The Country that Punishes Savers: Americans Saving 7 percent of Income Putting nearly $800 Billion Annual Rate on the Sidelines. Banks offering 0 to 0.10 Percent to Borrow Your Money.

- 3 Comment

Americans are increasingly putting more and more money on the sidelines. For the month of May Americans put away 6.9 percent of their income into savings. Not the stock market or real estate but bona fide savings. This is a stark contrast from the zero rates achieved back in April of 2008. When we discussed the new austerity for Americans, much of this is being driven by the loss of jobs and the fact that nearly 26,000,000 Americans are unemployed or underemployed. Now why are Americans suddenly finding the need to save some money? First, the decade long housing bubble has shattered the notion that phantom equity is the same as actual wealth. The next major issue is the stock market is no longer seen as a safe investment. Even if someone had his or her funds in the S&P 500 the index is still down approximately 40 percent and that is after the major rally since the March low.

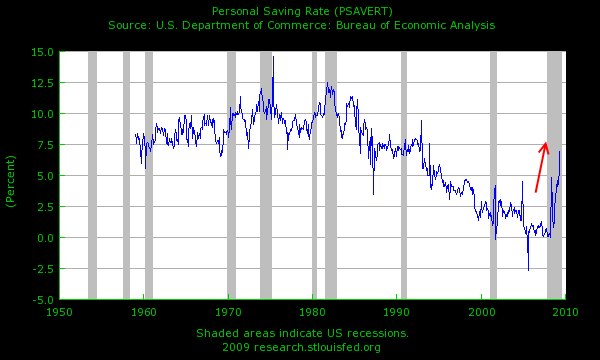

Something is definitely going on here:

We have never seen such a rapid change in the savings rate. Of course, going from zero anything would be an improvement. The current seasonally adjusted annual rate has not been seen since 1993 but as the chart above shows, the percent of change is unmatched with 50 years of data. What is occurring here? I’ve seen a few articles talking about the new found frugality that Americans are now embracing. This is something I hesitate to agree with because it presupposes that Americans are electing to save as a choice rather than being forced by external circumstances. I do believe many Americans are becoming more frugal by choice but the vast majority are simply responding to the horrific economy that has evaporated $13.8 trillion in American household wealth.

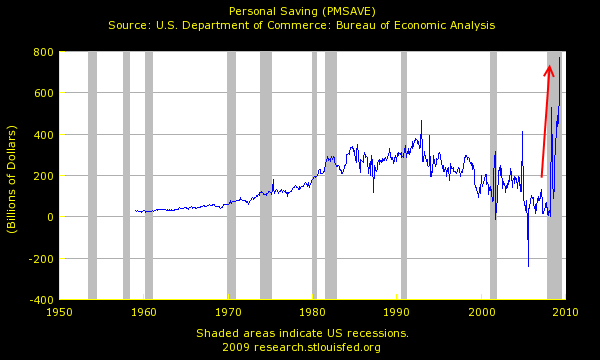

But who are the big winners here? Banks. The Fed shows that deposits at many banks now stands at $7.5 trillion showing the largest increase for the year. These banks are getting insanely cheap deposits from the government and now you to help mend their broken balance sheets. Call it double dipping. Look at how much money is being put into savings:

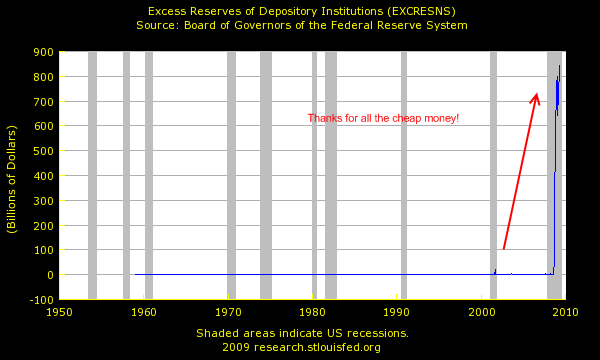

We have never seen so much money move to the sidelines. We are now approaching an $800 billion SAAR which means, nearly $1 trillion in money is being put on the sidelines. This is good right? Unfortunately the way our economy is set up this means more and more money isn’t out there chasing consumer goods. With massive market volatility this is actually viewed as bad. That is the irony here. Savings should be a good thing yet 70 percent of our economy depends on consumption. Taking out $800 billion from commission will do damage since banks are not lending this money:

So all that is happening is banks are building up their reserves for the second round of hits that will occur with commercial real estate, credit cards, and higher unemployment coming down the pipeline. It is fascinating to note that during the last month more insiders were selling stock than buying. These are the folks smiling on TV one minute telling you everything is okay while quietly dumping their holdings now that the market is artificially propped up.

