US households cannot avoid soft default consequences of deleveraging: While US households continue to unwind debt total public debt soars out of control.

- 0 Comments

The US is walking in a financial minefield. The recent government shutdown simply highlighted the mega dysfunction in our Congress run by millionaires. The government is in a deep capture by large financial interests. The IMF now has an indicator looking at household debt measured against GDP. Since the recession, US households have undergone a painful deleveraging. The number of people on food stamps doubled from 23 million to over 47 million where it still stands today. This isn’t exactly a common recovery. Unfortunately it costs money to get your message out and those facing the pangs of the soft default have no media microphone. The press continues to march on as the debt machinery is back in operation but we are simply setting up the platform for the next major financial crisis.

Austerity for you, digital money printing for me

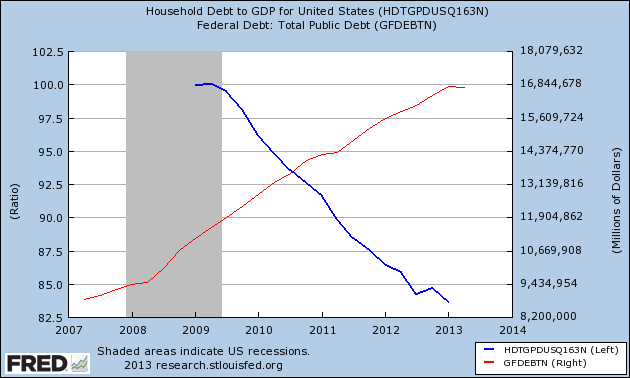

As mentioned before, the IMF now is calculating household debt compared to actual GDP. This is a good rough measure. In the US, it was no coincidence that our economy imploded when household debt hit a 1:1 ratio with annual GDP. Of course while households are taking the bitter pill of deleveraging banks and the government continue to spend money that really isn’t there:

So the “recovery†has been shouldered by US households for the benefit of a small few. This is abundantly clear. The government is merely a representation of the public, at least in theory. Taxes are collected from the public to run the system. And this is why the shutdown was so ludicrous because we had a Congress full of millionaires earning good money from taxes unable to actually do their jobs. It was a giant theatrical show to appease their financial overlords. They flat out do not care about the public.

This is why the peak in the stock market and now a new emerging housing bubble are leaving out most Americans. Americans have been cut out from this recovery. They are merely spectators to a system that they have bailed out. The public never voted on any of this. It is just a mass acceptance and people are numbed by shiny gadgets and plastic credit cards.

Household incomes

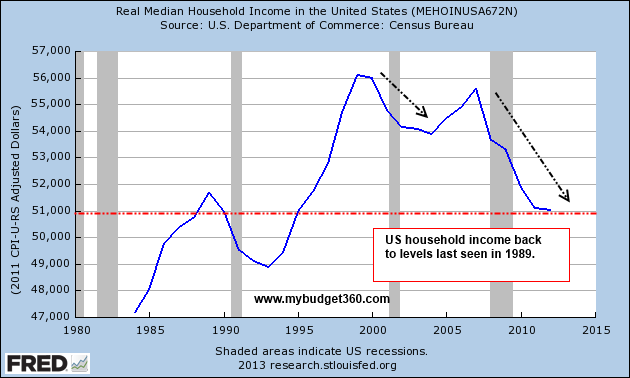

Adjusting for inflation, the juice of a soft default, household incomes are back to where they were a generation ago:

Does this look like a recovery? No. In fact, this is what a soft default will look like. These debt ceiling issues are going to continue over and over especially as millions of baby boomers begin to draw upon a system being supported by a much less affluent young generation. That is a battle for another day apparently but there is simply no way out of this debt quagmire. They never labeled QE as a bail out but that is exactly what it is. A bailout to the connected banking system. Whatever crumbs fall to the floor to the American public is only an afterthought once the best nectar is sucked by the banking system. This is how we have a flood of hedge funds and banks now gobbling real estate as if this was a healthy part of our economy.

Debt for you, assets for me

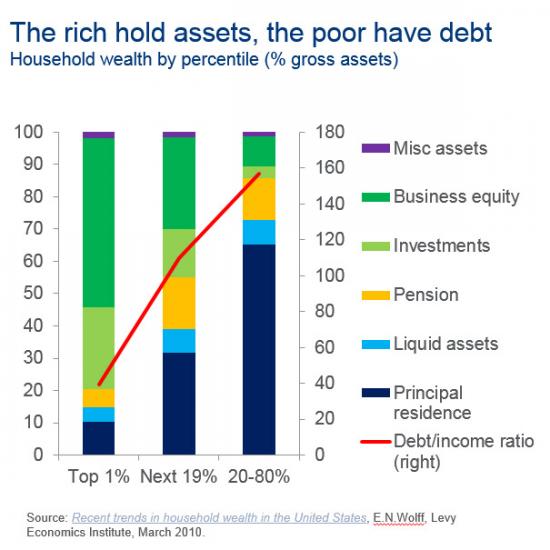

This leads to the next breakdown where the rich own assets and the poor carry an albatross of debt:

This is what makes the current real estate grab by banks so troubling. This grab is being assisted by QE to member banks and the public is largely losing out. How? First, rents and home prices are rising with no real rise in incomes. Is this good? It is simply a form of inflation. In a system of debt, money is debt and debt is money. Access to debt has been largely cutoff to regular households and has been given the big green light for financial institutions. Why else would real estate prices be rising so quickly without any real gains in the underlying economy? It also explains the massive amount of investors purchasing real estate.

A soft default is unavoidable but the problem is most of the burden is being pushed onto the majority of Americans for the benefit of a few. Over half of Congress is made up of millionaires. How many have big money invested with hedge funds or contacts in the financial industry? Do these represent the typical American worker making a per capita wage of $26,000? Probably not.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!