$100,000 a Year Will Make you Go Broke with the California Tax System: Why California is a Fiscal Disaster. Broken Tax Structure built on Bubbles.

- 15 Comment

It is amazing how little attention on a national scale the California debacle is getting. California alone is the 8th largest economy in the world and contributes $1.8 trillion a year to the national GDP. In the mainstream press, all you hear is sound bites of “there goes California” yet the state is teetering on economic insolvency. The U.S. Treasury and Federal Reserve seem more concerned about shoring up a situation where the U.S. dollar collapses instead of focusing on systematically changing the problems that have driven our economy to the cliff. California is a perfect example of how not to finance a state economy. I know many people out of state have a hard time understanding how $100,000 a year can make you feel broke in this state but after reading this article, you will understand why. Keep in mind, you can live here on a $46,000 a year budget but that is now going to become harder and harder given this crisis.

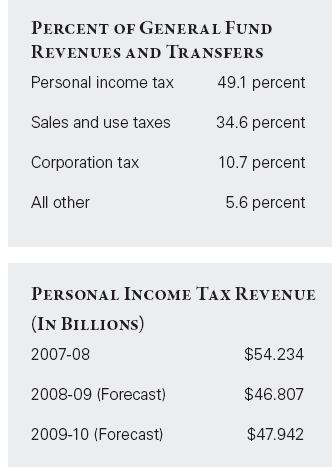

California has drastically changed in the past century. Before 1912 California would pull 70 percent of its revenue from property taxes. In most cases property taxes are a better and steadier revenue stream because they tend to fluctuate the least in challenging economic times (assuming we don’t have mega once in a century national real estate bubbles like we just did). Even with recessions, property taxes are a good revenue stream because people for the most part will cut back on virtually every other line item before losing a home. Yet that is now not the case. Now, the primary sources of income for the state are personal income taxes, sales and use taxes, bank and corporation taxes, and a variety of excise taxes. This is how it breaks down:

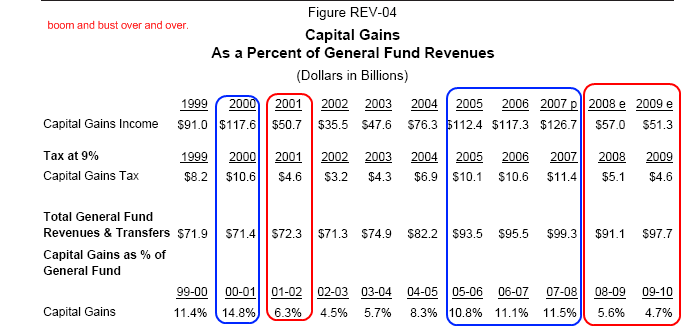

It is rather apparent how a recession this deep will plunge the state to near economic collapse. First, personal income taxes take major hits during a crisis like this. If the state is drawing nearly half of its revenue from a volatile stream, you will get volatile tax collections. Plus, with an 11.5 percent unemployment rate meaning over 2,100,000 people are “officially” unemployed there is no income tax being paid in the first place by a large contingent. Sales and use taxes make up nearly 35 percent. Well of course during a crisis, people are going to pull back and not buy items like cars, big televisions, and therefore sales taxes will be hit as well. The California revenue system is a boom and bust system. Take a look at revenue streams for the past few years:

Capital gains income highlights this boom and bust cycle perfectly. In 2000 with the technology bubble California residents took in $117.56 billion in capital gains which the state received a nice chunk of $10.6 billion. Yet after the bust, in 2001 only $50.7 billion was made and only $35.5 billion in 2002. So of course, this revenue stream was chopped each year. Then with the real estate bubble, we see that 2005, 2006, and 2007 actually brought in more money than the tech bubble. The state of course collected nice sums of money from this bubble. Yet now, this has busted and capital gains income has fallen off a cliff. Interestingly enough, property taxes actually increased from 2000 to 2001 at a modest rate even while cap gains split in half.

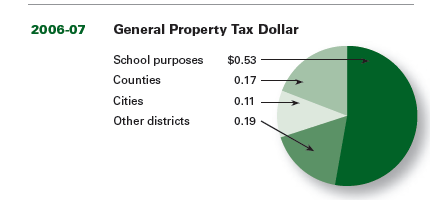

Now we are seeing drops in property tax collections given the epic California housing bubble that was built over the decade. Property taxes for the most part are viewed as local revenue streams and impact cities, counties, and schools more directly. The breakdown for example is roughly 17 percent counties, 11 for cities, 53 percent to schools, and 19 percent to special districts. Here is the breakdown:

Now keep in mind, this is for 2006-07 which was a banner year.   During the 2006-07 fiscal year property tax revenues came in at $43.16 billion. According to data provided by the Board of Equalization property assessed values during this time reached $4.28 trillion in the state. Now this was at the peak. By most estimates, the bubble has popped and California as whole has seen the median price drop by 50 percent. So it is safe to say that the values are now at $2.1 trillion. No wonder why revenue is drying up from every possible angle.

