Atlas Vacant – The Commercial Real Estate Bust: Gearing up for a $3 Trillion Headache. Increase in Vacancy Rates and Higher Defaults.

- 3 Comment

The commercial real estate bust is going to be legendary. We are talking trillions of dollars. The attention of Americans is being pulled away by massive market volatility that has seen the S&P 500 shoot up 44 percent in four months. Yet the U.S. Treasury and Federal Reserve have kept their eye on this market and have started examining a “Plan C†focused on bailing out this industry even before major problems occur. The new preemptive doctrine of bailouts. That is, they want to saddle the taxpayer with further burdens on some of the most speculative bets known to humankind.

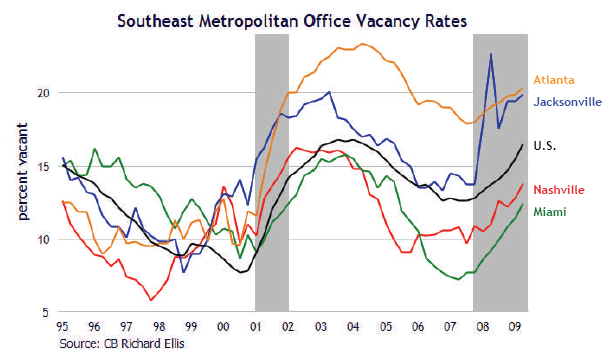

First, it is certain that commercial real estate will have problems. If we examine certain vacancy rates, we see that they are already starting to creep up:

The above chart is merely reflecting the deep contraction in the real economy. Businesses are needing less and less of that plentiful office space that is floating in the market. So much for the dream of an Eames Lounge chair sitting in your office space, entertaining clients while the $5,000 monthly lease payment sits on your mahogany desk. On the other hand, if you are looking for retail space you will find some room to negotiate.

More supply with less demand equals lower prices. Lower prices means tanking commercial real estate operations. You see, just like the residential housing bubble banks made extremely risky loans on commercial properties on very thin capital. All was well as long as the market went up. Now the assumption was real estate values were never going to go down. This faulty reasoning was bad enough. But to assume unrealistic appreciation rates caused many banks to jump in head first into a pool with no water.

The reason this will also cause a financial headache is that many regional banks without the clout of bigger Wall Street banks will begin failing in mass. Many regional banks unable or unwilling to compete with subprime and toxic loans (or their local market didn’t have enough customers) started making risky bets with CRE. There are more CRE loans out in the market and people probably don’t have a solid grasp of this. Let us look at some FDIC data:

26 percent of all loans in FDIC insured bank portfolios are backed by the CRE market. In total, over $3 trillion in commercial real estate loans are outstanding. Of course, it is highly unlikely that this portfolio will fall to zero but commercial real estate has less of a buffer than residential real estate. How so? An overvalued home in an area with people will find a buyer. So even a loan that was made for $400,000 at the peak and now finds a bottom at $200,000 is very likely to find a buyer. That is not the case with many CRE projects. Some communities are economically in shambles so there may be zero incentive for any business to rent even if the price was zero. Ultimately CRE is a business decision. A home can be just a home as we are now re-learning.

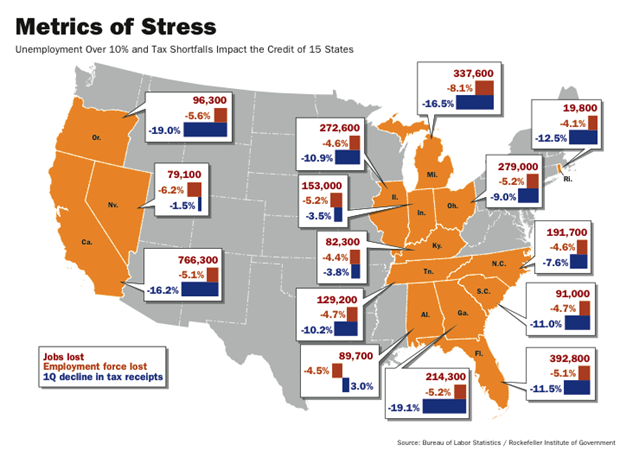

How many states are in tough times?

*Source: Bond Buyer

A large focus has been given to California but countless states are facing budget deficits. Budget deficits do not have an allegiance to the sunny west coast. Deficits are only going to increase as the unemployment rate climbs. The American consumer is being squeezed on multiple angles including onerous credit card gimmicks so many are cutting back on spending (aka less foot traffic in commercial real estate properties).

All across California vacancy rates are increasing:

*Source: L.A. Times

“Among his tasks is finding a buyer for Park Fifth, a stalled $1-billion high-rise condominium and hotel development proposed for a block next to Pershing Square downtown. At Playa Vista, he advised the owners of the enormous Spruce Goose hangar — built by famed aviator Howard Hughes — to take it off the block because prices are depressed.

