Housing Bubble Genesis: 5 Reasons that Didn’t Cause the Housing Bubble and 5 Reasons that did.

- 2 Comment

There is a danger in having power. Credit at least many decades ago was seen almost as an extension of the morality of the borrower. That is, the way credit was given many times reflected the capacity, collateral, and character of the borrower.  Main Street is already feeling this recession like the worst since World War II and credit is tight for most average Americans just like it was back then. In this recent bubble, all 3 historical credit factors were disregarded. Capacity was never examined in many cases. Collateral? Not much collateral with zero down mortgages. And character was never evaluated. How can one expect unethical lenders to judge the character of a borrower? Their primary concern was getting a fee.

There is much blame to go around regarding the housing bubble. I am certain over the next few years we will hear much written as to why this bubble was caused and have historical studies examining this in detail. Losing $50 trillion in wealth in one year warrants a deeper analysis. Yet we are now hearing revisionist theories as to why this bubble was caused. Let us first look at 5 reasons that didn’t cause this housing bubble.Â

5 Reasons That Didn’t Cause the Housing Bubble:

(1)Â Incomes Rising

*Click for larger imageÂ

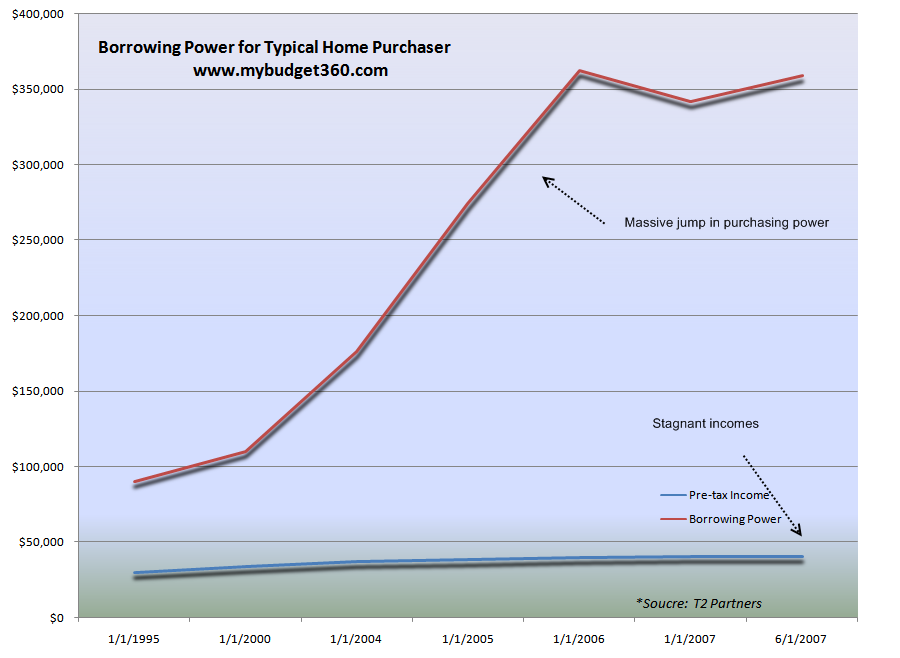

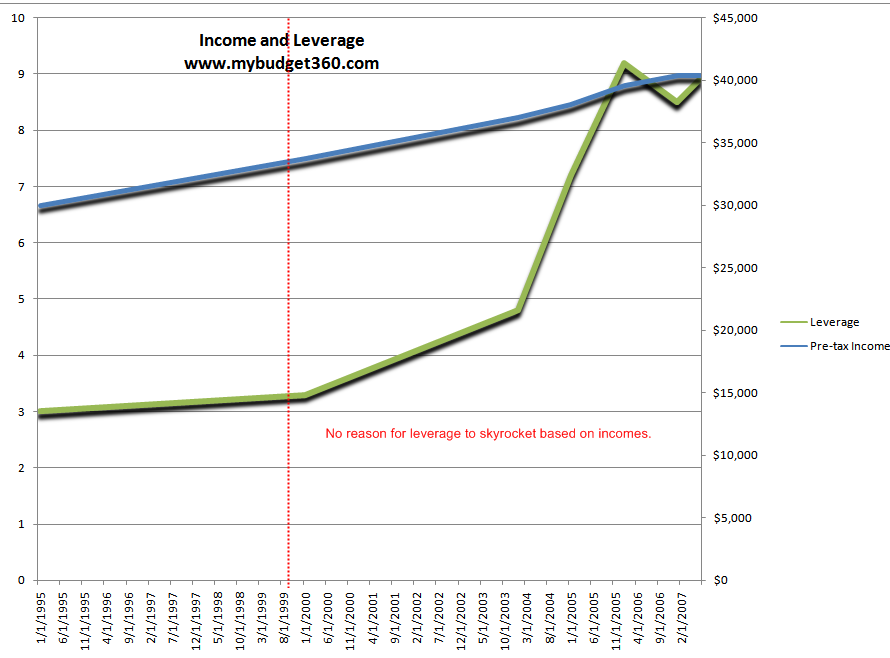