A big shift in revenue streams came on June 6, 1978 when voters overwhelmingly approved Proposition 13. The reason this was passed is dramatic rises in property taxes during that time and also, a growing state surplus of $5 billion. Proposition 13 rolled most local property taxes back to 1975 assessments and limited property tax rate increases to 1 percent plus the rate of local voter approved bond measures. It was a limit to future property taxes.

After this measure passed, property taxes collapsed from $10.8 billion in 1977-78 to $5.4 billion in 1978-79. So people tend to forget that once this happened local governments went into fiscal haywire. For the first two years after Proposition 13 passed the legislature had to bailout local governments. The first year a stop-gap measure costing $4.17 billion was used from the state surplus. A second year bailout cost the state $4.85 billion.

But many properties have traded hands in recent years given the California housing bubble. With this, many properties are now sitting on overpriced assessments. Proposition 13 allows for reassessment when properties exchange hands. So now after the drastic collapse in prices, you can rest assured that taxes may be too high on some properties ironically. It is pure insanity how California does its taxes. How so? Well if you assessed property at bubble level prices on a yearly basis, the overall cost of owning a home would be more accurately reflected. We now have people who bought at the peak with overpriced homes and over assessed properties. It just doesn’t give an accurate reflection of true cost. Also, you have corporations who use Proposition 13 as a shell to keep paying commercial rates dating back to the 1970s since they don’t need to exchange property as often as say a residential homeowner.

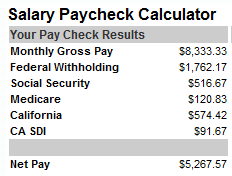

Yet that is one side of the story. The bigger drain is the personal income tax stream plus the sales tax. Let us see how this plays out for someone making $100,000 a year:

Let us assume you are a young working professional making $100,000 a year. The above chart shows you how much money you are left with once all taxes are taken. After all is said and done, nearly 40 percent of your income is gone (most of it going to the federal government). So after that, you can feel good right? No. Because the state will then tax you like crazy with sales tax. Here in California many counties now have 9 to 10 percent sales tax rates! So after your $8,333 a month gross goes to $5,267 net, you now have to go out and buy things. But when you buy an item, you are going to pay an additional tax. The true tax burden for Californians is near 50 percent when all is said and done. It would be one thing to pay for effective government but can you call what we have effective?

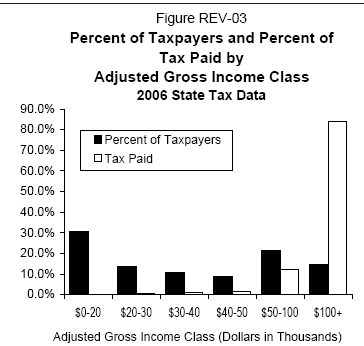

What many people don’t realize is that 15 percent of California taxpayers, those that make over $100,000 pay 84 percent of all the personal income tax revenue. And those that make over $480,940 which are the top 1 percent pay 48 percent of all state personal income taxes:

The problem with this system especially when you had many in the technology industry making tons of bubble money during the bubble is once it bursts, you will lose your primary source of income. More recently, you had a double revenue bubble since property taxes soared because of the massive housing bubble but you also had tons of people working in the finance, real estate, and other related industries making these high incomes which are now gone. So you lose the income and the property tax streams. Systemically our system is broken. Proposition 13 is only one piece of the puzzle. The problem is we depend on revenue sources that are not stable. Unfortunately a better source of revenue is property taxes just like many other states have. Yet to raise property taxes without adjusting state personal income taxes is insanity.

Also, going back to the $100,000 worker, housing prices are still much too high. For example, let us now assume this person wants to buy a modest home in a decent area. Let us look at some L.A. areas for an example. Let us assume this person wants to buy a starter home in Eagle Rock. The median price for Eagle Rock is $475,000 and that is with the current reality that L.A. County as a region has seen the median price drop by 50 percent (of course much of this is because of the lower end distress market making up over half of sales). So this person decides to buy this home with 10 percent down:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $47,500

Mortgage:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $427,500 (30 year fixed at 5.5 percent)

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,921

Net Income:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $5,267

Disposable income after house payment:Â Â Â Â Â Â Â Â Â Â Â $2,346

Now many would say big deal here. But you need to remember we have done no contribution to a 401k or we haven’t even factored in healthcare costs. Food? Car? You can see that a $100,000 in California does not go a long way and only 15 percent of taxpayers fall in this bracket. Just imagine for the median income earner which is approximately $50,000. So you say what about 2 income households? That puts us up to 26 percent of the population that makes over $100,000 but this is from 2007 data. With unemployment skyrocketing since then that figure is surely lower. It’ll be fascinating to see the data figures once we have our next big census in 2010. We may see a lost decade of income for many Californians.

