Bear Stearns: The Rise and Fall of the Mighty Bear.

- 0 Comments

Unless you’ve been living under a rock, you are probably aware of the JP Morgan/Fed orchestrated bailout. The amazing thing about this entire situation is how quickly Bear Stearns went under. In the matter of one year, the once fifth largest investment bank was bought out for a pittance of its once mighty price. Bear Stearns has a long and storied legacy going back to 1923. Bear has lived through numerous recessions and the Great Depression. The company has approximately 14,000 people and as of last November, was generating a net income of $233 million.

Bear even as recently as 2005 to 2007 was listed as “most admired” securities firm according to Forbes magazine. If anything, it seemed like the mighty Bear could do no wrong. That is until the credit crunch hit.In June of 2007 Bear had to come up with over $3 billion to bail out one of its funds that was dabbling in collateralized debt obligations (CDOs). Incredibly these funds were seized at the time by Merril Lynch for $850 million who was only able to get $100 million for them on the auction block. Talk about mark to market. This little hiccup turned out to be the tip of the iceberg as we entered August and the market pummeling credit crunch.

The company had a fabled somewhat legendary status. With Alan “Ace” Greenburg, the mythic chairmen of the board for nearly two decades, the company was a destination for many Wall Street types. But as the market would have it, having way too much leverage in a time when credit is tight and investors are jittery, the investment bank saw a run and in a matter of a week, had lost over 90 percent of its initial market value. It is hard to say what exactly was the catalyst that caused the camel er, I mean the Bear to break its back but this may be a good reason:

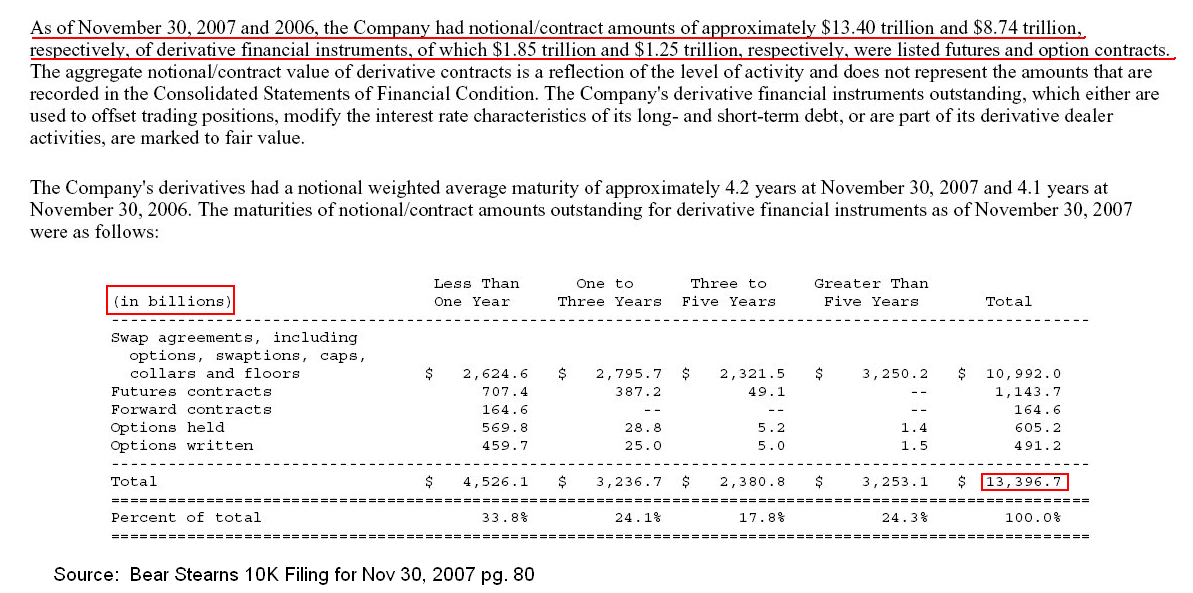

“First, as of Nov 30, 2007 Bear Stearns was counterparty to 13 TRILLION in derviatives contracts, as shown in their most recent public 10K Filing with the SEC. (hat tip to jerrbear from PrudentBear for tracking down the reference page. Great catch!).

