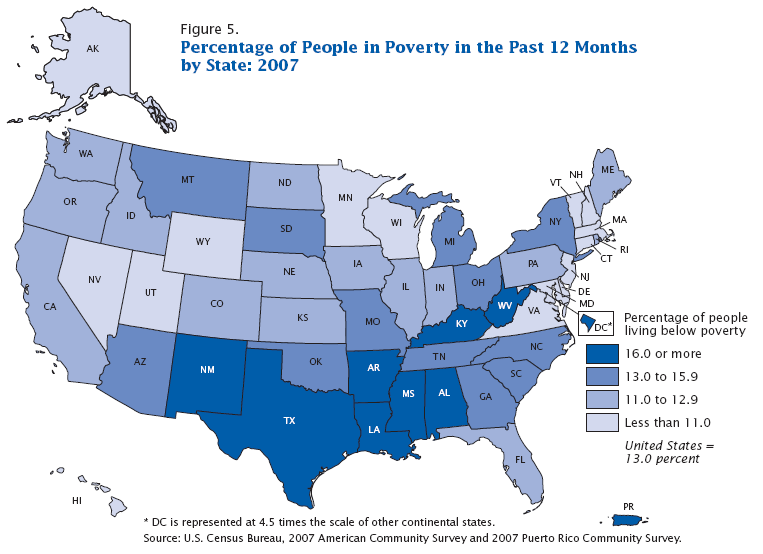

So it is easy to see how people can go under with a $50,000 household income and that is what we are seeing with the rising unemployment rate and the massive jump in bankruptcies. It is interesting to note that states with income tax and no tax are having problems. California for example had to patch up $60 billion in deficits this year alone. But if you think states with no taxes are immune to problems, take a look at the Gini Index for states in the U.S.:

It is interesting to note that a handful of states have higher income inequality and two states that you would expect at opposite ends of the spectrum, New York and Texas both show up in this data point. Only 5 states have higher than the U.S. Index average for the Gini Index. It is also interesting that some of the states also have some of the highest poverty rates:

So the solution to the current crisis isn’t so clear cut. You have states with high taxes like California having problems and states like Texas with no income tax having some of the highest poverty rates. Bottom line is many families making the median of $50,000 a year are being crushed in the current recession. It is all good to say things are getting less worse but we are not seeing any job growth. That is a major issue. With an aging population, how are people going to pay for food and healthcare? Social Security just announced no cost of living adjustment for the year. These are all issues we will be facing in the upcoming years.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!17 Comments on this post

Trackbacks

-

TJ said:

“We are assuming the person is renting a home. Rent of $1,200 should be sufficient for a nice home (a 3 bedroom and 2 bath home in Texas)”

Well that is the start of their problems, how about getting a $800 rental you can afford.And it is only about 5% of middle income America who is effected. Since the unemployment rate has only risen 5%, nice article but you people like in your senario get zero sympathy from me.

August 29th, 2009 at 2:30 pm -

t-bone said:

Or they could live in their car and sell one of their children, or at least a kidney. Problem solved.

TJ at Christmas time: “Are there no prisons? Are there no workhouses?”

You can keep your sympathy, in fact, why don’t you shove it up your ass where it will be nice and safe?

August 30th, 2009 at 4:34 am -

TX said:

TJ- While you’re at it, just find a house that only costs $600/mo to rent- Even better! While we’re dreaming, why not a house that someone will let you live in for free? Gotta be a few of those out there!

Stupid poor people, they just don’t know how to do anything!

August 30th, 2009 at 7:51 am -

silver said:

The answer to collapes is food supply,water,guns an ammo,an silver and secure shelter and above all else….. prayer without ceasing. God Bless.

August 30th, 2009 at 11:05 am -

KB said:

Yeah, TJ. Nice.

Instead of putting 1,200 into a home payment towards a house you will actually OWN, they should totally cram themselves into a small 800 dollar rental where they will never receive equity or property and will have to deal with neighbors on either side, as well as above and below them, and mediate any problems through a landlord.Brilliant. You should be be in charge of the Federal Reserve, my friend.