The first theory regarding rising incomes can be easily put to rest. First, we can measure over the past 13 years purchasing power versus incomes. As you can see from the above chart, the purchasing power of someone from 1995 to 2006 tripled while incomes only went up 30 percent. Incomes did not triple. The median household didn’t start making $100,000, in fact the median income for a family in the U.S. in 2008 is $46,000. There is no merit to this argument. Incomes did rise but not to the point of justifying the prices we saw in the current housing market.Â

(2)Â Land Shortage

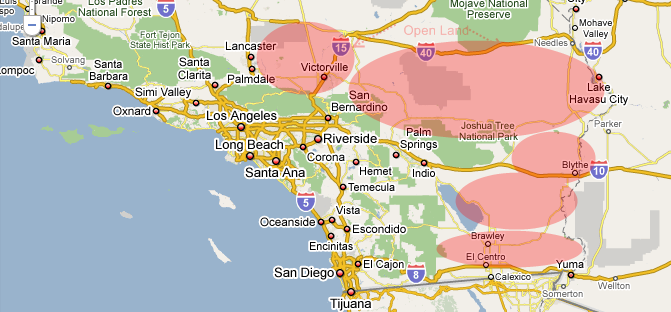

This was another argument that never held water. The notion that we were somehow running out of land. This argument was made in Japan during their real estate bubble and they actually had more ground to stand on with this argument since they are after all an island. Yet the U.S. has none of these limitations. In fact, take a look at the Southern California map above. This was one of the preposterous notions going around California during the epic bubble here in the state. All the circled areas for anyone who has flown or driven through the area, are places where theoretically homes could be built. Hey, if we can build a gambling paradise in the middle of the desert with Las Vegas, there is no reason for homes not to be placed here.

Yet the truth of this argument is people wanted to live in coastal regions. So the argument should have been rephrased to say land shortages in prime coastal regions. Well, that is always the case. Yet many areas that were never prime or even near the coast went through the roof.

Many studies have come out saying that we have a shortage of “affordable” housing, not mega priced bubble homes. The fact that California will see at least a 50% peak to trough drop in price should cement any notion that prices went up because of land shortages. Clearly, there is plenty of land.