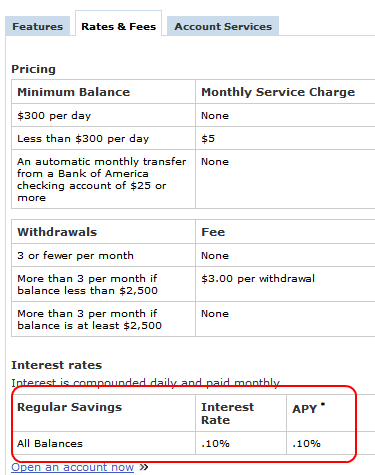

Let us go on a quick test shall we? Many banks are being bailed out with golden parachutes with diamond pull strings so let us see what kind of savings rates they are offering Americans:

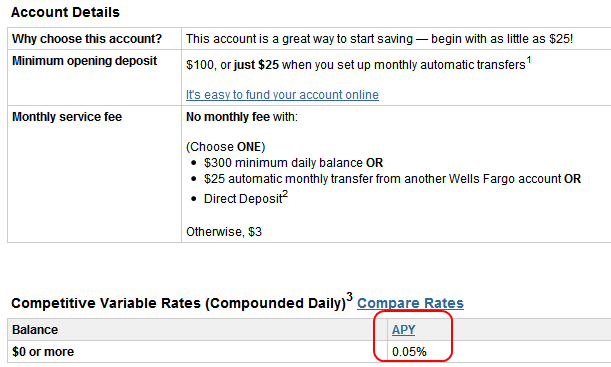

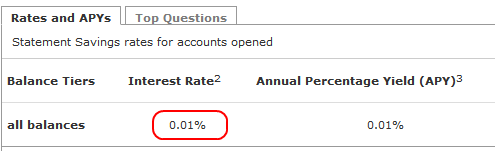

Don’t adjust your glasses or monitor. You are reading the above right. Bank of America is offering a stunning 0.10 percent for your regular savings account. You might as well stuff the money in a mattress! Let us see what Wells Fargo is offering:

If you thought Bank of America was low Wells Fargo is offering a 0.05% rate! You know how much money you would get if you left $10,000 with them for one year? Five stinking dollars! Just for the sake of it, let us look at Chase since they now own WaMu as well:

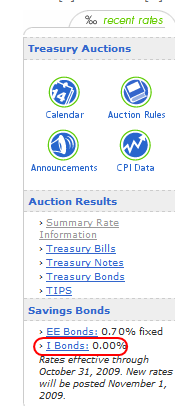

Say what? At these rates people are saving out of fear and not a new sense of frugality. People figure that it is better to get the service of an ATM card than putting their money into the Wall Street casino or the housing bubble. Oh, but it gets better. The U.S. government through the U.S. Treasury and Federal Reserve do not want Americans to save any money. In fact, they are offering even lower rates:

That is correct. A 0 percent savings rate. And this is all designed by purpose. The Federal Reserve is intentionally keeping the Fed funds rate low so banks can fix their balance sheets and the U.S. can inflate itself out of debt. Yet this is bad news for prudent savers. The attempt is to make every option so unattractive that people have to pump their money back in the stock market that is now operating like a game of blackjack in Vegas. Yet even though we hear about historical low rates, banks are making a ton on the margin of money they are borrowing from the government (aka taxpayers). That is, they are taking in money paying 0.05 percent or whatever it is, and getting 5 or 6 percent on mortgages and taking in 15 to 20 percent on credit cards. Give me access to those kind of terms and I’d make money too.

The bottom line is the government and Wall Street do not want Americans to save. This is reflected in these absurdly low rates. It is easy to encourage savings. Increase the yield on savings accounts through hiking the Fed Funds rate. Yet the U.S. Treasury and Federal Reserve know that their Wall Street friends and our government debt is so large, that we are going to have to deflate our currency and destroy the dollar. Enough with the “strong dollar” policy talk since all actions point to a weak dollar policy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

CD Rates Guy said:

Everyone is saying there’s going to be a rally next month if unemployment numbers and housing data “stabilizes.” If you ask me, our problems haven’t gone anywhere while our spending is up. The banks are already on course to pay crazy executive bonuses again this year.

June 30th, 2009 at 2:02 pm -

Tim Tyrrell said:

While this is irrelevant to the article, I have used online banks for years to get a higher savings rate. Emigrant Direct is currently 1.55%, better then those in the article (but still sucks).

July 4th, 2009 at 11:56 am -

retireby35 said:

Rates are extremely low now but I wonder how much things will change once inflation kicks into high gear. I suppose we are still running through the deflationary period so naturally people will save, which in turn increases the amount of money on the sidelines and lowers the interest rate. High supply of savers = low interest rates.

July 6th, 2009 at 10:27 am