August 30th, 2009 at 11:36 am -

Bubba said:

$1200 gets you nice rental home? Not anywhere near Los Angeles. I pay $1750 for my modest 50 year old house with a small yard and that’s because last November I negotiated a $250 drop in my rent.

All the “systems” at work here run against the prototypical American who is working hard to pull himself up “by his own bootstraps”. If you are a free-lancer you not only have to pay high rent (pay the mortgage for someone who bought several homes years ago when they were cheap) you also pay self-employment tax and can’t apply for unemployment if things get tough. Then look at how every company you pay monthly bills to is cheating, gouging, or tricking you…slowly nickle and diming you to death. The cable company, the phone company, the water and power company…here in California I called the DWP to find out what the $80.00 charge was (2 months) and I was told that the city wasn’t paying for trash pickup anymore and it cost me $36.00/month more now.

August 30th, 2009 at 1:47 pm -

J said:

Try to get a decent house rental in Houston for $1200, not possible, and if you want a good school then your into $2000+

August 30th, 2009 at 2:09 pm -

Zack S said:

Hmmm, let’s see. A few million people lose their jobs and homes in the near future and end up on the street. I wonder what those formerly middle class people will do with their now copious free time? You think they might be a tad angry??

August 30th, 2009 at 4:40 pm -

RWS said:

TJ is just typical of all republicans. They make statements like that until it happens to them and they are the first to whine.

Democrats and progressives are simply people who are smart enough to realize that it could easily happen to them and that care about those who have less.August 31st, 2009 at 6:41 am -

Don Burnstein said:

$1200 is slightly above low income housing for Indiana and this is a sate that has really been hard hit. Rentals went way up as foreclosures keep going like gangbusters. The notion that there are plenty of places available for $800 anywhere in the country, especially if the renters have impaired credit from a foreclosure is just dreaming. There may be something available for a single person with one bedroom. But if they have kids, and need two-three bedrooms, $1200 is cutting it close.

Once the inventory of foreclosed, devalued homes under $100,000 are eaten up by investors and first time home buyers no longer get a $8,000 credit, and/or the banks start to actually foreclose on the properties that are in the process but have not been pulled through so they can be carried at full value on their balance sheets even though it’s a non-performing asset have been it’s reasonable to assume the supple-demand equation will be highly in favor of renters. That $1200 rental may still be available as long as people don’t mind a few murders in the street and the sounds of automatic gunfire.

I just love it when Americans show no empathy and no sympathy for the plight of the middle class that have driven many of those American’s wealth. Even Henry Ford believed that his workers needed to make enough to buy the cars he sold.

The same people then show their intelligence by showing how “easy” it is to balance the payments with a low income . Wiping their hands after “solving” this problem. They then HAVE to interject how they have no feeling for a large part of the country that are in situations where the above analysis would be pure nirvana for them

Not only that , The analysis is also showing a family that is virtually debt free. Add a few credit card payments to the low car payment, and maybe some payday loans that were used to cover the out of pocket expenses for a crappy health insurance policy. Then see what’s left.

A better representation of the family’s finances should include

1. Monthly Minimum Payments on Credit Cards at 35% at the average debt of $9,000. $656 a month with the new 5% minimum payment or $262 per month at the old 2% minimum payment.

2. Auto Fuel assumes 3 fill-ups on a family size vehicle and 4-5 fill-ups on a compact car. Or 1200 miles a year or 100 miles a month. Really? With kids and commute. I would put it up around $700.00 at a bare minimum

3. Out of pocket medical expenses. $250 per month

This is after they have charged them to their credit limits on the credit cards that no longer have any credit left on them.4. Insurance needs to be bumped to include Life Insurance and Renter’s Insurance.