(3)Â Poor People

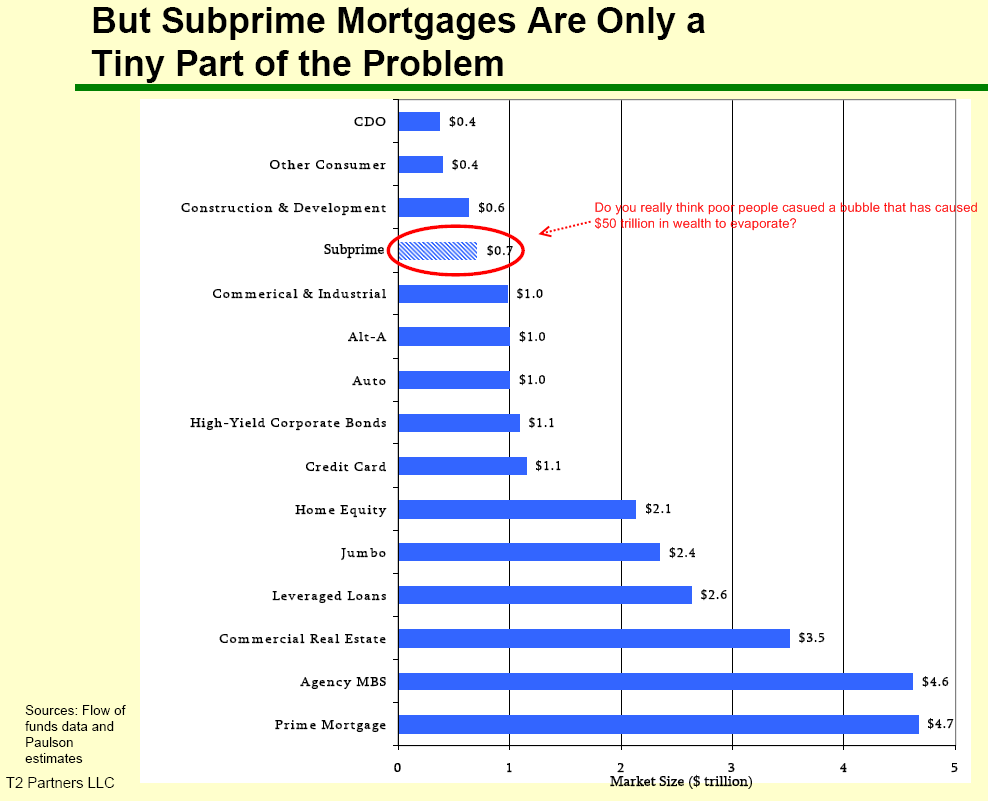

For a few months, we had some absurd notion that poor people caused this global credit calamity. $50 trillion in global wealth evaporated because some people in the inner-cities of America bought too much good property. Show me a poor person buying a $10 million home in the Hamptons or Beverly Hills. By the way, many of those properties are now selling for millions off but I doubt someone making $46,000 a year is going to buy that up.

First, take a look at the above chart. The subprime problem, or loans made to those with poor credit or weak incomes was only a tiny portion of this global mess. In fact, most of the subprime problems have already washed out. They were the first to default since many of these people were marginal to begin with. They had no buffer to back them up from any economic calamity. Most of the subprime debt has already been written down by originators since the likelihood of collecting is very slim.

Yet this notion that somehow poor people through down payment programs or government encouragement caused this bubble is flat out condescending and points the blame on the wrong group. Where there many lower income people that bought homes that shouldn’t? Of course! But look at the above chart and you tell me that this was the reason for the housing bubble. It wasn’t. Most of that has already washed out of the system. Now we are seeing prime and Alt-A loans go bad. Why? Many hard working Americans, middle class Americans are losing their jobs. If you want to call someone that went from middle class to poor as causing this housing bubble then you are probably left with little evidence to justify your argument. The data simply does not back you up.

(4)Â New Paradigm

The fact that the bubble has now exploded is proof enough that this idea is wrong. There was and is no new paradigm with housing. Historically housing has always been a relatively boring investment. This housing bubble was sold on similar ideas of the 1920s Florida housing bubble which also included Charles Ponzi, the person who now is referenced when we talk about Mr. Madoff and his $50 billion Ponzi scheme.

The new paradigm was based on this notion that housing and finance have somehow through financial alchemy created a new way of looking at the world. Through risk management all problems were washed out of the system by creative financial tinkering. This of course is wrong and made no sense.

The bubble bursting is enough reason to put to rest this argument.