If it isn’t obvious to you already, we need a massive overhaul of the system. The current solutions of pure cuts or pure tax hikes are piecemeal solutions because as you can see, we’ll be back at this again next year. We need to reform the system to include more stable revenue streams and link up state government to these streams so they don’t go into feast and famine mode every few years. For the past 20 years, we jumped from one bubble to the next. Unfortunately, there is no other bubble in the short-term and the reality of the mess is being exposed. Because if $100,000 a year is not enough for someone to live on here in the state and have a middle class lifestyle, then we have some serious issues.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!15 Comments on this post

Trackbacks

-

traineeinvestor said:

Sounds pretty awful. It also sounds like a problem without a good solution. Higher taxes will make matters worse. A Federal bail out would set off a chain of “me too” claims from other states (as well as a lot of resentment from taxpayers in other states). Spending cuts will also make matters worse but the only viable long term solution is for the state to live within its means (just like everyone else).

As an investor, I can also say that it is very hard to justify investing in real estate in California with this kind of economic background.

June 24th, 2009 at 9:38 pm -

,mh said:

but that troublesome house even without the troubles was only worth 80,000

June 25th, 2009 at 8:58 am -

John said:

As a Californian, I can say that we deserve to go bankrupt…

We (meaning residents of L.A., San Francisco and Sacramento) elected a socialist governor, and Idiots like feinstine, boxer, and worst of all pelosi…..What else would you expect to happen?

I feel sorry for American, knowing my fellow Californians elected the worse candidates possible to send to Washington to help destroy the American dream…..June 26th, 2009 at 9:10 pm -

Fred2 said:

“It also sounds like a problem without a good solution”

Really? The problem is located in sacramento. The solution is legislators acting ina conservative and prudent fashion, starting with a 50% cut in expenses. REpeaking any manny of dumb laws would be helpful too.

June 27th, 2009 at 5:33 am -

Concerned Citizen said:

California is a very, very expensive place to live, but you have not talked about where all this money goes. The best estimates I’ve seen showed that about $10 billion a year goes to services for illegal aliens. Pensions and salaries for government workers are off the charts. The state legislature was gerrymandered to the point where elected officials can’t be removed from office. Proposition 13 offers rent control for property owners and now they can gift their home (with it’s low property taxes) to their children. Identical houses next door to each other pay wildly different taxes, based only on how long they have been owned. What’s the solution?

You can move out of state, or you can fight this system. What’s happening here is going to happen elsewhere, the temptations are just too great to the politicians. Elect responsible officials who are committed to solving this problem. Starve the beast by becoming self sufficient in many things and cut spending as much as possible. Barter and “earn income” in non-cash ways. Go “off the financial grid”. It’s much more convenient for a state to tax money than to take actual property.

June 27th, 2009 at 10:17 am -

Gregg said:

Federal taxes are $2400. CA taxes are $666. I’d say the problem is in Washington.

June 27th, 2009 at 7:20 pm -

katiya said:

and I thought living in Washington with no state taxes was expensive. We have 9.5 sales tax as well. No Prop 13 here. My parents benefited from Prop 13 but it was just too cost prohibitive to live there anymore. They sold their house at the height of the housing boom and moved to a low tax burden state.

California is a disaster and needs to be fixed pronto. I wouldn’t live there myself. Enough of supporting the non legal people on the dole though, that should be outlawed right now! My aunt works for the state and she verifies illegals get benefits before legal citizens. Shameful!!!!

June 27th, 2009 at 9:00 pm -

John said:

California is a lost cause. Immigrants, both legal and illegal, have destroyed the State. It is appropriate that SwarzenKennedy be the Governor As Mothernature gives her the coup de gras.

June 28th, 2009 at 7:12 am -

Keepin it real said:

Lets keep it real. Why blame it on immigrants? They don’t make the laws here do they? My goverment does and that same goverment is yours. We have all talk shit about illegals but if we ever need repairs at our houses we don’t call Joe’s Contruction Company we go to the local Home Depot and get some mexican guys to do it for 1/3 of the price and the quality might be the same or better. Lets keep it real. Why all these big companies keep going over seas? I bet is for the labor cost and taxes, who doesn’t agree?