5. Bank Charges: They don’t make 40 Billion in the aggregate on wealthy people. So lets make it $50 a month

6. Health Insurance: Less and less employers are offering fully paid health insurance, so go ahead and eliminate the clothes, entertainment, personal care and vacations. Then add about $100. If they are not supplied any insurance which becomes almost a given for the 30- 50% of the middle class that are employed by small business or own small businesses. That can be $800 for a major medical for a family of 3 to $1600 for a family of four assumming no preexisting conditions. Of course 47 million are going naked but there is no break down of the income levels.

7. Gas and Electric in any of the northern states needs to be punched up by 3-4 times. Make it $200.00

So here is what I think is a more realistic snapshot:

1. Rent $600

2. Gas and Electric $320.00

3. Phone $50

4. *DSL (no way)

5. Insurance $225.00

6. Groceries $550.00

7. * Car Payment $300

8. Auto Fuel: $700.00

9. Auto Maintenance: $50

10. Household Maintenance $40.00

11. Misc $100

12. Health Insurance $325-$1200

13. Credit Card payments $252-$656

14 Out of pocket medical Expenses $250

15. Bank Charges $50.00Total Expenses : ($3812.00 )

Take Home: : 3285.00

(Deficit)/DsiposableAugust 31st, 2009 at 11:28 am -

Sam said:

The grim reality is that most of us will need to become “third worlders.” We’re going to have to go without health care, AC, cars, etc etc. Those will all become unaffordable luxuries for most of us soon. We will have to learn to eat pb&J, beans and rice, “drive” a bicycle, and wear our coats, hats, gloves all day long in the house in winter like they do in the unheated houses in the mountains of Peru. We’ll have to go to bed at sunset and get up at sunrise like the Amish do in order to save on the electric bill, dry our clothes on a clothesline, probably eventually wash on a scrub board, etc etc etc. Perhaps some of us will emigrate to China to open an “American” laundry in China in the future! The Chinese have done our laundry for decades. Soon the tables will turn and we will end up doing their laundry…. What goes around comes around in this world!

August 31st, 2009 at 7:18 pm -

Don Burnstein said:

I think that’s happening now. Even the upper 10% are taking kids of private schools, watching 20 years worth of investments get whacked, real-estate values declining, health insurance at the top end of the range or higher – around $20,000 a year. They have no choice. I ‘d say a $100,000 salary would probably take that revised budget, add enough to bring it up to $60,000 which leaves the low 6 figure earner little wiggle room.

The average $50,000 wage earner is poor now. As you implied, what was once taken for granted are now unaffordable luxuries. Add in the anxiety of losing even this teneous connection to a low standard of living by USA standards by a sudden job loss or illness and even if they get an occasional windfall, it will be used to pay down debt, or put in savings. This was the sweet spot at one point for a consumer driven GDP that was pulled forward by debt . I once did a look at Consumer debt in 1945-46, adjusted it for inflation and population and came out with a figure of 150 billion compared to the 2.5 trillion we have now not counting mortgage debt.

People have been fiancing their onw deficits for a long time and now many are forcibly deleveraging through bankruptcy. I suspect next year, individual bankruptcies will exceed the record set in 2005 when people filed to get ahead of the reform in October. In My neck of the woods, filings are up 50% Y oY

September 1st, 2009 at 10:50 am -

JP Merzetti said:

I think what constitutes middle class needs to now remove from the philisophical and the psychological, the social and cultural meanderings of self-definition…….and come back to hard dollars and cents (if not sense!)

In an age when middle class appears to have embraced the notion of the polished granite countertop, the European vacations, the lower category of high-end vehicles, and a host of other tagged status durables – we’ve stumbled into a definiton gap that hardly resembles the historical definition of what middle class was taken to be.

Of course, this means that, depending on where you live, and what your lifestyle happens to be, dictates how closely you adhere to whatever middle class definition applies.I get the impression that something such as a private school, for example – traditionally would never had fit a middle class lifestyle or income.

I suspect that in some really weird inflationary way, what most of us think of now as a middle class existence….has quietly slipped upward into the top quintile of income earners.

