Demand Destruction Price Deflation: Earnings up when you Fire Employees. California Lowering Tax Brackets. Social Security no Cost of Living Adjustments.

- 0 Comments

The Consumer Price Index has shown a year over year decline for the first time since the 1950s. This in itself has added fuel to the growing flame of the menace of deflation. Yet what we are seeing in the psychical world in the form of price declines is directly linked to demand destruction and the evaporation of old debts in the form of foreclosures and bankruptcies for example. In a fiat currency like the one we have, the Federal Reserve with the aid of the U.S. Treasury has no bounds in how much money it can print. But we have seen in this recession nearly $14 trillion in household wealth disappear and this wealth destruction has occurred at a faster pace than any money creation. The CPI going negative for the first time in half a century will look like full-fledged deflation by the public. After all, with housing prices bursting from the bubble and other items going down in price, what else is the consumer to expect?

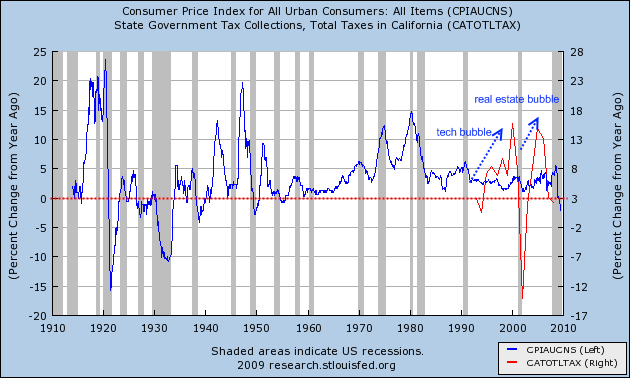

Let us look at a chart showing year over year changes in CPI and also, tax revenues from the state of California:

What we are seeing here is the story of two decades of bubbles in California. First, we had the 1990s technology bubble followed by the real estate bubble. You’ll notice on the chart how quickly revenues can fall. The problem in a state like California that has had to fix $60 billion in budget gaps this year is that the real estate bubble came just in time to save the technology bubble bursting. This time, there doesn’t seem to be another bubble waiting and already there are projections for another budget short-fall for the next fiscal year.

In a sign of current price destruction deflation, the state is actually lowering the income tax brackets for the first time in 30 years. You heard correct, lowering the tax brackets:

“(LA Times) Reporting from Sacramento – While Californians are still feeling the sting of income and sales tax hikes signed into law earlier this year, now comes news that state tax authorities plan to take a little more from their pockets.

For only the second time in 30 years, the tax board is lowering the point where each tax bracket begins, bumping many people into a higher category. At the same time, officials are cutting back some deductions. Everyone will pay more, even people whose bracket or income doesn’t change.

The extra sums will total as much as $140 per family, on top of the increases previously enacted.”

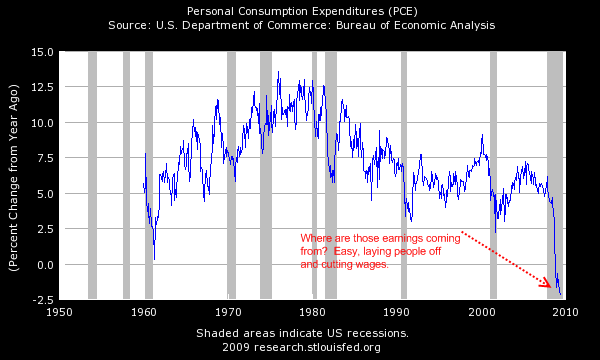

On top of the increase in taxes, every income bracket is going to feel the menace of demand destruction deflation. Now why would the state do this? To increase revenues. That is why with the S&P 500 jumping over 50% in a few months, people need to be cautious how companies are making their money. Most of the jump in “earnings” has occurred on the “cost savings” side more so than the consumer spending side:

It is rather apparent that spending and consumption which make up a big part of our economy are not leading the charge in earnings. When you have 26,000,000 unemployed and underemployed Americans, it is easy to save money from a company perspective. This is not a growth model but one time earnings from demand destruction.

Even more evidence of this demand destruction, Social Security announces no cost of living adjustments:

“(AARP) For the first time in 35 years, older Americans will receive no cost-of-living increases (COLA) in their Social Security checks in 2010 according to Congressional Budget Office estimates. The forecast is based on expected low inflation, in contrast to 2009 when the COLA added 5.8 percent to Social Security benefits.

Next year’s zero COLA is bad news enough for many retirees living on fixed incomes during a recession. But millions of them also face much higher Medicare Part B premiums next year.”

Is this sounding familiar? But given the rising cost in healthcare, many can expect a hike in their Medicare Part B. What does this mean? Less money for consumption. And with many baby boomers entering retirement in the next few years, a perfect storm is starting to brew.

If we dig into the CPI we notice that things such as food and healthcare are going up. For someone on a fixed $1,000 a month from Social Security, this might be a big burden. Many retirees (of course not all) already have their home paid off if they own (one third of American homeowners own their home free and clear). So food and healthcare become their major expense. And these few areas are going up. Discretionary items like a home (yes, to own a home is a choice since there are rentals), vacations, and automobiles are taking major hits in prices. Go on eBay or take a look at your local newspaper and you will find deals in these area.

Ultimately earnings will have to occur from growth including job growth. To assume these deep cost cuts are a way to make earnings and rally the S&P 500 is simply a way to make Wall Street wealthier while most average Americans scrimp by. We still have major issues that will add further demand destruction. $3 trillion in commercial real estate loans are out there. With demand going down as we have seen, who will buy/lease that space? Many boomers are going to be downsizing in the next few years. In terms or rampant inflation, this is still something not in the equation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!