California MLS inventory up 25 percent since April. MLS public data at 144,000 but 742,000 mortgages in California are in foreclosure or one payment behind.

- 1 Comment

MLS inventory for California has increased by 25 percent since April of this year. Part of this has to do with more foreclosures and short sales trickling their way onto the market. It also has to do with sales declining because of tax credit expiration fatigue. But what is the real inventory if banks were honest with their distressed properties? That is a hard question to answer but is definitely worth the examination. As we know banks have purposely kept off the books large amounts of housing supply. Basic economics tells you that with more limited supply, prices will go up or remain sticky on their way down. The problem of course is that home prices being too high is the core of the problem. The bailouts have focused on keeping banks alive by allowing them to pretend that bad mortgage debt is actually good (or will turn good on the taxpayer dime). Even with that, the MLS inventory for California has jumped 25 percent from April to September.

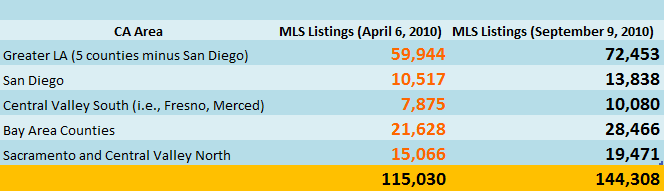

Let us take a look at the biggest regions of the state:

Every county has seen a steady jump in inventory. We can even determine the amount of housing we have given recent sales figures for California:

35,000 homes sold in July

144,000 / 35,000 Â Â Â Â Â Â Â Â Â Â Â Â Â Â =Â Â Â Â Â Â Â Â Â Â Â Â 4 months of inventory

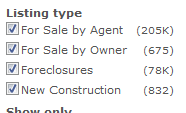

The above is not bad. But the basic MLS doesn’t account for the entire inventory on the market. Let us use a broader measure. Zillow provides a somewhat better figure for inventory:

Source:Â Zillow

With the above, we realize that inventory is closer to 280,000 instead of 144,000 (this includes foreclosures that the public may see depending on what MLS system they are going into. With this minor change, we now realize that market inventory is up to 8 months (a stark difference from the previous 4 months.

But let us dig even deeper into the data.

5.3 million homes in California have a mortgage. Latest delinquency data shows 14 percent of mortgage holders are in foreclosure or at least one payment behind. California is higher but we’ll use the 14 percent nationwide figure to be conservative:

5,300,000 x .14 Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â =Â Â Â Â Â Â Â Â Â Â Â Â 742,000

So we know, simply be extrapolating overall mortgage performance data that 742,000 homes in California are either in foreclosure or one payment behind. Being in foreclosure does not mean that it shows up on the MLS. If you miss three payments, it is likely that you will foreclose (cure rates are abysmally low even with one missed payment) so it is likely that these homes will end up in the inventory pipeline soon. Even the broader measure of 280,000 doesn’t come close to the 742,000 distressed properties. California has years of inventory pent up to hit the market.

So is it good use of taxpayer money to allow banks to hold off mortgages and keep prices inflated so new buyers will have to go into massive debt to purchase a home? The philosophy of keeping home prices up is misguided. Lower prices will allow future buyers to have more disposable income to go into the economy. What use is it if you are paying 70 percent of your income for the mortgage? That merely goes into the banks bottom line. Those that are over leveraged will probably do better simply by renting. Is there anything wrong with that?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

ordaj said:

“That merely goes into the banks bottom line.”

That tells you everything you need to know right there.

September 9th, 2010 at 11:57 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!