Muhlstein tries to use humor to cope with hard times in the commercial real estate industry, a business in such pronounced distress that some experts predict its problems will thwart the nation’s hopes for an economic recovery.â€

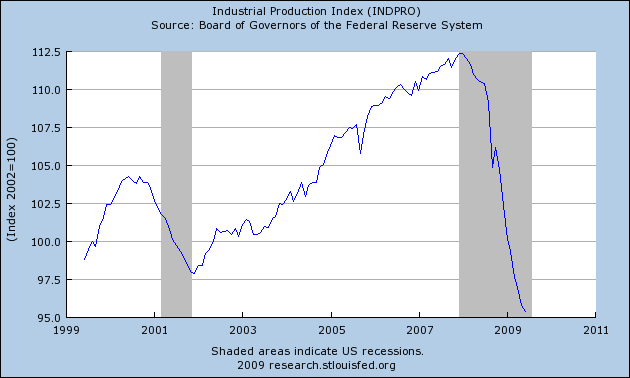

The commercial real estate bust is simply gigantic and is a coming down the tracks at a hundred miles an hour. We are now seeing Manhattan real estate coming down in the double-digits which was heresy during the bubble. The market has changed and in the real economy, not much has changed:

Industrial production is still heading lower. So why would businesses need so much office space? Do some people still believe in that service sector mantra? The one in which we basically offshore any goods-making jobs and basically sell homes and financial products to one another while not manufacturing anything? As this recession is now showing, that assumption was wrong.

The market recovery is based on optimism that things will be back and we’ll see some kind of “V†shape recovery. There is no room for an “L†shaped recession or a double-dip recession in these predictions although that is most likely what we will get. The current economy is juiced on stimulus plans, bailouts, easy money from the U.S. Treasury and Fed, and other supposed temporary measures. The market is being supported by Atlas but can he hold the economy up like this forever? Probably not and commercial real estate is going to be a gigantic collapse. 7 banks failed on Friday and more are coming.

3 Comments on this post

Trackbacks

-

deflation now said:

The question is at what point will the market recognize this? It seems that no matter what happens the market just keeps going up. It just doesn’t make sense.

July 27th, 2009 at 5:58 am -

Marc Narosny said:

I believe your recent article on the commercial realstate bubble that is about to burst, is spot on. By the time the Fed’s can clear another bailout, if in fact they can, it will be too late.

What we are witnessing here is the total collapse of the US economy, and it will bring down much of the world economy with it. Great Britain, Ireland, the Baltic Nations, and much of the European Union sits in toxic debt and near bankruptcy.

Manufacturing is gone in the US, as is the American consumer, which this economy relied on for the last 30 years. Between unemployment skyrocketing, and no more credit available, and the debt taken on, retail will collapse by the end of the year.There are too many factors as you have stated for any economic recovery. The system is broken, and the patient is on life support!

China and the rest of the world, mainly Russia Brazil, and India are unloading the dollar as we speak. It will soon become apparent that the bond market will collapse, as it is being manipulated as we speak. The US printing presses are on overdrive, and will soon dissolve into oblivion with the dollar tanking, and the American people left out to drift into an unknown future.

Mankind has not learned from past history. Greed and corruption have taken away the freedoms we have enjoyed for many years. It’s time for humanity to break the chains of bondage that has prevented him from shifting into a new paradigm of existance, where learning and sharing of ideas, and helping one another will lead us to a far grander existance.

We have been a slave to this banking system for all too long! There is a part of the human race who understands this, and will survive what is about to take place. They will take us into the next paradigm shift, where we will not be enslaved by corrution and greed, and where humans will not have to worry about paying for energy. With the technology we have, the knowledge is here right now to provide energy to the whole human race.

It’s time for the leaders of this planet to understand that there is no place for wars and political agendas. The Earth changes taking place is a message to all of humanity that the planet is saying enough is enough. There will be no more polluting, deforestation, and the mass killing of sealife and other species. This reality as we know it is coming to an end.

What we need to focus on, is the positive vibration that connects humans and the rest of the multiverse. For we are all interconnected.We are all made of the same star matter. It’s too bad we are manipulated by the Elite evil entities of the world, and they are brainwashing most of the masses into thinking everything will be alright. Far from it!

But, they to will find out soon that what they are planning will never work, and it will implode into a billion fragments of matter, never to be erected again. Mankind was meant for greater things, there are other civilizations out in the multiverse who are millions and billions of years ahead of us, waiting to teach us their wisdom, and help us to achieve a greater understanding of how things work.

It’s not the finish line that’s important, its taking a quantum pause, and slowing things down, and enjoying the journey. Watch a turtle one day, they live much longer than we humans, because they aren’t in a hurry to let life pass them by.

Best regards,

Marc

(aka TimeTraveler)July 27th, 2009 at 9:43 am -

silver said:

Plan on the government taking every opportunity to bailout everything that fails and placing the pricetag for that bailout on the taxpayer in an orgistrated effort to destroy the middleclass period……that plane an simple is what is happening and until we say enough is enough it will continue to happen…….our president is just giving them more time to accomplish there sculdugery…..he is just a plant for the elites elected by the people with a plateform of lies for change an yes we can slogans to buy time…..it’s time to say TIME THE HECK OUT.

July 27th, 2009 at 9:52 am