(5)Â Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac, the two big government sponsored entities are still taking much of the blame for this housing bubble. In fact, these two entities came late to the toxic mortgage party. It is true that these 2 agencies have extreme problems yet they were egged on to get into the toxic mortgage party and fortunately, did not jump in head over heels. Most of the truly toxic stuff like option ARMs and subprime stayed out of the books of Fannie Mae and Freddie Mac.

In fact, the next big problems we will see will come from the option ARM front, something Fannie Mae and Freddie Mac have nothing to do with. So blaming Fannie Mae and Freddie Mac for our problems is missing the point. The fact that many so-called cautious business people were encouraging Fannie Mae and Freddie Mac to step into the toxic mortgage lender vacuum was absurd but proves again how looking at them is barking up the wrong tree.

For the most part, Fannie Mae and Freddie Mac purchase relatively safe mortgages. Yet what is truly safe when we have a global calamity and market volatility not seen in over a century?

5 Reasons That Did Cause the Housing Bubble:

(1)Â Wall Street

Remember that chart above when we talked about poor people? Well that chart also includes many kinds of mortgage debt. If you add every area above you won’t come close to matching the credit default insurance market which was a pet project of Wall Street. Now take a look at this chart:

This market is huge, unregulated, and a financial bomb that has been going off. In fact, when Lehman Brothers collapsed one of the fears was the collateral it will cause with other folks making these bets. Where you making these bets? Do you think poor people were investing here? Do you think average Americans have any money here? Sure, we can argue that some top mutual fund investors placed the money of many Americans here but that was stupid to begin with. This market is an absolute mess and larger than any can imagine.

The fact that the credit default insurance market is twice as big as the U.S. stock market should tell you something.Â

Many times Wall Street made bets on non-existent things, derivatives (as in derived from phony make believe notions) and placed large amounts of money on these make believe securities. Since they needed some substance for this make believe, they had a never ending appetite for mortgage backed securities. That is, their hunger allowed lenders to make the most absurd loans and find a market for it. After all, if a lender needed to hold a mortgage on their books, do you think they would make it? Of course not.

Now, standards are back into place and we are seeing that Americans even with historically low interest rates still have a hard time buying homes in this current market. They were able to push prices higher because of the leverage we discussed earlier. It wasn’t income. It was the ability to get these loans. Yet Wall Street never exercised restraint or caution here. In fact, they put the world economy at risk here and now are complaining to our government for bailouts which include nice little paychecks for them. Shouldn’t we be throwing these people into jail like the criminals they truly are?Â

(2)Â Lenders willing to allow higher debt-to-income ratios

You need to remember that lenders did not operate in a vacuum here. Taking reason number 1 above, you can understand why lenders were so willing to make these toxic mortgages with no hesitation. In fact, if you look at the credit default insurance market, there is almost a perfect correlation between the growth in CDS and toxic mortgages. After all, the geniuses at Wall Street figured that you can take a toxic mortgage and with the right kind of insurance, insulate yourself off from any problems. This is like a fountain of youth argument. Life is full of risks. You can’t make a toxic loan turn into gold yet this is what they believed. They believed it because they made bets on this assumption.

Lenders of course not caring about collateral, capacity, or character were driven strictly by fees. That is why many once mighty lenders like IndyMac and WaMu are now gone in the ash heap of banks who believed their own hype.Â

So lenders followed the “well X should have known better” mantra meaning Wall Street should have done THEIR due diligence while they collected their absurd fees while doing zero due diligence. They were complicit just as much as Wall Street. But in raw numbers, they were merely puppets in the game of Wall Street if you look at the nominal values. Many smaller lenders are realizing you need big sums of money and political connections to receive bailouts. Many of the i-banks had this aside from Lehman Brothers.Â

So lenders were all the willing to make toxic loans and Wall Street was more than willing to oblige to purchase these loans to make more stupid side bets on loans that really never had any chance of ever being repaid.