I could keep on going, lets stop talking about people that don’t have anything to do how this country runs is MY GOVERMENT that f#7k up. Im sure my neighbor John wouldn’t like to work on the valley for $8 the hour under the son picking tomatoes and guess what he is loosing his house and recently got laid off from work. Guess what he said…. I’m going to milk the system before I start looking for a job…. ?…. This smart answer came from a Computer Engineer.. WTF? He also like many of us blame all in the illegals, blacks and low income people. Think again we all suffer and the CEOs are laughin at all of us, they eat, sleep and travel as much as they want and we can’t even take our kids to Disneyland because gas prices are high..

Who wants to be real?

July 12th, 2009 at 8:46 pm -

Jonas said:

Excellent even-handed article that succeeded in avoiding the political mud-slinging to focus on the accounting mechanics underlying the difficulties facing CA. Thanks for that.

Of course, the shift away from property to excise, income and capital-gains tax have decided deep political motivations that were the source of the problems and cannot be ignored in seeking a way out of the morass. In a form of double jeopardy, ideological thinking of the ’70s, ’80s and 90’s displaced logical analysis in both political parties – as if the laws of economics could be modified by majority vote, political will, arguments, and persuasion (they can’t) and celebrity, independent of competent experience, were sufficient credentials for office (it isn’t). Fighting the latter impulses, while difficult, offers some hope of revival while accepting them as inevitable makes catastrophe inevitable.

As with the national political parties, the state parties are operating in two parallel universes that make little or no contact with each other (the ideological approaches) with each seeking its own goal no regard to the economic consequences in one case and no regard to the social consequences in the other. The author rightly cites the bubble-to-bubble gymnastics that both parties have been exhibiting – to try to serve both masters simultaneously, while merely picking at the opposition’s short-sightedness when they sense an opportunity to garner a few more swing voters. Given that both are populated with ideological demagogues of featherweight competence, the worst solution would be compromise, the standard fall-back solution for any two rational parties and democratic government. Compromising two irrational systems of thought and policy does not produce either rational thought or policy, but only greater irrationality.

That’s the problem as I see it and I’ll leave the listing of the ideological contradictions for another time and place.

October 21st, 2009 at 8:03 pm -

ttdub said:

Okay about what keepin it real said. I’m sick and tired of people who talk crap about CEO’s (I’m not one!) If you think they make so much money, why don’t you become a CEO?? Oh ya, that’s right, because it’s really really really really hard to do what they do and get that position. Your life has te be litterally devoted to your work, but you’re not willing to do that. In fact very few are (HENCE WHY THEY MAKE SOOO MUCH). They deserve what they get paid because most people, if they were guaranteed to make millions but had to work 75 hours a week for 10 years to get there wouldn’t and those CEO’s aren’t even guaranteed. You have the same chances they do so quit talking crap about them. Also, do you know how much the top 1% pays in our taxes?????? 70%!!!! Those “big bad billionaires” pay for 70% of America. So I don’t want to hear any more boohooing!

December 11th, 2009 at 2:25 pm -

ADolf Hitler said:

Let Everything just go to hell, let people get a glimpse of what other 3rd world countries live by.

February 20th, 2010 at 6:10 pm -

lyla rose said:

OMG. I cannot believe you posted this. This is exactly what I am going thru and cannot believe it. I am serious. I have been saying, “Are they really taking almost half of our income?” I keep thinking I am seeing something wrong on the statements. It’s unfreakingbelievable(yes I made up a word.) And then they wonder why we can’t afford children? I am curious how different it is in other parts of the world, because in areas outside of Philadelphia the property taxes are insane(like 7000 plus a year average. For a 800,000 home like 17 to 20,000 a year.) I am shocked at this world, and not proud to be living here because to be honest, I would have thought you were doing well with 100,000 a year income. It is sick. We finally got it and WTF? Yeah. Well my neighbor is an oncologist and she said she is broke barely making over 60,000 something is wrong.

May 20th, 2010 at 6:24 pm -

Bannishthetaxman said:

GREED. cost of living in California is absurd. To think that with 50 percent of one persons income going to some kind of tax those receiving the tax would have the coffers overflowing, yet they are scraping the bottom of the barell. Let’s not forget those A holes from that small California community paying themselves ridiculous amounts of money, follow the money, it always leads to Greed, Theft, or a politician.

June 15th, 2015 at 6:29 pm -

HONEY WATERBURY said:

Useful discussion . I was enlightened by the analysis . Does anyone know if my business might be able to find a blank IRS 706 document to edit ?

June 30th, 2016 at 4:29 pm