As of November 30, 2007 and 2006, the Company had notional/contract amounts of approximately $13.40 trillion and $8.74 trillion, respectively, of derivative financial instruments, of which $1.85 trillion and $1.25 trillion, respectively, were listed futures and option contracts…

The Company’s derivatives had a notional weighted average maturity of approximately 4.2 years at November 30, 2007 and 4.1 years at November 30, 2006. The maturities of notional/contract amounts outstanding for derivative financial instruments as of November 30, 2007 were as follows:”

*Hat tip: Jesse’s Café Americain

There is a lot of talk discussing how great of a deal JP Morgan got Bear Stearns for but again, take a look at the counterparty risk that is involved. There is a reason why the Fed has offered up $30 billion in non-recourse loans to JP Morgan to assume the mess that is on the books at Bear Stearns. The irony may be that Bear Stearns may be one of many that have their hands in the counterparty cookie jar. Just like Bear was early in June with its imploding hedge fund from the August crunch, it is quite possible that they are early here with the unwinding of the counterparty market which the Fed knows that it has one and only one shot to save. Once the unwinding and panic sets in this market, there is no putting the genie back into the market.

What Bear Stearns also shows us is how deceitful Wall Street can be to a public that relies on transparency to invest. On the week before the collapse CEO Alan Schwartz had this to say:

Chronology of Events:

Wednesday March 12: “Our balance sheet has not weakened at all,” he said. “We don’t see any pressure on our liquidity.”

“There’s been a lot of volatility in the market, a lot of disruption. That’s causing some administrative pressure, getting trades settled. We’re in constant dialogue with all the major dealers, and I have not been made aware of anybody not taking our credit,” he said

Thursday March 13: “Our balance sheet has not weakened at all,” said Schwartz, noting that Bear’s $17 billion cash position was the same as it had been in November. On Monday, the company posted a similar message on its web site: “The company stated that there is absolutely no truth to the rumors of liquidity problems that circulated today in the market.”

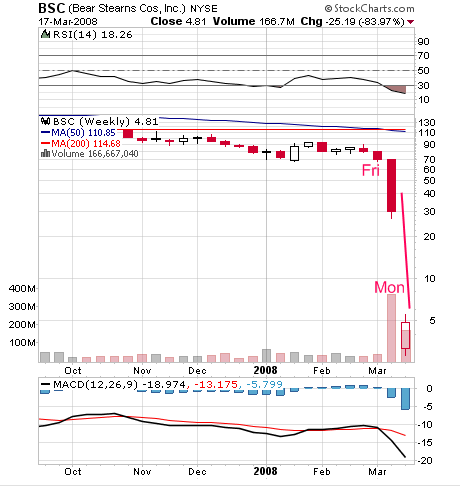

Friday March 14: Bear Stearns drops from a share price of $54.24 to $30.

“JPMorgan, backed by the Federal Reserve, provides an undisclosed amount of emergency financing to Bear Stearns. Bear says its liquidity position had deteriorated dramatically in the previous 24 hours. The stock plunges to close at $30.85. The average price target: $93.62.”

Sunday March 16: “JPMorgan agrees on March 16 to buy Bear for $236 million, or $2 a share, representing just over 1 percent of the firm’s value at its record high close just 14 months earlier. The deal essentially marks the end of Bear’s 85-year run as an independent securities firm. On Monday, March 17, Bear shares close at $4.81 on optimism another buyer may emerge. The average target price: $2.”

The Federal Reserve on an unusual weekend meeting, decided to accelerate the bailout by arranging the meeting and having the negotiations taken care of before world markets opened. The news was announced a few hours before world markets in Japan and Honk Kong opened but did little to relieve the market downturns. Overall global markets ended sessions significantly down. As the Monday session opened, Bear was trading slightly above the $2 target range, around $3 to $4 per share but significantly down from its $30 Friday close.

And so the mighty Bear has fallen. The only question is, will there be others to come or was this an isolated event?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!