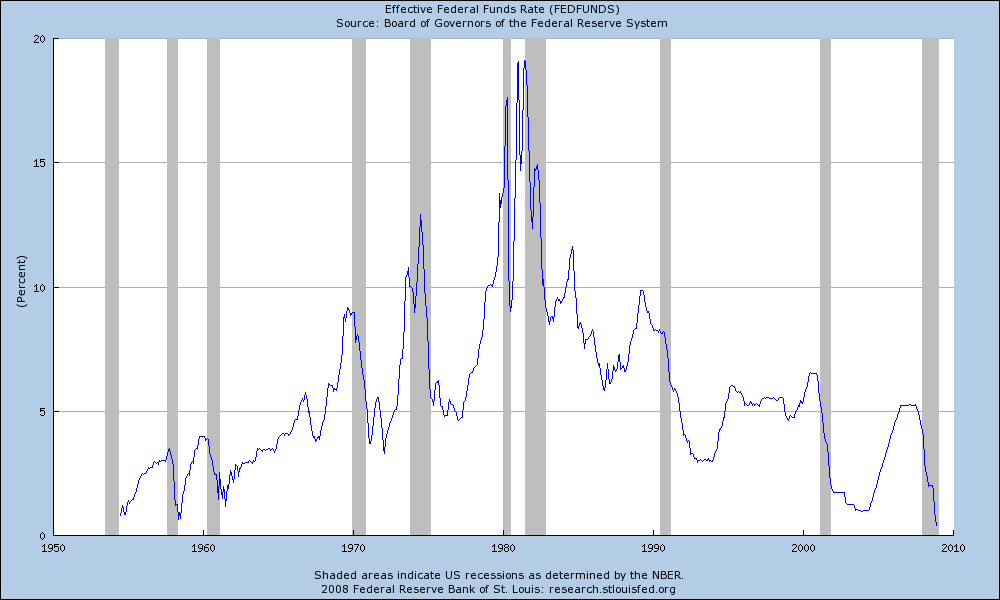

(3)Â Falling interest rates encouraged by the Fed

Let us first say something. The Federal Reserve cares nothing about the U.S. Dollar. The U.S. Treasury doesn’t care if the U.S. Dollar carries the same value as toilet paper. As I’ve argued before, their policies in fact are hoping to destroy the U.S. Dollar.Â

Alan Greenspan once stated publicly how fantastic adjustable rate mortgages were and encouraged the use of these. Recently, he has been on a legacy tour yet thanks to the speed of the modern press his reputations is taking the much deserved hits it needs. He is an accomplice to this housing bubble. His record low rates and notion that adjustable rate mortgages were good demonstrate his responsibility in knowing that lower rates would thus fuel more borrowing. Remember that crazy leverage chart above? He was totally okay with this.

He took rates to record lows and thus created an environment that was still hungry for another bubble. He could have easily stopped any bubble from forming by taking rates a bit higher and making money harder to come by. We would have had a recession, maybe minor but now we are left with dealing with the worst recession since World War II.

Greenspan is gone and so is his reputation. Bernanke is now taking the ship and he is even less shy about destroying the U.S. dollar. The fact that rates are now at basically zero, shows how low he is willing to go. There is no bottom. In fact, now that we have reached bottom he is discussing more absurd notions of taking on more debt onto the books of the U.S. even though we already have $3 trillion of questionable assets on the books! By the way, Bloomberg and Fox are suing the Fed to release this data. After all, it is our money that is at risk.Â

The Fed is another party responsible for the housing bubble.