And if that is so – the numbers should tell us the obvious: that’s the top 20% of households. Which means that is a decided minority of the population.

At one time it was the majority. I suspect that has long since departed.When I was a kid, the milkman’s family lived a middle class lifestyle.

My school principal, the bank loan officer, my dentist, and the average lawyer………all lived something a cut above that.Back to the milkman. Yep – the guy who delivered the milk bottles in the morning. His wages did all those same things that we would think of as bottom line middle class yearnings today.

That’s all it took. Those wages weren’t buying a whole host of toys, trinkets, and otherwise superfluous stuff…..they didn’t have to, and anyway, none of that stuff existed.My point……….we can afford all those toys and trinkets – but that’s not what achieves middle class status. Any deadbeat can throw a few hundreds around and acquire them.

What we can’t afford are the touchstones and milestones of what middle class used to define: secure home ownership, education, health care, retirement………..all without massive debt.If exactly that same measurement were used today to establish how solidly secure our middle class is……………I think we’d find that most of what we think of as “middle class” are in fact, actually upper class. The majority of the rest of the wannabes…..are playing party poker with declining returns.

Sadly – if the majority of that number, had settled into a solid “working class” mode…..much lower economic expectations based on their TRUE earnings – (imagine – only spending what they could safely afford) this would probably be the backbone of our culture, outlook, domestic product…..and the strongest and truest definition of what “middle” class actually is.

March 24th, 2010 at 10:07 pm -

carol nenna said:

we can all thank our greedy, correpy politicans.

December 7th, 2010 at 5:21 pm -

Kim said:

Don’t forget many of us have college school loans to pay on ($250 a month) to pull 50K salary at our prime.

January 13th, 2011 at 12:45 pm -

howard said:

ronald reagon. he was the cancer . the national debt when jimmy carter left office was less then 1 trillion dollars. our country fought two world wars , the great depression , went to the moon ,. reagon cut taxes on the rich. he decided that america had it too good and decided to kill the roosevelt new deal. and so he ordered that we print treasury bonds and sell them to china . and so america started living on a credit card . if trump gets in we will witness starvation. he wants more tax cuts for thr rich. he is nothing but a street wise con artist. bernie sanders was the real deal .

August 31st, 2016 at 12:18 pm -

Brittney said:

I’ll say this as someone who makes $50K and also lives in Texas. Someone with zero credit card debt, a decent rate on my mortgage (3%), and excellent credit.

First off, there are no longer “decent rentals” for $800 here. Likely most anywhere. You can get a decent 1 bedroom apartment here between $950-$1150, or you can rent a newer home for $1200-$2600. My mortgage is just shy of $800 on my 4 bedroom, 3 bath home in a great area… but with property taxes and fairly basic home owners insurance and PMI, we shell over $1500 each month. For families, an $800 studio isn’t going to cut it, TJ. This budget works under the assumption this isn’t a happy bachelor making ends meet.

Net pay can vary greatly, obviously, based on if the worker contributes at all to a 401K and what their OOP for healthcare is. I work for a giant company with decent benefits and my take home, sans 401K contributions, is still just $3200 a month.

We fully own a 16 year old SUV and have a $500 car payment for a newer vehicle as well, which we also plan to own for several decades if possible.

But $80 for gas and electric wouldn’t have covered my utilities in my apartment in Los Angeles. We easily shell out $250 for the privilege in winter months to keep the house at 65 and up to $450 in Summer months here in the South just to keep the house at a brisk 80. The cost of utilities here is another reason to not head this way.

You also need to add on water and trash services. Trash is a flat rate to everyone and combined with water (we only have 2 adults taking semi-regular showers when our two toddlers permit us the time, lol, and we don’t bother ever using our sprinkler system or watering our lawn at all because we get enough rain to somehow keep it alive just fine) we still have shelled out a static $110 a month for the last decade.

I’m curious when this article was written? Some items are spot on and others carry along 1980’s price tags.

January 11th, 2017 at 8:09 am