$50 Trillion in Global Wealth Gone in 1 Year: Examining the Financial Markets of the World.

- 3 Comment

Even after the historic stock market rally, global markets have lost $50 trillion in wealth over one year. I think people still haven’t come to terms or grasp the magnitude of wealth destruction we have just lived through. Sure, we can flip out about the $200 billion the U.S. Treasury injected into consumer debt markets so people can go out and jump on the consumption treadmill on Black Friday but that is a drop in the bucket compared to the wealth destruction we just went through. And future indicators point to further market distress.

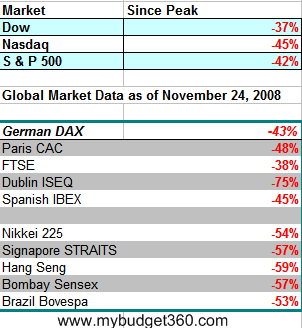

What are the 3 major areas where this wealth was destroyed? We have global equity markets, real estate, and commodities. First, let us take a look at the financial damage done in the global financial markets:

In this area alone, more than $32 trillion in global wealth has evaporated. The global stock markets provided the quickest and most up to date information on the perceived market value of actual assets in countries around the world. The fact that we are $32 trillion poorer on paper this year than in 2007 should make you think what exactly happened to that money? If you need a helping hand you should read the article describing deflation and exactly what wealth destruction will do to a society.

Much of this destruction is based of course on the credit crisis. So far, institutions have taken credit losses on bad loan write-downs to the tune of $910 billion. Of course this is only the tip of the iceberg when we consider all the commercial real estate that will be busting in 2009.

So that is one area where the money has evaporated. Let us now look at how much wealth has been destroyed in U.S. real estate markets. During the peak, residential real estate in the United States had a value of $24 trillion. Since that peak, as measured by the Case-Shiller Index U.S. residential real estate is now down by 22%. So only in residential real estate in the U.S. $5.28 trillion in housing wealth is now gone:

$24 trillion x 22% = $5.28 trillionÂ

Keep in mind that this doesn’t factor in the collapse of the commercial real estate market as well. In addition, there were global housing bubbles in the U.K., Spain, Ireland, Australia, and China that are facing similar price declines to the United States.

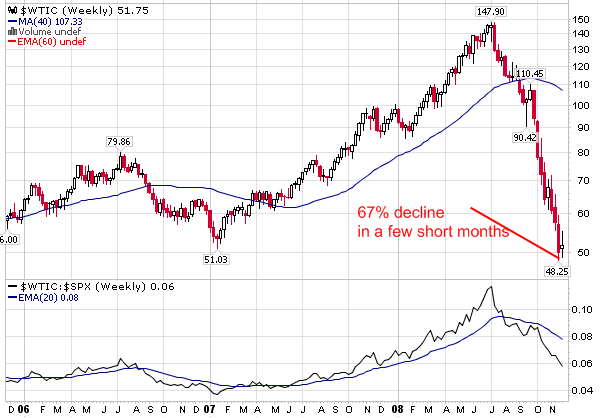

The other wealth destruction comes from the utter collapse of the commodities markets. The most visible and probably most highly followed is the collapse of the oil markets:

The oil markets have collapsed by 67% since the peak of $147 a barrel was reached.  This is a stunning reversal of the fortune of many countries dependent on oil. For example the Russian Trading System Index was holding up a bit stronger due to exports in oil but with the collapse, the index is now down a jaw dropping 74% and the market had to be closed a few times during the turmoil.

What this global collapse should prove is that anyone that thought that there was going to be decoupling was simply wrong. We are completely tied together. No economy is isolated and what this shows is that there was really hardly any place for money to hide.

$50 trillion is now gone from the system. Will there be more losses to come?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

jimbo said:

ad that my house is paid for and that i have converted all my 401k to a yellow shinny metal. if everyone else has time to do this i suggest that you do the same.

November 28th, 2008 at 11:46 pm -

Mike said:

Wealth do’es NOT disappear it is transfered.

SO, Where is the money….? ? ?

Some-one SOLD at the Peak.Has OIL Demand fallen 66%, like the price…!!!

No, but supply is DOWN 9% in 2008Could 3billion$ Ameranth ..ALONE… speculate the oil price up to 147$

NO & NO

Is the WHOLE Electronic market RIGGED…with Promis spy-ware by

the FED,Cia or Rothchilds, Hijacking the trading platforms.

IS that why the IRanian oil Boers MUST be stopped, because they REFUSE to USE Microsoftware….November 29th, 2008 at 2:08 am -

A. S. Mathew said:

Very informative article. The wealth lost to the world in trillions, how long it will take to build up? Then the next question, without having wealth to invest, how wealth can be created?

So, the whole world is caught up in an unimaginable gird-lock of economic challenges and questions. The GDP of the six OPEC countries in the Gulf region was 1.8 trillion in 2013, while the oil price was over

$ 115.00/barrel, now the price is half of that. The Asian economy is going to feel severe economic whirlwind. The lost commodity price in coal-oil-iron-copper-rubber-natural gas etc etc is by the trillions, the purchasing power of the people engaged in those commodity trade are in serious trouble. The State of Kerala in India produce 90% of the rubber for India which is the 3rd largest consumer of rubber in the world. The rubber price is hit too low, in 2011 Rs. 247.00/KG, but now it is Rs. 117.00/kg. 11 million people are making a living through rubber plantations, marketing and service jobs.The domino effect of the oil price crash will be far-reaching, they will be cutting down on their massive construction projects, less import from the emerging Asian countries, and millions of expatriates from those countries are forced to leave the country. This world-wide economic meltdown is like the third world war but there is no planes and bombs.

December 11th, 2014 at 12:46 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!