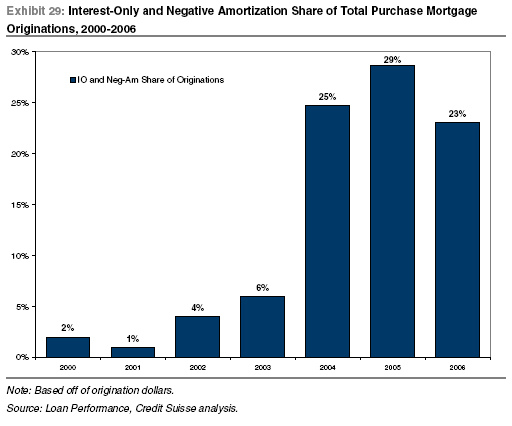

(4)Â Toxic mortgages

Toxic mortgages of course, were simply the weapon of choice of the above reasons. After all, you need an effective vector to gather and collect mortgages. Your army? Mortgage brokers and banks that have the ability far from Wall Street to find souls, any soul to sign their name on the dotted line to buy a home. The buyers have been primed by reality show drivel like Flip this House or napkin real estate analysis like Rich Dad, Poor Dad and the ground was set for nearly 3 decades to create this epic housing bubble. The bank and lender foot soldiers were easy to gather. All they wanted was a quick hit like a junkie. They wanted a fee and that was it. That is why many of these people now find themselves out of work. Very few invested wisely and many are now left broke or getting foreclosed since they bought into their own delusional analysis.Â

Yet lenders were the street dealers. Wall Street was the head capo at command central dishing out the orders on toxic mortgages. As you can see from the above chart, what we have recently seen is the world markets have done a global intervention and the game is over. The supply is finished. Now we are left dealing with this.Â

(5)Â Greed

None of this could have happened without the last ingredient. Human greed. That is why we have placed strong regulations on Wall Street since the Great Depression. The Glass-Steagall Act of 1933 established the FDIC and also included banking reforms which were designed to control speculation. This was all repealed in 1999. The major item was the ability for banks being prohibited from owning other financial companies. Why do you think JP Morgan Chase was able to gobble up Bear Stearns? Or Bank of America’s ability to buy Countrywide Financial and Merrill Lynch? Is this really good? Having these mega entities?Â

Either way, the profit motive is what drew many people to buy homes for speculation. It is the reason Wall Street created a credit default market that now rivals global GDP! Greed was the main reason banks and lenders pumped toxic mortgages onto the street in place of more traditional and safer conventional mortgage products. To say we are all to blame is too simple of an explanation. Some are much more culpable than others here. That is how we assign blame in our country. We don’t expect someone that stole $10 from their mom to be punished the same way someone who stole $50 billion from others. Or is our analysis going to believe the simple minded notion that poor people looking for land created this housing bubble?  Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Suziclue said:

You are so accurate with your points. I personally blame the Fed and the mortgage lenders for causing home prices to balloon the way they did between 2000 and 2006. It was a feeding frenzy when it came to buying a house during those years. It seemed as if there was no end to it. Well as we all know home prices have been dropping like a fly with it’s wings clipped the last year and a half. The trend in home prices look to continue down for atleast another 5 years according to the website:

I personally think it’ll hit bottom in 2015 and stay there for another 5 to 10 years. We won’t see 2006 prices until 2020.. Sad!

January 1st, 2009 at 2:16 pm -

Kirk I said:

Good research, some great enlightening points – especially with the CDI – though that might be a global number, it’s still staggering.

Disagree on several points though; 1) the SEC should have caught this regardless of Bugsy dereg – that was a competitive measure vs world banks. Remember, Regulatory legislation DOES NOT work, never has, never will. For every Gov politician setting a Reg, there are 5 MBA’s and 5 lawyers figuring a way around it. This creates the complex derivatives and CDI junk that no economist can figure out!!!! 2) If you add subprime with Alt A paper it’s a bigger issue than you admit to, and affects market dynamics more than you indicate. (this greatly decreases supply and increases demand. 3) I also think you’re a bit naive on the congress side of things. Their implicit backing (GBE) of Freddie and Fannie was yet another factor in this toxic soup. To say F&F just “have problems” is laughable.

Yes wall street’s to blame; yes the loan originators and derivatives are to blame. But greed certainly isn’t – without the complex regulation, raw capitalism would have weeded this out long ago with pure risk v reward. Did you see Congress or the so called regulators really trying to hang someone for this…didn’t think so, they just threw more money at them. As for the Obama’s Trillion dollar give-away, didn’t work in 1939, won’t work in 2009.

We’re all idiots for buying that stock.

February 19th, 2009 at 5:21 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!